REITs offering numerous short opportunities

Conrad Capital Group

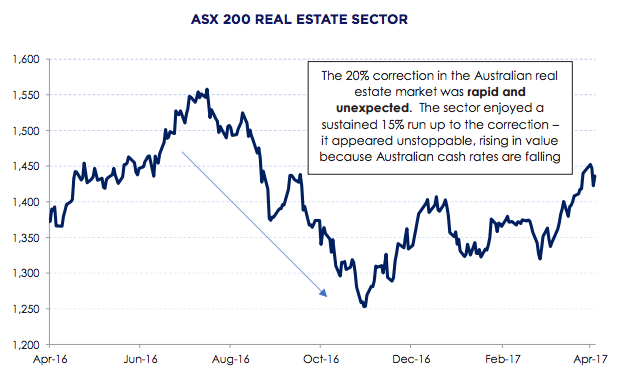

Since the rapid 20% correction witnessed from August to November 2016, the real estate and infrastructure sector has made a significant recovery. This recovery is difficult to reconcile given there has been no fundamental improvement in the earnings outlook for many of the securities that have rallied so strongly – and interest rates have not fallen significantly to support valuations.

Based on our valuation-driven process we find it very difficult to find compelling investments on the long side. Conversely, we can find numerous short ideas.

Situations where fundamentals are highly priced and where any increases in interest rates or a deterioration in fundamentals will see a significant correction in security prices. To highlight the lack of fundamental value overall, and focusing specifically on the AREIT sector, we make the following seven comments:

- The Australian real estate and investment (AREIT) sector is currently trading on a 17.6 times multiple of cashflow, this compares to the historical average of 13.6 times

- Earnings are expected to grow in aggregate at just 2%, barely above inflation

- The sector is currently trading on 10-year low unfranked dividend yield of 4.5%

- The AREIT sector is currently trading at a 9% premium to the underlying value of their asset base, versus an historical average of 7%. This must be taken in the context that asset values have risen considerably over recent years. For example capitalisation rates for prime Sydney office are now below 6%, lower than where they were prior to the global financial crisis.

- Many REITs are paying out in distributions more than they are earning in cashflow. This is an unacceptable practice and calls into question the sustainability of the distribution being made by real estate investment trusts.

- We do accept that capitalisation rates are still at a reasonable level compared to interest rates (the 10-year government bond rate is currently at 2.5%)

- Whilst not very powerful analysis, when the 10-year government bond rate was last at this level (March 2016) the AREIT sector was 10% lower than where it is today

The current environment for ‘interest rate’ sensitive securities reminds us of that during early calendar year 2016. During this time, the strength in these sectors was pronounced and unrelenting. During this period, these sectors were driven by Australian cash rates falling more rapidly than the market expected.

In contrast, this rally does not have an obvious driver apart from ‘defensive buying’ due to geopolitical concerns, which can wane quickly. We also understand that there are significant capital flows from international ‘income funds’. Our experience with this type of capital is that it can change course rapidly, and if this does occur we should expect a significant correction in ‘low risk’ securities.

Lucern Investment Partners

2 topics

Tim has 25 years’ experience in the investment and securities markets. Tim was a partner of Goldman Sachs and during his 16-year tenure at the firm had senior experience across all areas of equities investing.

Expertise

Tim has 25 years’ experience in the investment and securities markets. Tim was a partner of Goldman Sachs and during his 16-year tenure at the firm had senior experience across all areas of equities investing.