Retirement and legacy: No longer just the pot of gold at the end

What we do with our financial legacy is the subject of a new survey study from Fidelity International and MYMAVINS. The report, Rainbow’s end, asked a cross-section of everyday Australians about financial legacies and estate planning:

“We have heard from 1,500 Australian voices, representing Gen Y (27-42), Gen X (43-60), Baby Boomers and the Silent Generation (over 60s); a cross-section of everyday Australians.

We have explored their expectations and discovered that while most people aspire to leave a financial legacy, far fewer have made reliable plans to do so,” said Simon Glazier, Head of Wholesale Sales at Fidelity International.

Sharing wealth as a living legacy

According to the report, almost nine out of 10 respondents are likely to transfer at least some of their legacy before they pass away, although only around one in seven are likely to transfer most of their wealth before they die. According to one baby boomer quoted in the report,

I think not giving away too much, too soon. And also trying to keep my children motivated towards their own self-achievement goals and not falling into the thinking of they can always rely on me.

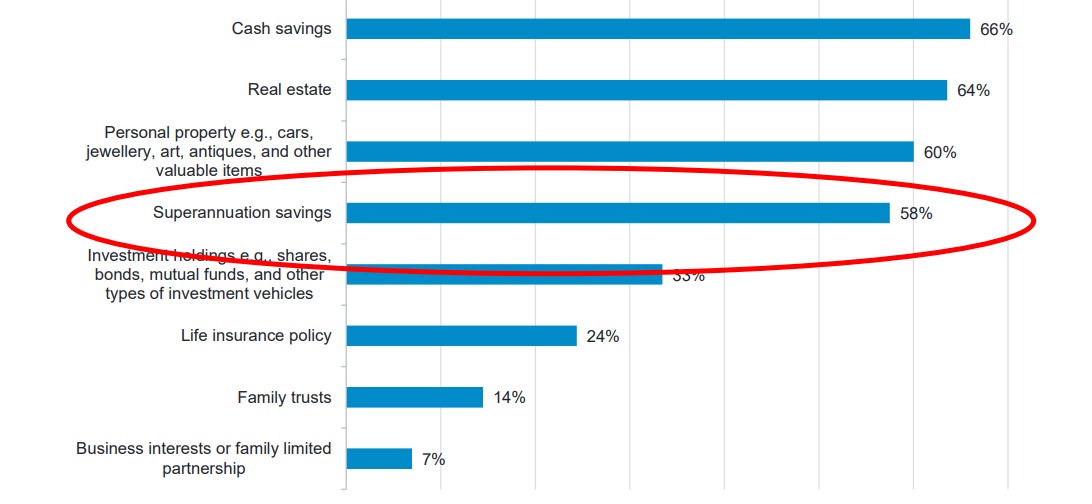

The range of assets all four generations have to share is extensive, from cash to real estate, personal property such as jewellery, art, antiques or other valuable items, investments, family trusts and superannuation.

Given modelling from Australia's Productivity Commission anticipates we will see $3.5 trillion pass from the older generations to younger generations this decade, a phenomenon known as "The Great Wealth Transfer", there will be a lot of Gen Ys benefiting from the superannuation funds left over by their parents. At the same time, they are also accruing their own superannuation savings via higher levels of SGC contributions by their employer.

This doesn't only challenge conventional thinking about the purposes of superannuation. Hoarding superannuation to pass onto the next generation impacts how the older generation thinks about their own retirement. Glazier notes:

"There is a hesitancy to spend early, because you want to maintain a nest egg to ensure you still have funds available for spending later in life. But as we pass through retirement, that nest egg becomes something to be passed onto the next generation."

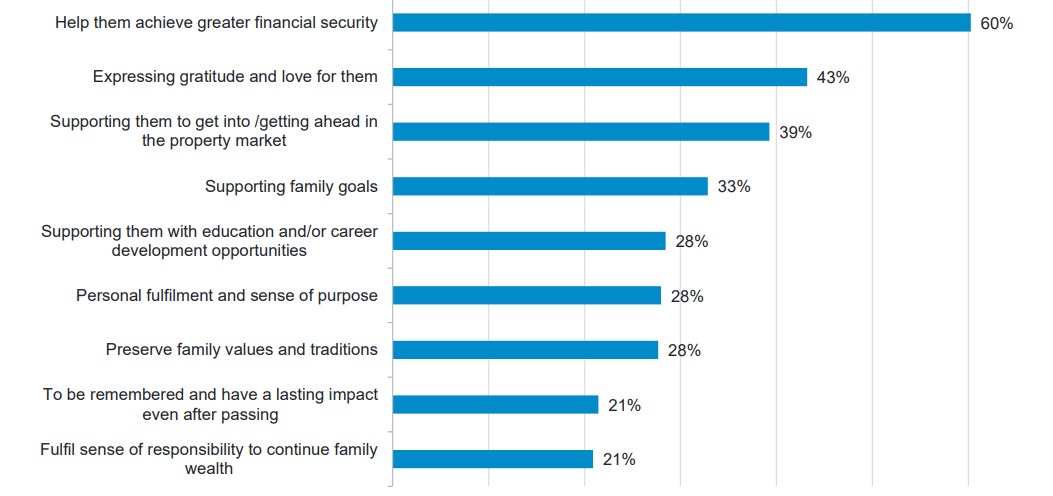

Leaving a legacy is not just about the money, but it helps

Helping loved ones achieve greater financial security is the top goal for leaving a legacy across generations. Intangible goals are also relevant to givers. What appears to beneficiaries as a transfer of financial assets actually has deeper meaning for the giver.

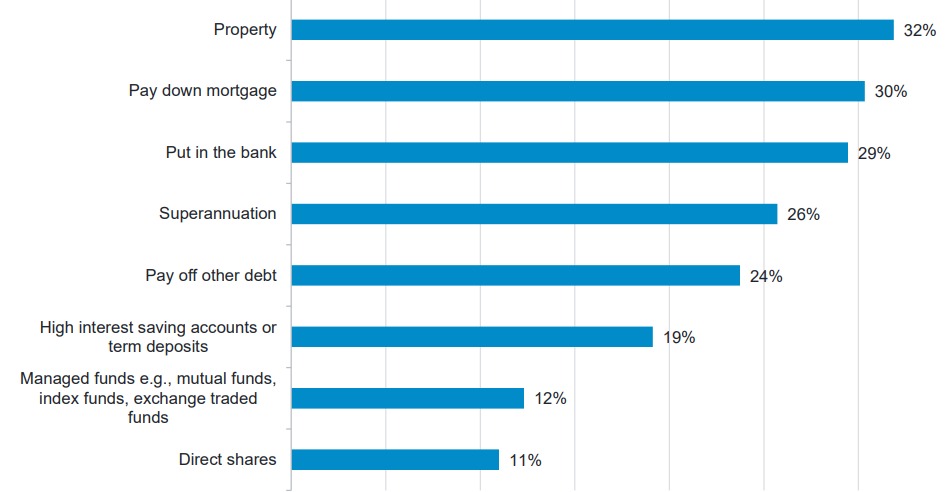

Gen Y will most likely use the windfall to improve their financial security via property, with preferences to buy property or pay down the mortgage ranking highest.

Handling the family dynamics

While nearly two in three intending to leave a bequest have a will, less than one in 10 have a comprehensive estate plan to transfer their wealth and fulfil their legacy wishes. Of those with plans in place to transfer wealth to younger generations, over three in four think financial advisers should play a role in teaching the next generation in financial literacy.

Those Australians who want to share their wealth with the next generation are unsure how to transfer that wealth and need help to plan for an effective transfer.

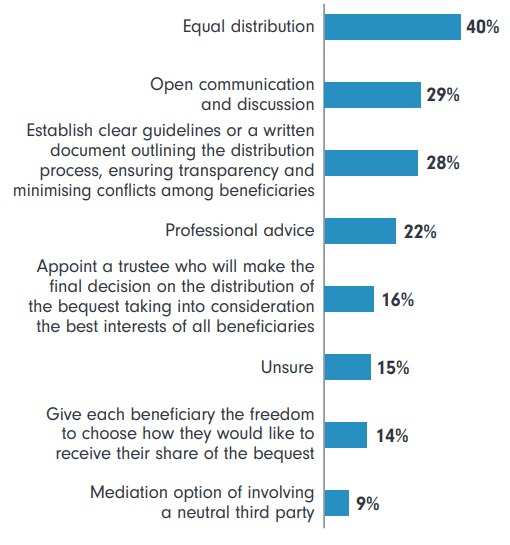

“Most people intending to leave a legacy emphasise the importance of open discussions and documented planning with their family, but this can be easier said than done.

This suggests a role for financial planners to help provide structure and mediation for these sometimes difficult discussions on how wealth can be transferred, to whom and when,” says Mr Glazier.

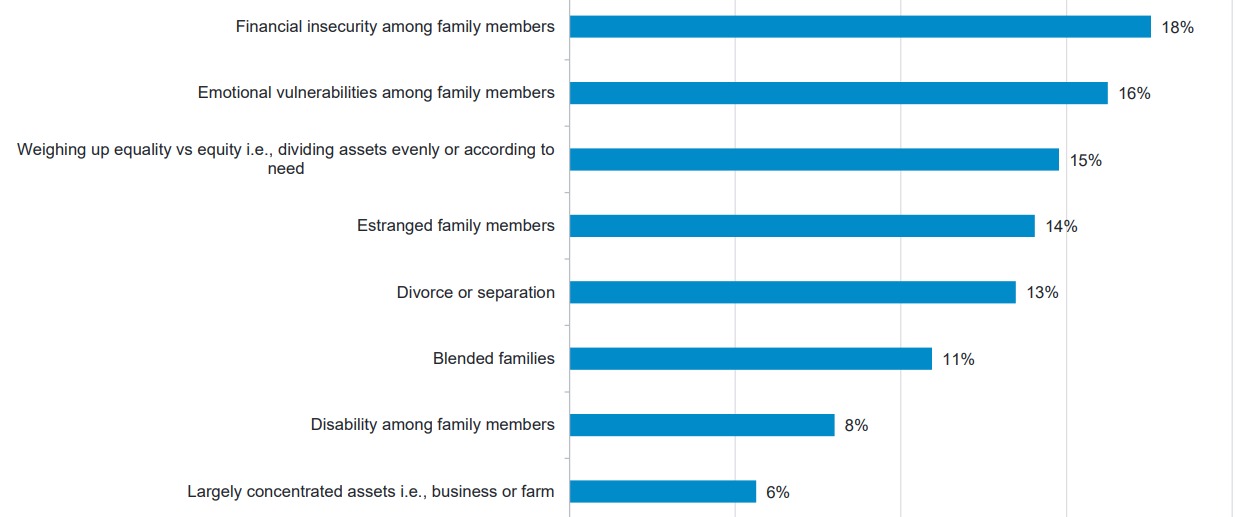

Survey respondents had clear preferences for managing the potential for conflict from the distribution of the legacy, with a strong preference for equal distribution of the legacy amongst the beneficiaries.

Yet the strong preference for equal distribution noted above may be swayed by the life circumstances of the beneficiaries, which can mean revisiting plans or at least managing expectations.

The new financial advice profession

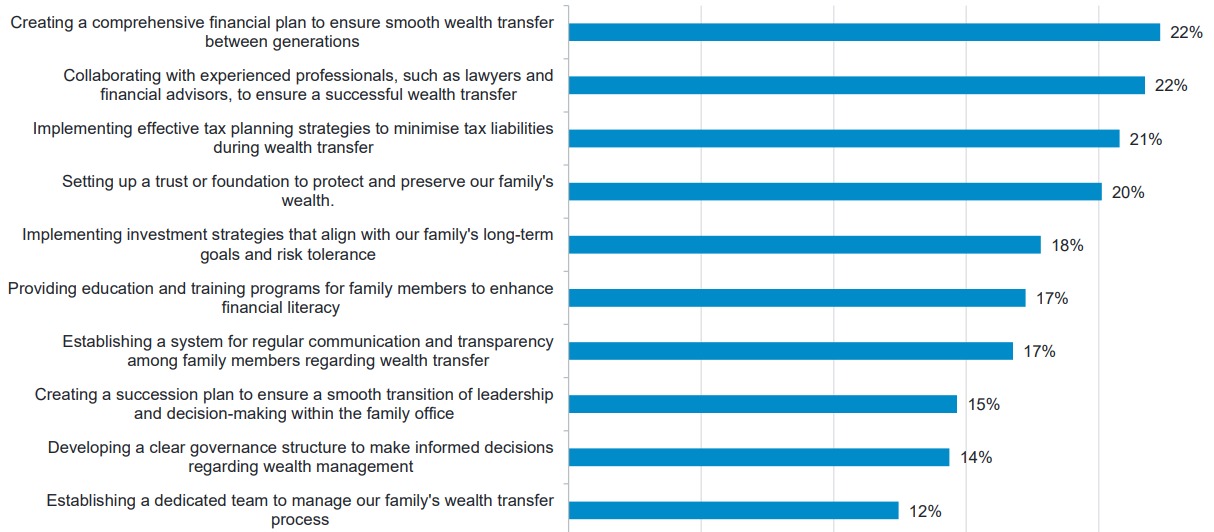

One clear message from the report is that there is opportunity for financial advisers, but their role must evolve to offer services more akin to those currently offered to family offices, as demonstrated by the chart below.

There are already fewer financial advisers than before the Hayne Royal Commission and the aftermath of law reform, notably as the Big Four Banks exited from financial planning. With around 15,700 advisers servicing an average of 120 clients each on a flat fee-for-service basis, there is an advice gap.

Given the goals for leaving a financial legacy and the range of decisions to be made, a one-off visit to a financial adviser isn't going to be enough. It will barely scratch the surface. Of course, retirement is a big decision financially but it's also one laden with emotional and mental considerations. Decisions need to be mulled over away from the financial adviser's office. It takes time and skilful management to get it right.

If advice clients want not only a broad range of services, as indicated above, but also guidance on how to manage the discussions with family (which may include having the financial adviser present), the skill set of the financial adviser is broad. It means working alongside other advisers, such as lawyers, to ensure the documentation is legally watertight, that the plans are tax efficient, and the giver can manage the expectations of beneficiaries.

2 topics

1 contributor mentioned