Should you buy the dip in Woodside Energy shares?

Woodside Energy Group (ASX: WDS) is the worst performing stock in the ASX Top 20 over the last 12 months. It has lost 23% of its value over this time compared to a similar sized gain in the S&P/ASX 200. This underperformance has no doubt been felt by investors who have remained loyal to Woodside, which to be fair has otherwise been a strong performer for many years.

Investors who choose to add commodity stocks to their portfolio likely understand the cyclic nature of the earnings of these companies, but the resolve of even the most ardent believers in the Woodside story is likely being tested. It is likely to continue to be tested as increasing investment requirements threaten to extend a decline in the company’s earnings that started in 2022 for several more years.

.png)

Woodside just released its September quarter production and operating report, and the market will be digging through the details for clues on whether the company is executing its strategy of bringing large new projects online, as well as for hints on the sustainability of the dividend. We checked in with several major brokers to get their views on Woodside’s quarterly report with a view to answering the question: Should investors buy the dip?

September Quarter key numbers & takeaways

Sales Volume: Sales volume 55.8 MMboe vs consensus* 54.4 MMboe

Revenue: $3.68 billion vs consensus $3.46 billion

FY24 (Year ending Dec 31 2024) Guidance:

- Production 189-195 MMboe vs previous guidance 185-195 MMboe

- Capex $4.8-$5.2 billion vs previous guidance $5.0-$5.5 billion

- Gas hub exposure (i.e., % of LNG produced) 33%-37% vs previous guidance 26%-33%

Key Takeaways:

- New production record set thanks to strong performance at Australian LNG operations and Sangomar ramp up, increased up-time across portfolio of assets

- Revenue assisted by higher average LNG prices, increased gas hub exposure, although contracting environment remains difficult

- Scarborough is 73% complete, on track for first LNG cargo in 2026

Individual broker views

Broker notes quarter results were broadly in line with forecasts, but remains cautious on stock because of ongoing Sangomar royalty risk (Senegal’s government has announced intent to review terms of agreement), limited production growth, expectations of ongoing gas price weakness, and “relatively full valuation” in share price.

Broker expresses positive view on quarterly performance, in particular the increase in production guidance

Broker notes production was above forecast, and highlights WDS’s strong growth profile and attractive valuation

Broker notes “solid” production, but revenues were only “in line” with forecast due to weaker LNG realisations again, concludes “Fading oil prices remain a concern given sizeable capex commitments ahead”

Broker notes its investment thesis for WDS remains unchanged, but sees “modest upside” in the September financial results given they beat consensus, but the impact to the broker’s (and likely consensus) earnings forecasts for the next 12 months is largely unchanged

Broker notes September quarter production and revenue beat consensus estimates, as well as commends management on narrowing production guidance range, lowering capital expenditure guidance, and increasing gas hub pricing exposure

Broker is pleased with the tightening of the FY24 production guidance range, as well as above-consensus production and revenue

Broker acknowledges strong production performance during quarter, and views major projects as on track to completion as well as likely to contribute to adding long term value

UBS: Retain NEUTRAL | Target price: $28.30⬆️ vs $28.10

Broker describes September performance as “solid” underpinned by strong ramp up of production at Sangomar, which triggers a 9% lift in the broker’s FY24 earnings per share

Woodside Energy broker consensus: Buy, Hold, or Sell?

%20Broker%20Consensus%20vs%20Q3%20Results.png)

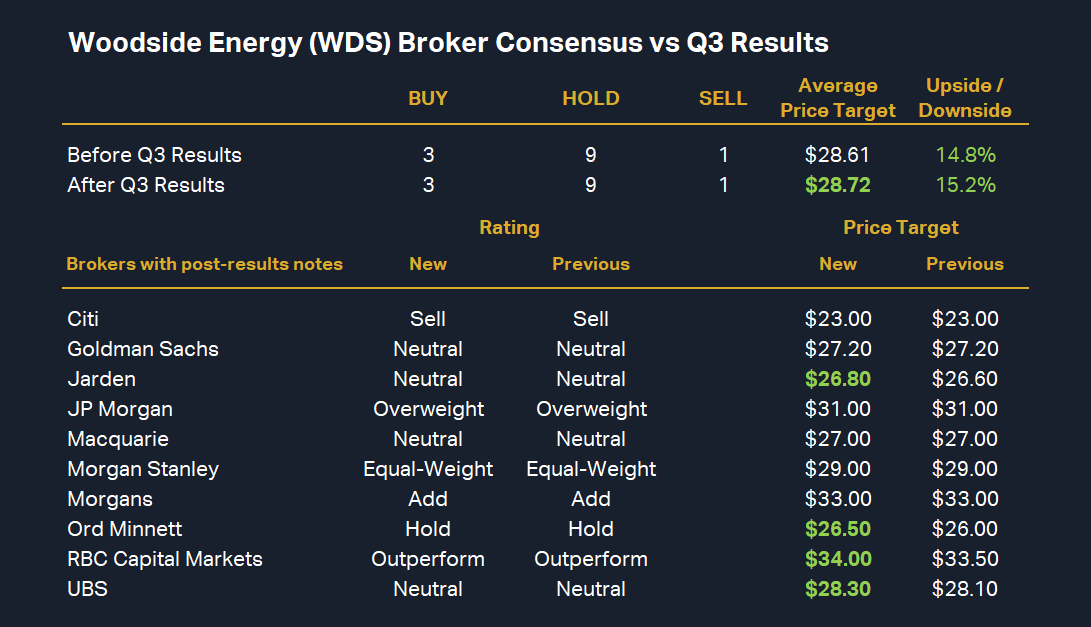

The above table shows all ratings and targets for MP1 from broker research notes since May 1 (to keep it current). To obtain MP1’s Broker Consensus Rating, we assigned a value of +1 to any rating better than HOLD/NEUTRAL/MARKETWEIGHT, a value of 0 for any rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT, and a value of -1 to any rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

We then take the average of all assigned – rating values and assign a Broker Consensus Rating of BUY to average rating values greater than +0.5, a rating of HOLD for average rating values between -0.5 and +0.5, and a rating of SELL for average rating values less than -0.5.

Using this model, WDS’s average rating value is +0.15, unchanged compared to prior to its September quarter results, resulting in its Broker Consensus Rating remaining at HOLD.

WDS’s consensus (average) target price is $28.72, up 0.4% from $28.61 prior to its September quarter results. This suggests brokers collectively believe the stock is around 15.2% undervalued based upon the closing price on Wednesday 16 October of $24.93.

It’s worth noting that the consensus price target may change over the next few days as the three brokers we have on file who have not yet updated their analysis on WDS post-results may do so. But, given there have been only marginal changes to most brokers target prices so far, the above data is likely robust.

This article first appeared on Market Index on Thursday 17 October 2024.

5 topics

1 stock mentioned