Seeking exposure to rare earths? These 4 companies show why details matter

While there are multiple brokers covering the hot rare earths space, not every note focuses on the details and the issues behind each individual company. Recently, we found two such examples in Macquarie and UBS.

In this wire, I explore the insights on regulatory risk, commodity pricing and project staging on their sentiment around these 4 stocks: Lynas Rare Earths (ASX: LYC), Iluka Resources (ASX: ILU), Meteoric Resources (ASX: MEI) and Hastings Technology Metals (ASX: HAS).

Regulatory risk

All mining projects require various government approvals to proceed, from their exploration phase up to the mining and processing stages. And when a government signals a change of policy - which can be anything from a twinkle in the relevant minister’s eyes, or something more concrete as formally withdrawing licences or shutting down operations - it creates uncertainty around the ability not only of the companies immediately impacted, but also to the market for the commodity more generally.

Macquarie’s latest broker note on rare earths calls out Lynas in light of last week’s announcement by Prime Minister Anwar Ibrahim that Malaysia will ban exports of rare earth raw materials so as to boost its domestic industry. Despite this, Macquarie still like Lynas as they think this announcement may not have as much impact on its Malaysian operations as appears at first glance.

One reason for this is the nature of the announcement itself. Aside from no clear policy timeline to implement the ban, Macquarie calls out the lack of a clear definition of “raw materials” in the announcement.

“LYC's operations are unlikely to be interrupted, in our view, given the company produces rare earths oxide products which is the last step during the refining process”, the note says.

Rare earths value chain

The Malaysian PM also wants to maintain the raw earth value chain in that country. UBS analyst Levi Spry regards that messaging from Malaysia as “positive noise” for Lynas, while Macquarie see it as playing into Lynas’ application to the High Court of Malaysia for leave to initiate two judicial review proceedings against the government over the operating licence conditions that prohibit the import and processing of lanthanide concentrate after 1 January 2024.

“In addition, the government's commitment to capture more value along the rare earths value chain could de-risk the judicial review filed by LYC. A successful review would extend the operation of its cracking and leaching facility in Malaysia beyond 1 Jan 2024, in our view”, the note says.

Effects on commodity prices

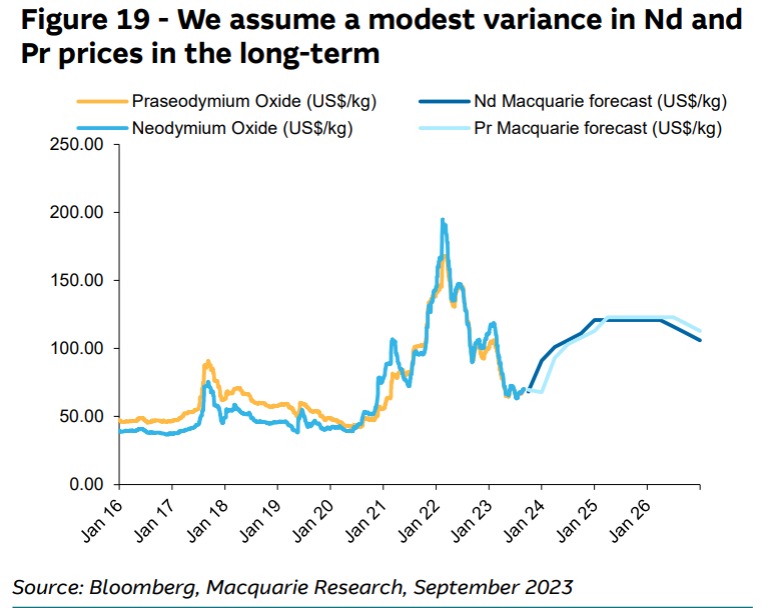

What about the effect of this policy stance on commodity prices? Macquarie anticipates the overall Neodymium / Praseodymium (NdPr) market to remain tight in 2023, with 2HCY23 production quota being a key catalyst for the NdPr price. Based on a production quota for 1HCY23 of 120kt (REO equivalent), they assume an output of 128kt from China for the second half. And their outlook for prices remains cautious.

UBS also notes that prices have improved from the bottoming out at around US$50-55/kg to up to US$63/kg. And while their long term price expectation is US$95/kg with a steady 2-3 year recovery to that level, they aren't expecting anything other than a modest improvement in prices for 2HCY23.

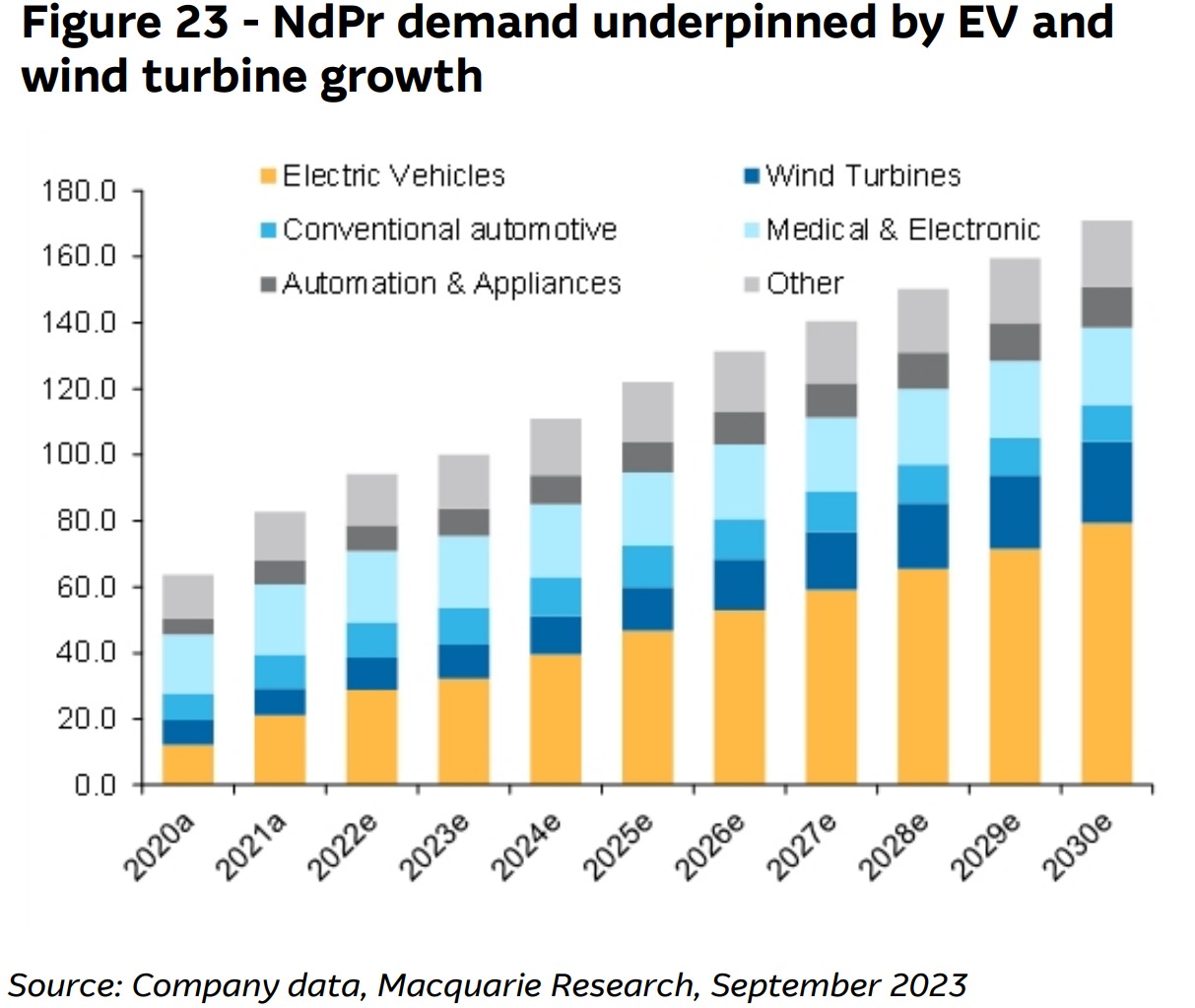

Yet demand for these resources continues to increase courtesy of electric vehicles and wind turbines, although other uses also generate the increased demand.

Impact on 4 ASX listed rare earth companies

So what does that mean for Lynas, as well as our three other ASX-listed companies with rare earth operations? The answer depends on where they are in the lifecycle of their projects. Only Lynas is at the production stage, so commodity prices are highly relevant.

Macquarie notes that Iluka is progressing its Eneabba (WA) Rare Earths Refinery phase 3 project to capture more value along the value chain through the delivery of separated rare earth oxides from its existing operations at Eneabba, which include phase 1 screen and phase 2 concentrating. They see the issue right now for Iluka is project capex, not NdPr prices, as first production is not expected until FY25.

“We see upside risk to project capex driven by cost inflation pressures in the mining sector and expect the company to provide an update after its front end engineering design. Our base case capex for EB3 is ~A$1.3b, 10% higher than the upper end of its A$1-1.2 billion guidance range.”

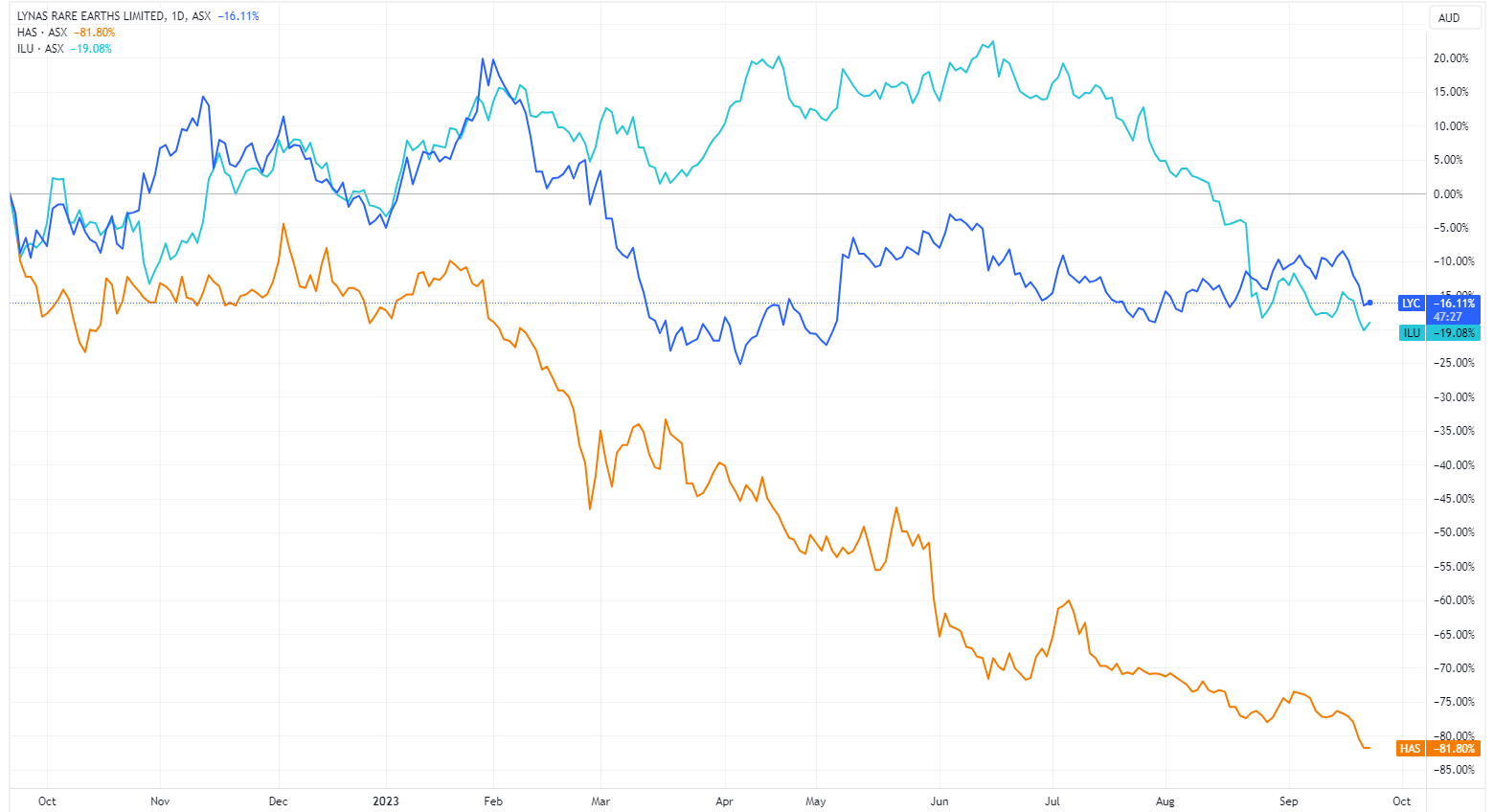

Meteoric Resources is living up to its name, enjoying strong growth over the past year, and in stark contrast to the decline in share price performance of the three other stocks mentioned.

.png)

It is developing its high-grade Caldeira ionic clay rare earth deposit in Brazil. Macquarie believes this project has the potential to produce up to ~7ktpa of NdPr. However, it is also not yet at production stage. It's still conducting multiple studies including metallurgical test work, run by Australian Nuclear Science and Technology Organisation (ANSTO).

Hastings Technology Metals is also at an earlier stage, continuing the early construction works at Yangibana (WA), spending $106 million by the end of June 23 to complete the site road and the Yangibana airstrip were both completed in the 4QFY23. In early September, the company expanded its offtake agreement with Thyssenkrupp, who will purchase two-thirds of Yangibana's annual rare earths concentrate for the first five years, starting 2QCY25. So right now, sentiment about its share price is not related to NdPr prices.

Broker sentiment

Macquarie is rating Lynas, Meteoric and Iluka as OUTPERFORM, but is NEUTRAL on Hastings Technical Metals.

UBS prefers Lynas to Iluka Resources for NdPr exposure, but remains NEUTRAL on Lynas and has a SELL rating on Iluka Resources due to expectations around mineral sands pricing. The other two stocks are not covered by the broker.