Protection finally cheaper just as markets push higher

With markets testing new all-time highs, volatility is finally starting to decline with the VIX Index recently touching post-Covid lows, closing near 16 on Friday. This is good news for investors who wish to remain invested but who may want to de-risk their portfolios and lock in some of the massive gains of the past 12 months.

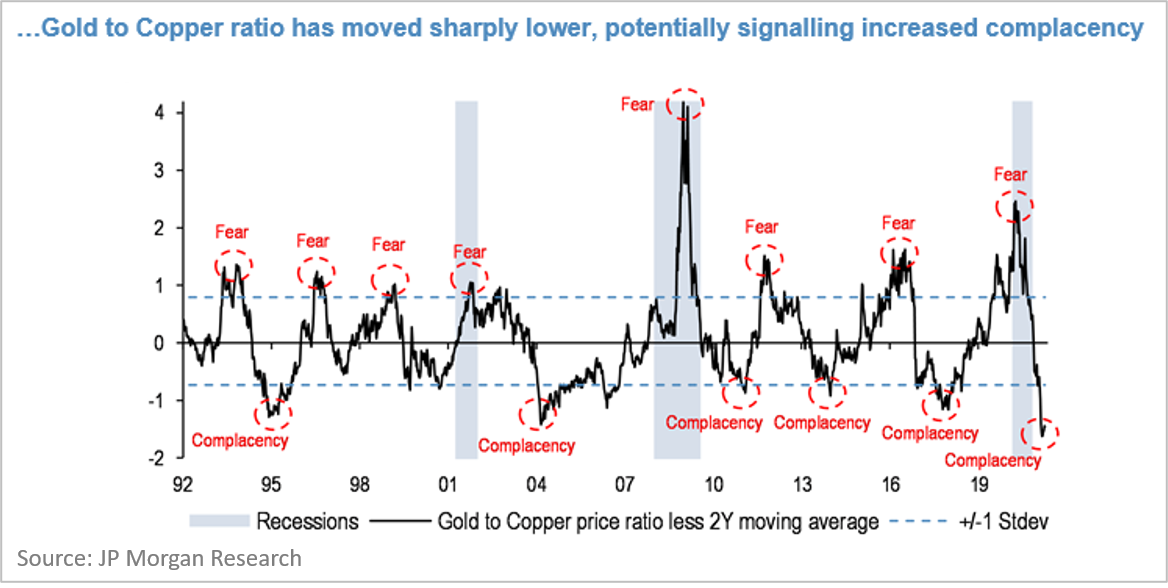

On any measure, both the Australian and Global stock markets are looking expensive. Whether one considers market PE multiples, profit margins, Price/GDP, stock margining, retail participation... the list of indicators is universally signaling orange to red. In addition to these more traditional bellwethers, this week JP Morgan also flagged that the Gold/Copper ratio is currently touching new lows. This is reflective of increased demand for Copper (a bullish sign) vs Gold (a defensive sign). Empirically there have been far better times to put new money to work in equity markets.

One alternative to exiting the market is to consider adding protection to an equity portfolio by way of tail hedging. While we flag that this is a specialist area and involves derivatives, when used correctly we believe that tail hedging can better match the returns of the equity market with the specific investment objectives of an investor, even when accounting for all its ups and downs. With market volatility falling in recent weeks, the cost of protection is also falling, just as markets continue to punch new highs.

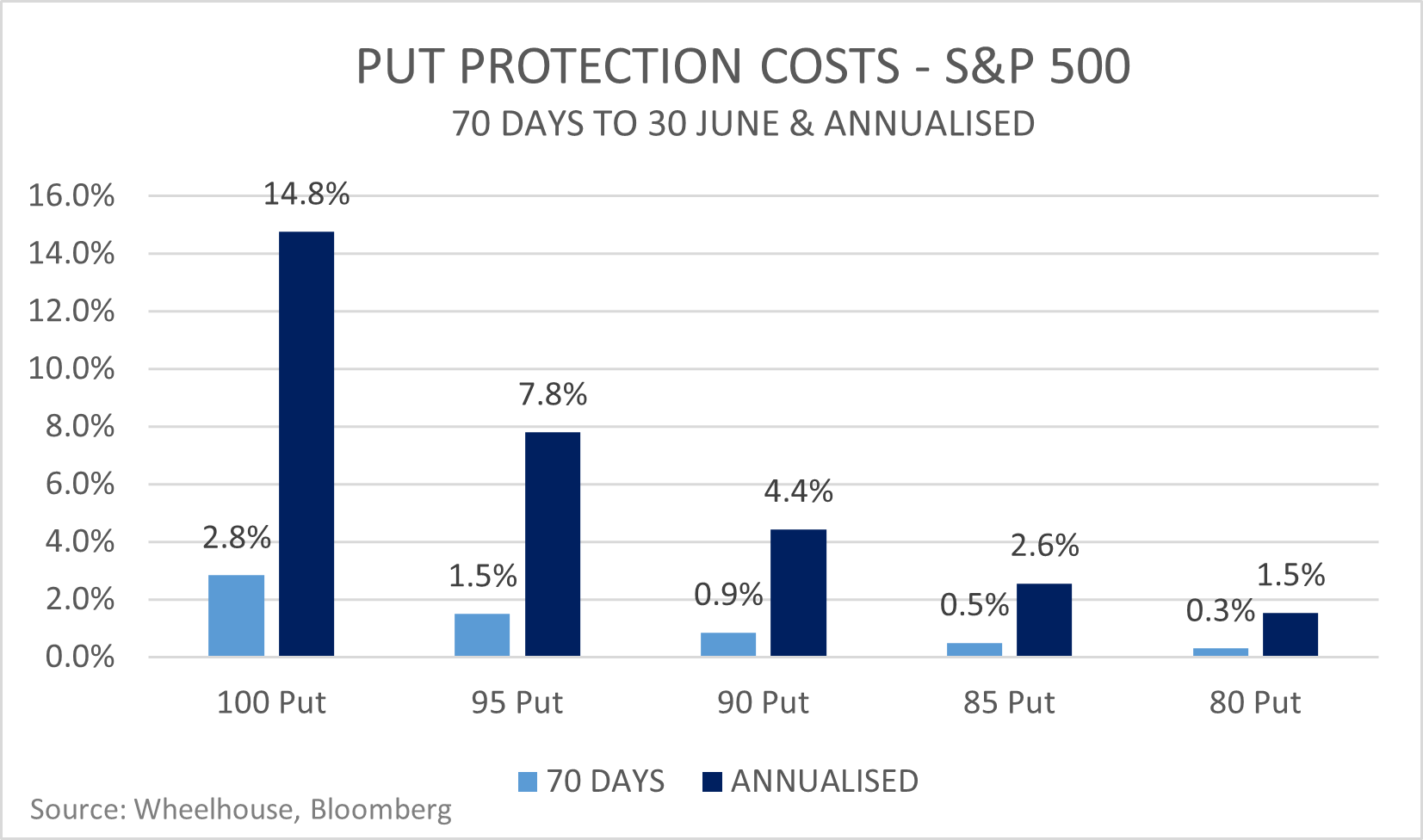

Below is a chart which sets out the current cost of June month-end protective puts:

- A 100 Put is at-the-money, meaning the market exposure is fully protected.

- A 95 Put is 5% out-of-the-money, meaning the market needs to fall 5% at the expiry date before the protection provides payback, and so on for the other strikes.

The 'moneyness' of the option operates in a similar way to the excess on your home insurance.. how much of the initial loss you are willing to wear, means the premium paid can be a lot cheaper. But also means the protection is less likely to be of benefit.

There are two key questions an investor needs to decide when considering tail hedging.

1. How much of the loss are they willing to bear before the protection engages, and;

2. How long a period do they want the protection to last for.

Both of these considerations will meaningfully affect the protective strategy chosen, and as a result the efficacy of the hedge in terms of meeting the investor's goals.

Example 1 - Full protection

Say an investor was sitting on meaningful short-term gains and wants to lock in some of those gains. There may be specific reasons why the investor may not want to crystallise gains, possibly tax related, or they may relate to a personal situation where they simply want to fully protect their capital through to the end of the financial year. The investor may consider buying an at-the-money put option (the 100 strike in the above chart), which would fully protect market losses from today through to the 30th of June. The cost of this protection on the S&P 500 Index is currently 2.8%.

For short-term or tactical purposes, this cost may be acceptable. However, the cost is still very high when considered on an annual basis, with the protection costing over 15% to maintain year-round. Given that equities usually only provide 9-10% returns, this approach is likely to be a losing strategy if implemented all of the time. However, for a targeted objective over a discrete period, it may achieve the investor's objective.

Example 2 - Partial protection

Perhaps an investor intends to remain fully invested, however given the recent red flags appearing for the market's valuation, has decided to tactically de-risk the portfolio for the next 12 months. Buying a put option provides 100% protection below the strike price, but given markets are highly unlikely to go to zero, in this scenario a put spread may better suit the investor’s objective. A put spread would typically provide more limited protection than an outright put but would do so at a far lower cost.

In a put spread, an investor buys a higher strike, while simultaneously selling a lower strike. For example, a 95/90 put spread would buy the 95 strike at 1.5%, and sell the 90 strike at 0.9%, for a net cost of 0.6%. At expiry this strategy would protect 5% of a 10% market fall, but the market would have to fall 10% to see the full benefit. The spread reshapes and reduces the protection, but it also meaningfully decreases the cost to around 60 basis points for the 70-day period, or less than 4% annually, which may be more bearable to carry and still assist in achieving the investor's objective.

Hedge needs to match objective

Ultimately delivering a tailored protective hedge needs to be intrinsically matched to the investor's objective, with knowledge of how different derivatives behave in different scenarios. Within the Wheelhouse Global fund, we budget a cost of 1.5% a year on tail hedging, with the objective of halving losses in a drawdown of greater than 10%. We don't pretend to know when markets are going to crash or correct, but for our objective we are willing to carry this at all times. Coupled with the typical defensive benefits of owning Global shares during an Australian dollar retracement (another way to reduce risk in a crash), the combined protection has delivered positive absolute returns in all acute market corrections the Global Fund has experienced - which suits our objective to provide capital integrity to our predominantly retiree investors.

3 topics