Should you buy the dip on Nvidia?

You would have to live under a rock to have missed the excitement about generative artificial intelligence. For those who don’t know, it’s a type of artificial intelligence capable of creating new content, including text, audio, and video. The use cases stretch from code generation for software developers, protein design to aid drug discovery, to helping my son write a resume for McDonald's. And it's not perfect; I mean, we haven’t lived on Burger Boulevard for some time, and he isn’t the Le Bron James of fast food!

But you get the picture, it is a super practical technology with many real-world applications. And when discussing AI, all roads lead to Nvidia (NASDAQ: NVDA), the swashbuckling company headed by the godfather of AI, Mr Jensen Huang. Mr Huang famously mapped out his vision for the company at his local Denny’s restaurant. From this humble beginning, it has been elevated to the world’s largest company, an extraordinary path few would have predicted 18 months ago.

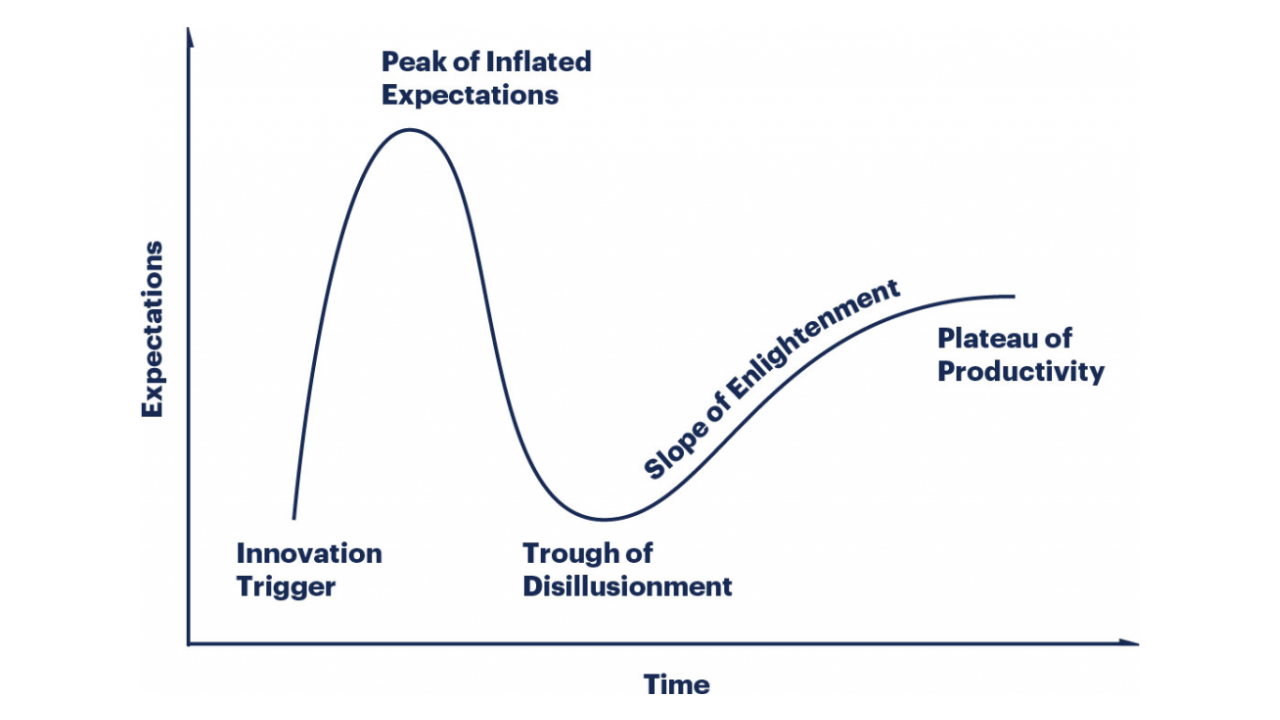

Many investors are asking themselves, where do they go from here? To kick off this discussion, it is worth mentioning Gartner's hype cycle, a graphical illustration of the path of most technologies from adoption to maturity. You could safely say we are sitting somewhere between the innovation trigger and the peak of inflated expectations. And as a technology investor, I assure you, the trough of disillusionment will come, but when is anyone’s guess.

.png)

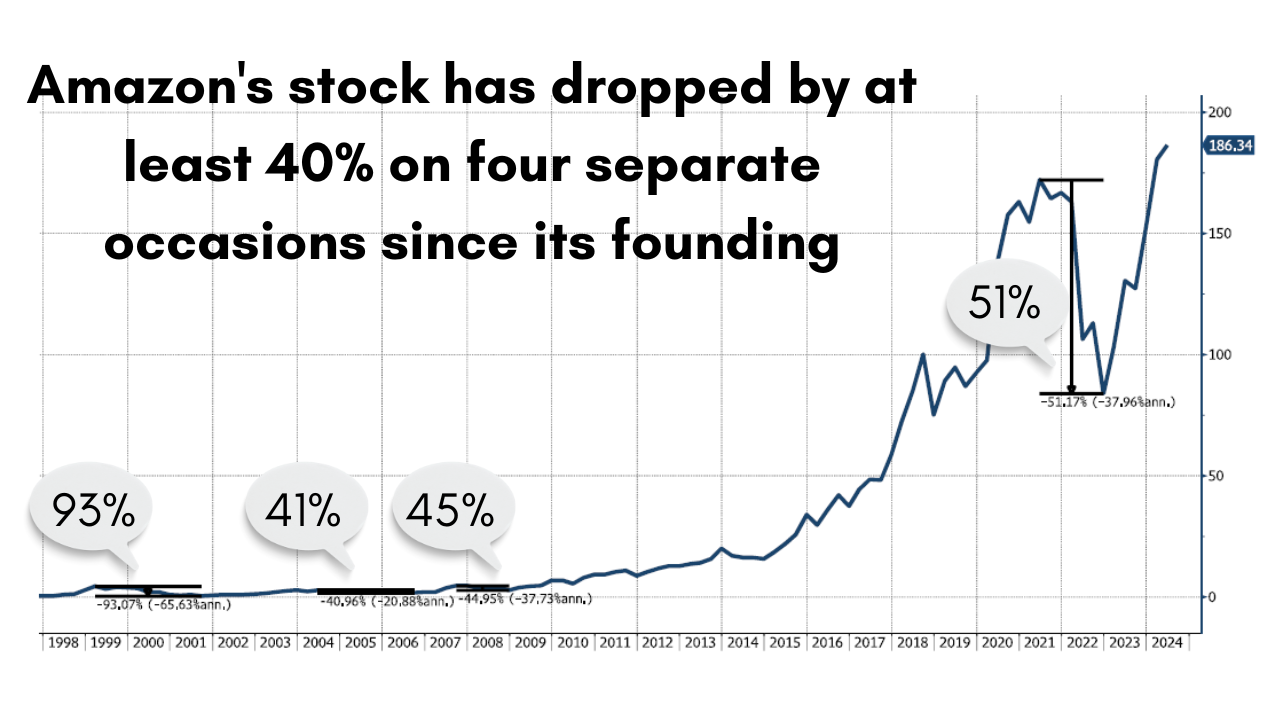

And while Nvidia is a wonderful company, no company grows without suffering re-tracements. For example, Amazon (NASDAQ: AMZN) has retraced from its highs by more than 40% four times in its history, 2000 (93%), 2005 (41%), 2008 (45%), and 2022 (51%). For this reason, at Swell, we like to consider how we would feel after a major decline. And at that point, will you be sitting tight, adding more or selling out?

.png)

To help answer this question, we like to map out both the bull case and the bear case ahead of time as the “lizard” brain reacts emotionally, leading investors to make irrational decisions based on fear or greed.

I include below a high-level bull and bear case for Nvidia. A thorough evaluation could significantly expand each of these bullet points.

Bull Case for Nvidia

- Dominant position in AI and Cloud GPU market – Nvidia holds over 90% market share in data centre GPUs and more than 80% market share in AI chips.

- Full stack AI solution – Nvidia offers a comprehensive AI solution that includes hardware, software and services. Its CUDA programming language and ecosystem create a strong moat, making it difficult for competitors to replicate

- Strong growth potential – AI market is expected to grow rapidly through to 2030.

- Partnerships with cloud giants – Nvidia has strong partnerships with major cloud vendors like AWS, Azure and Google.

- Expansion into New Markets - Nvidia is diversifying its portfolio by entering new markets such as autonomous vehicles, drug discovery, and supercomputing. This expansion could open up additional revenue streams and reduce dependence on any single market.

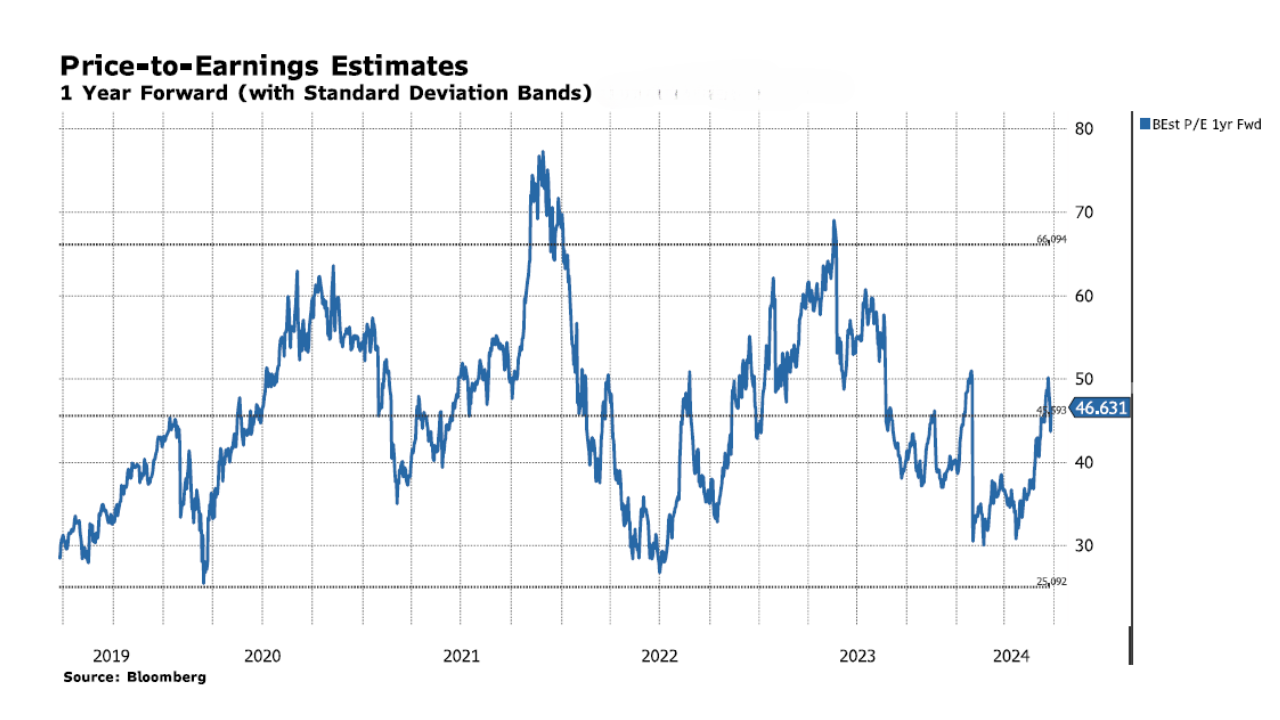

- Valuation: Despite the run-up in share price, Nvidia’s earnings have grown significantly, sustaining its valuation. The chart below highlights its 1 year forward p/e ratio of 46x relative to its historical valuation multiple.

.png)

Bear Case for Nvidia

- Hyperscalers Designing Their Own GPUs - Major cloud providers and tech companies are increasingly developing their own custom AI chips. This trend could potentially reduce demand for Nvidia's GPUs in the long term.

- Retracement — Nvidia's stock has materially appreciated in a short space of time, potentially setting it up for a difficult period should growth slow or competition intensify.

- Dependence on China Market - A significant portion of Nvidia's revenue came from China. Recent export restrictions on AI chips to China could impact Nvidia's growth in this key market.

- Cyclical Nature of Semiconductor Industry- The semiconductor industry is known for its cyclical nature. Any downturn in the industry or global economy could negatively impact Nvidia's performance.

- Increasing Competition - While Nvidia currently dominates the AI chip market, competition is intensifying. Companies like AMD and Intel are investing heavily in AI chip development, which could erode Nvidia's market share over time.

- Potential AI Bubble- There are concerns the current AI hype might be inflating a bubble. If AI adoption or progress slows, it could lead to a correction in Nvidia's stock price.

Our investment process requires us to have a strong understanding of how the industry will look in five to ten years' time. A few questions we have considered about Nvidia remain unanswered:

- Which companies are likely to lead in semiconductor manufacturing and design?

- What will be the impact of government policies and investments on the semiconductor industry?

- How will the demand for AI and machine learning influence chip design and manufacturing?

- What new materials might replace or complement silicon in future chip manufacturing?

- How will advances in quantum computing impact the semiconductor industry?

- What innovations in lithography are expected to emerge?

- How will the supply chain for semiconductor manufacturing evolve?

- Could future iterations of AI models require less computational power, easing the demand on GPUs?

These questions have led us to consider other companies with exposure to the AI upside and lower risk. Let’s review the cloud vendors dominated by Amazon (AWS), Microsoft (Azure), and Google (Google Cloud).

Four key elements are required to win in the future for cloud vendors:

- Users - All three companies have entrenched user bases developed over many years.

- Data - All three hyperscalers have extensive global networks of data centres, allowing them to store and process vast amounts of data while ensuring low latency for users worldwide

- Capital - All three companies are investing billions in expanding their data centre networks and developing custom hardware to lessen their reliance on Nvidia

- Expertise – All three cloud vendors have deep technical knowledge across a wide range of domains critical to winning enterprise customers.

Their competitive position is strengthened by the critical attributes necessary to succeed in this field.

- Infrastructure: a large-scale physical infrastructure with numerous data centres spread across geographic locations each with a vast number of servers, storage systems and networking capacity.

- Advanced data centres: state of the art in terms of design, energy efficiency and cooling systems.

- High scalability: the ability to scale resources quickly and efficiently to handle rapid increases in demand without performance lags.

- Wide range of services: offering a broad spectrum of cloud services including Infrastructure as a service (IAAS), Platform as a service (PaaS) and Software as a Service (SaaS).

- Security and compliance: advanced security measures for data protection which includes cybersecurity measures as well as compliance with various regional and industry specific regulations.

- Research and development: continuous investment in R&D to stay ahead in technology including the development of custom hardware, innovative software and new services.

- Financial resources: operating hyper scale infrastructure requires significant investment, including the cost of building and maintaining data centres.

- Skilled workforce: a team of highly skilled professionals in various domains, including IT, networking, cybersecurity, AI and cloud computing.

- Customer and vendor ecosystem: building a healthy ecosystem of partners, vendors and customers is crucial as are strong relationships with software and hardware vendors, service integrators and a large customer base that spans various industries.

Should you buy the dip?

In conclusion, whether to buy the dip on Nvidia depends on your investment horizon and risk tolerance. Nvidia's dominant position in the AI and GPU markets, coupled with its comprehensive AI solutions and strong growth potential, makes it a compelling long-term investment. The company's strategic partnerships and expansion into new markets further bolster its growth prospects. However, investors should be mindful of potential risks, including increased competition, reliance on the Chinese market, and the cyclical nature of the semiconductor industry.

Additionally, the current high valuation and potential for market corrections warrant caution. By considering both the bull and bear cases, investors can make a more informed decision and better manage their expectations and emotions during market fluctuations. Ultimately, Nvidia's strong fundamentals suggest that it remains a solid long-term investment, but short-term volatility should be expected.

3 topics

4 stocks mentioned