Recent rally leaves global equities more vulnerable

LGT Crestone

The MSCI World index has rallied around 16% from its mid-June lows. The S&P 500 and NASDAQ have fared even better, up 19% and 25% respectively from their June lows. For several reasons, we feel the path from here is more uncertain, and would recommend a patient approach to capital deployment.

In this Special report, we outline why we feel the recent rally leaves global equities more vulnerable near term (though less so for domestic equities). While several of our signals for moving more constructive on equities have been triggered in recent weeks, markets have rallied quickly to levels where there is arguably less valuation support. As such, we recommend taking advantage of the recent rally to lower overall equity risk exposure, where portfolio allocations have drifted above strategic allocations.

The market has already front run a ‘Fed Pivot’

Equity markets have become accustomed to central banks cutting interest rates in response to slowing economic growth. Indeed, in ‘Pavlovian’ fashion, there are precedents. Most recently, the past two hiking cycles have seen the US Federal Reserve (Fed) respond to slowing growth—and have seen it do so aggressively: Rate hikes in the middle of 2007 gave way to cuts in 2008, and more recently, the ‘Powell Pivot’ saw the Fed hike rates in December 2018 only to change course in January 2019.

However, these pivots need to be seen in the context of the inflationary regimes that presided at the time. For the better part of 30 years inflation averaged just over 2%. Indeed, the ‘Powell Pivot’ occurred when inflation was less than 2%. That is a much more palatable position to be stimulating/protecting growth compared to the current situation where inflation remains around 8-9%.

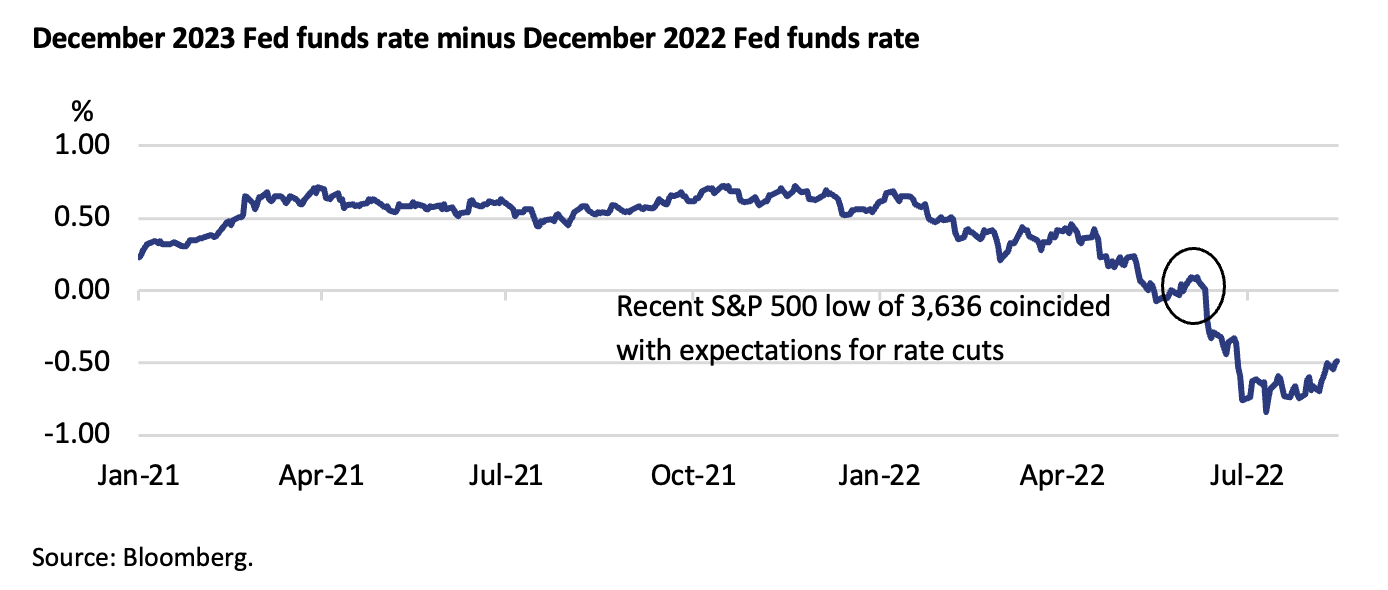

Again, global equity markets are seemingly already pricing in a Fed Pivot, as the chart below suggests. Equity markets bottomed in June as investors started to factor in Fed rate cuts in 2023 (as well as other regions). In fact, at one point, investors were factoring in more than three rate cuts to the Fed funds rate in 2023. Now they are factoring in less than two.

Surprisingly, the market has continued to rally, despite there now being less than two rate cuts priced in. Our central case is that the path for inflation should be viewed in two stages:

- The path from peak inflation of more than 9% in the US to 5-6% will be comparatively easy. Easing supply chains, lower commodity prices, greater mobility, and lower aggregate demand should assist.

- However, the path to 2%, the Fed’s mandated level, from 5% is likely to be harder. Unemployment has not been this low since the 1960s, which has resulted in wages pressure. Energy prices, which despite falling from their highs, have likely seen a structural shift higher due to security concerns and sustainability issues. And China’s zero tolerance approach to COVID is likely to see corporations, once heavily reliant on China to manufacture their products, introduce redundancy (i.e. costs) into their supply chains (i.e. moving from a ‘just-in-time’ approach to a ‘just-in-case’).

Consequently, we perceive that the hurdle for a central bank pivot is higher than is currently being priced by the market. At the very least, it appears premature, despite slowing economic activity. When viewed through the lens of trading off embedding higher inflationary expectations, or higher unemployment from near record lows, we believe central banks will show a much greater tolerance for the latter than the former.

Valuation multiples are no longer supportive

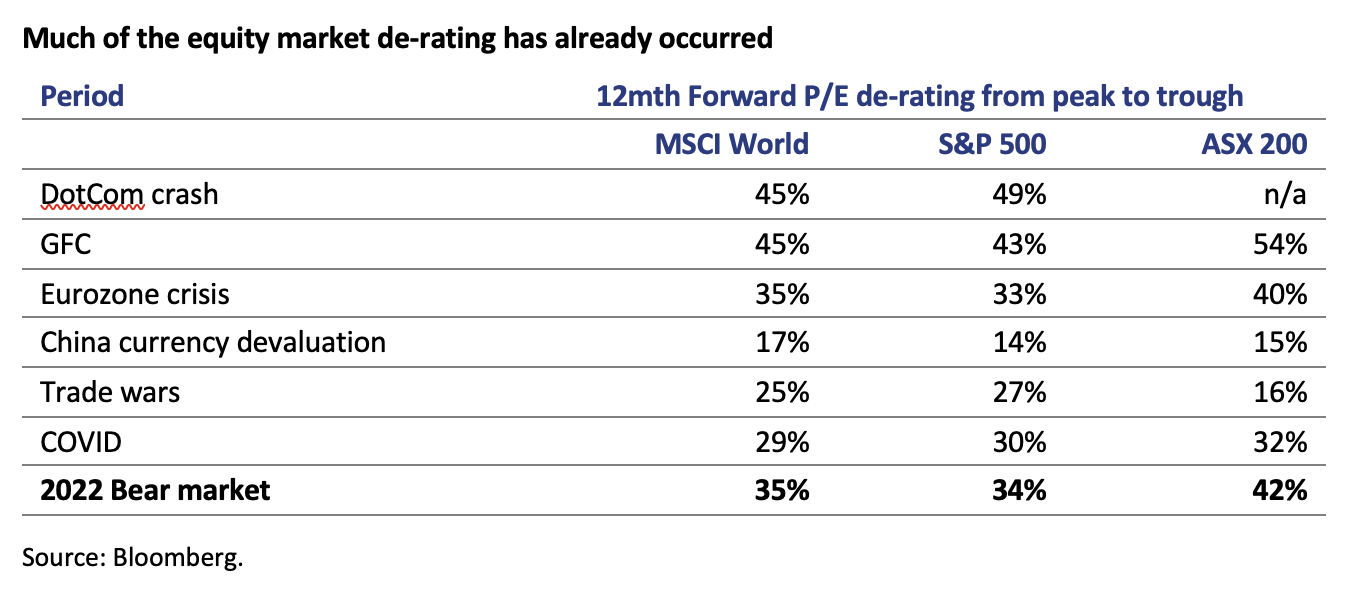

In the July edition of Core Offerings, we noted that Phase 1 of the bear market in equities had largely run its course – that is, valuations had recalibrated sufficiently in line with longer-term multiples, providing an element of valuation support (see table below). However, this was predicated upon two key nuances:

1. That current and future earnings estimates were accurate (more on that below).

2. That although the falls in forward price/earnings (P/E) multiples were in keeping with what we have seen in prior bear markets, they were still not sufficiently cheap, especially in light of the more attractive returns that were on offer in fixed income markets.

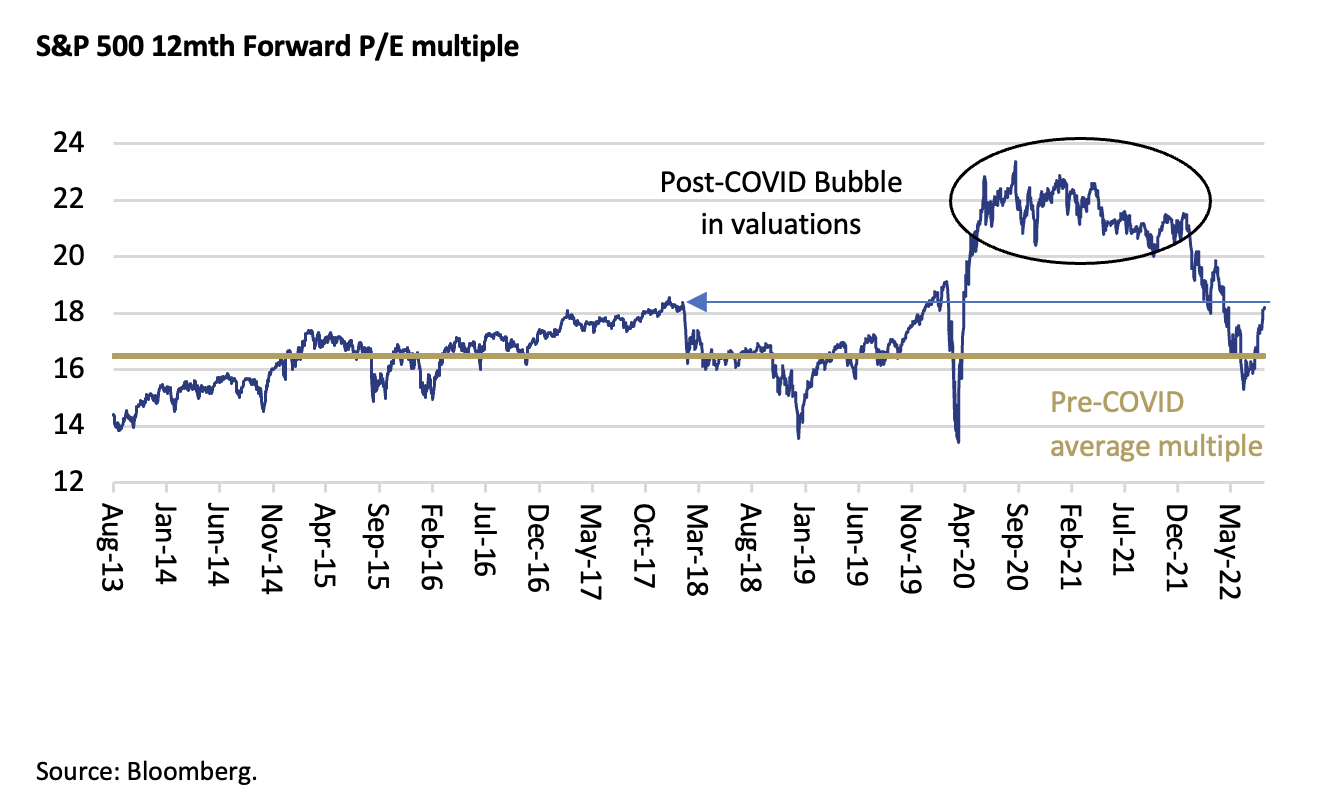

Since the market lows, 12-month forward P/E multiples for the MSCI World, S&P 500 and NASDAQ indices have expanded by roughly 15-20%. Although investors might be tempted to suggest that current multiples are cheap relative to post-COVID peaks, it must be remembered that these multiples coincided with:

- Nominal interest rates, globally, at the zero lower bound (i.e. zero)—not rising as they are now.

- Historically record low negative real interest rates—not positive as they are now.

- Quantitative easing by central banks—not quantitative tightening.

- Record (in terms of size and quantum) fiscal stimulus—this impulse is now fading.

- Accelerating earnings and record margins—not decelerating earnings growth (albeit resilient thus far).

As a result, it is more appropriate to benchmark current multiples with those that presided in the pre-COVID era. To this extent, it can be seen below that, for example, the current multiple on the S&P 500 (18.2x)—is at levels that coincided with ‘peak multiples prior to COVID’. With a higher cost of capital and significant uncertainty regarding the economic outlook, it would appear difficult for multiples to expand from current levels. Furthermore, free cash flow and earnings yields relative to those on fixed income still do not screen attractively (i.e. fixed Income as an asset class is now a viable alternative to equities).

The technical backdrop

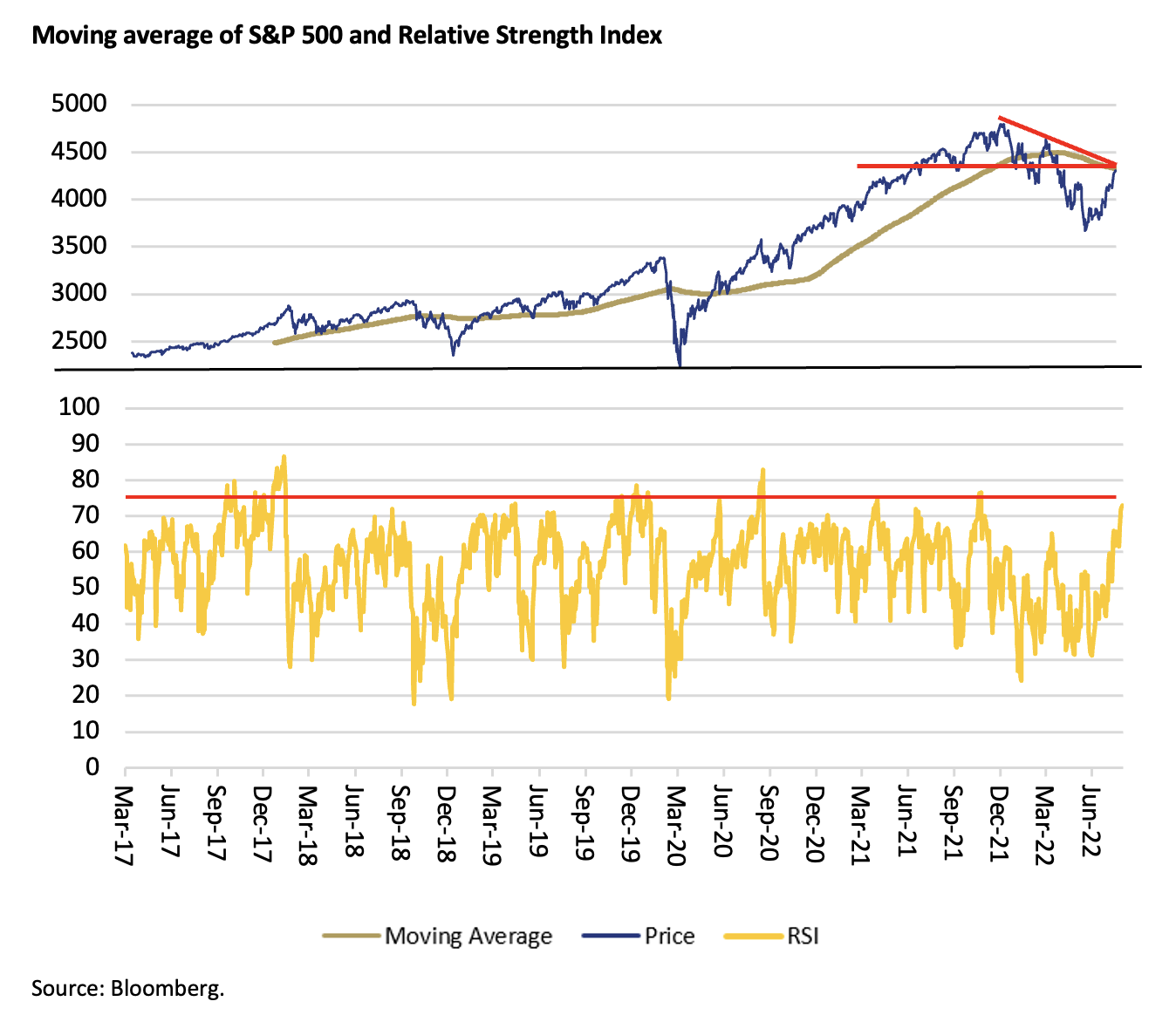

The S&P 500, having broken a line of support at 4,170 in May, quickly fell to new lows in June. Having recovered from that level, it is now trading at two instances of heavy resistance:

- Firstly, the downtrend line from the market’s peak in early January 2022, a level that was validated in March 2022.

- This downtrend line also happens to correspond with the 200-day moving average, 4,325.

Furthermore, as the bottom sub-chart shows, these two levels also coincide with a market that appears overbought. The Relative Strength Index (RSI), which is a momentum indicator that evaluates the speed and magnitude of change, is now at 73. In the past, levels at or exceeding this have been conducive to short-term weakness (where it breaches the red line).

Are current earnings estimates accurate?

This brings us to the final piece of the puzzle—earnings. The critical issue for investors is whether current earnings estimates are accurate. Put another way, will wages and raw materials cost pressures, and a consumer that no longer has fiscal or monetary support (notwithstanding strong cash surpluses) result in earnings and corporate profit margins that are lower than currently forecast? If that is the case, earnings-based valuation metrics will likely become more expensive than they currently appear.

The just-completed US reporting season has been, admittedly, resilient. According to FactSet, the blended earnings growth rate for the S&P 500 index is 6.7%. Significantly, the energy sector is not only reporting the highest earnings growth, it is also the single largest contributor to earnings growth for the S&P 500 for Q2. In fact, if the energy sector is excluded, the S&P 500 would be reporting a year-on-year ‘decline’ in earnings of 3.7% rather than a year-on-year increase in earnings of 6.7%.

For the S&P 500 index, 2022 earnings per share (EPS) growth estimates are now 7.5%, compared to the almost 10% expected at the beginning of the year. EPS estimates for calendar year 2023 have also fallen from a peak of USD 250 per share to USD 244 presently—a decline of 2.5%. The path for earnings, although more resilient than expected so far, remains for weaker sequential growth at this stage.

Conclusion (and a final word on Australia)

It should be noted that very low interest rates, all else equal, have served to suppress volatility. With interest rates higher and the path forward more uncertain, this should result in greater equity market volatility over coming months. In our view, this should serve to reward patient and cashed-up investors. With markets having aggressively re-priced the path of interest rates, with multiples higher, and with earnings showing signs of weakness, we feel that now is an adequate time to be tactically reducing risk and waiting for better entry points. The resilience of corporate earnings in the face of weakening/weaker economic growth will determine the magnitude of any potential correction.

Alternatively, when analysing the opportunity cost if markets were to continue to rally, it would necessitate current expectations for a Fed pivot to eventuate (which markets have already priced); an expansion of multiples beyond what was consistent during periods before the post-COVID period; or earnings to at least stabilise and, in all likelihood, expand from the current levels of record profitability. On balance, we feel that this is an appropriate trade-off to make (i.e. the opportunity cost of being wrong is not especially severe from current levels).

Within this context, however, it should be noted that we retain an overweight stance to Australia. The wages data released today (+2.6% last quarter) missed expectations and suggests that despite almost 50-year low unemployment levels, the path of inflationary pressures will be less severe than in other parts of the world. Additionally, valuations in Australia remain comparably attractive, at around 14x, in line with their longer-term, pre-COVID average. Money supply growth in China is accelerating and is also likely to provide a backstop for the mining and energy sectors, notwithstanding uncertainty over repeated COVID breakouts.

Learn what LGT Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, LGT Crestone offers one of the most comprehensive and global product and service offerings in Australian wealth management.

Click 'CONTACT' to find out more.

4 topics

Todd joined Crestone in June 2017 and he is responsible for global equities investment and advice. He has over 15 years experience covering fixed income, Australian and global equities both domestically and internationally.

Expertise

Todd joined Crestone in June 2017 and he is responsible for global equities investment and advice. He has over 15 years experience covering fixed income, Australian and global equities both domestically and internationally.