Setting the scene for an eventful year

K2 Asset Management

A decade-long bull market in global equities has been stoked by loose monetary policy and massive liquidity injections. 2018 saw these policies come to a dramatic halt and the ramifications were felt throughout financial markets globally.

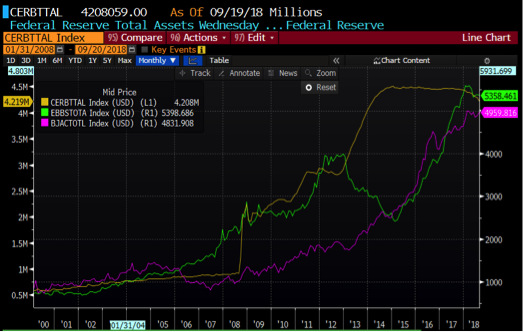

The US base rate was raised 4 times through 2018, by a total of 100bps to 2.5%. Combine this with liquidity withdrawal as the US Federal Reserve introduced Quantitative Tightening (QT) to reduce its balance sheet by US$400bn to still a significant US$4.1tr in assets. Only a matter of months ago US rate expectations were for four more hikes. The Fed has become more Dovish now predicting two in their latest comments, while markets are predicting that it may only be one more rate hike in 2019.

The changes in expectations are closely aligned to a slower growth environment that is becoming evident in the US. High rates and liquidity withdrawal have put the brakes on auto sales and housing, as funding becomes more expensive and capital more scarce.

US corporate earnings are also experiencing mixed results, as higher costs through wages and raw materials have crimped margins across a number of sectors, whilst we do not envisage a recession in the US, we see growth slowdown impacting equity markets.

Chart 1: Federal Reserve Balance

Source: Bloomberg

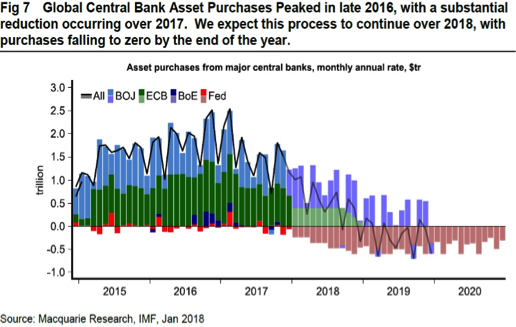

Chart 2: Global Central Bank forecast QT

The crimping of the US economy is highlighted by a declining CPI inflation rate that in July stood at 2.9% and had fallen rapidly to 2.2% by the end of November. Lower inflation is a direct result of the abovementioned liquidity tightening that has seen a US economy slowing all year. The underlying slowdown in the US economy has been disguised by fiscal stimulus that President Trump has thrown at the economy, including substantial tax cuts, which in our view, has lead to the Federal Reserve tightening policy too far without fully understanding the extent of the slowdown.

The combination of rising rates from historically low levels and QT simultaneously is something that has never been done before and the consequences are still widely unknown.

Chart 3: US Inflation

Source : Bloomberg

The picture in Europe

In Europe, the economic indicators are even worse. The EU, a grand concept that takes the meaning of the word “bureaucracy” to a new level has seen political impasse and debt spiral out of control. Italy sits on a knife-edge, with unemployment over 10%, GDP growth less than 1% and a significant budget deficit hampering structural reform and breaching EU rules.

Germany, the titan of European growth is experiencing a substantial slowdown shown by its IFO Business Confidence Index coupled with exports contracting.

Let us not forget the “Magic Pudding” as Theresa May leads the UK in Brexit negotiations – the gift that just keeps on giving! The UK consumer has slowed significantly as evident from recent company reporting including online retailer ASOS.

The trade war drags on

The Trump “Trade War” is expected to continue into 2019. China initially won the opening skirmishes in 2018 as its currency, the Renminbi fell nearly 10% offsetting Trump’s tariffs. That said, the US has been getting the upper hand in more recent salvos, with the threat of higher tariff rates, the arrest of Meng Wanzhou, the daughter and CFO of giant Chinese telecom components maker Huawei.

China’s replies have become more ineffectual, with the recent arrests of Canadian businessmen in China deemed toothless and highlighting the fact that Xi Jinping is concerned and doesn’t want to inflame the US / China relationship further. Behind the scene’s, negotiations continue with topics including Intellectual Property rights and marine freedom of navigation also on the table.

The continuation of the trade war has hurt global trade, impacting Chinese growth and other export-led economies such as Germany. FedEx recent profit warning highlighted these risks. Chinese Industrial Production has slowed to 5.4% from 7% at the beginning of the year.

Problems at home

Australia is facing a number of problems that have accumulated from a twenty-seven year economic expansion. Households are struggling with their budgets as the impact of higher power prices, rising health costs, higher education costs, falling property prices and stagnant wage growth, combined to subdue consumer confidence.

The Banking Royal Commission has seen the major banks restrict the supply of credit, impacting what is the greatest store of wealth for Australians - housing. The credit-crunch may place the Australian economy close to recession in 2019, which does not bode well for equities.

The Australian Federal election likely scheduled for May 2019 and a number of foreshadowed capital/investor unfriendly policies proposed by the Labor Party, will also prompt investor, business and consumer caution over the next 5 months.

Australia is also exposed to an economic deceleration of the Chinese economy. China is Australia’s largest export client and may also be at risk from the consequences of a US-China trade deal, to the extent that China must buy more US exports that could partially be funded from Australia.

Political and regulatory impediments are compounding the Australian slowdown. The Liberal party that is unable to implement policies due to a hostile Senate, while the Labor party, who look likely to form government in 2019 have a policy agenda (changes to negative gearing, imputation credits and industrial relations) that may further impede growth.

The scene is set for an eventful year.

Access further insights

You can access more insights from K2 Asset Management by clicking here.

Stay up to date with the latest insights from K2 Asset Management by hitting the 'follow' button below and you'll be notified every time I post a wire.

1 topic

Mark is a Co-Founder and Executive Director of K2 Asset Management. He is also the Joint-CIO for the K2 investment funds and focuses on the portfolio management of the Asian equity strategy.

Expertise

Mark is a Co-Founder and Executive Director of K2 Asset Management. He is also the Joint-CIO for the K2 investment funds and focuses on the portfolio management of the Asian equity strategy.