Ramsay Healthcare (RHC) – Australia’s Hidden Property Tycoon?

Schroders

Equity investors are facing land mines everywhere, and dare I say it, bear market conditions! From Zuckerberg’s long-shot bet on the metaverse, the post-COVID stimulus hangover, and now a Federal Reserve Chairman that’s turned inflation crusader at all costs. Within this backdrop, there will be few companies that can deliver earnings growth that aren’t trading at eye-watering valuations.

Enter stage left Ramsay Healthcare (ASX: RHC), a property-rich enterprise with the best private hospital network in Australia. During the pandemic, Ramsay was hit hard by elective surgery cancellations, staff shortages, and elevated consumable costs. KKR saw this as an opportunity and lobbed an $88 all-cash buyout proposal in 2022. However, after months of negotiations, the second wave of COVID, KKR walked, leaving Ramsay stranded at the altar. This saw the fast money exit, sending the share price down to $58.

As they say, beauty is in the eye of the beholder, and thus the market’s temperament with any bad news has thrown up an attractive opportunity that ticks the right boxes:

- A quality business: With leadership and scale positions across Australia & the UK

- A defensive and growing earnings stream: Underpinned by long-term structural tailwinds.

- Hidden property assets: That would be the envy of any REIT or infrastructure investor.

- An undemanding valuation: When considering property assets, earnings resilience, and growth profile.

There is pent-up demand for private elective surgery

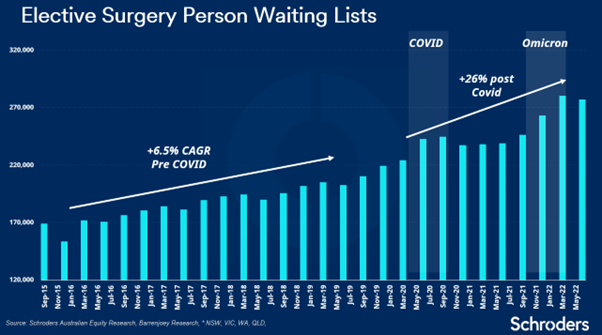

Demand for healthcare services is generally immune from economic shocks, however, COVID was the exception given forced lockdowns and isolation orders in 2020-22. Consequentially, there has been a significant build-up in elective surgery backlogs, with patients on elective waiting lists up 27% from 2019-2022. While Ramsay’s Australian operations are still suffering from the Omicron wave (estimated $40m impact in 1Q23), the recent removal of isolation orders should see trading start to recover from 2H23 onwards.

With restrictions removed, elective surgery volumes should start to bounce back, as surgery cannot be deferred indefinitely. This was evident in Ramsay’s Nordic operations, which had less exposure to elective surgery restrictions in 2022, with MSO (medical, surgical and obstetrics) volumes up over 14%. Once the backlog clears, we expect elective surgery growth should return to trend growth of 6% per annum, given an ageing population and advances in clinical practice which tends to be supportive for healthcare utilisation.

Strategic initiatives to restore profit margins

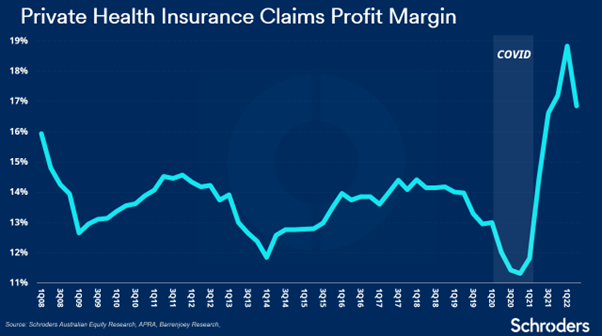

As volumes return, profit margins should improve. However, management is not sitting idle and has several initiatives underway to accelerate profit margin growth into 2023-25. The big one is negotiating improved terms with payers to reflect an inflationary environment. While Ramsay has been a COVID loser, private health insurers have benefited from a benign claims experience environment, with the industry gross margin increasing from 14.6% to 16.9%, the highest level since 2008.

In August 2022, Ramsay signed a new three-year deal with Bupa after tense negotiations which saw Ramsay terminate coverage for Bupa members. To quote Ramsay Australia CEO Carmel Monaghan, “the new agreement recognises both the cost of living pressures facing health insurance customers and the significant cost increases at hospitals ranging from consumables to staff wages”. This is a stark change from previous agreements where payers historically extracted a productivity dividend from Ramsay by awarding more modest pricing increases.

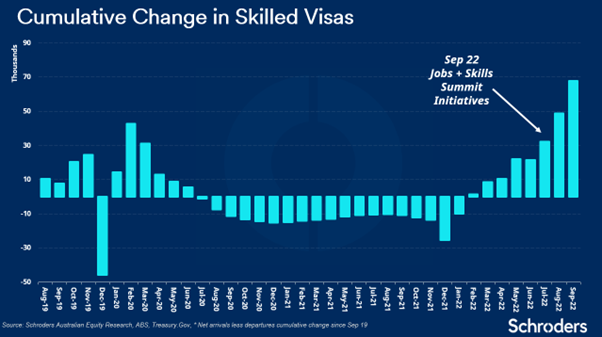

Access to skilled labour is still a challenge, with Ramsay using more agency staff during 2020-22, which is a higher cost. To address this, Ramsay and the broader hospital sector have liaised with the government to address shortages. The government has responded by accelerating visa processing times for international skilled labour, with a particular focus on healthcare workers.

As the chart below highlights, skilled worker visa intake has accelerated with the net cumulative arrivals now turning positive for the first time since June 2020. Other cost reduction initiatives underway include sourcing lower-priced protective equipment at scale by leveraging Ramsay’s global operations, given panic buying of healthcare, consumables has ceased. Combined, these initiatives should be supportive of improved profitability over the medium term.

The crown jewel property portfolio

The heart of Ramsay’s competitive advantage is the ownership of 47 freehold hospital sites out of 70 hospitals in Australia. This includes the mega-hospital sites of Hollywood Private Hospital (WA) and Greenslopes Private Hospital (QLD), first built in 1942. Ramsay’s total freehold beds amount to about 6,700 beds. Freehold ownership has enabled Ramsay to deliver >10% return on assets from brownfield expansion, and the flexibility to optimise the footprint by case mix.

This network can’t be replicated today for a commercial return. For example, the Northern Beaches Private Hospital was the first greenfield site in Sydney in over twenty years and came at a construction cost of $600m ($1.3m/bed), excluding the land. Applying those metrics to Ramsay’s freehold portfolio would imply a replacement cost of $8.6bn, excluding land. Recent government hospital expansion programs imply an even higher replacement cost of over $1.8m-$2.8m per bed.

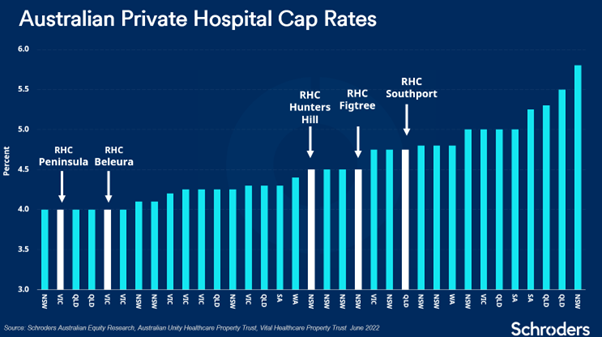

We believe this hidden property portfolio is what attracted KKR. The precedent was set in 2019, when Brookfield privatised Healthscope (HSO), the second largest private hospital operator at an enterprise valuation of $6bn. Shortly afterward, Brookfield spun out 22 of its freehold hospitals for $2.5bn, which implied a capitalisation rate of 5%. As with all property transactions, it is the rent cover that matters, which in this case implied 3.0x, so a third of Healthscope’s earnings attracted a 20x multiple.

The demand for hospital assets is currently insatiable, given the structural headwinds facing other commercial asset classes such as office and shopping centers. Unlike industrial property, hospital asset supply tends to be scarce in the long term. Applying the Healthscope metrics to Ramsay’s Australian business, would imply a property valuation of $6.4bn, 45% of its enterprise value today. Given the quality of the portfolio, it’s possible that lower capitalisation rates could be applied, which is already the case for some of Ramsay’s properties that are owned by external real-estate trusts as seen below.

Is it time to abandon the French conquest?

In 1789, the French revolution was a watershed event in history that enshrined fundamental principles of liberal democracy. Unfortunately for Ramsay, its A$1.9bn expansion into France has not been as spectacular, which has led to a part ownership (52.5%) of Ramsay Générale de Santé. Générale de Santé still remains listed on the Euronext with a market value of A$3.2bn. While Générale de Santé has a formidable position in France, with 21% of the private sector, the industry is heavily regulated with the government setting tariff rates. Unlike Australia, operating margins and returns had been under pressure prior to COVID, and there is little freehold ownership.

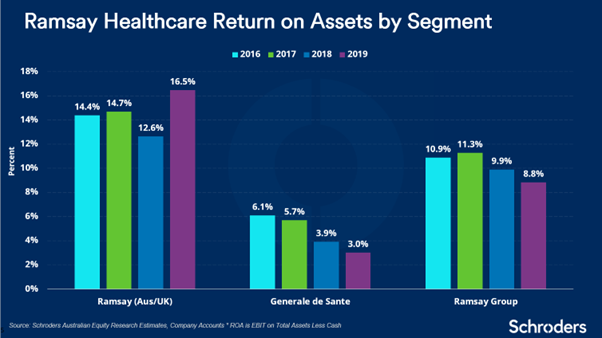

Ramsay’s part ownership of Ramsay Générale de Santé was also a sticking point for KKR ceasing discussions, given an inability to conduct due diligence. The 100% consolidation of Générale de Santé’s financial accounts with Ramsay Australia/UK has the effect of reducing group returns and increasing group gearing. The divestment of Générale de Santé, or a restructure of ownership would have the effect of simplifying Ramsay’s accounts, lifting returns, and reducing gearing. Générale de Santé is carrying A$2.5bn of debt, compared to Ramsay Australia/UK of A$2.3bn. We highlight the differential in return metrics for Ramsay Australia/UK compared with Ramsay Générale de Santé below.

Ramsay offers significant hidden value

Ramsay is often compared to global hospital operators, which are valued by the market at 10-14x one-year forward EBIT. Payer systems and property ownership is mixed by operator, with European hospital groups having a lower freehold mix and operating in more difficult funding settings. Meanwhile, Global Healthcare Property Trusts are valued at 18-22x EBIT, given their stability and the absence of structural headwinds faced by other REIT sectors.

Backing out Ramsay’s Générale de Santé holding and using 18-22x EBIT multiple to the implied rent from the Australian properties (prop.co), and a range of 12-14x EBIT to the normalised Australian (op.co ex-rent) and UK operations, implies a valuation range of $59/share to $70/share for Ramsay Healthcare. For KKR to offer $88 a share, higher multiples were clearly being applied, or KKR saw an ability to extract value from other parts of the business which suggests there could be more hidden value. One thing KKR did stand to benefit from was the absence of duties and taxes on any property transaction, unlike Ramsay shareholders.

One could conclude that Ramsay Healthcare is to Australian investors what Pebble Beach was to famed investor Peter Lynch in 1976. To borrow from Peter Lynch’s words, it is likely that Ramsay Healthcare offers investors “incredible hidden assets that don’t show up on the balance sheet, overlooked by the market”. Obfuscating the attractive returns from the Australian business is the complex holding structure of the European assets, which if resolved, could redraw investors’ attention back to the attractive growth and return profile of the Australian private hospital network.

Learn more

The Schroders Australian Equity Funds are actively managed portfolios of Australian equities focused on investing companies with attractive valuations, characterised by sustainable earnings and competitive advantage. To learn more about Schroders please visit our website.