Right commodity, right spot on the cost curve, right timing, and right price!

At Tectonic we are always on the lookout for "hidden gems" - small-cap companies flying under the radar of other institutional investors. Especially those stocks trading at a fraction of their intrinsic value, and with catalysts that will put them on a path to becoming billion-dollar-plus companies over the medium-term.

We believe Highfield Resources (ASX: HFR) - a Spanish potash mining company listed on the ASX - is one of those hidden gems and our fund has been building a meaningful position in the company (at rock-bottom prices).

Company and potash overview

Highfield is the 100% owner of three potash projects in Spain, its flagship Muga Project situated 50km to the southeast of Pamplona.

For those unfamiliar with "potash" - it refers to potassium-containing salts used as fertiliser by the farming industry. Potash increases water retention in plants, improves crop yields, and enhances the taste and nutritional value of many plants. Highfield is focused on ‘Muriate of potash’ (MOP) which is the most common potash, representing 90% of worldwide agricultural potash. More than 70% of the global production of potash is concentrated in just four countries:

- Canada,

- Russia,

- Belarus, and

- China.

Once built, the Muga project will have the capacity to produce 1 million tonnes per annum of MOP. The mine will have a 30-year life, with Phase 1 production (500,000 tonnes per annum) and first revenues expected in the first half of 2024.

The development of the Muga Project has been a seven-year (!) journey of consultation and securing the required approvals from multiple levels of the Spanish Federal and Provincial governments. This culminated in the final permitting milestone - the Mining Concession - being awarded to Highfield in July 2021. This significantly de-risks the project, allowing construction to commence early next year (the company has already ordered long-lead-time equipment demonstrating its confidence in the project moving forward).

Why we like Highfield

The company has many of the attributes we look for in a typical Tectonic investment:

- It is an ‘under-the-radar company with limited institutional ownership. As a small-cap company ($160 million market cap), Highfield is too small to attract much attention from analysts or other professional investors. We typically find our best investments in the small-cap space where the market inefficiencies are greatest.

- It is targeting a growing market with long-term tailwinds. While everyone is talking about lithium and copper right now, we think there are attractive dynamics at play in the potash market that should provide long-term tailwinds for this commodity.

Potash demand is expected to grow substantially (from 70 million tonnes today to 97 million tonnes by 2035) as the world population grows, urbanisation accelerates, and environmental regulation increases requiring existing farmland to become more productive.

We're not alone in holding this opinion - the mining giant BHP Group (ASX: BHP) has singled out potash as one of just a handful of future-facing commodities it will focus on after its divestment of thermal coal, oil and gas assets.

Highfield has already signed memorandums of understanding with customers for amounts exceeding its entire Phase 1 output. MOP prices have been on a tear of late - up more than +200% since the start of the year - perfect timing for Highfield given they are now in late-stage financing discussions with their banking group for the construction financing.

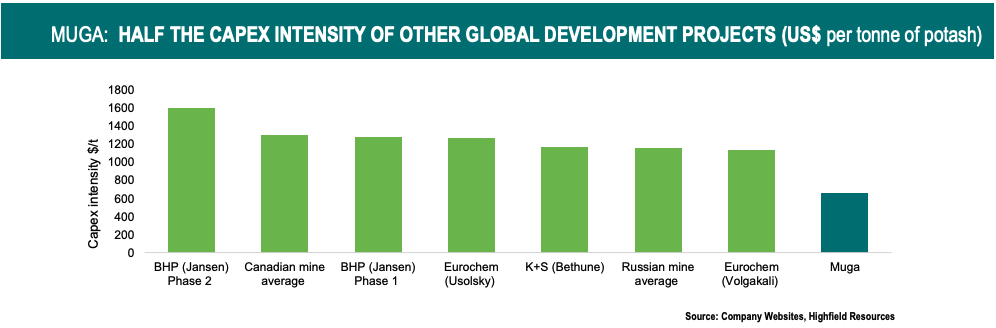

It has built-in cost advantages versus its competitors. The Muga project has a number of key advantages that limit the required CAPEX spend and improve mine economics. The project is located close to the existing port, road and electrical infrastructure, saving the build-out of project-specific logistics infrastructure. In addition the shallow mineralization of the resource and no aquifers means the mine only requires conventional mining techniques (no need for an expensive shaft). Because of these attributes, the Muga project can be built at half the CAPEX intensity of other global potash projects.

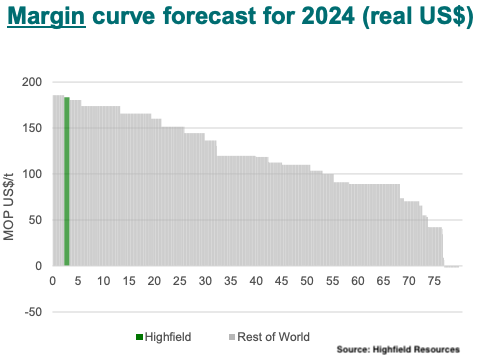

Being located in Spain, Muga will be one of only two potash mines located in Southern Europe, right on the doorstep of its major customers. The geographical location of a project is an increasingly important consideration as the global economy struggles with supply-chain disruptions, high freight costs, as well as re-alignments due to geopolitical factors (noting that 3 of the 4 largest potash producing countries are Russia, China and Belarus). The result of Muga’s low cost to build and operate is that it will place it at the very bottom of the global cost curve, making it one of the highest margin potash mines in the world! This means in the event of an extended downturn in potash pricing, the Muga project will be one of the last potash mines still profitable while other more expensive mines are mothballed or permanently closed.

The Feasibility Study for Muga (which is currently being updated by the company with final construction figures and updated potash price outlook) projects average annual EBITDA (earnings before interest, tax, depreciation and amortisation) from the mine at full capacity of c. EUR 300 million per annum. Our own forecasts are more conservative on both Muga’s cost of mining and on the long-term price curve (assuming a significant decline from current spot prices), but we still come up with projected EBITDA of more than EUR 190 million per annum once the Muga mine is operating at 1 million tons per annum nameplate capacity.

It is led by a high-quality management team and board and is backed by a top-tier private-equity sponsor. We have had several direct interactions with the Spanish-based management team as well as the Chairman (Richard Crookes) and are convinced they have the experience and capability to deliver the project. At Tectonic we ideally like to back founder-led businesses where management has significant skin-in-the-game so are more likely to act in shareholders’ interests. While Highfield is not founder-led we are encouraged by the fact the CEO (Ignacio Salazar) has been buying shares on-market as recently as last month (at 47 cents a share) and the Board has been taking its director fees as shares rather than cash for the past year, as well as buying shares at 52 cents in the recent share purchase plan.

There are only two other institutional shareholders of note on the register:

- EMR Capital with a 29% stake - a top-tier resources-focused private equity fund led by Owen Hegarty (an industry veteran who was the founder and CEO of Oxiana which later became OZ Minerals (ASX: OZL); and

- Australian Super - which has been creeping up the register with a 7.4% stake.

We have had direct engagement on several occasions with Mr Hegarty regarding Highfield and are convinced that EMR shares our conviction on the intrinsic value of the project that is multiples of the current share price!

It is trading at a bargain valuation - providing a large margin of safety and significant upside potential. At the same time as there has been a significant improvement in the fundamentals of the company (i.e. final permitting milestone achieved, potash prices skyrocketing, other potash stocks soaring) - the share price of Highfield has declined, allowing us to build our investment in the company at a fraction of what we think it is worth.

At its current 44 cent share price, Highfield’s $160 million market capitalisation is valued at only ~ 5% of the EUR 1.97 billion net present value (NPV) of the Muga project as calculated in the company’s feasibility study (undertaken before the recent run-up in potash prices).

In terms of earnings multiples, the Canadian-listed potash producer Nutrien Ltd trades at 12.5 times its current EBITDA. Yet Highfield’s total market capitalisation today is less than six months worth of expected cash flow once the Muga mine has been ramped up!

As a small-cap, Highfield doesn’t get much coverage from the investment banks, but the only two analysts that cover the company have 12-month target prices of $0.97 (CanAccord) and $1.56 (Fosters) respectively.

Why so cheap, and what lies ahead?

We can’t comprehend why the share price has continued to decline as the outlook for the company has improved - but mispricings like this are more common in the small-cap market.

Investors are possibly worried about the eventual capital raise required to fund the construction of the project. Based on the feasibility study, the near-term construction funding requirement will be around EUR 370 million, which is a big number compared to Highfield’s current market capitalisation (and current net cash balance of $30 million). But we think the market is under-appreciating the strong appetite from European banks to debt fund a significant portion of the project (we expect up to EUR 250 million of debt availability).

We also think the market overlooks the optionality Highfield has to bring in strategic investors to partially or fully fund the balance of the equity requirement - therefore mitigating the need to do the heavily dilutionary capital raise the market seems worried about.

At the same time, we see several near-term catalysts that could lead to a re-rating of Highfield Resources in the coming months. These include:

- an updated feasibility study for the Muga project reflecting the final project costs and revised potash price outlook (which we still expect to show a NPV that is multiples of the current market cap);

- finalisation of the debt term sheet for the construction financing;

- an announcement of binding offtake agreements for Muga’s full capacity; and

- the potential for near-term strategic interest in the project (which could potentially remove the need for an equity raise at all or even take the company private).

Highfield Resources is a conviction holding for us at Tectonic - a company focused on the right commodity, at the right end of the cost curve, with quality management and directors (who are themselves buying shares), and trading at an absurd discount to its intrinsic value.

We have no idea when the market will start waking up and taking notice of the fundamentals here, but suspect it won't be long!

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

2 stocks mentioned