ResMed still offering investors a breath of fresh air

In February of this year, I laid out three reasons why we at Firetrail Investments believe ResMed (ASX: RMD) was set for future growth in Resting easy with ResMed. Since then, the company has continued to succeed with its share price up more than 50% in six months.

In this follow-up, I discuss two new opportunities the company is pursuing and why we believe ResMed remains a compelling investment opportunity with substantial valuation upside.

ResMed 101

A quick refresher for those unfamiliar. The most common illness treated by ResMed products is obstructive sleep apnoea – a condition in which sufferers stop breathing involuntarily for extended periods during sleep. It occurs because the muscles that support the soft tissues in the throat temporarily relax, narrowing or closing the airway such that breathing is cut off. Sleep apnoea can seriously inhibit regular functioning and is related to high blood pressure, heart attacks and daytime fatigue.

ResMed manufactures continuous positive airway pressure (CPAP) devices to assist patients with sleep apnoea. These devices send a steady flow of oxygen into the nose and mouth during sleep, keeping the airways open and allowing normal respiratory function. The CPAP device involves a machine and a separate respiratory mask, see figure 1.

Less common, but equally debilitating, is a chronic obstructive pulmonary disease (COPD) – a lung disease that causes obstructed airflow and predominantly occurs in smokers. ResMed produces cloud-connected ventilators to treat COPD, depicted in figure 2.

An opportunity to increase market share

ResMed’s key competitor in CPAP devices is Philips. In June 2021, Philips voluntarily recalled a range of products, including its legacy CPAP range.

The recall was driven by deterioration of the sound abatement foam used in Philips’ first-generation DreamStation CPAP flow generators and several of its other devices. In total, it expects to repair or replace around 3.5 million devices over the course of 12 months. The withdrawal of Philips from the market presents a significant opportunity for ResMed to dominate new CPAP flow generator installations over the near term while Philips is busy replacing its existing fleet.

Factoring in the impact of the recall, we expect a 10% increase to ResMed’s share of new patient demand in the first half of the fiscal year 2022. Moving into the second half, as the impact of chip shortages lessens and ResMed is able to lift production, we see this share increasing further to 72%. There is the potential for even greater upside if ResMed can negotiate a lift in chip supply earlier than anticipated.

This trajectory does however depend on the pace with which Philips returns to market and begins servicing new patients. Currently, Philips expects to be out of the market for twelve months, but their market share loss could last longer. Cochlear provides a useful case study – when it initiated a product recall in 2011, its market share remained depressed for almost ten years, showing a long-term impact on market structure. Even after Philips returns, we believe some of ResMed’s market share gains will remain.

With mask sales also likely to benefit as more new patients purchase ResMed devices, we see total revenue growth for ResMed in the mid-teens for at least the next two years.

Cloud-based care delivers increased efficiency and a better user experience

ResMed began its venture into cloud-based health informatics with the purchase of information technology group Brightree in 2016. It has since continued to add to its technology offering with the purchase of several other software providers, most recently Snapworx and Citus Health. These acquisitions provide ResMed with a substantial suite of digital solutions across a number of types of out-of-hospital care.

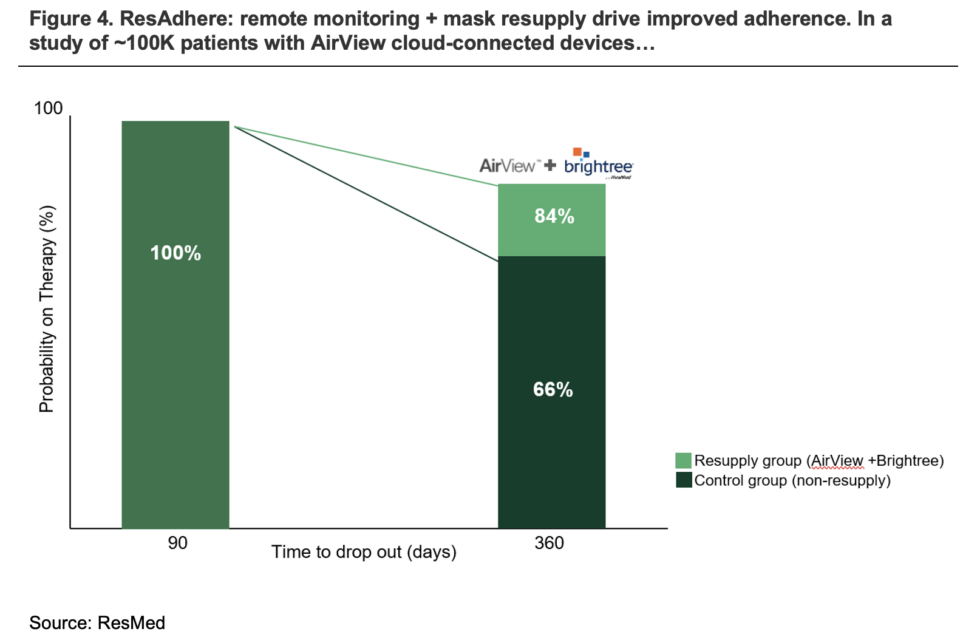

As shown in figure 4 below, the integration of Brightree services into ResMed products has substantially improved patient adherence rates.

We see scope for ResMed to continue to integrate its SaaS business more closely with healthcare providers over the medium-long term, driving significant value and improved retention.

Conclusion

ResMed is a market leader in the production of CPAP devices with a proven capacity to attract and retain a large customer base. We consider ResMed well-positioned to capitalise on the short-term market disruption caused by the Philips recall and to strengthen its leadership position over the medium to long term. Given this, we believe it remains undervalued by the market.

ResMed is one of our holdings in the High Conviction Strategy:

Want more market analysis?

We hope you enjoyed this wire on Firetrail's investment thesis behind ResMed. If you want to read more market analysis like this, click the follow button below. We hope you enjoyed this wire. If you did, give it a "like".

3 topics

1 stock mentioned

1 fund mentioned

1 contributor mentioned