Readytech is ready for the big time

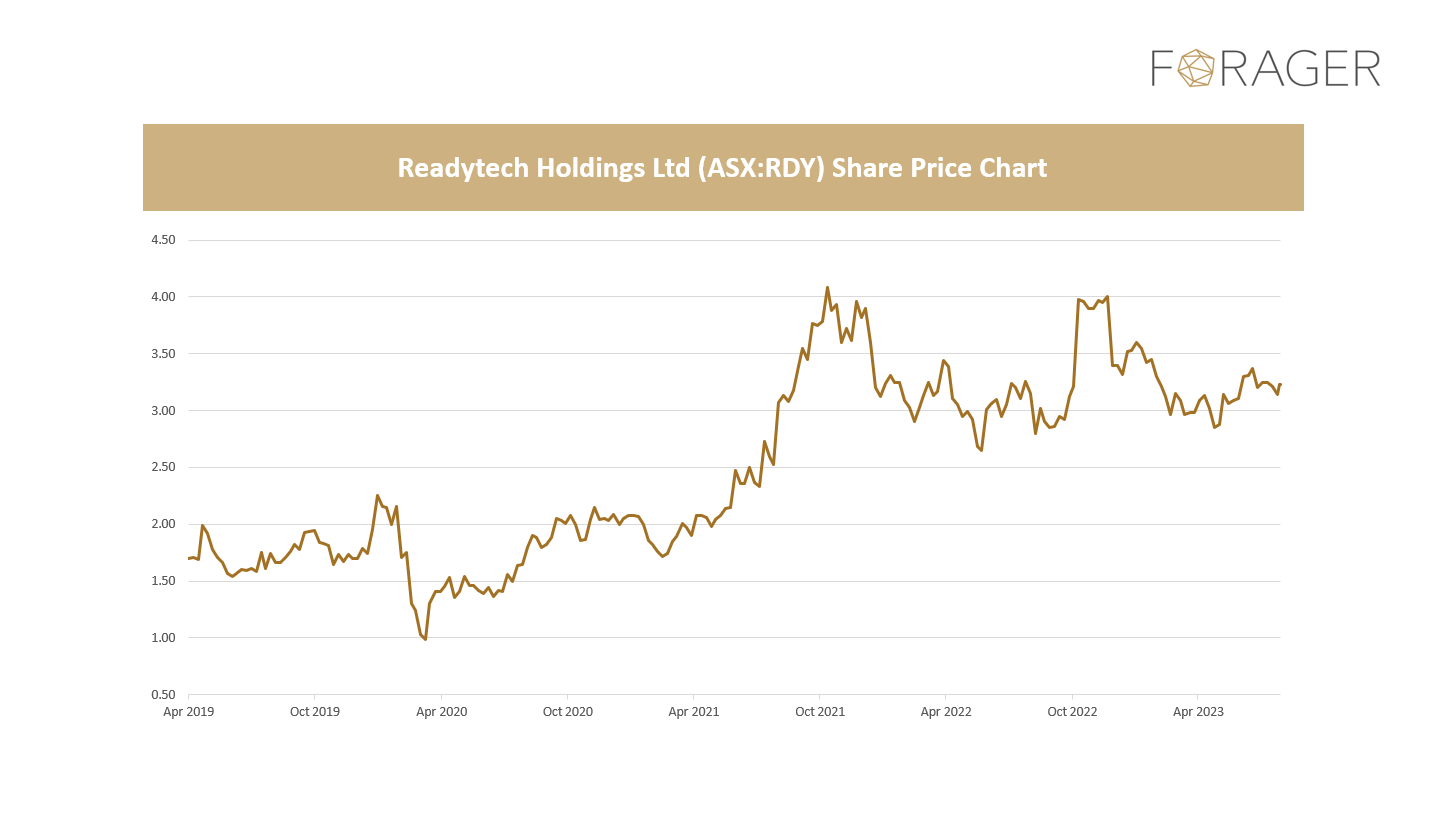

On Tuesday Readytech (ASX: RDY), a software provider to the education, workforce and government & justice industries, announced the company’s results for the 2023 financial year. The results were largely in-line with expectations and painted a picture of continual growth across verticals, improving profit margins and increased cash operating leverage.

Total revenue climbed 32% for the year, capping off a three year period where the company grew at a compound growth rate of 34% per annum. More importantly, though, organic growth, excluding the acquisition of the IT Vision government software business last year, was up 13%. This continues the company’s strong organic growth, sourced from higher prices, selling more software modules to existing customers and adding new clients. The revenue is sticky and products serve mission-critical functions for clients. Very few customers turn the products off and stop paying.

New client wins, especially in the larger ‘enterprise’ customer space, were strong. Across 11 new enterprise clients, $12.4m of work was signed, with total contract values over time far exceeding this number. This included clients like Auckland Council and Nando’s. The company is also competing for $28m of new work.

Profit margins, in Readytech’s case measured by earnings before interest, tax, depreciation and amortisation, fell during the year, hampered by the lower margin IT Vision acquisition. There is some evidence that the business has reached a margin nadir.

Second half profit margins improved over the first half (though seasonality may have played a part). IT Vision profit margins have leapt up, printing 27% in the second half, a full five percent better than its full year margin. And the company has forecast an improvement to profit margins next year of a little under one percent, with longer term targets another three-odd percent better.

The only blight was that technology spend has been running high, and most of the spend gets added to the balance sheet rather than expensed. Total capital expenditure was up 56% on the prior year, outpacing revenue growth. Management suggests some relief here too, with technology spend as a proportion of revenue reducing next year and falling again longer term.

If everything goes to target, by 2026 management will have the business generating profit margins in the ‘high 30%’ range with technology spend of 12-13% of revenue. That would be good enough to drop about $25m of free cash flow into the business, a very attractive 7% free cash flow yield on today's price, while still growing healthily.

With growing predictable revenue and a clearer line on cash costs Readytech is ready to break into the big leagues of Australian technology companies.

Readytech continues to be one of the largest investments in the Forager Australian Shares Fund (FOR).

.png)

Learn more about Forager

If you share our passion for unloved bargains and have a long-term focus, Forager could be the right investment for you. Click 'FOLLOW' below for more of my insights.

For all of Forager's latest content, videos, podcasts and fund reports, register here.

2 stocks mentioned

1 fund mentioned

.jpg)

.jpg)