Quickfire Q&A with the fundie up +42.9% in 2018

The last four months of 2018 were brutal for investors everywhere. October was particularly painful, with most managers off by -5 to -10%. So it caught my eye when I saw one posting +7% for October. This same fund has finished CY18 up 42.9%.

The stats are from the Odey International fund run by UK-based hedge fund veteran Crispin Odey who oversees US$5.5 billion. Odey is decidedly bearish and recently told his investors:

"...my money remains on the likelihood that this is the early stages of a profound bear market in assets. Populism in the west has a long way to go. QE has undermined savings and now populism will undermine the price mechanism. We are at the start of a 25 year cycle so get used to it".

We reached out to get some understanding of the market view that supported this kind of performance when most of us took a hit.

Q1) While most managers have had a tough 2018, the Odey International Fund has had a stellar year. What have been the biggest drivers to this performance, and how are you positioned to keep benefitting from current market conditions?

"Firstly although the fund has done well this year, I am not yet that pleased. We are still way down on three years ago. The good news is that the returns have not just come from the Macro book. We have made a bit from being short sterling against the dollar but bonds are pretty well unchanged. Equity returns have come both from the long book and the shorts. Whilst others remain undecided about whether the dreaded bear market in equities is upon us, we have, at Odey, taken the view that the most likely direction of the market is down for now."

Q2) In your view, was the recent pullback a correction, or could it have been the overture to a bear market? What are the key factors that will determine this?

"Valuation is never important for timing, but overvalued markets as we have now, when allied to high levels of indebtedness sit very uncomfortably with momentum already reversing to the downside. Joe Public undoubtedly finally got involved at the end of last year and tried again in September for the Christmas rally. They have turned sellers, which is offsetting corporate buying and means buying the dips is becoming a dangerous game".

Q3) Just as the Odey International Fund is bucking the trend this year, it also went the other way to the market in 2016 and 2017. What were some of the reasons for this tough patch?

"Strangely our reasons for doing well this year are not really related to why we did so badly in 2016 and 2017. We were very macro in 2016, determined that China was out of bullets and that the business cycle was over. It turned out that China and the USA were not out of bullets. Today the markets are much more circumspect about the ability of the authorities to ‘let the economics fall down.’ But the fact is that the interference in markets by the central bankers has had serious political consequences. Before they save us next time, they must worry that it is not only very costly in money terms but that it fuels populism. My returns this year do not need the end of the world, just this world to continue. So yes, I feel that I am at the beginning of several good years for the fund".

Q4) You’ve been managing Odey Asset Management for 27 years, with George Soros being one of your original investors. Has there been a period during your career that serves as a template for navigating the market today? Or do you need to go further back into financial history to see something similar? Please explain.

"Part of the reason for my optimism is that I had a similarly difficult patch in 1994 when we were entering the deflationary age ushered in by GATT and the arrival of the Chinese economy into our trading platform. In 1994 I lost a nearly similar amount but the thinking helped me to make it back (and more) over the next 5 years".

5) Credit markets have been sending warning signals. What are they telling you today about what to expect in the next 12 months?

"Credit markets are quite human. Up until now the US credit markets remained remarkably cheerful about the future. But recently they have started to price in a fading of the benefits of the tax cuts for the corporates. An inverted yield curve has arrived just as the likes of GE are pushing up junk bond and the corporate bond yields. For EM countries this is some relief because their unwillingness to follow Fed tightening was hurting their economies. The fight between China and the USA is not going away, exacerbated as it is by China’s determination to take back Taiwan into its thrall. Economics is taking a back seat to politics, which is always bad for markets".

6) Brexit is at a critical juncture: what are your expectations, and how will the expected outcomes affect global markets?

"Brexit in a global context is small beer but what it highlights is that the political class everywhere is out of touch with its electorate. Trump was elected because he hates politicians – the only thing on which we all agree with him! Brexit may be a V-sign to Brussels but it is also an indictment of the currently constituted parliament and it has been such a surprise that parliament has not known how to handle it. Populism will hurt markets – manifesting itself in a massive intervention in the price mechanism and in asset prices".

7) As you are net-short Australia, could you share your view on the market, and outline one of your Australian short positions?

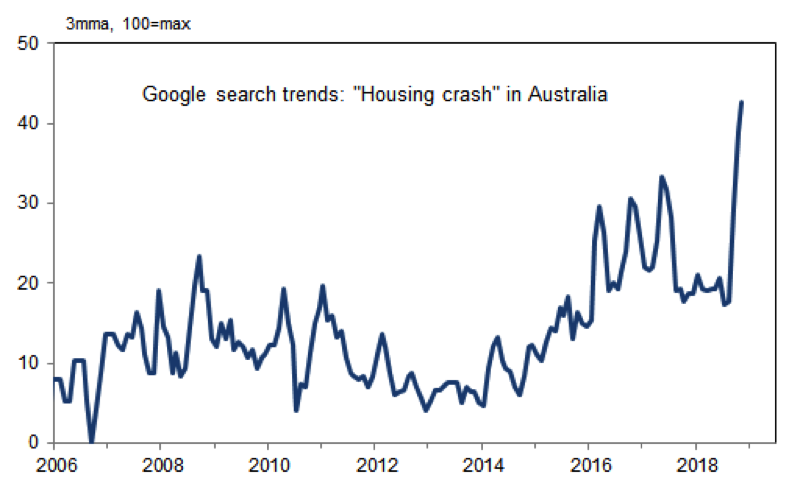

"The truth is that almost all of the developed world has not had a serious recession since 1992, but Australia has also shown the greatest growth rate, helped by the blessings of a strong constitution, the rule of law and a far-sighted immigration policy. However, with China now looking in difficulty, Australia is going to have to deal with asset prices too high to withstand even a flat economy. Our favourite short is Genworth, which has a business model that only works if house prices rise. Any rise in bad debts and they have cause for concern".

Australian-based internet searches of 'housing crash' spiked in recent months

Source: Google, Goldman Sachs Global Investment Research

8) Could you outline your short thesis on Tesla?

"It is good that Tesla is finally manufacturing some cars but it is not enough to be an OEM, Tesla needs to develop an infrastructure of dealers and garages as well as a leasing model. The dealerships we estimate to cost another $15 billion (they have already spent $15 billion so far). The leasing is difficult because battery lives are shorter than combustion engine lives. Tesla has its devoted followers but they need to have deep pockets".

9) If you only had 100 words to summarise your market outlook for 2019, what would they be?

"Cloudy with the likelihood of rain, interspersed with periods of sleet and snow. Outbreaks of sunshine will be short in duration!"

10) What was the last book or report you read that really stunned you?

'Diplomacy' by Henry Kissinger changed my life. To develop a template on how diplomacy should be carved out and then to put all history through the eyes of that template without distorting the view is a remarkable achievement. He also writes well and the book takes forever to read.

4 topics

1 stock mentioned

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.

Expertise

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.