Recession comes… but so too will the inevitable recovery

Easing geo-political tensions and better growth momentum as we entered 2020 are but a distant memory. The month of March delivered rolling shocks—from the spread of COVID-19 outside China, to the collapse of oil prices and the unfolding realisation the virus was rapidly breaking out across Europe and the US. With economies locking down, a global recession involving Australia now seems likely, and one of the sharpest bear market equity corrections in history has transpired. This month we consider the path ahead, including alternative scenarios.

Atypically, we have found ourselves making several tactical portfolio tilts during the month. Despite improving signals, we were neutral in equities (though underweight Australia), reflecting later-cycle valuation concerns. Early in March, we moved underweight international credit, capturing severe dislocations, before reversing this position later as policy makers stepped in. We also closed our underweight to domestic equities in mid-March (and our defensive overweight to alternatives). We are now modestly overweight equities in recognition of the sharp equity corrections to date. Positioning for recovery, in time, will be key.

The most uncertain of times…

The global economy and Australia have suffered numerous shocks (arguably ‘black swans’) over recent weeks. A health crisis that began in China has now morphed rapidly into a severe economic crisis, accentuated by tardy efforts of some nations to initially deliver an appropriate response. The breakdown in negotiations between the Organization of the Petroleum Exporting Countries (OPEC) and Russia to support oil prices also contributed to an unexpected rise in stress in global credit markets, particularly high yield.

The catalysts for past periods of panic and crisis were often unknown (1987) or unique (the freezing of credit markets in 2008). This time, the breadth of human fear at a time of simmering geo-political tension and uncoordinated nationalistic world governments is a unique feature of this crisis. Despite good growth momentum as we entered 2020, the unique and multiple features of this crisis are adding to what is now clearly the most uncertain period of time for the world since the GFC.

In response to the pandemic governments have enforced the lockdown of many economies, including Italy, other parts of Europe, the US, India and Australia. Borders have been shut, output curbed, and normal human activity (work, travel and spending) curtailed. A GFC-style collapse in global and Australian growth now appears inevitable for mid-2020. Whether the world can recover quickly (a V-shaped pick-up) or over a more extended period (a U-shaped pick-up) depends on how soon the virus’s spread is contained.

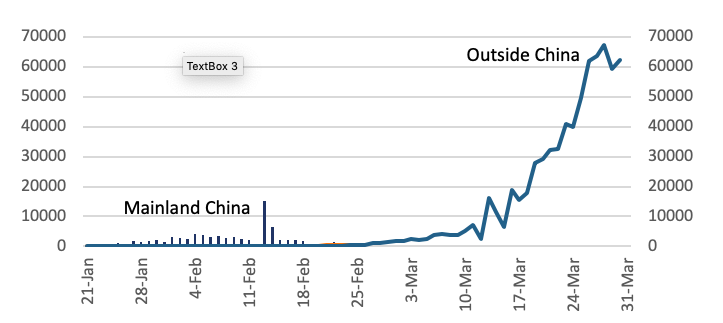

COVID-19 remains uncontained—world cases daily

Source: John Hopkins University, Crestone.

Policy makers have responded aggressively to the crisis

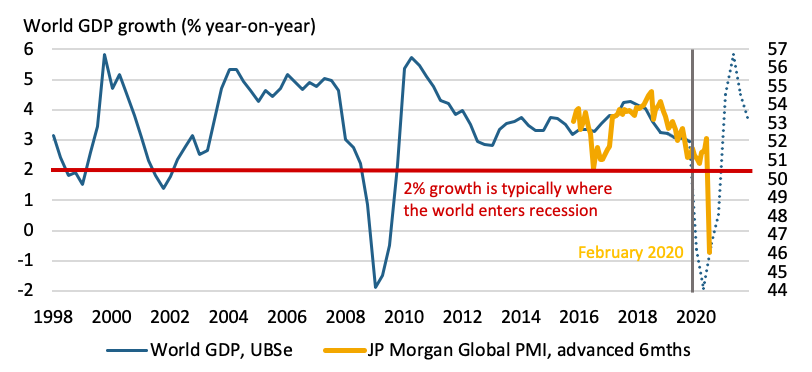

As we enter Q2, there are likely to be increasing signs in the data of the sharp magnitude of the growth decline that’s unfolding. There are already glimpses. Across the world, composite purchasing manager indices (PMI)—leading indicators of activity—for March have collapsed to recessionary lows, adding to the weakness in the global PMI for February (driven initially by China’s shutdown) as shown in the chart below. In the US, initial jobless claims spiked 15-fold in late March to 3.3 million, raising the risk that unemployment may jump from its 50-year low of 3.5% in February to over 10% by April. As the chart also shows, UBS has cut its forecasts for 2020 global growth from around 3% this time a month ago to -0.7% (a similar downturn to the GFC in 2007-2008). It forecasts a strong recovery unfolding from in H2 2020 that underpins growth of 4.5% in 2021, which would be its fastest since 2010. This view is broadly predicated on a peak in the virus’s spread by end Q2 2020.

JP Morgan global PMI and UBS world growth outlook

Source: UBS, JPMorgan, Crestone.

Policy makers—both governments and central banks—have responded aggressively through March to the threat of a global recession:

- Monetary policy—Developed economy central banks have moved quickly to cut interest rates everywhere to virtually zero, and to flood short-term funding markets to avoid a health crisis morphing into a financial crisis. Central banks in the US and Canada both cut rates by 150 basis points (bps), while the UK cut by 65bps and Australia cut by 50bps. Many other central banks have also cut rates, including across Asia. Extensive loan facilities and renewed quantitative policies were also announced in the US, Europe and, for the first time, in Australia.

- Fiscal policy—Unprecedented stimulus of at least 3% globally (around twice that during the GFC) has been promised. Historic packages in the US, Europe, UK and Australia (of 5-10% of output), as well as many parts of the emerging economies, target unemployment relief and deferred taxes for business, as well as wage subsidies for workers.

Massive global fiscal stimulus announced

Source: UBS estimates, Crestone

How will the world transition this crisis?

Investors are not likely the most esteemed sources of analysis when it comes to disease outbreaks. But history shows that outbreaks have been inevitably brought under control (often via human behaviour). The Severe Acute Respiratory Syndrome (SARS) outbreak lasted nine months, H1N1 Swine Flu lasted eight months, while Middle East Respiratory Syndrome (MERS) outbreaks have typically taken several months to contain, as in South Korea.

COVID-19’s contagiousness and relatively long (asymptomatic) incubation period nonetheless makes this a challenging pandemic to contain, as evidenced by over 850,000 cases around the world (and 40,000 fatalities). The full weight of the global medical technology sector is being applied to discovering a vaccine. Peter Doherty from Australia’s The Doherty Institute says a COVID-19 vaccine could be available within 12 to 18 months.

Scenario 1—our central case (50%): H1 2020 data confirms a sharp mid-2020 collapse in activity and earnings. For most countries Q2 and Q3 growth contracts (and PMIs trough around 30). Fiscal stimulus mitigates but cannot prevent an inevitable rise in global unemployment. But a peak in the spread of the virus is achieved in early Q3 (around July). A global return to work during Q3 underpins a sharp recovery in Q4 2020 growth, ahead of a strong recovery in 2021. This is likely best thought of as a U-shaped recovery, where there is only a moderate permanent loss of output. Typical of supply-chain shocks (rather than demand shocks), economies rebound strongly, aided by the massive fiscal and monetary support that has been added in 2020. Conversations about rising inflation do not gain momentum until 2022.

In this scenario equity markets likely rebound solidly by end-2020. After a 20% to 30% decline in earnings in 2020, the return of growth and earnings visibility underpins expectations for 20% to 30% earnings growth in 2021, also allowing some modest valuation expansion. Central banks would continue to keep policy rates anchored near zero, and quantitative easing (QE) policy would limit any material yield curve steepening until mid-2021 at the earliest.

Scenario 2—the upside scenario (30%): The disease’s spread is contained more rapidly than expected in most countries during Q2. This is the V-shaped recovery with limited permanent loss of output. Data for Q2 contracts sharply across the world. But governments make pre-emptive decisions to open economies and restart activity to minimise the economic costs of the crisis. In this scenario, fiscal policy can more significantly bridge the gap in activity and lead to only a more moderate rise in unemployment. As in the central case, growth rebounds sharply—but through both Q3 and Q4 2020, with a similarly strong outcome for 2021. Stimulus sustains growth for several years and conversations about rising inflation gain momentum during 2021.

In this scenario market performance would be similar to scenario 1, though the equity rebound could be materially stronger, and 2021 could see indices return to pre-COVID-19 levels. While policy rates would remain near zero central banks would likely allow some drift up in bond yields in H1 2021.

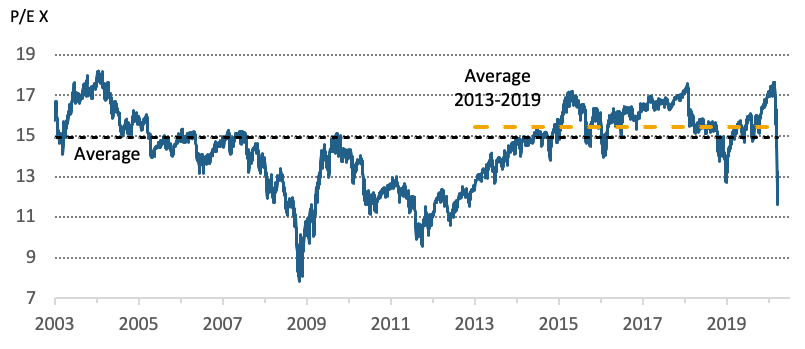

Is valuation support

returning to equity markets?

Source: UBS, Crestone as at 20 March 2020. Shows world ex-Australia P/E 1-year forward.

Scenario 3—the downside scenario (20%): In the L-shaped recovery the spread of the disease is harder than expected to contain, and ‘peak disease’ only occurs in early 2021. The long shutdown of activity sees a deep recession (bordering on depression) that extends into H1 2021. Recovery only emerges from mid-2021. The depth of the crisis, and slow recovery, is hampered by significantly elevated unemployment (10-20%) and loss of human capital, as well as greater insolvency and long-term debt workouts. Policy makers are constrained in their ability to further support activity due to slow growth, low inflation and weak consumer and corporate sentiment.

In this scenario, the correction in equity prices is deeper than in scenarios 1 or 2, and any rise in equity indices is more sluggish and drawn out. Earnings could potentially fall 40% to 50% in 2020 before recovering 10% to 20% in 2021. Index levels may not return to pre-COVID-19 levels until after 2021. Policy rates would stay near zero and curves would be relatively flat for the entire 2020-2021 period.

Managing through our central case scenario

A considerable amount of uncertainty remains about the outlook. However, we made a number of decisions through March to protect portfolios and position for an eventual recovery, particularly given our constructive view on growth and the outlook for markets through H2 2020:

- Moving underweight credit early in March, recognising the implication of the oil dispute and the vulnerability of high yield markets. Spreads widened sharply mid-March but, as the US Federal Reserve (Fed) added liquidity to calm markets, we closed that position later in March

- Closing our underweight to domestic equities. With markets 30%-35% lower (and not looking to overweight yet), the extent of the fall and the potential to begin building positions at a much more attractive entry point than a few months ago argued against being underweight.

While H1 2020 will contain challenging economic data, an inevitable rebound in activity, be that mid-year or a little later, underpinned by an increasingly historic policy stimulus now underway should deliver a rebound in risk appetite in time. Reflecting that, and absent material new information, we expect to maintain our preference for the key asset classes as 1) equities, 2) alternatives, and 3) fixed income on a one to two-year outlook.

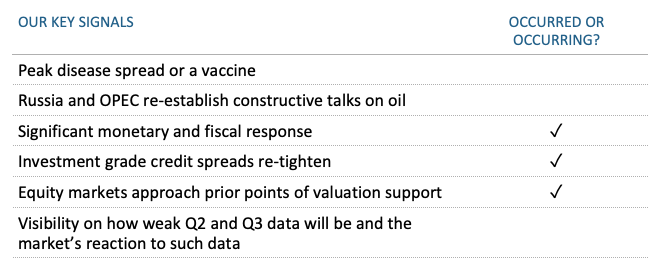

We continue to monitor key signals to guide us closer to when markets may trough. These include:

Over the past couple of weeks, a number of these have been ticked off, namely policy stimulus, while we have made progress on valuation, a re-tightening of credit spreads and weak data. However, at this stage, we are yet to achieve ‘peak disease’, which appears the most critical for markets (to the extent it impacts whether the outlook is a U-, V- or L-shaped recovery).

For now, as we monitor these signals and look to take a more positive view on the outlook, we encourage investors to remain disciplined in their strategic and tactical asset allocation. This should involve taking opportunities to selectively rebalance up over time what are now likely underweight equity portfolios (due to price weakness). Any new investments should have a strong focus on quality, long-term thematics, as well as solvency.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

4 topics

1 contributor mentioned