Rising collectable debt underscores corporate financial stress

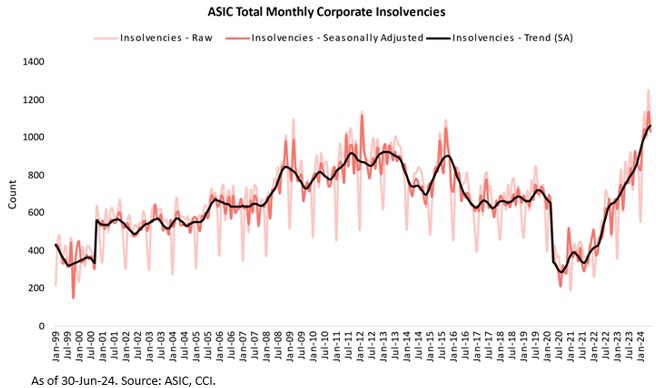

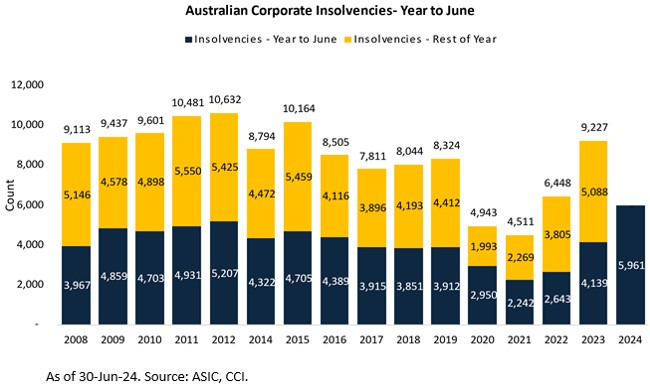

The latest ASIC release shows corporate insolvencies for June 2024 remain at their highest level since monthly data was first published in Jan-1999, with CCI’s discussions with business recovery and insolvency specialists suggesting the number will continue to increase.

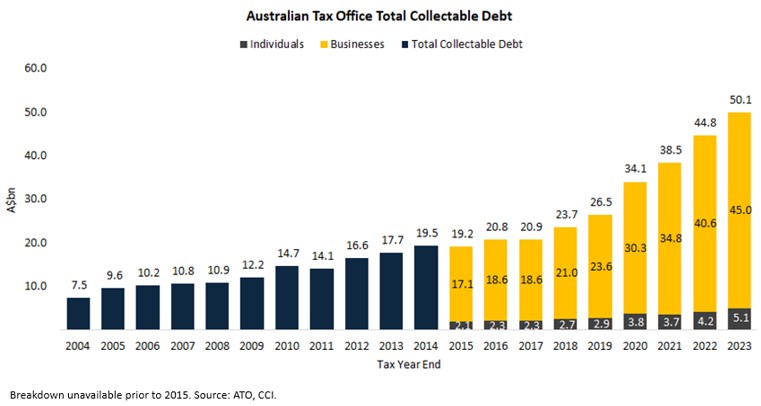

The rising value of Australian Tax Office (ATO) outstanding collectable debt tells the same story, providing a more complete picture of the financial stress of increasing insolvencies.

The collectable debt represents outstanding payments for income tax, GST, superannuation guarantee charges, and all other taxes, yet it excludes debt that is subject to objection or appeal, or to some form of insolvency administration.

As you would expect, nearly all debt is owed by businesses.

The ATO data, which are only released annually in October each year, show the value of collectable debt has practically doubled from $26.5 billion in 2018-19, to $50.2 billion in 2022-23.

Industry specialists have told CCI that they estimate the value of outstanding collectibles to have reached the high ‘$50 billions’ in 2023-24.

During the pandemic, the ATO shifted focus from debt collection to stimulus payments, with over 5,000 staff redeployed, including staff from debt collection, to focus on how they could assist taxpayers.

CCI’s understanding is that payment plans, deferred due dates and remitted penalties and interest were offered without question.

That is behind us, a point made very clear in a speech by Vivek Chaudhary, Deputy Commissioner of Lodge and Pay at the Tax Institute Tax Summit, who stressed that the time has come to re-establish the culture of paying tax on time.

- “Payment plans and general interest charge remissions will be reserved for those who genuinely need the support; and will become the exception rather than the rule”.

- “Clients who need more time and support, should contact the ATO before they decide not to pay on time. This will be critical in influencing future payment behaviours, moving away from a culture of waiting until the ATO contacts you before paying”.

Not all companies can pay their debt and generally 1 in 6 corporate insolvency actions are initiated by the ATO.

The ATO’s recent ‘firmer action’, has already led to a noticeable escalation in the collection of unpaid debt, with steps including:

- Garnishees;

- Director Penalty Notices;

- Claims or Summons;

- Creditors Petitions;

- Statutory Demands;

- Wind Up Applications; and

- Debt Collectors.

However, the ATO’s return to pre-COVID standards still has further to run.

For example, the ATO initiated almost double the number of wind-ups in the Federal Court prior to the pandemic in the first half of 2019, compared with the same period in 2023.

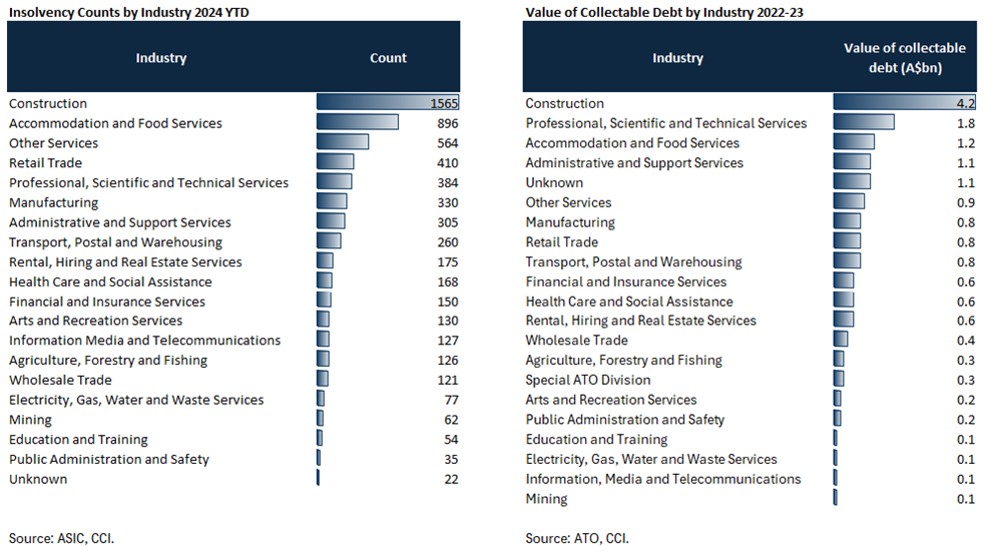

By industry, Australian corporate insolvencies and outstanding debt collectable remain concentrated among commercial real estate, residential property development, construction, retail and hospitality.

These sectors dominate the portfolios of non-bank lenders catering to sub-prime borrowers, who struggle to secure financing from conventional banks reluctant to lend to those with poor debt service capabilities.

The Australian Prudential Regulation Authority’s research has consistently shown that commercial real estate and residential development exposures are the most likely drivers of bank failures, as they were in the 1991 recession, and has strongly discouraged regulated deposit-taking institutions from risky lending in these areas.

1 topic