Reporting season preview: Looking forward by looking back

As investors, we’re bombarded with the importance of fundamentals and warned constantly about the dangers of obsessing over the rear-view mirror.

“Past performance is not an indication of future performance” is a familiar refrain to those of you who have read one of the industry’s most common disclaimers. And it’s true. But so is this century-old quote from US-Spanish philosopher George Santayana: “Those who cannot remember the past are condemned to repeat it.”

In the following wire, I look back at the last 11 reporting seasons to track some of the trends of this timeframe and reflect on what they can tell us about the present and near future.

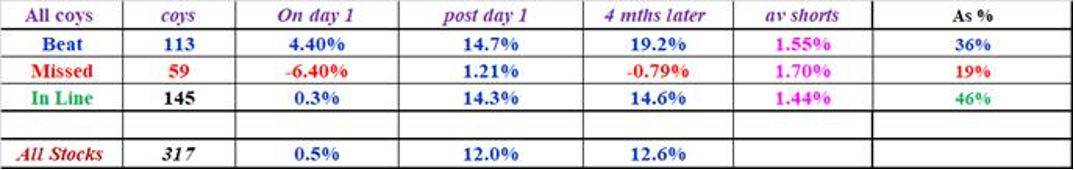

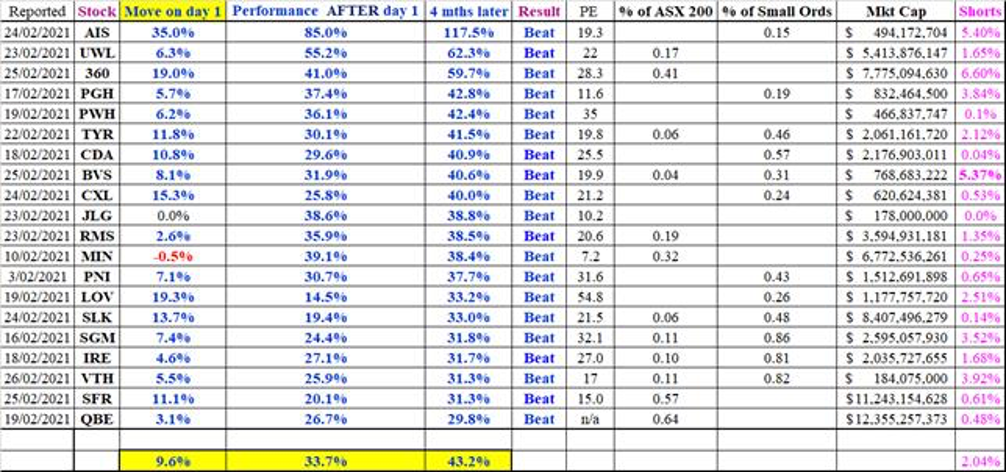

First, let’s look at the washup from the last reporting season of February 2021, starting with the stocks that exceeded analyst expectations – the “beats” – four months after their respective management teams delivered fiscal 2021 results.

Source: Coppo Report

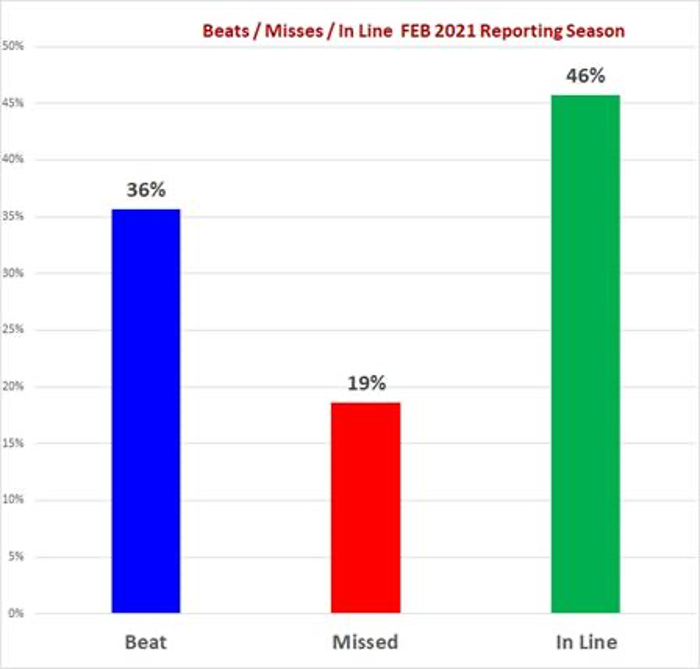

That time around, 36% beating consensus expectations, outstripping the average of 28% beats across the last 11 reporting seasons.

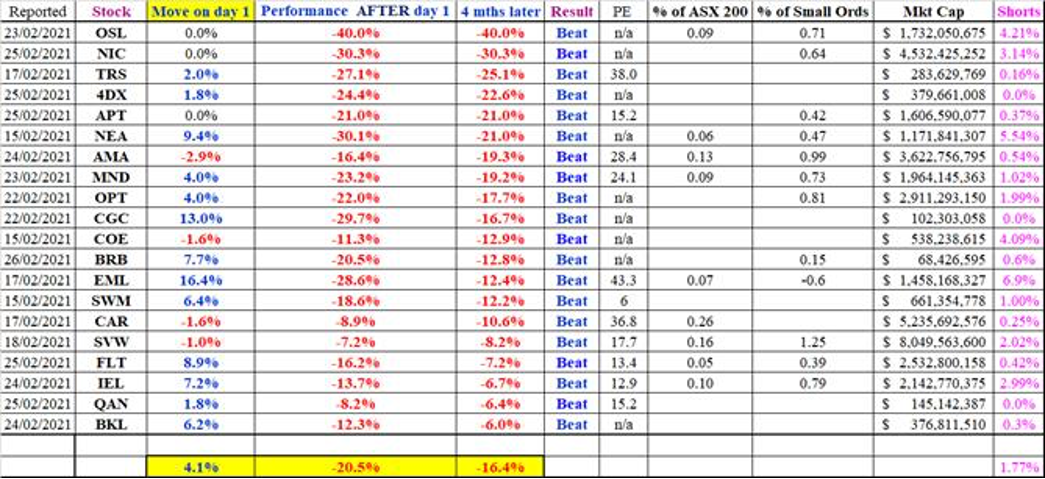

Source: Coppo Report

In another pleasing outcome, the proportion of companies that missed was far lower at 19% versus the average of 22% - but many of these were smaller stocks that hold lower weightings in the ASX 200.

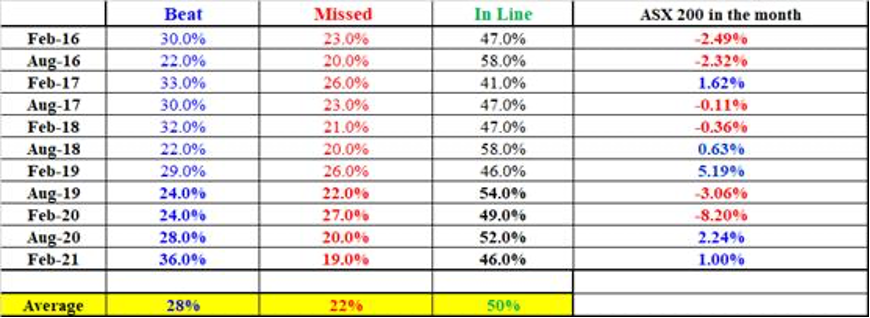

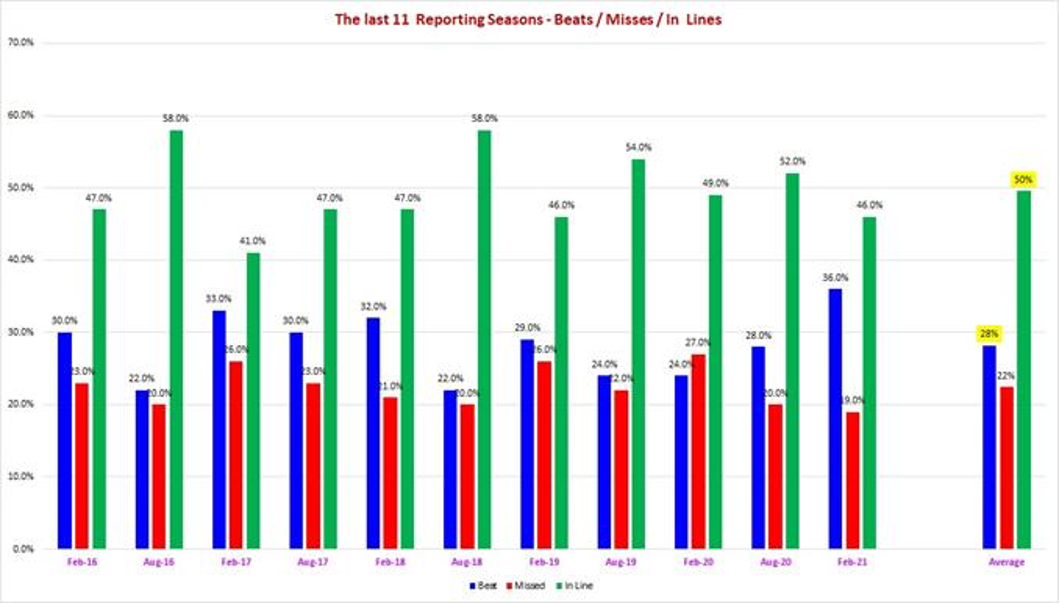

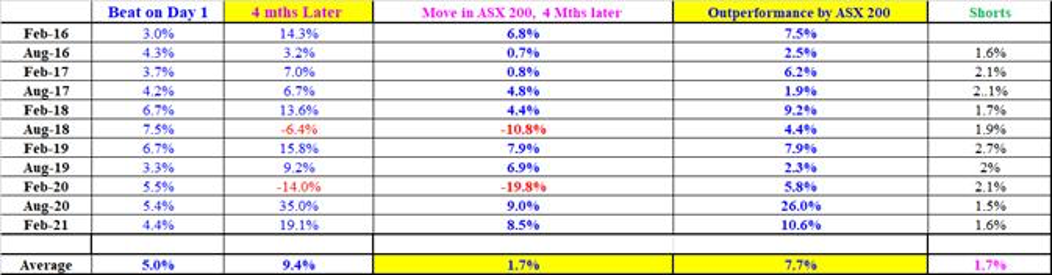

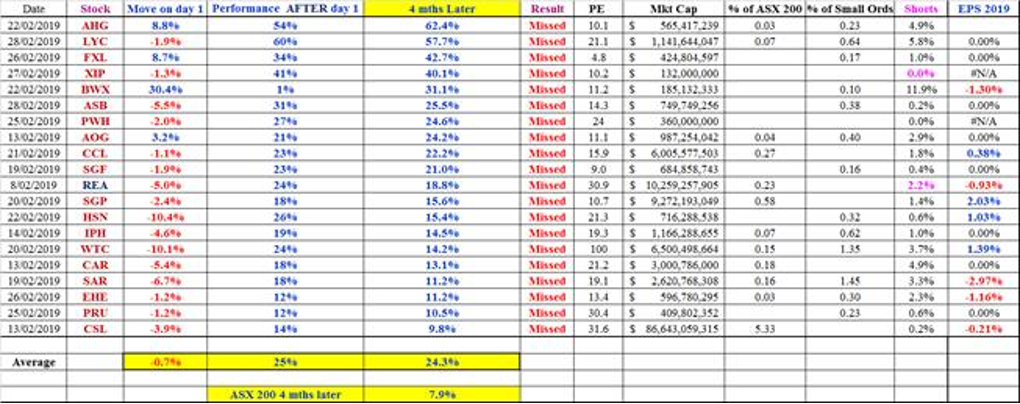

The following table shows how each reporting season has panned out over the last six years. The ASX200’s massive market rally of more than 5% in February 2019 was an anomaly, a reflection of bank stocks running after the Kenneth Hayne-led royal commission concluded and miners rallying on a huge spike in iron ore prices rather than the overall quality of results which were pretty ordinary.

Source: Coppo Report

So, in the last 11 reporting seasons the results of ASX200 companies were on average:

- A beat of expectations 28% of the time

- A miss around 22% of the time

- Inline almost half of the time.

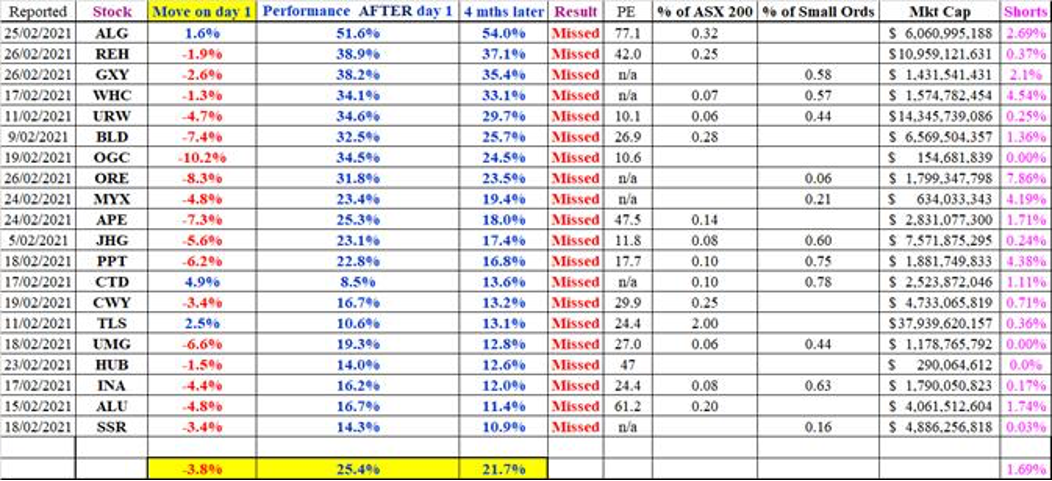

Source: Coppo Report

On the specific day on which ASX200 companies reported their respective half-year 2021 results, when compared to the previous 10 periods:

- More than 4.4% of stocks gained

- Around 6.4% performed poorly.

Source: Coppo Report

Average moves in the last 11 reporting seasons, average beats and misses, respectively, have been up by more than 5% and down by more than 6%. The latter figure reflects the behavioural finance assertion that humans react more aggressively to bad news versus good.

The average movement for the in-line results was up by around 0.2%, while the average of all stocks reporting was 0%. It’s also interesting to note that the beats had a “lower short interest” at just 1.9% versus the misses, which were 2.4% higher.

Source: Coppo Report

The beats keep on banging!

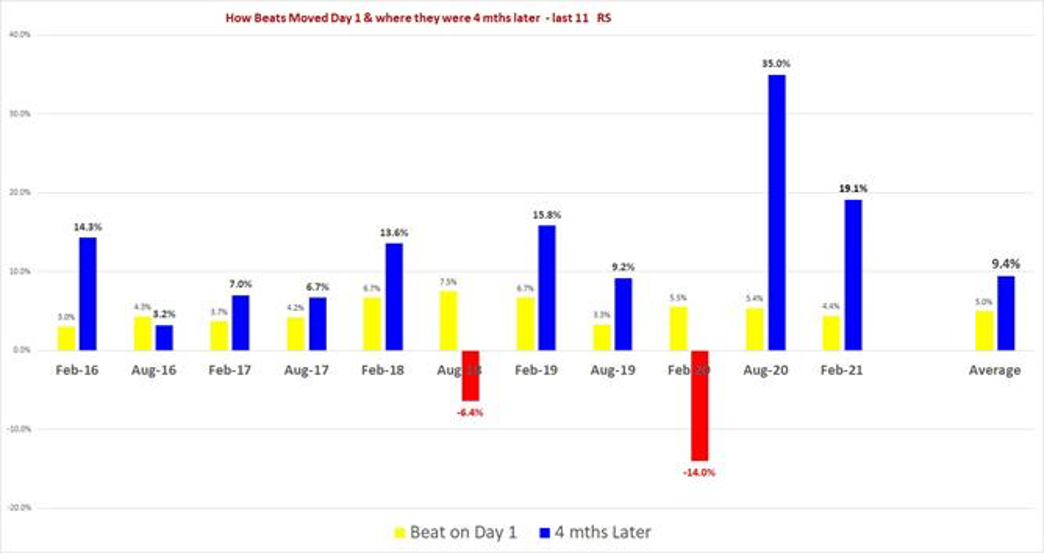

As the chart below shows, over the 11-year period, beats that were up more than 5% on the reporting day were just under 10% higher after four months, up 9.4% over this longer timeframe.

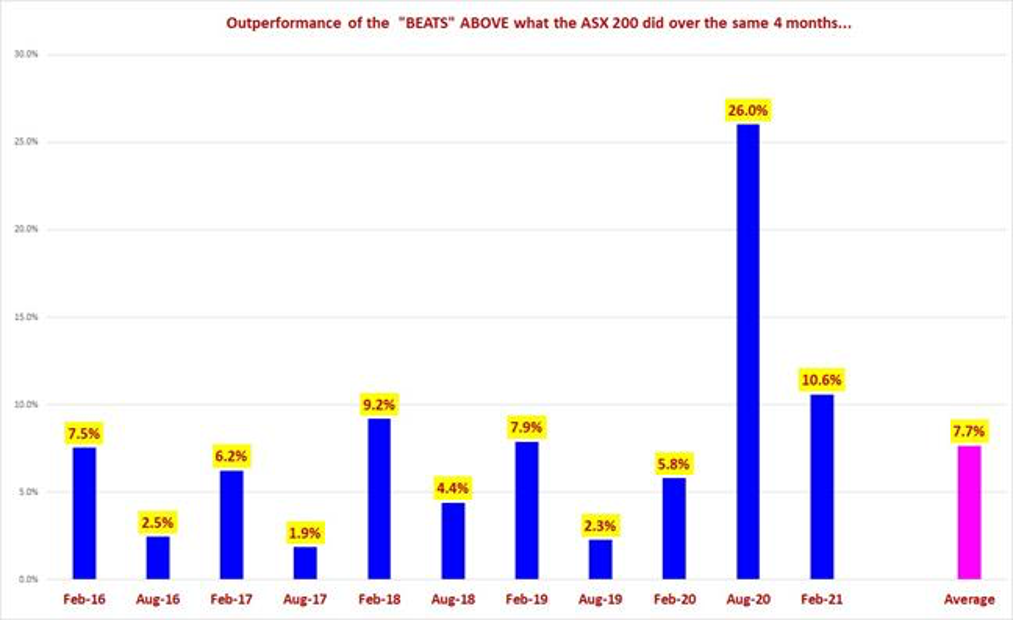

And when pitted against the ASX200, the beats have performed strongly over the last six years, outperforming the index by 7.7%. Collectively, they beat the ASX200 100% of the time when measured over four months from when they reported.

Source: Coppo Report

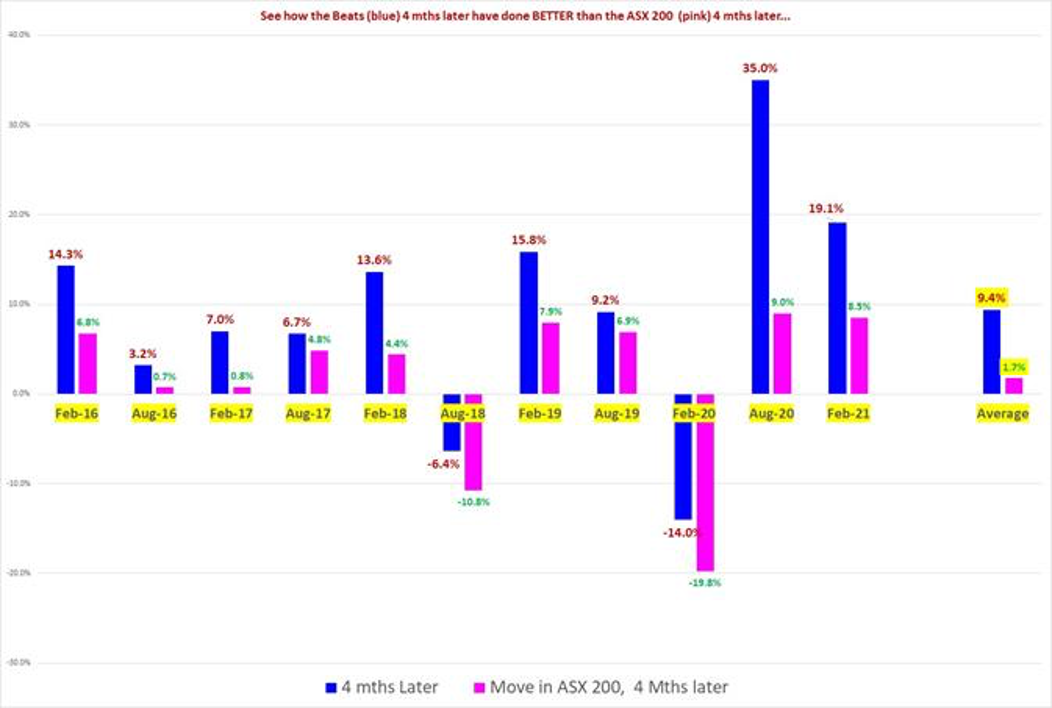

The following chart shows the stock performances of the beats between their results release day and four months later, over the last 11 reporting seasons (blue bar). As a comparison, the purple bar shows where the ASX200 sat.

On average, the beats were up 9.4% four months later. This significantly outperformed the ASX200, which was up just 1.7%.

Source: Coppo Report

And this chart shows the proportion by which the beats outperformed the ASX 200 (EVERY time!) – and by an average of 7.7% when measured over the period of four months from their respective reporting days.

Source: Coppo Report

Those that missed (short-sellers had a field day)

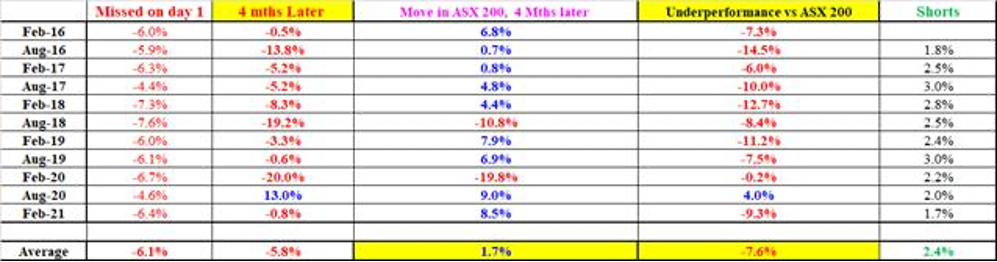

In the last 11 reporting seasons, on the day their respective management teams announced results, the "misses" stock prices closed 6.1% lower than where they started. And four months later, they were still down by an average of 5.8%.

It’s also interesting to note that the “misses” attracted the highest short interest (2.4% versus 1.7% for the beats). So, it appears the shorts called it correctly on many of these.

Source: Coppo Report

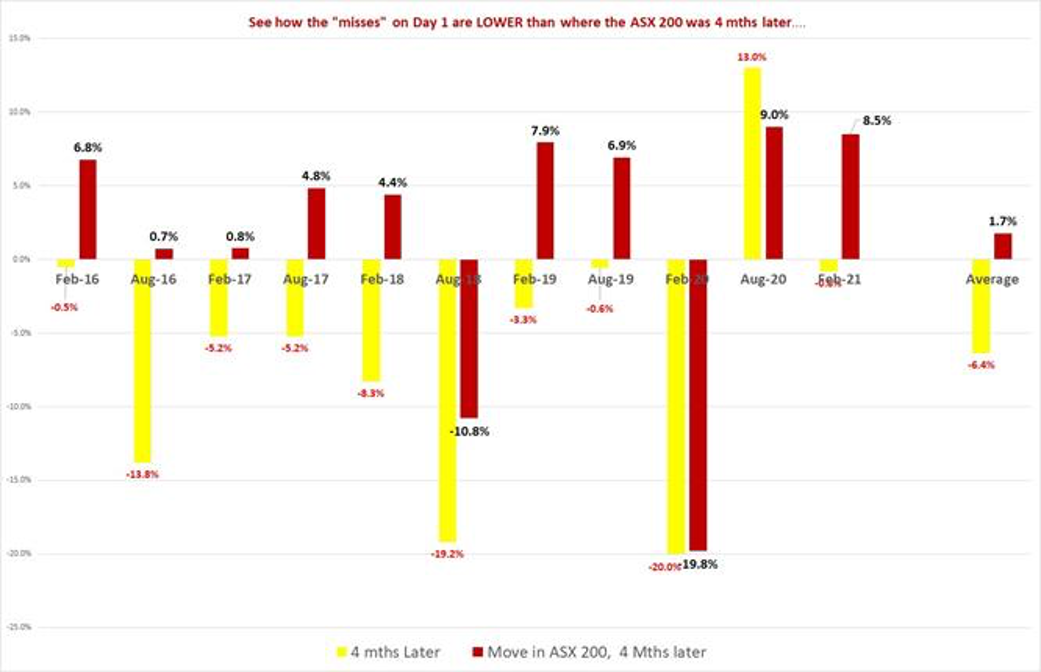

The chart below shows the day one move and where they were four months later, when measured over the last 11 reporting seasons.

Source: Coppo Report

This chart shows how the misses over the last 11 reporting seasons were priced four months after their results day (yellow bar) and the ASX200 comparison (iron red bar).

On average, the misses were down 6.4% four months later, significantly underperforming the ASX200, which rose by 1.7%.

Source: Coppo Report

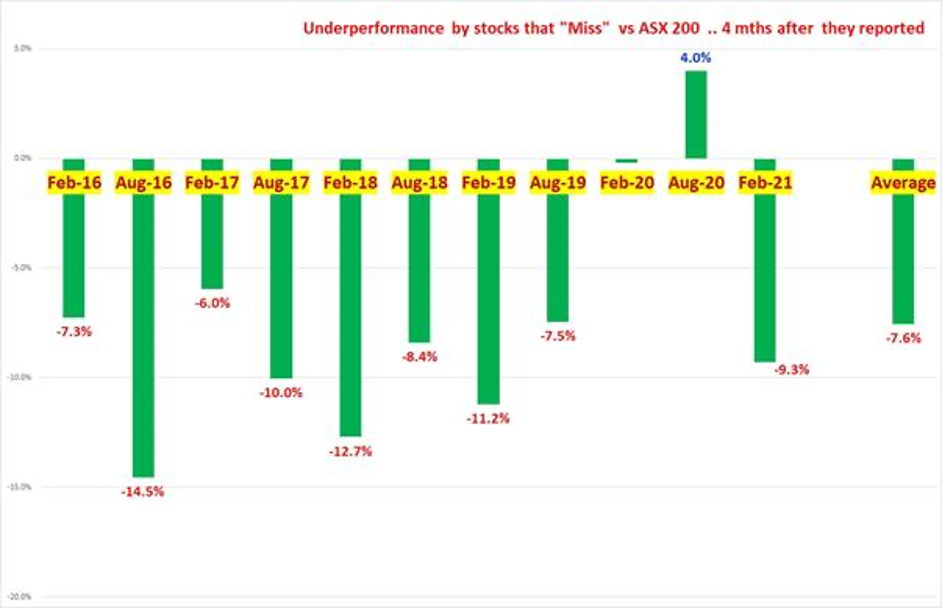

The following chart shows the margin by which misses have underperformed the ASX200 (EVERY time except one, in August last year, when the whole market rallied after the selloff that hit in March) Four months after the respective reporting season day, they were still down by an average of 7.6%.

Source: Coppo Report

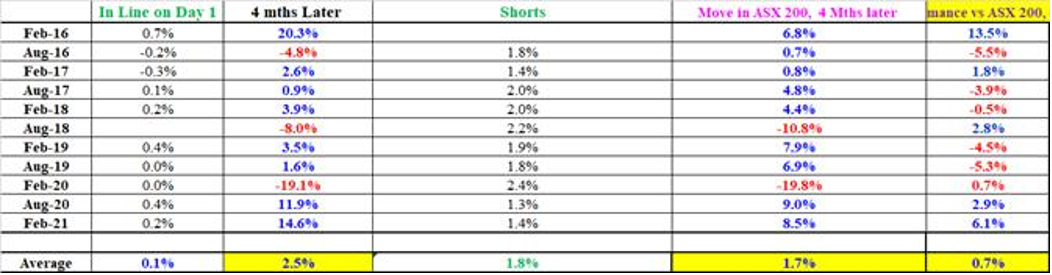

Don’t ignore the “inlines”

Those stocks that delivered “in-line” results on the day they reported were up by an average of just 0.1%. Four months later, they were up 2.5%, still beating the ASX200’s gain of 1.7% over the same period. So, in lines generally do well as time passes.

Source: Coppo Report

In the chart below, we show how the top 20 gainers of the February 2021 reporting season fared four months later…

Source: Coppo Report

…And on the other hand, the following chart shows how the top 20 “biggest losers” were positioned four months down the road.

Source: Coppo Report

February 2021 reporting season: The top 20 gainers four months later, compared against the stocks that “missed".

Source: Coppo Report

And finally, from the February 2021 reporting season, we show the top 20 falls four months later, as compared to the stocks that "missed".

Source: Coppo Report

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

1 contributor mentioned