Resources stocks are at a "turning point" - and now is the time to invest

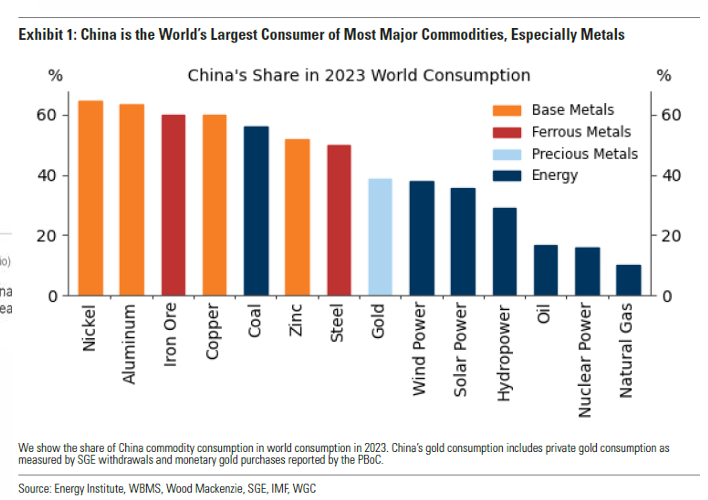

The market for natural resources has shifted tremendously over the past few decades. Only a few decades back, the US had the greatest purchasing power. Now, it is China, with India rapidly catching up.

And although the roster of resource companies is shrinking, Janus Henderson’s Daniel Sullivan says that is actually a good thing.

Investors also continue to focus on the green transition – and this continues to propel the demand for natural resources. After all, you can’t build the infrastructure without traditional forms like iron ore or copper, while lithium is one of the critical components in the electric revolution.

But perhaps most of all, Sullivan believes we are on the cusp of the nuclear renaissance, which could spell a dramatic change in fortunes for companies in this field.

In a recent webinar, Sullivan discussed the environment for natural resources and why he believes it is at a turning point. He also shared some of the commodities he is finding big opportunities in right now.

The turning point for natural resources

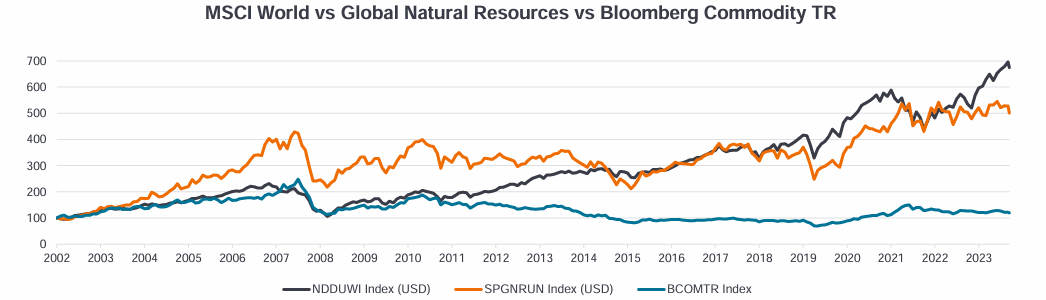

Returns for natural resources have been 8.1% pa for 22 years, it’s an area that typically has a low correlation to the general market and is a proven diversifier.

As a highly cyclical area, Sullivan believes we are getting close to a turning point in the cycle for a few reasons:

- M&A activity (and regulatory environment)

- Country economic growth

- Global population growth

M&A activity to continue in resources

Sullivan explains that it is far harder today to start new projects, particularly with rigorous local government requirements and exploration involved. As a result, we are seeing a “shrinking roster of companies” with the “concentration of power in a few companies due to M&A”.

He expects record-high M&A activity for the coming year, pointing to BHP’s several attempts to acquire Anglo American earlier this year or Glencore’s acquisition of a 77% interest in Teck’s coal business. Companies are seeking to allocate towards ‘future-facing’ commodities and are using M&A to build their capabilities.

Growing demand

Demand for natural resources continues to grow off the back of economic and population growth. This in turn is providing a boon for companies in that sector.

Many of the world's emerging economies are experiencing a rising middle class and are dealing with the effects of urbanisation. This process has seen China overtake the US in terms of pricing power. India currently holds half the pricing power of the US – but this, in Sullivan's view, will continue to build. Sullivan is also seeing significant investment across Africa.

Globally, the population is set to grow from eight billion to 10 billion in coming years – meaning metals, energy and agriculture will all be critical. Naturally, this will offer ongoing support for the resources industry.

Trends to watch across the sector

Sullivan is seeing a range of trends shaping ongoing demand in the sector – particularly in what he calls the ‘power battles’.

Such battles include the battle for EV domination where China is currently leading, oil production constraints related to OPEC or the ongoing tussle between gold-backed currencies and the US Dollar.

In particular, this last battle between gold and the US Dollar is typified by the heavy buying behaviour of central banks at the moment. China is the largest buyer of gold and this has helped gold prices soar to all-time highs.

This is before we also consider the battles for the best forms of energy supply. Tech companies in particular require massive reserves, and Sullivan is seeing a “new rush to options like nuclear power”.

Attractive valuations

Amid the strong and growing demand for resources, Sullivan notes valuations are appealing too.

“It’s a small sector that is cheap and has great cash flow,” he says.

He notes that miners like BHP (ASX: BHP) have simplified their operations, made their business models more sustainable, and focused on strong cash flow and low debt. As a result, they are well positioned in the market and can enter more M&A activity.

“Large miners are trading at a quarter of the valuation of the big tech leaders,” he says.

And, given how energy-hungry some of the tech leaders are, resources offer an alternative exposure to some of those tech themes.

Where to watch and why uranium is positioned for new growth

Sullivan notes that gold is experiencing a spike at the moment off the back of central bank buying patterns and the battle for the fundamental currency.

While oil markets have been challenged by oversupply and OPEC constraints, he believes the predictions around lower oil usage are overly optimistic, telling investors, “I still think 30% growth is possible.”

He also expects a strong natural gas cycle to come as businesses rely on it during the transition.

But perhaps one of the most interesting areas he is watching relates to nuclear energy. Nuclear energy and uranium markets had effectively languished for decades, with the cost to build reactors being viewed as unrealistically high.

But now, big tech companies are looking for energy options to fuel their activities and nuclear energy is increasingly viewed as the answer. These days, development costs as high as US$20 billion are hardly a problem for companies the size of Nvidia or Apple.

“The sticker shock of what used to be a big headline cost has gone,” Sullivan says.

In addition to this, there have been sizeable funding packages available in the US to cover these sorts of costs.

An example of this in play is Google’s recent nuclear deal with Kairos Power, while Microsoft reopened a plant in Pennsylvania and Amazon purchased a nuclear-powered data centre early this year from Talen Energy.

In short, it’s a renaissance for nuclear energy and Sullivan is bullish on the outlook.

4 topics

1 stock mentioned

1 fund mentioned

1 contributor mentioned