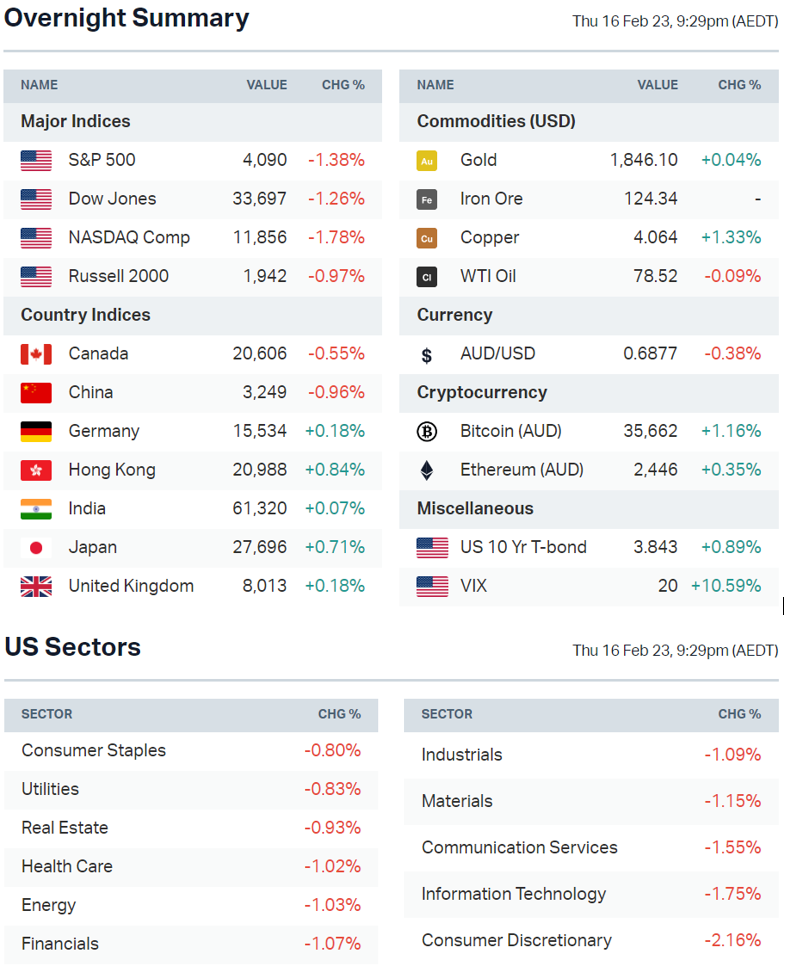

S&P 500 slumps on hot producer prices and hawkish Fedspeak, ASX set to fall

ASX 200 futures are trading 18 points lower, down -0.25% as of 8:40 am AEDT.

US producer prices came in hotter-than-expected thanks to higher fuel prices, the Fed's Loretta Mester reiterates the need to bring rates above 5%, China new home prices increase for the first time in over a year, the US 6-month Treasury yield starts with a 5 handle for the first time since 2007 and three interesting charts for the week.

Let's dive in.

S&P 500 Session Chart

MARKETS

- US stocks sold off at the close thanks to a hot producer price report and unexpected decline in initial jobless claims, further fueling Fed tightening expectations

- Fed's Loretta Mester sees a compelling case for a half-point hike at the last rate meeting and reiterates the need to bring rates above 5%

- Both Fed and markets underestimating how high rates may have to rise (Bloomberg)

- Investors drop bets on falling US rates in face of stubborn inflation (FT)

- ECB 50-bps hike in March a done deal (Reuters)

- BoJ will scale down ultraloose policy this year (Nikkei)

STOCKS

EARNINGS

- "... our fiscal 2023 is shaping up to be a great year...We are raising our full year outlook driven by our growing recurring revenue base and RPO, along with our healthy backlog & the steps we have taken to improve supply.” - CEO Chuck Robbins

ECONOMY

- US producer price index rose 0.7% month-on-month in January vs. 0.4% expected due to higher energy costs

- US initial jobless claims were 194,000 versus 200,000 estimates, reiterating the tight labour market, hawkish Fed and soft landing theme

- China new home prices increase in January for first time in a year (Reuters)

- Australia unemployment rate unexpectedly jumps (Bloomberg)

- US 30 year mortgage rates hit their highest level in more than a month (Bloomberg)

Deeper Dive

Charts of the Week ft. Chris Conway

I’ll keep it short and sweet this week. Until yesterday the ASX was tracking lower, continuing to push away from the all-time highs. We saw a bit of a bounce yesterday and volumes are picking up, but ultimately the technical evidence is showing the least conviction that it has for some time. Clearly, with reporting season well underway, neither the bulls nor bears are willing to take any big bets at the moment, and that is being reflected on the chart. And with plenty more of reporting season to wade through, this sideways grind might continue for some time yet.

South32 (ASX: S32)

The chart does look solid. We’ve recently seen a break above a sideways congestion zone – through $4.50, and yesterday (off the back of the results no less), that $4.50 level was tested and respected as support. That’s an encouraging sign. With the stock ‘de-risked’ from results, could we see some follow through to the upside. Time will tell but this looks like one to keep an eye on.

Altium (ASX: ALU)

.png)

As charts go, there are none that look much sweeter (to me, at least) at the moment than Altium. The EMAs are showing bullish trend alignment across multiple timeframes, we’ve seen a breakout out of a long-term sideways congestion zone – and through a big round number at $40, which has been supported by a volume spike. Furthermore, the RSI is not overcooked. What more could you ask for?

Interesting stuff

Tempting yields: The US 6-month Treasury yield now starts with a 5 handle for the first time since 2007. Many investors are likely asking themselves why would they want to risk things like a recession or earnings crash when they can get 5% safely.

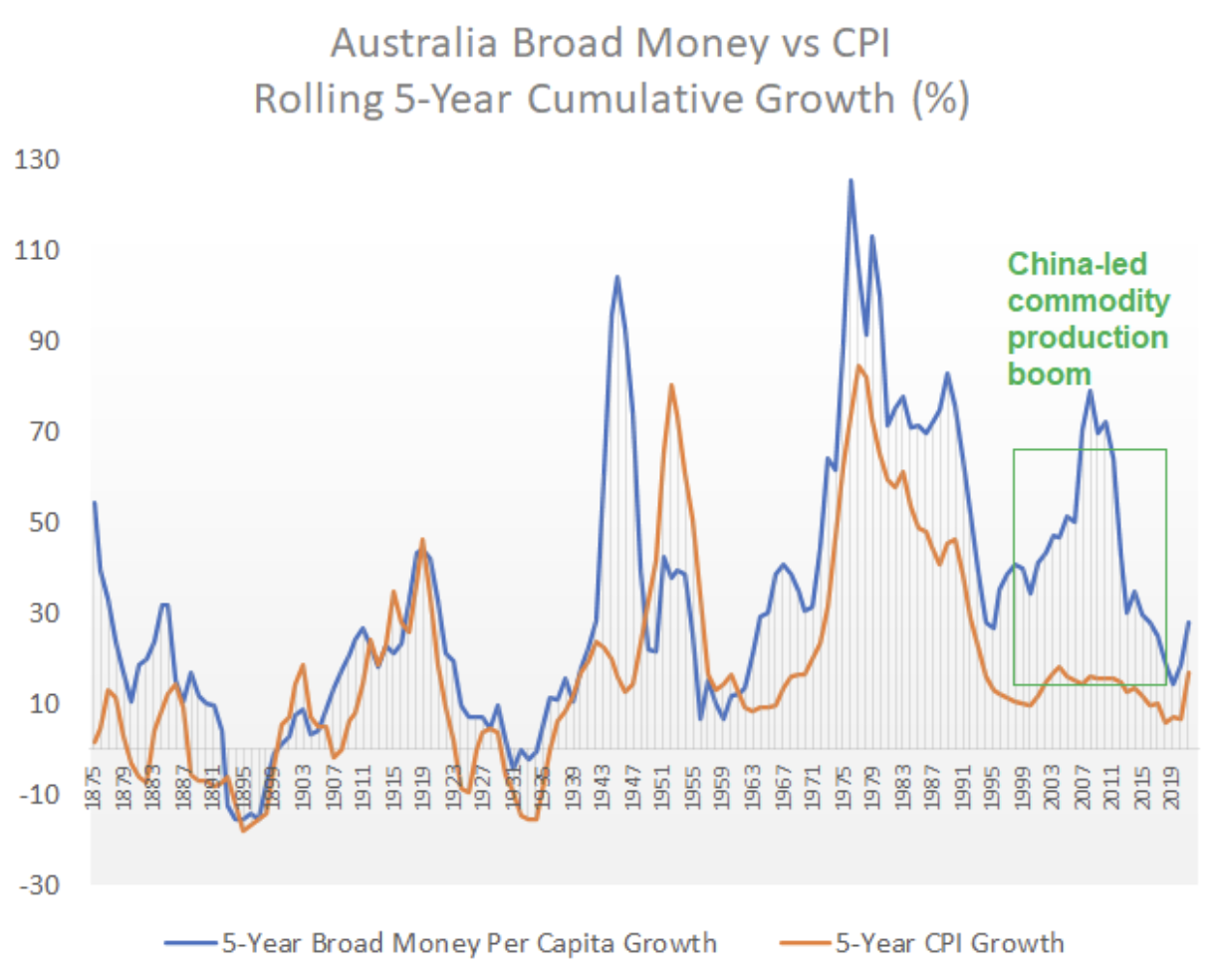

Price inflation 101: When too much money chases too few goods and services. Both high growth in money supply and major changes in the supply of goods and services significantly affect price inflation. Long-term charts from developed countries illustrate that areas where money supply growth exceeded changes in the consumer price index were generally associated to some sort of productivity boom.

.png)

Today's Events

- Trading ex-div: Lendlease (LLC) – $0.049, Argo Investments (ARG) – $0.165, Kelly Partners Group (KPG) – $0.004

- Dividends paid: Euroz Harleys Group (EZL) – $0.025, Cromwell Property Group (CWM) – $0.01375

- Listing: None

- 9:30 am: RBA Lowe Speech

- 10:00 am: Fed Mester Speech

- 6:00 pm: Germany Producer Price Index

- 6:00 pm: UK Retail Sales

Are you enjoying the new Morning Wrap? Here’s the chance to have your say

We’re inviting you to participate in a quick survey, so that we can understand how you feel about the Morning Wrap in its current form, tell us what you like and what you don’t, and suggest any areas for improvement. Simply click here to participate.

Thanks for your ongoing support and feedback,

The Morning Wrap Team.

Today's Morning Wrap was written by Chris Conway.

2 stocks mentioned

1 contributor mentioned