Series: Is private debt ready for recession? Part 2 - Reaching for resilience as we take a closer look at leveraged loans.

Falling markets are largely seen as a challenge for traditional asset class investors, though the interest in private market investments, such as leveraged buyout loans (LBOs) is rising. Senior Portfolio Manager David Saija and Portfolio Manager Lucie Bielczykova at Revolution Asset Management (Revolution) weigh in on the momentum of LBOs for investors and where opportunities lie in generating stable and predictable income.

What do surging inflation, rising rates, widening credit spreads, volatile financial markets and a potential recession waiting around the corner all mean for LBOs?

First, it is helpful to establish Revolution’s focus within the private company and leveraged buyout segment of the private debt market. The private company and leveraged buyout debt market is wide and can range from conservative bank-type lending that involves lending to large and established companies, through to bi-lateral and Small Medium Enterprise (SME) lending that involves lending to small companies and SMEs as a sole lender, all the way to distressed and special situation debt where lenders take equity-like positions with a view to turn around a company that is facing challenging conditions or requires a complete restructuring or recapitalisation.

Revolution focuses on the larger, broadly syndicated transactions, which usually involve top tier private equity firms (such as KKR, PEP, TPG, EQT, Apollo for example) acquiring large, well-established and market-leading businesses.

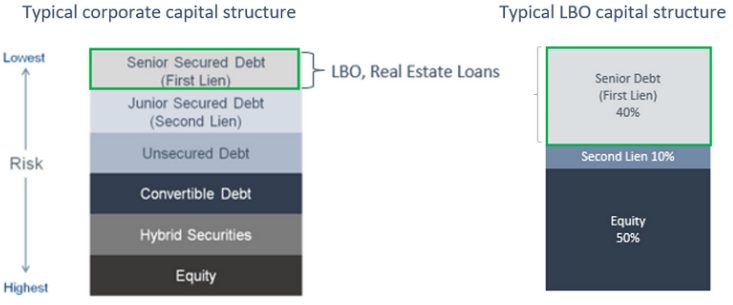

Revolution is a senior secured lender to these businesses. Seniority refers to investors’ relevant position in the capital structure. Senior lenders rank at the top of the capital structure and receive priority repayment of cash flows, meaning that any principal and/or interest on senior instruments are paid before junior debt and equity holders. A typical LBO capital structure has ~50-60% equity and/or junior debt buffer, which provides a significant amount of buffer and protection.

Revolution holds first ranking security over the company’s assets and operations. Security (also known as a lien), is legally documented in loan contracts and allows lenders to have rights over the borrower’s assets should they be unable to meet their repayment obligations. Together with seniority and security, covenants and loan terms provide further structural protections, which combine to mitigate risk.

Being floating rate in nature, private debt has embedded protection against inflation and changes in interest rates. The yield of floating rate assets is anchored to short-term interest rates. Therefore, as interest rates rise, the cash yield on private debt assets will also increase without any negative impact on the value of principal (as opposed to traditional fixed rate bonds which incur capital losses when interest rates increase). From the borrower’s perspective, this means that the cost of debt servicing can increase significantly.

While Revolution expects to see some deterioration in coverage metrics for LBO assets with increasing interest rates flowing to borrowing costs, it should be noted that they are coming off a very low starting point with rates having been near zero for a long time. On an absolute basis, cost of funding remains relatively cheap. It is also notable that most Australian borrowers at least partially hedge their interest costs, and therefore Revolution does not expect them to fully feel the impact of rising rates from a servicing perspective. From an overall fundamental standpoint, borrowers are generally in good shape with sound balance sheets and manageable leverage.

Revolution’s strategy focuses on lending to large, well-established businesses in stable, non-cyclical industries, that hold a leading market position, with a strong and experienced management team, strong profitability, and stable margins. These factors all work together to ensure that cash flows remain stable throughout economic cycles, with ample liquidity to service and repay debt.

“There are a number of factors that determine how a particular business can deal with inflationary pressure and recessionary environment. Some of these factors include industry, business size and market position, basis of competition and if they have a sustainable competitive advantage, who has the balance of power in terms of relationships with customers and suppliers, the quality and experience of the management team as well as profitability, margins and cash flow generation, to name a few.”

Non-cyclical industries

Revolution favours industries such as healthcare, mission-critical software and consumer staples. Demand drivers in these industries tend to be quite stable given the importance of the products/services offered. Further, demand in these industries tends to be relatively price inelastic (not sensitive to increases in price), which enables businesses to better manage margins in times of inflationary pressure, as is the case at the moment.

Large well established market-leading businesses

Larger businesses typically have a longer track record, with a well-established and diversified client base as well as deeper, stronger, and more sophisticated management teams. Having a strong market position also means that the barriers to entry make it difficult for competitors to enter the market or existing competitors to compete against the dominant player. As such, the dominant position provides them with more flexibility to manage their top line and cost base. Combined with inelastic demand, market leading businesses are able to manage input cost pressures to increase their sale prices without a corresponding decrease in volumes, ceteris paribus, allowing revenue to increase to offset any cost pressures.

Due diligence

Revolution performs significant due diligence on the business, industry and historical financials, as well as stress testing and scenario modelling for each individual loan to determine how the business would perform should identified risk factors materialise or the economy weaken. It is for this reason that Revolution avoids transactions in cyclical sectors which can experience volatile demand throughout economic cycles, as well as bilateral SME loans, which are typically smaller in size and are significantly more sensitive to changes in the macroeconomic backdrop such as changes in demand, the rising cost of labour, input cost inflation and increasing cost of debt.

This all leads to Revolution managing a “sleep at night” portfolio of stable, non-cyclical businesses which is at the very core of its investment philosophy and a function of its disciplined approach to lending. Revolution is comfortable with the ability of its corporate borrowers to withstand economic weakness. This is due to the focus of its investment strategy being on well-established market leading companies within stable non-cyclical industries with strong barriers to entry. As it relates to the broader market, Revolution expects some pain to be felt in certain pockets of the market during a potential recession, particularly in cyclical industries with variable demand, sectors linked to discretionary consumer spending (such as retail, hospitality, consumer discretionary), and smaller companies that could see their margins squeezed.

Where will pressure likely emerge?

In Revolution’s view, areas that are likely to experience pressure are:

· Cyclical sectors

Such as retail, hospitality, consumer discretionary which are linked to consumer health and demand and will likely come under pressure as consumers manage their increasing costs of living and mortgages and rein in their discretionary spending.

· Highly leveraged capital structures

Revolution considers the appropriate capital structure is dependent on the business as well as the industry the business operates in. The leverage multiple can quickly escalate, particularly for cyclical businesses and industries.

· Small companies

SMEs and smaller market players are more likely to come under pressure as they may not be able to pass on the increasing input costs to their customers to the extent large companies and market leading players can. As a result, these companies could see their margins contract as they are forced to absorb increasing costs, resulting in declining profitability.

The winners

On the other hand, defensive strategies will be the winners. Defensive strategies such as Revolution’s that focus on high quality businesses and sectors, that demonstrate stable demand and generate stable and predictable cash flows, regardless of economic conditions, will be able to withstand the economic turbulence. Later in the cycle, distressed and special situations strategies may also become potentially attractive, as they will be able to capitalise on the opportunities that this environment will create. Revolution does not participate in these opportunities as it is outside the investment strategy of the firm.

Conclusion

There are a number of factors that determine how a particular business can deal with inflationary pressure and recessionary environment. While Revolution expects to see some deterioration with respect to fundamentals and coverage metrics across the LBO market, Revolution expects little impact to its portfolio which benefits from stringent due diligence and strategy focus on strong, stable, market leading businesses in stable industries which are able to produce sound cash flows regardless of the cycle. Revolution will continue to focus on identifying and capturing real value opportunities across businesses that can withstand volatile economic conditions.

Is private debt ready for recession? – a four part series

Missed the previous parts of Is private debt ready for recession? Click the links below to go to:

3 topics