Ramsay Health Care: Peddling uphill through inflationary cost pressures

Healthcare provider Ramsay Health Care (ASX: RHC) is facing challenges on a variety of fronts: ensuring sufficient skilled labour across its various markets, setting prices based on government payer tariffs and health insurer benefits, not to mention higher funding costs. While the message during the results call from the company was about moving forward, according to Henry Jennings from Marcus Today:

COVID really did distort this business, quite considerably and it hasn't really changed. It's still really suffering. I guess the hangover from COVID in some respects, it's probably got long COVID itself.

In this wire, Jennings gives us his take on Ramsay Healthcare. As you’ll see, for Jennings it is a story of disappointment, with not much upside to be found in RHC's outlook statement.

Ramsay Healthcare Full Year Key Results

- Revenue $15.34B up 11.6%

- Adjusted EBITDAR $2.15B up 10.3%

- NPAT $298.1M up 8.8%

- EPS 124.8c up 7.5%

- Final dividend 25cps, fully franked; FY23 total dividend of 75cps, down 22.7% on FY22

FY24 outlook

- Group growth in earnings to be driven by mid-single-digit top-line growth, margin recovery, and digital and data opex investment

- Growth capex $0.89-1.1B and brownfield investment spend in range of $250-300M

- Modifying investment strategy in light of higher development costs and disruption in the building industry

Key company data for RHC

Source: Market Index

Note: This interview took place on 24 August 2023.

In one sentence, what was the key takeaway from this result?

Disappointment on a number of fronts.

The numbers were a little bit light on. The Outlook statement wasn't particularly good. We're still seeing the pressures in terms of staffing costs and in terms of the funding costs that they have. There was no further news on the potential Sime Darby sale. There are some issues still with Elysium. They paid $1.4 billion for that mental health business in the UK. So all up in a market that does not reward anything apart from beating forecast, this one was pretty light on.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

With RHC down around 10% this morning, I'd say it's probably appropriate.

We've seen a number of companies in the healthcare sector succumbing to less than optimistic forecasts and slight misses on revenues etc. That includes CSL (ASX: CSL) which up till recently had never downgraded. We've also seen that with Resmed (ASX: RMD) and now we're seeing it with Ramsay and the healthcare sector generally is a sector that the market seems to be avoiding at the moment.

It's hard to find serious positives in RHC's result. The one thing that has been keeping it up is the potential sale, that has helped. And also, there are some corporate appeal. We've seen Brookfield in the past look at this one to try and separate the company into the property side and the hospital side and release some value there. But that deal has long past and it does look as if there are few catalysts to get excited about it.

At the moment the market takes no prisoners. Do not disappoint is the mantra. So I suspect this one has fallen foul of that. Whether it recovers remains to be seen, but it usually takes three days for things to settle.

Were there any major surprises in this result that you think investors should be aware of?

There were no major surprises. Having said that, 10% downside suggests some.

It was death by a thousand cuts more than anything else.

The surprise was possibly that the UK is doing somewhat better than the market may have thought. That seems to have been overridden by other concerns. Anecdotally the UK health system is under serious pressure. Seriously underfunded, etc. So that was I guess slightly surprising that RHC had done better in that market. Certainly the growth doesn't really seem to be particularly good in the company.

Would you buy, hold or sell RHC on the back of these results?

Rating = HOLD

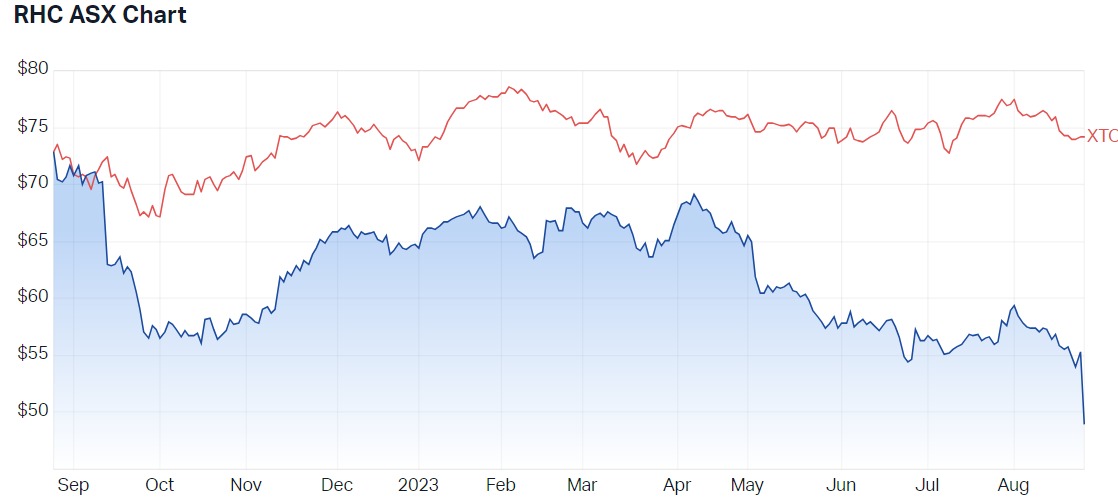

It's obviously a quality business under some cost pressures, inflation pressures and staffing issues. It has fallen a long long way in recent times from $70 back in April this year to under $50. I think if you were looking to sell it you probably missed the boat. If you're a shareholder, you're probably holding and hoping.

For prospective shareholders, there's probably no reason to be there at the moment, at least until the dust settles, but certainly, it is probably a hold of these levels. I wouldn't be surprised to see further downside as brokers downgrade their numbers, taking into account, what's happened with these results.

What’s your outlook on RHC and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

I think the sector generally is seeing the same sort of inflation pressures, the same sort of disappointment and it was a defensive sector that people were happy to hide out in. It's proved to be not quite as defensive as some thought and has suffered on the back of it. As a result, I think we're seeing a lot of people shunning it at the moment.

The only one that really has done better than expected: Cochlear (ASX: COH). That one seems like a shining light, but I think the healthcare sector generally is not quite as defensive as some investors thought and as a result, I think we're seeing a lot of people shunning the sector at the moment.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

Rating = 2.5-3

There are pockets of excitement and pockets of caution. We're coming to the tail end of reporting season, the good ones are being rewarded, the bad ones of being hit, but then some of that hit has been negated in the days to come.

At an index level, It's hard to get massively excited without banks and resources doing very well. We've seen a little bit of interest stirring in resources. A lot depends on what's happening on the macro front, but certainly, as we head into September, when the US starts to get serious and summer holidays are finished, we could see some moves. My best case scenario is that we see a gradual grind higher.

Results season hasn't been too bad, noting the stress in the economy from the mortgage cliff that some had been talking about especially in the media. The banks seem to be under control in terms of those bad debts and 90-day arrears which is positive. What we really need to see is the resource sector fire up on a little bit of Chinese stimulus, which we're all hoping and waiting for. We have seen some signs of that but we still need to see a little bit more.

The 10 most recent director trades

Source: Market Index 24 August 2023

1 topic

4 stocks mentioned

1 contributor mentioned