Seeking diversification in a zero rate world

Portfolios combining bonds and equities thrived in the 2000s and 2010s, as the structural decline in interest rates propelled bond and equity markets higher. With the investment landscape now changing, this traditional, static asset allocation approach to diversification may not survive the 2020s.

Recalibrating the investment landscape

The Covid pandemic has changed the way we live, work and consume, and encouraged us to be more innovative. Some existing trends – such as the shift to online shopping – have accelerated. Other new trends – like digitised healthcare and flexible home design – are emerging.

The Covid crisis is also driving change in the investment landscape, with little prospect of returning to the ‘old normal’ any time soon. In particular, the economic damage wreaked by the pandemic means that interest rates will stay low for much longer than previously anticipated. This reduces returns for fixed-income investors. It’s important also because interest rates are used to value financial assets. When rates fall, they push up asset valuations, compressing the future returns investors can expect.

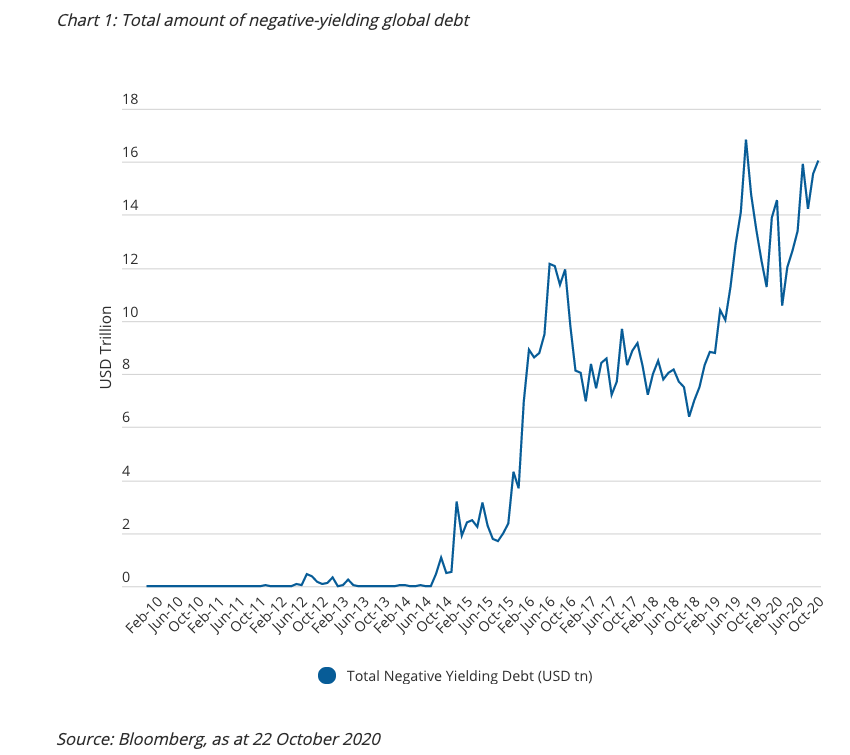

Chart 1 illustrates the extent to which yields have fallen. Over US$16 trillion of debt is now offering negative yields, which means the bond-issuer is paid to borrow by the bond-buyer.

Moreover, not only are returns expected to be lower, they’re also likely to be more volatile. This reflects the huge uncertainty around global growth prospects, and worries about the excessive levels of debt racked up by businesses and governments. With lower expected returns, investors’ tolerance for losses is reduced as the ability to recover is more limited.

These changes in the investment environment demand a radical overhaul of our investment approach. Investors need to develop new ways to diversify risk and generate reliable returns.

The challenge of diversification

In a deeply depleted market expected to generate low long-term returns, we cannot rely on static asset allocation – the standard bond/equity approach to diversification that thrived for much of the last two decades is unlikely to survive the 2020s.

With global interest rates converging towards zero, the usefulness of developed market government bonds as a diversification tool is limited. While it may be simplistic to argue government bonds can no longer diversify portfolio risk, investors will have to rely on leverage, or focus on longer-maturity bonds that offer higher yields.

How then might we build genuinely diversified portfolios in an environment of ultra-low interest rates, low returns and volatile markets? It’s clear that investors will need to actively manage the risk profile to generate uncorrelated returns, to diversify, and to adapt as market drivers change.

Cross-asset positions may be the answer

Being able to make use of cross-asset positions at both macro and security level is likely to be a crucial advantage. Here are some examples.

Backing long-term winners

Within equities, there are opportunities for investors to construct targeted exposures to different future growth and inflation outcomes. Using thematically driven ideas and expressing them through relative-value positions allows us to seek returns irrespective of market direction.

One such theme might be increased government spending. Policymakers have growing influence over the distribution of capital. This will create winners (e.g. companies developing green energy infrastructure, or providing educational services) as well as losers. Using relative-value positions, we can express preference for one asset over another. This lets us seek positive returns in both adverse and favourable market conditions.

Likewise, a world characterised by low growth and abundant cheap money magnifies the premium placed on sectors and industries that can promise future growth, as capital investment continues to flow their way. Beneficiaries would include certain technology stocks.

Currencies as diversifiers

In the new investment landscape, currencies are likely to gain prominence as useful diversifiers. Currencies offer exposures to several types of risk that are distinct from traditional equity, interest rate and emerging market risk. In addition, in a regime where interest rates are anchored at very low levels by central bank policy, currencies are likely to operate as ‘pressure release valves’ for economies. So, we can use currency pairs to express our views on the economic outlook of one country in relation to another. For example, a Japanese yen versus euro position might represent caution over political and economic risks in Europe.

Casting a wide net in bond markets

In fixed income, being able to take advantage of relative value across countries, and being able to leverage, are likely to be valuable tools for investors. In addition, new diversifiers may arise in the form of investment-grade corporate bonds and emerging market government bonds (hedged to remove currency risk). Investment-grade bonds are increasingly benefiting from central banks’ asset purchase programmes. Across emerging markets, central banks have been responding to cyclical downturns by cutting interest rates. This regime shift has expanded during the current Covid-19 pandemic. A record number of emerging market central banks have cut interest rates and several have undertaken asset purchase support programmes. This has allowed emerging market bond yields to fall in tandem with developed market bond yields, delivering positive returns for investors (when bond yields fall, bond prices rise, and vice versa).

Trading commodity curves

Commodities are another potential source of diversification. Expectations for a protracted period of near-zero rates should continue to support the price of precious metals such as gold. In addition, we can seek returns by harvesting the risk premia embedded within various commodity curves to provide a diversified source of income for investors. (A commodity curve shows how the future price of a commodity changes over time. By trading a commodity at selected future prices, we can seek to profit from any pricing discrepancies.)

Be active

It’s clear that investors can no longer rely on static equity/bond combinations to provide diversification. Rather, they will need to actively manage risk to deliver genuinely diversified returns, and to respond readily as market drivers change.

3 topics

.png)

.png)