Regardless of the worry surrounding sharemarkets, there is always a place to invest.

Pella Funds Management

Since the start of 2022 the share market has been weak with the MSCI ACWI declining 15.6%. This is resulting in widespread atrophy and panic as people question whether to invest or not. Pella’s approach to this is to stick to its fundamentals and invest when opportunities positioned to grow and trading on an attractive valuation arise.

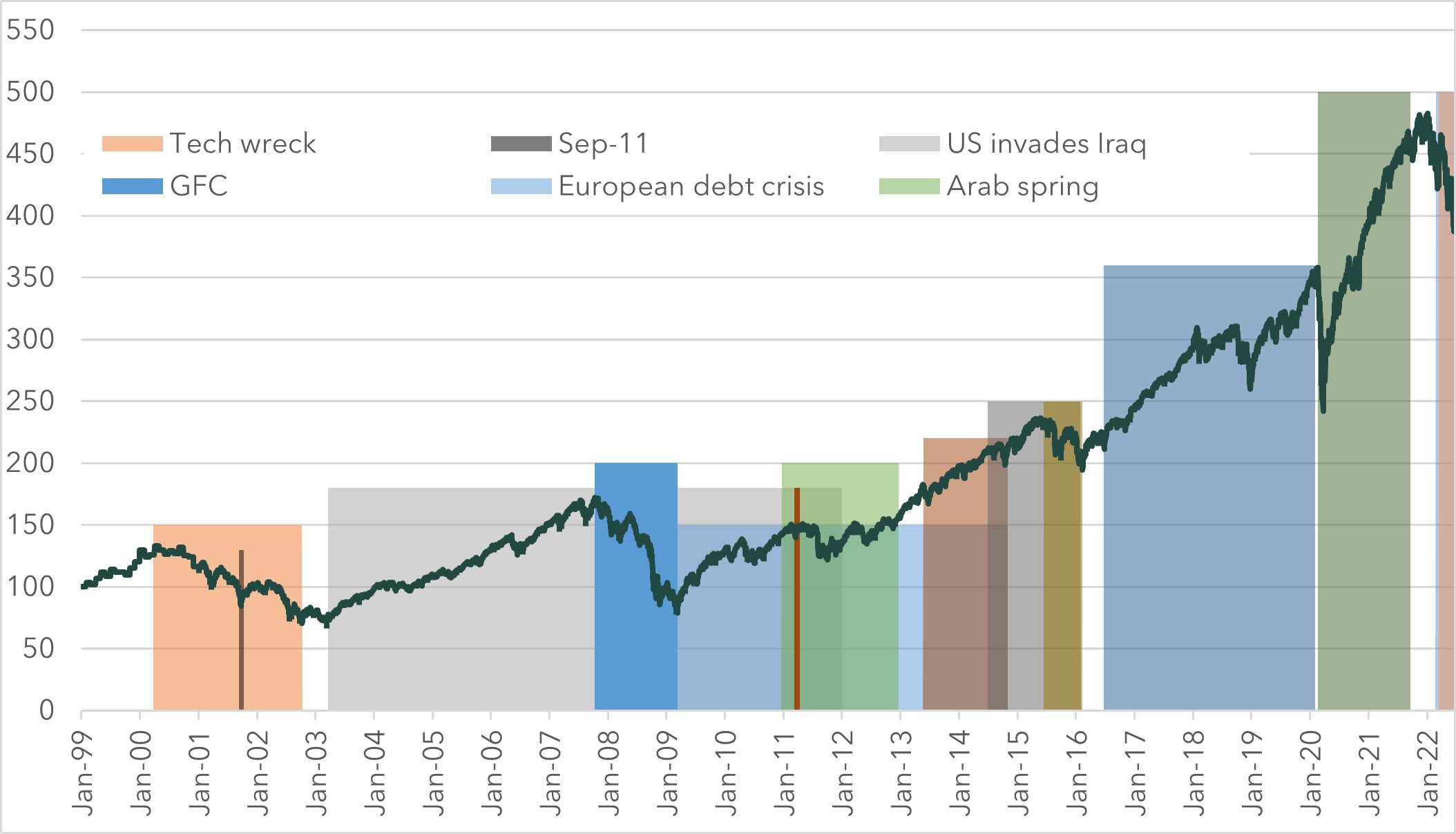

The market has witnessed several investment shattering events.

- In 2000 it was the Tech Wreck,

- 2001 brought September11, followed by the US invasion of Iraq (2003)

- the GFC occurred in 2007, followed by

- the European debt crisis (2008-2014),

- Arab Spring (2010-2012) and

- Fukushima (2011),

- Taper Tantrum (2013-2014),

- oil price plunge (2014-2016),

- China bear market (2015-2016),

- Brexit (2016-2020),

- Covid (2020-2021),

- Russia’s invasion of Ukraine (2022),

- severe inflation and monetary tightening (2022).

Figure 1: MSCI ACWI total return index performance

Looking into some of the crises we find that there were areas that generated acceptable returns even if we invested in those areas in the middle of the crisis and held the investment for three years. Table 1 illustrates some of these opportunities. For example, investing in Water Utilities during the Tech Wreck and holding onto that investment for three years would have generated a 70% total return. Investing in Korea during the GFC would have generated a 35% total return over three years. Investing in Health Care Equipment & Services during the Taper Tantrum would have generated a 48% total return. Investing in virtually any industry or geography during Brexit would have generated healthy returns.

Table 1 - Areas generating acceptable returns if invested in middle of a crisis

Source – Pella Funds Management, Factset

(1) Assumes investment for three years starting in Jun-01

(2) Assumes investment for three years starting in Jun-08

(3) Assumes investment for three years starting in Feb-14

(4) Assumes investment for three years starting in Apr-18

(5) S&P Global 1200 total return industry indexes, measured in local currency

(6) MSCI ACWI indexes, measured in AU

The key message of the above analysis is that there is always somewhere to invest, even in the depths of a crisis. However, one word that must not get lost in that sentence is ‘invest‘.

As far as Pella is concerned, investing is not guessing the direction of the stock market, betting on something simply because it is going up, or have a short-term mindset. Investing involves putting your money to work into productive assets that generate sufficient cash flow to compensate for the initial cost of the asset. It takes time for the asset to generate these cash flows, which means investing requires a minimal three-year time frame.

At present some areas that Pella is investing due to their likelihood to benefit from structural themes includes companies that benefit from tightening monetary policy, or inflation, or consumer trade down.

Derivative exchanges such as CME Group (CME-US) and Deutsche Börse (DB1-DE) are key beneficiaries of tightening monetary policy. During Quantitative Easing (‘QE’), central banks were the biggest purchasers of government debt. This is a headwind for derivative exchanges as the central banks don’t hedge their government debt holdings. The end of QE means that future government debt issuances will be purchased by investors that normally do hedge their government debt holdings, boosting the derivative exchanges’ volumes. Furthermore, the winter of interest rate stability heralds an increase in interest volatility, which should result in volatility across all asset classes, which is a meaningful positive for derivative exchanges. With CME trading on a 24x PE and DB1 on a 19x PE, Pella believes their valuation is attractive relative to their outlook.

Commodities are typically beneficiaries of inflationary environments, particularly if the commodities are supply constrained. Copper fulfills these requirements following ten years of under investment into that commodity, coupled with expected booming demand from Electric Vehicles (EVs), which use 4x the amount of copper as Internal Combustion Engines (ICE) vehicles. Pella has an investment in Antofagasta (ANTO-GB), which is a Chilean copper producer with an AA MSCI ESG rating, and Boliden (BOL-SE), a Swedish industrial metal company with a AAA MSCI ESG rating.

Inflation will concurrently eat away at real income forcing households to trade down, which will likely accelerate if the tightening monetary policy results in a recession. Partly reflecting this, Pella has an investment in Dollar General (DG-US), a US discount retailer. DG is trading on a 3.2% FCF yield, which we believe is reasonable given its massive growth opportunity.

Venturing out of the sector straitjacket Pella has also identified several companies that satisfy our growth-valuation criteria. Examples of these investments are listed in Table 2 and one of the most striking observations of these companies is their diversity. While we can’t predict how the share price of these companies will fluctuate in the short term, they fulfill our definition of investing and should generate sufficient cash flow to justify their valuations and commiserate share price performance should follow.

Table 2: Examples of companies fulfilling Pella’s growth-valuation criteria

Source – Pella Funds management

(1) Forecast growth based on the median of consensus three year revenue growth forecasts.

Pella believes even during times of turmoil there are attractive investment opportunities. This has been the case throughout crises that we have witnessed now and over time.

However, the key is to ‘invest’ by seeking companies positioned to generate growing cash flows and trading on good valuations, rather than speculating on the short-term share market direction. Pella has identified several such opportunities and is poised to invest in many others should the market decline further.

3 topics

Joy is the Head of Distribution of Pella Funds Management. She has built her career in funds management over the last 15 years. Prior to joining Pella, Joy was the Executive Director of Pengana’s International Equities division. Her experience...

Expertise

Joy is the Head of Distribution of Pella Funds Management. She has built her career in funds management over the last 15 years. Prior to joining Pella, Joy was the Executive Director of Pengana’s International Equities division. Her experience...