Coppo: It pays to be a bull

And while history doesn't repeat itself and is never a perfect guide to what your investments will do next, data collated by Bell Potter's Richard Coppleson shows you'd rather be a bull than be a bear.

I'll share some of these historical insights in this wire (with some extra bits thrown in from yours truly.)

Big falls are rare but big rises are more common

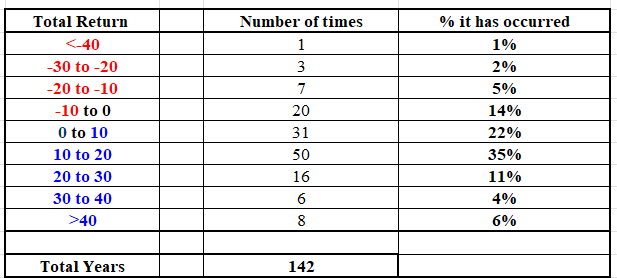

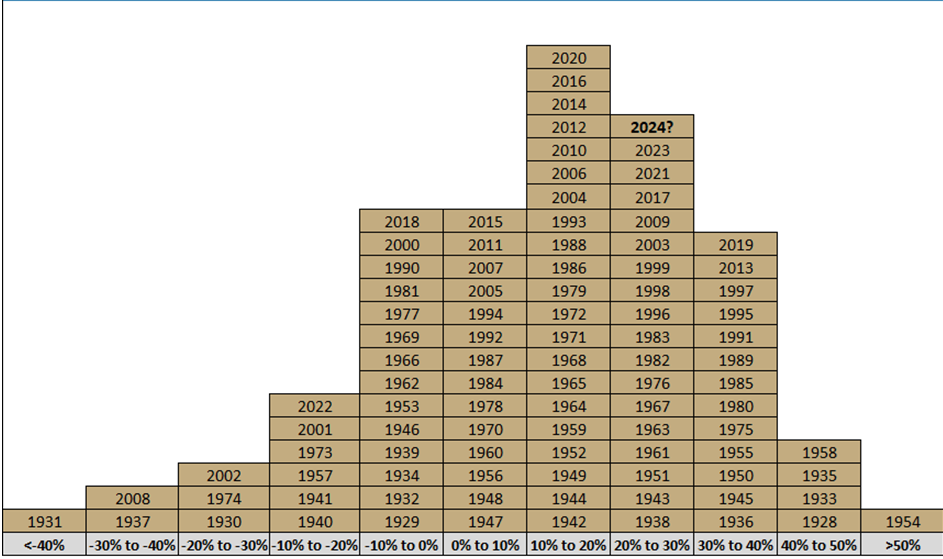

2024's 14.3% makes this year the 50th incident in 142 years that the Australian stock market recorded a total return gain of between 10 and 20%. A total gain of between 10 and 20% is also the most oft-occurred yearly result for the Australian share market in this data set.

As you can see, a massive fall (i.e. an index-wide fall of greater than 20%) has only occurred four times in 140+ years. And the All Ordinaries has only ever had a 40%+ drop once in its history. Can you guess which year it is?

It's 2008. The All Ords fell from a peak of 6,422 (reached on January 3rd) to a low of 3,441 (reached on December 8th.) That year, Commonwealth Bank (ASX: CBA) shares fell by 50% while BHP (ASX: BHP) shares fell by nearly 25%. And all of the following were not public companies then: Afterpay, WiseTech Global, Costa Group, Nearmap, and The Lottery Corporation.

Coppleson reinforces this bullish bias in his report.

"It may sound silly – but as a statistician - you have the stats, maths, and history on your side," he says.

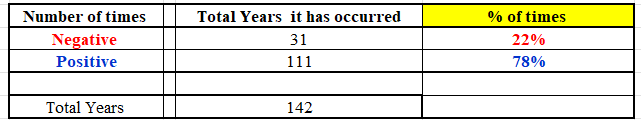

So, does being a bear work? Well, overall, the All Ordinaries has had an up year 78% of the time. As Coppleson so eccentrically puts it:

"This tells me, you want to be bullish about 80% of the time and bearish just 20%. If you can get the timing right on that 20% number, then you’ll be a genius. Many bears try to get it and can see the market run for a long time (and a lot higher) before they eventually get it right & say "I told you"!"

"Being negative EVERY year does not stack up (you know the ones - the same ones that the papers quote every time the market falls and they tell you it’s going a lot lower. They say “don’t buy the dips this time” and then (you wouldn't believe it) but it goes straight back up!!"

What about the chances of a huge crash?

As Coppleson puts it:

"The bears are (still) waiting for that really big market melt down (that they have been forecasting for the last eight years) will be horrified to know that in 142 years, only 11 years (or just 8% of the time) has the market dropped by -10% or more over a calendar year. Even if we get a zero to -10% year (which to be honest, isn’t that bad) – that has only happened 14% of the time," he writes.

In other words, unless you've got A+ timing, being a perennial bear doesn't net you strong results.

It's the same in the US as well. The average US bull market for equities has seen a 150% gain over more than four years. In contrast, the average bear market drop has been just shy of 32% over only 11 months. Or put another way:

"The average bull market in the US has seen a gain of 5x more and it has been 5x longer," Coppleson says. Of course, this is far from a straight line higher and most years do not look like the 10% historical average. As Michael Goldberg explained in his wire earlier this week, "volatility is the cost of outperformance."

Including dividends, the S&P 500 is now up over +29% so far this year. What's even more remarkable is that the S&P 500 has had a total return of at least 25% in 26 out of 96 years since 1928 (see the chart above.)

Long story short, to quote my boss Chris Conway, it's more fun being a bull.

Get more insights from the insto desk in the Coppo report

This article contains data and insights from The Coppo Report contributed to Livewire by Richard Coppleson, director - institutional sales and trading, Bell Potter.

2 contributors mentioned