Platform Wars - Betting On The Dark Horse

The listed independent platform providers – HUB24, NetWealth, Praemium and OneVue – have been stellar performers in recent years. It’s not surprising when you consider the favourable environment they’ve been operating in.

The enormous migration of funds under advice from bank-owned platforms to the independents continues and there are no signs of it stopping any time soon.

Another $200 billion in the next 12 months and $900 billion in the next five years is estimated to be in play as the new education standards and the shift away from the banks shakes up the advice market. A big chunk of it will end up on independent platforms.

They also happen to be good businesses – stable cash flows, high returns on capital, operating leverage, low capital requirements and recurring revenues.

More recently the share prices of these companies – which have well and truly become market darlings – came off slightly as the market realized the bank-owned platforms that still dominate the industry aren’t finished fighting. BT have lowered fees and CBA will spin out Colonial which will mean the CFS platform will become independent, in theory at least (same with NAB and MLC Wrap). And Macquarie is investing enormous amounts of money to surpass HUB and NWL in functionality.

But the trends in play for independent platform providers and managed accounts in particular have not changed and show some signs of accelerating.

The best time to be invested in these businesses is typically when they achieve scale and move from loss making (or marginally profitable) to accelerated earnings growth as additional FUA and revenue drop substantially to the bottom line.

Managed Accounts Ltd (ASX:MGP) is the next listed platform provider to reach scale and achieve rapid earnings growth. The company recently came in at the upper end of FY18 guidance and reiterated FY19 guidance for $7.5m-$8.5m of EBITDA, three-fold its FY18 earnings.

That would put MGP on a P/E of about 10-11x, making it the cheapest platform play and worth a closer look.

MGP’s Scale Moment – Linear Merger

MGP merged with Linear Financial, a specialist provider of platform and administration solutions, in November 2017. The vendors took most of their consideration in equity at 33c and a host of big name fund managers joined the register in the $34m raise at 28c.

The merger created a business with $13b of FUA having grown at a CAGR of 34% since 2014. Approximately $7.5b of this amount generates revenue as a % of FUA while the balance is in the Portfolio Administration Service (PAS) generating fees on a per account basis.

The merger significantly expanded MGP’s service offering beyond its core managed discretionary account solutions.

MGP now has best in class functionality in international direct equities and the solution that gives the adviser the greatest level of flexibility and discretion. A wrap platform is being launched in September. The acquisition of a registrable superannuation entity has been announced and a greater presence in retail super is being built.

The cross-selling opportunity between MGP’s core business and Linear is substantial particularly in the Institutional space where the traditional MGP business had no presence but where Linear does.

And inflows, the most important forward indicator of the company’s growth, continue to be strong with management expecting FY19 to sustain that trend.

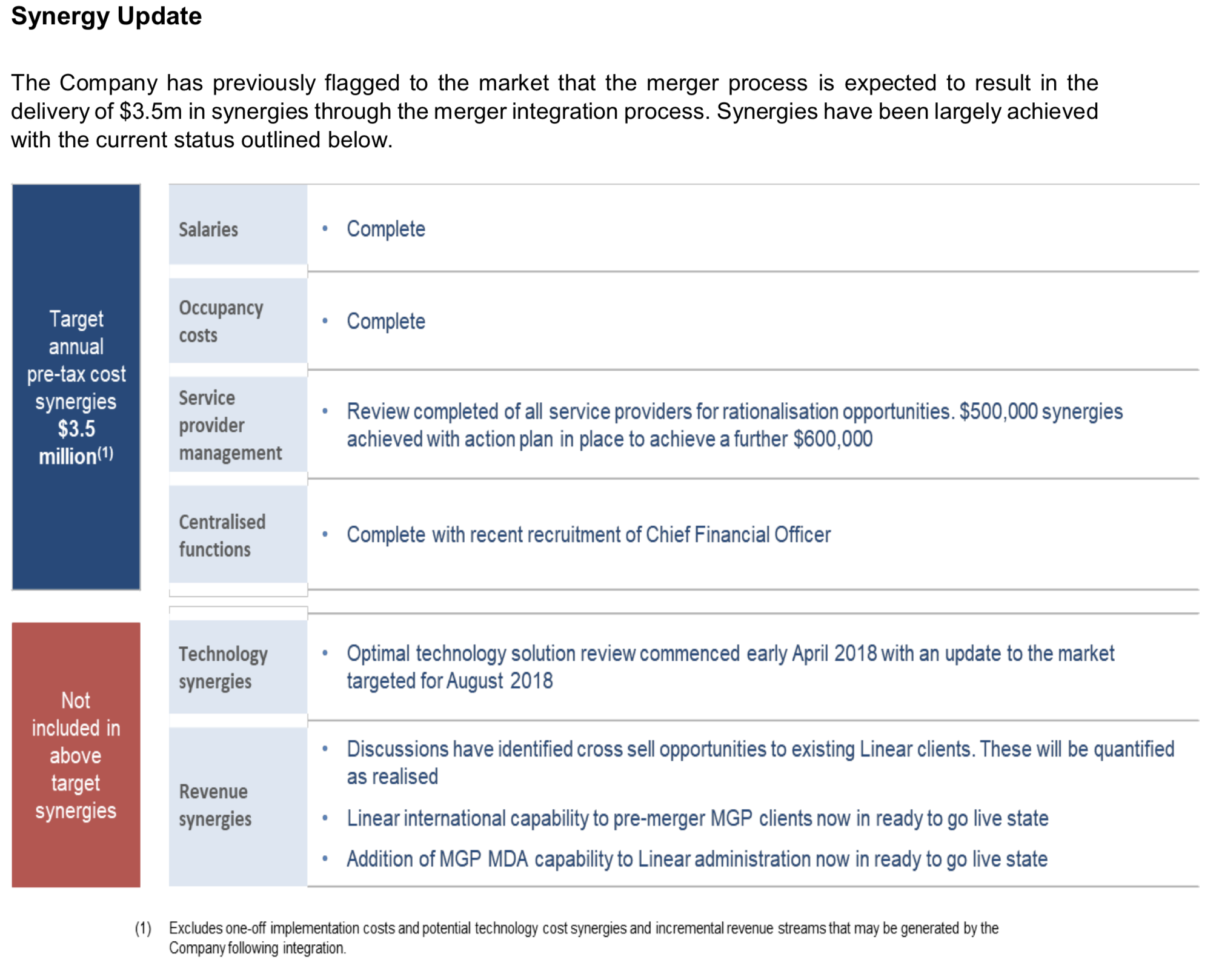

Post-merger management identified $3.5m+ of cost synergies and at full year results stated they are on track to achieve the full run-rate by 2H19.

Further, earnings for FY18 beat guidance suggesting the business has good momentum.

With about $1.5m in capitalized development spend this year and no tax to pay (due to tax losses from Linear) MGP is trading on 10-11x cash NPAT. There is talk of a potential dividend in FY19 which would be a nice catalyst.

That leaves plenty of room for the stock to re-rate towards a market multiple and trade closer to 35-40c. Provided guidance is achieved then I am betting that the re-rate likely to occur over the next 6-12 months.

There is further upside if FUA growth accelerates as there will be a case to argue that MGP deserves a multiple closer to its platform peers (20-40x PE), but let’s cross that bridge when we get to it.

Given all of the above the critical question simply becomes how likely are MGP to hit FY19 guidance?

Breaking Down FY19 Earnings Guidance

Let’s start with the run-rate of the business exiting FY18.

The company came in at $2.9m EBITDA last year (vs guidance range of $1.5-$2.3m) but to be conservative we will remove the $0.5m generated from R&D Income.

That puts underlying EBITDA at $2.4m for FY18.

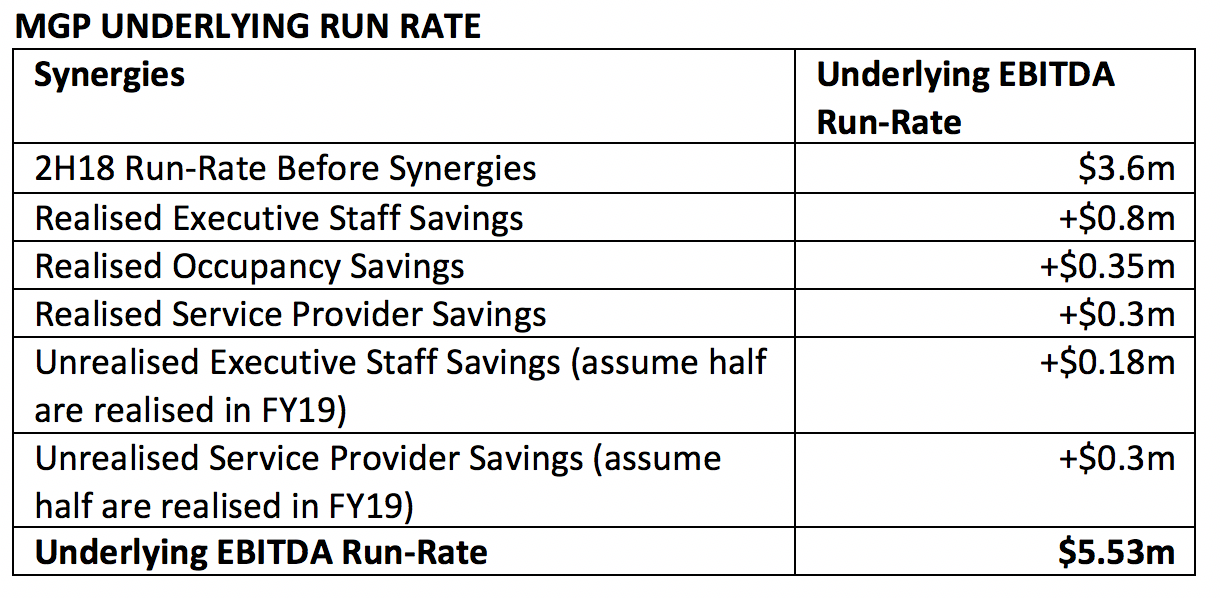

MGP achieved $0.6m in the first half meaning 2H18 EBITDA was $1.8m for an annualized run-rate of $3.6m.

Then you need to account for the substantial synergies realized during the half but yet to actually hit the bottom line.

Start with executive staff savings. $1.6m won’t kick in until Nov/Dec this year. When they do we have another $0.8m in earnings to add to FY19.

There was $0.4m of savings on office space post-merger that only kicked in from May. On a full year basis that’s about $0.35m.

$0.5m was realised from service providers but only $0.2m of this hit the bottom line in 2H18. We will see an additional $0.3m on a full year basis.

We then have to factor in those synergies that have been identified (and quantified) but not yet realised.

MGP stated there is another $0.36m in savings from executive staff to be realised at some point in FY19 and another $0.6m to be realised from service providers.

Let’s be conservative and assume half of these are realised during FY19 for an additional benefit of $0.5m.

There will be further savings (as yet unquantified) from the integration of the technology platforms (AWS, network savings, integrated development team, etc), the announced superannuation acquisition (eg internalizing the member admin process rather than outsourcing) and revenue benefits from cross selling.

All of the above will in time have very real benefits to the bottom line. But we’ll be conservative and assume none of those benefits flow through in FY19.

That puts us at a $5.5m EBITDA run-rate starting FY19 before growth and any further synergies.

Based on management commentary it is likely more synergies will be realised throughout FY19 but they may not contribute a full years run-rate so the additional upside will flow into FY20.

The above is based on a ‘business as usual’ assumption – no growth or contraction. Given FUA has grown at a CAGR of >30% p.a and the tailwinds driving it show no sign of stopping it is highly likely that revenue and earnings will grow off the back of the FUA growth in FY18 and continued inflows in FY19.

The market may be viewing FY19 guidance as unrealistic or ‘hockey stick’ based on the face value jump from $2.4m to $8m in just 12 months. But MGP are lot closer to achieving FY19 guidance than a quick glance might suggest, as the above shows.

It also helps to explain why the board have continued an aggressive share buyback at these prices.

If and when MGP makes it clear that they are well on track to hitting FY19 guidance the stock will react positively.

The next question is, can MGP trade closer to the multiples that HUB, PPS, NWL and OVH command?

For MGP to justify a P/E multiple of 20x or higher the market will need to see accelerating inflows as MGP builds out its full feature platform capabilities and becomes a real rival to its larger peers.

The Case For Accelerating Inflows

There is an argument as to why MGP will see accelerating inflows in FY19 vs FY18. The key points are listed below.

Wrap Platform – MGP will release a wrap platform in September, opening up a much larger pool of potential inflows compared to the ‘niche’ managed discretionary accounts space the company has traditionally played in. If MGP can report inflow numbers more akin to its peers that already have a wrap offering then the stock has a long way to move higher.

There will be an opportunity to cross sell to the existing client base. Wrap platforms are more of a product sale than a solution sale so clients tend to be less sticky than MGP’s core bespoke managed account solution. That gives MGP, who will come in with a highly price competitive offering, the chance to win its share of the market.

New Platform Development – The integration of MGP and Linear’s platforms provides an opportunity to refresh the technology and ensure they are market leading in functionality and design. There has been a feeling in the market that MGP’s platform needs to play catch-up to the functionality of its larger peers and the company’s ability to move quickly was hampered by its use of outsourced technology.

The integration process provides management with an opportunity to fix that perception amongst analysts. A company rebranding and potential name change to reflect the significant transformation now underway are also under consideration.

It is likely that the front ends will be merged initially and it makes sense that in time so will the back end, and both will be internally developed by the company. This may have cost savings but it is beneficial if any of these cost savings are reinvested in continuing to improve the functionality of the platform.

Keep an eye out for updates on the company’s technology development plan. The upgrading of its design and capabilities could be a significant driver of inflows in FY19.

Build Out of Distribution Team – One of CEO David Heather’s key hires was the new Head of Distribution, who came across from Macquarie Wrap and was instrumental in building their market leading business from the ground up into what it is today. The Head of Product is also ex-Macquarie Wrap. New BDMs have been added. This is a team that knows how to build and run a successful investment platform and they’ve been incentivized with equity in the business (in addition to the board owning over 50% of MGP) so we should see that benefit flow through in coming years.

Retail Super – This is a massive market but MGP’s share is comparatively tiny. The announced acquisition of a business in this space will help bulk up the offering and should support MGP’s growth into this market. Completion is pending regulatory approval.

Institutional Clients – Linear brings with it a presence in the institutional market that MGP didn’t have. This is again one of the key factors driving the big inflows for larger peers so being able to play in the space increases MGP’s addressable market.

Cross Selling – In July MGP told the market that they were now able to provide Linear’s international market solutions to pre-merger MGP clients as well as the pre-merger MGP MDA capabilities to Linear clients. This should be a decent source of growth in FY19 and beyond.

What’s Driving This Growth?

There is an element of a rising tide lifting all boats here as MGP does not have to develop into the market leader for the company and its share price to do well, given the rate of growth in this enormous market.

The managed accounts market as a whole grew 45% last year to roughly $60b and continues to expand its share of the $750b platform market. Data from the Investment Trends Managed Accounts Report suggests that growth may accelerate as an increasing portion of financial advisers are indicating their intent to use a managed accounts solution.

Independent financial advisers (IFAs) have tended to be greater proponents of managed accounts and, of course, independent investment platforms. As they have left the big banks (or bank aligned dealer groups) in droves they’ve set up their own firm or joined a smaller one and put their clients on an independent platform.

The managed account structure drives enormous efficiencies through an adviser’s business with some figures stating it saves up to 14 hours per week. It also gives the adviser more discretion (MDAs) around the clients investments which allows them to either add additional revenue streams for investment management or help justify existing advice fees.

Both of the above are important when you consider that the adviser’s business model has been disrupted over the last 5 years and further changes are likely. Saving time and costs as well as growing the business and differentiating in the market is a key driver of the move to managed accounts. Clients tend to like it as it gives them greater visibility of what they own compared to a managed fund and the structure allows direct ownership of assets.

The growth of managed accounts and the rise of independent investment platforms may not continue in a straight line but it certainly appears to have many years of growth ahead of it.

Risks

MGP don’t assume market growth in their guidance figures so the market doesn’t need to go up for them to hit guidance but as with all FUA-based plays there is the risk of market movements impacting FUA and revenue both to the upside and the downside.

Regulatory risks are always around, though they tend to be tailwinds for independent platforms on balance.

In the media recently is the topic of fee compression as the banks try to fight back against the independents who are dominating the share of inflows secured each year. There is a bit of a land grab going on to secure clients and pricing is competitive to reflect this. But MGP offers a highly competitive solution and will launch a wrap platform that does the same.

It would be wrong to completely discard the banks too. Macquarie are investing heavily. WestPac were the only big 4 bank to hold on to its platform business in BT Panorama. CFS and MLC Wrap will be a part of independent wealth management groups soon enough, discarding the ‘bank-owned’ tag. They have the capital and scale to build out market leading functionality or acquire it.

In fact acquisitions probably become a much more likely scenario once these businesses are spun off than when they are part of the big 4. So that is potentially both a risk and an opportunity for the independent platforms.

The integration process raised the risk of client attrition in the Linear business. But integration appears to have gone smoothly and management are confident that clients are happy. The improved financial position of the merged group (compared to Linear pre-acquisition) has helped significantly and the integration and development of the platforms should further increase client satisfaction.

Betting On The Dark Horse

For most of the ASX listed platforms the market is already pricing in the very positive outlook for independent investment platforms in the years to come, but MGP has yet to experience that re-rate.

As the market realizes MGP is now at scale and is on track to hit FY19 guidance the stock will re-rate to reflect a market multiple.

We’ll have good visibility on any growth into FY20 too, based on inflows throughout FY19, allowing the market to price it favourably on forward projected earnings. FY20 will also see the full benefit of the post-merger cost synergies.

The key will be inflows. The stronger the flows in the next 12-24 months the higher the share price will move.

It is possible that in 12 months time and with the benefit of hindsight an independent platform provider at scale trading on 10-11x this year’s earnings will have looked like a bargain.

The next phase – commanding a premium in line with its peers – will require MGP to build out a full feature platform that rivals the bigger competitors, drives accelerating inflows and some big name clients on to the platform.

That part of the thesis remains unproven. But the upside if they can achieve it is substantial.

1 topic

8 stocks mentioned