Qantas raises sizeably and Novatti raises quickly: this week in capital markets

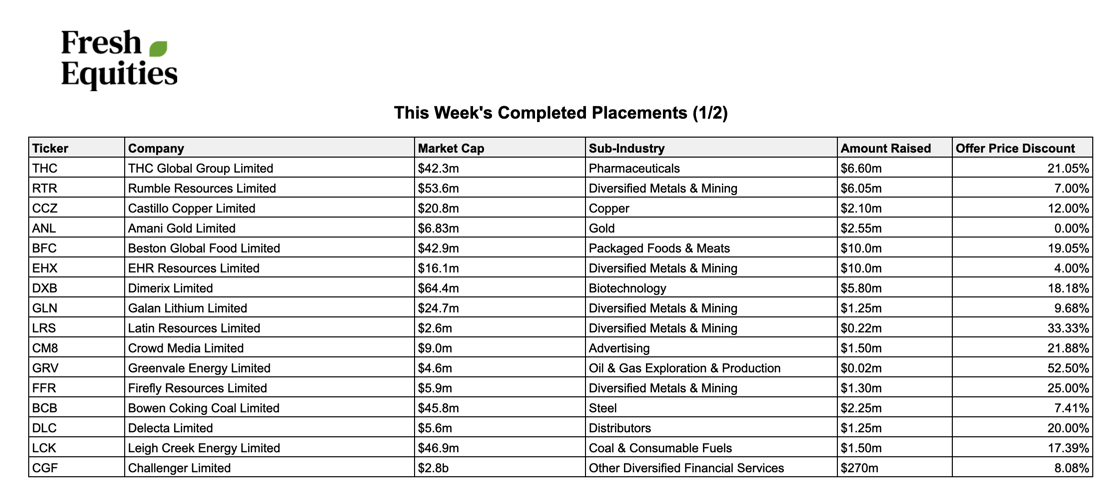

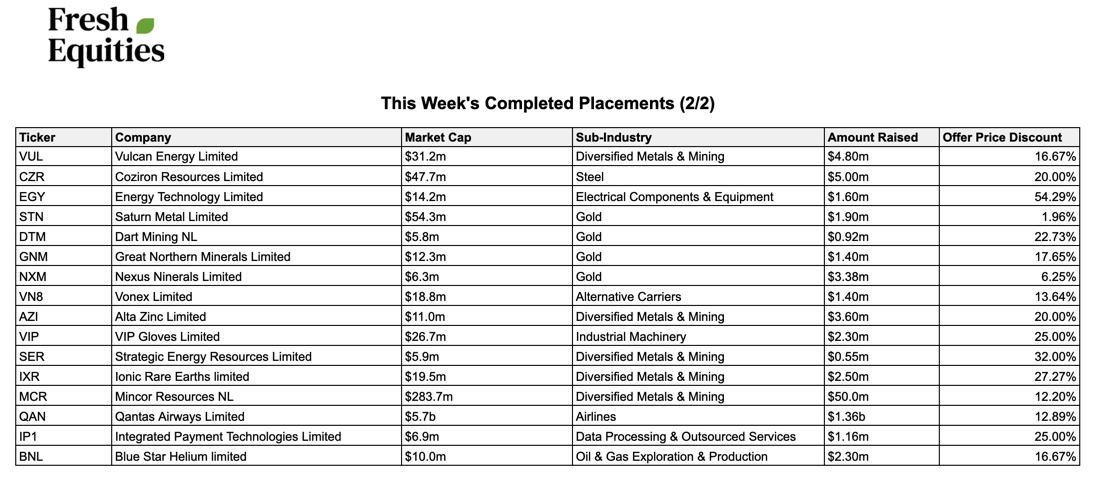

33 placements were completed this week, raising a total of $1.7b in fresh equity. The bulk of this was for Qantas, but a resurgence of small cap activity filled the volume of completed deals.

Qantas and Novatti were the hot topics this week

It was a tough week for the travel and tourism sector. News of interstate restrictions hit the US, and fears of a second COVID wave were rumbling on the home front. Notwithstanding the market conditions, our two major carriers were making big moves. Virgin finalised their sale to American suitors, Bain Capital. Qantas took a highly anticipated trip to capital markets and raised $1.4b. It's perhaps one of the last raises that will be able to use a 25% placement capacity. This was introduced as part of a raft of "temporary relief measures" by the ASX, and is set to expire at the end of the month.

The deal was covered by lunchtime, and existing shareholders came to the table for 94% of the placement. Qantas' sizeable registry (over 92k shareholders) will now have the chance to take up to $30k of discounted stock in a whopping $500m SPP. The discount is nice, but the incoming 25%+ dilution and bumpy road ahead for airlines will still be a tough pill for holders.

Novatti, a payment solutions provider with plenty of good attention, made a surprise rattle of the tin this week. There was some good news out in the market on Thursday morning and early in the afternoon the company entered a trading halt to complete a raise. Although it is strange to pull the trigger in the afternoon, it's possible that it was after the morning's news that the wall-crossed funds came to the table with a strong bid. Remaining invited participants were not given much time to act, the deal launched Friday morning at 10am and closed shortly after at midday.

And, there's lots of small caps coming out of the wood work

Sub $250m market companies are seizing the day, and taking advantage of slightly more stable and buoyed investor confidence. As we've discussed before, anything with "Gold" seems to be attracting investors and raising towards the top end of target raise amounts. Even though most of these companies are explorers and don't have any direct exposure to the commodity, their share price tends to be correlated and their binary-outcome drilling results provide for some attractive volatility.

Coziron Resources raised a clean $5m this week and notably included $700k from directors and major shareholder Mark Creasy. The raise was earmarked for "accelerating exploration" which is always a great reason to raise as it means there is at least a few months of news-flow for investors and punters to look forward to.

Amani Gold was another favourite for investors, bringing in $2.55m to fund a "major exploration program". The deal was accompanied with an attractive 1.5 for 1 free option, which you really only see in small cap raises.

In March/April the small cap market was favouring a larger discount over attaching options as a means of providing additional downside protection in a rough market. Now that green-shoots are emerging and mining companies can start drilling again in earnest, the upside exposure of an option is appearing more frequently. It's also a bonus for companies, as it has the potential to bring in more funds when the options hit the money and are exercised.

Get investment insights from industry leaders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics

31 stocks mentioned