Prepare for President Biden … or, do market traders have any idea?

Last week we predicted that the sharp share market correction over the final days of October would be reversed (an index recovery) following the US election – no matter who won.

Our view of equity market direction has been clearly stated for the last few years, and we reinforced it during the COVID recession. We have consistently stated that the world’s central bankers will create and maintain policies that will/or are highly supportive of risk asset market prices – in particular equities. Consequently, the long-term focused asset managers (e.g. pension managers) who are the real investors, will be required to actively adjust their asset allocations as risk free/low risk yields collapse. They, like SMSF trustees, must take on more risk and thus accept higher short term volatility, to achieve longer term compounding returns of 5% to 7% per annum. We explain the reasons for volatility below.

To be clear, short term index price moves should be treated with scepticism. Whilst SMSF trustees should observe them, they should also understand why they are occurring. They should only be concerned if their asset allocation is not appropriately set according to their individual risk profile and objectives. A broadly balanced and diverse asset allocation, tilted to risk assets, remains appropriate for most investors.

Traders and price volatility – a toxic mix

The short term “index” price moves that we observe, are in the main caused by traders who are compelled by their mandates to try make profits by constantly taking positions – backward and forward, buying and shorting, logical and illogical – with leverage thrown in.

It seems obvious to us that the amount of capital allocated to this trading pool will grow as a clear consequence of unlimited QE policies and zero interest rates. Hedge funds, trading divisions of banks and broker-facilitated day traders are all recipients of flows, and this results in a rise in “momentum trading” and thus price volatility. In the main, it is momentum trading of indexes that is adopted because they are liquid asset pools. Therefore, the trading of indexes has become the staple diet for most large traders. Also in the trading pool are many small traders who blindly follow the money and hope that they are not the last ones in to the trade. Because many (probably most) traders have little idea what they are doing, they adopt a “follow the pack” mentality that ensures daily market prices for index assets become detached from reality and move around based on sudden sentiment shifts. The most recent example being the US election – pre, during and post.

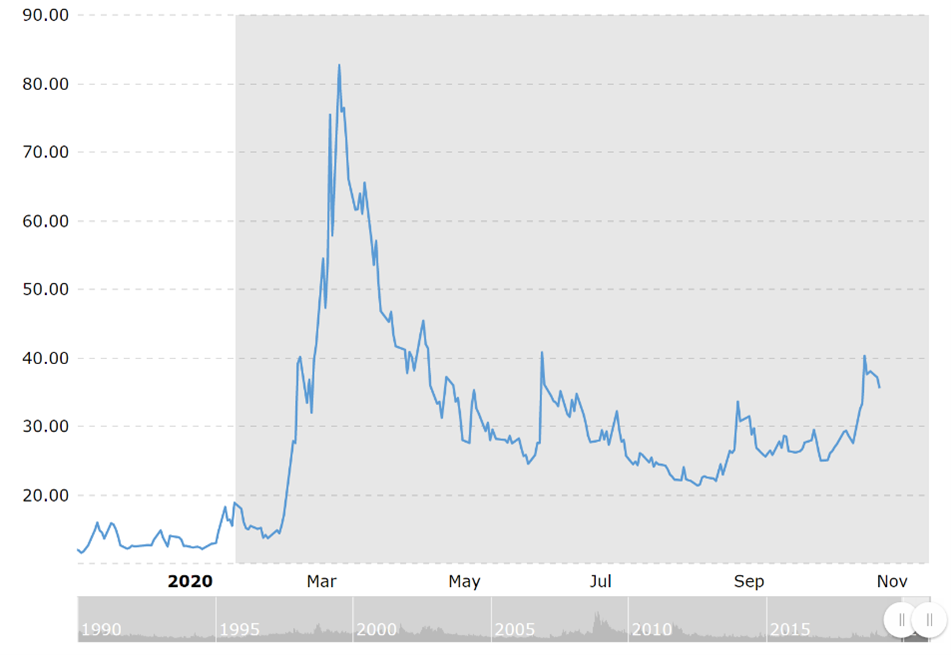

The VIX charted over the last 12 months

The VIX index measures the expectation of stock market volatility over the next 30 days implied by S&P 500 index options. The current VIX index level as of 5 November 2020 is 29.5 (down from 35 just prior to the US election).

Source: Macrotrends

Why price volatility is not important to SMSFs

The short term volatility in broad indexes (equities, bonds, currencies, commodities, etc) is omnipresent in a zero interest world with abundant cheap credit. That is a significant reason why the comparison of investment returns (over the short term) to index returns is not that instructive or important. To explain this, we give a simple example.

It is generally considered by superannuation advisors that the “average” 55 year old individual should have at least $300,000 in superannuation to be on the road for a comfortable retirement. Think about that number and you observe that the average person has taken 35 years of combining super contributions and investment returns to reach that amount. However, it is the next ten years where things need to start happening quickly.

(The reason that this figure is suggested is because it is expected that this amount will grow towards $800k by 65 years of age through the compounding of the fund by 7% per annum ($300k will double) and further accelerated contributions. Around $800k takes that individual outside the Commonwealth pension and creates a tax free income flow of $32k from pension payments. It also assumes home ownership and a fairly frugal life style.)

Our point is fairly simple in thinking about the 10 years from 55 to 65 years of age. Would the individual prefer an index return, whatever it may be? Or would that individual like a focus on the management of their superannuation capital to generate a compounding 7% per annum return? We think the answer is obvious, but with zero long term interest rates, the 7% target will become more difficult to achieve. A diversified portfolio that balances risk and return is the preferred solution.

The US election result does not change the outlook

An exhausted Joe Biden projects confidence

Source: CNN

Whilst we may have a few more days to wait and see if Joe Biden will be the next President of the USA (even that may be delayed by legal challenges), we reiterate our view that it did not matter that much for markets who won the election. It is the Federal Reserve that is driving US economic policy, the recovery and thus markets. While the US Treasury is rolling out $3 trillion in fiscal deficits, it is the Federal Reserve that is setting the cost of Government debt through bond market controls. The US Treasury can afford to spend and stimulate, being assured that the increased debt will not blow out of control because its cost is negligible as a proportion of total budget expense. Both President Trump and President-elect Biden would be advised of this by Treasury and so each was free to promote massive expenditure programs that need not be funded by normal budget policy (i.e. higher taxes).

Therefore, the amazing index price volatility that preceded the election and then recovered during and in the aftermath of the election, was just an example of the excessive creation of short term trading capital.

Before moving to the outlook for the markets, it is worth noting President Trump’s legacy and reflecting on what awaits Joe Biden.

Trump was the first US President in living memory to challenge the status quo of the political elite. While he was adopted by the Republican Party, there is no doubt that he challenged the concept of political parties and political correctness. Time will tell whether he has decisively changed the embedded functioning of US politics so that charismatic non-politicians are promoted by the electorate to leadership. The fact that he did not get beaten by a much forecast landslide, in a record voter turnout, suggests that he had significant support and also that the US electorate is deeply unhappy with their politicians.

President-elect Joe Biden is a lifelong centrist who does not appear to be particularly ideological, other than his admiration for ordinary working and middle class Americans. When Biden enters the White House in January 2021, he will confront an extraordinary set of circumstances: the US economy is clawing its way back from the sharpest slump in living memory; the legacy of the pandemic will include millions of long-term unemployed; public debts will soon exceed the all-time high of 106% of GDP; and America faces a wave of bankruptcies and accelerated digital disruption in many industries.

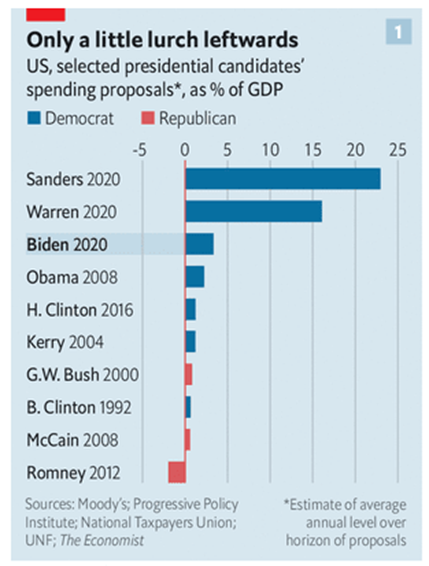

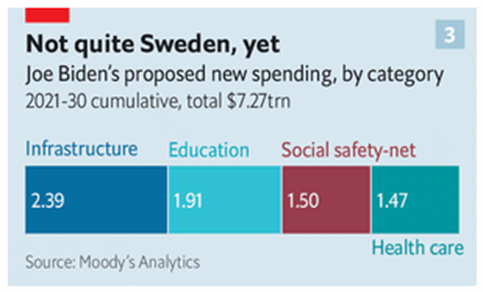

Because of the challenging backdrop and Biden’s lack of a fixed economic doctrine, the range of outcomes attributable to a Biden presidency is still open. Biden says his goals are to tilt the balance of American capitalism in favour of workers, not the rich. His stated priority is a stimulus bill to revive growth. He is expected to focus more on environmental issues, with a more active industrial policy, higher public spending and borders open to skilled migrants. Biden would raise taxes on the wealthy and on corporations (from 21% tax rate to 28%), but not on those families earning below US$400,000. He is not expected to reverse America’s new protectionism, or significantly alter the relationship with China. Importantly he does not have a plan to resolve the country’s long-term fiscal problems.

Source: The Economist

As Joe Biden inches towards victory, it appears that Republicans will retain control of the Senate. Investors find themselves attempting to price a new market risk: political gridlock. The prospect of a Biden presidency combined with a Republican Senate could make it more difficult to push through the big fiscal stimulus which investors had thought might come with a "blue wave." As markets consider this outcome, they may decide that political paralysis is a good thing for risk assets, since it means President-elect Biden might not be able to push through corporate tax increases, for instance, or overspend on a stimulus package or the environment.

Source: The Economist

Where to for Australia and investing?

Australia is a mid-sized open economy in an interconnected world, so what happens abroad has a large impact on both our exchange rate and our yield curve. In the past, the interest rate differentials provided a reasonable gauge to the relative stance of monetary policy across countries. However that has now changed with QE ($100 billion) introduced with yield curve management by the RBA. Further, the RBA will now be tolerant of some rise in inflation and be led by the global monetary policy by international Central banks. In its most recent forecasts, the RBA is expecting GDP growth to be around 6% in the year to June 2021 and 4% in 2022. The unemployment rate is expected to peak at 8%, below the 10% it had been previously expecting. By the end of 2022, the unemployment rate is expected to be around 6%.

Given the RBA forecasts and our observation of international events – particularly a concerning second wave COVID outbreak across Europe - we consider some of the thematics that will persist and influence financial markets in the year ahead.

Global markets continue to be supported by record low interest rates, fiscal and monetary stimulus on an unprecedented scale, and the accelerated digitalisation of the global economy. The second wave of COVID in the Northern hemisphere ensures that massive fiscal support will continue and so will the support of central banks.

The Covid-19 pandemic has been the defining event of our time and yet, so little is definitively known about it. The extent and duration of the economic dislocations that the pandemic is causing are unknown, but the effects on the global economy are likely to be prolonged. Unlike previous recessions, this economic downturn and recovery differs in that the downturn was driven by government shutdowns; fiscal and monetary support has been faster and bigger; forced asset sales have been avoided; it is dependent on containing the pandemic; and it is accelerating structural change.

Within the new Covid environment, businesses capable of adapting quickly to an online environment have thrived, whereas many caught up in sectors such as bricks and mortar retailing, international travel, live entertainment, and so on, have struggled. All these changes have meant big winners and losers in financial markets. Stock selection will be important with indexes being highly volatile for the reasons outlined in our introduction.

Structural reasons why we remain moderately positive towards equities (and particularly in Australia) are:

- High but declining unemployment suggests the global economy (including Australia) is early cycle, typically the most attractive phase to be invested in equities;

- A vaccine for COVID-19 by mid to late 2021 is likely, while treatments are improving, progressively lowering the risks of economic disruption due to the virus;

- Support for markets from policy makers is present and ample;

- Credit markets look more expensive than stocks, pushing funds into equities.

- The outlook for Australia is far superior to many of our international peers, with pent up immigration a predictable growth generator from 2022 onwards.

That said, we characterise this positioning as “a positive bias”, rather than a bullish stance on equities in particular and risk assets in general.

- John Abernethy

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics