Signal or Noise: Central banks navigate the inflation "high wire"

Inflation may be the common enemy of global finance right now, but every central bank has different ways of dealing with it.

In the US, Federal Reserve Chairman Jerome Powell ruled out any chance of a policy pivot at the recent Jackson Hole Economic Symposium.

In Frankfurt, the European Central Bank recently hiked interest rates by an unprecedented 75 basis points. But many keen observers argue it is too little, too late, especially with all the uncertainties around the Russia-Ukraine war.

Here in Australia, Reserve Bank Governor Philip Lowe called rampant price rises a moment of "soul searching" for global central bankers.

But if there is one thing that all the professionals agree on, it's that the dream of a "soft landing" (rate hikes without causing a consumer recession) is either dead or extremely unlikely. Bridgewater Associates co-founder and co-CIO Ray Dalio has already predicted a 20% fall in US equity valuations if the Fed hikes interest rates to the current consensus estimates.

Where does this leave investors and, more importantly, how should you be handling these remarkable times?

All these questions and many more will be answered in the all-new, all-shiny episode of Signal or Noise - Livewire's video series dedicated to economics and its impact on asset allocation. Each month, I am joined by Diana Mousina, senior economist at AMP. This month, the team is also joined by:

- Stephen Miller, advisor at GSFM and veteran of the Australian bond market

- Matthew Sherwood, head of multi-asset investment strategy at Perpetual Asset Management Australia

This month's episode features the following topics covered in-depth:

- Jerome Powell's "non-pivot" at Jackson Hole

- The European Central Bank's inflation dilemma

- What a resilient Australian dollar does for our economic outlook

Plus, stay tuned for our Charts to Watch segment. Our guests will bring along their single favourite chart in markets right now, including one which was described by its contributor as "an obsession".

Note: This episode was taped on Wednesday 14 September 2022. There are references made to the US consumer inflation figure, released the evening of Tuesday, 13 September as well as references to the September Federal Reserve decision.

EDITED TRANSCRIPT

Hans Lee: Hello, I'm Hans Lee from Livewire Markets. And a very warm welcome to the latest episode in our video series for economics, Signal, or Noise. This is our show dedicated to making data more applicable and more interesting to your investments. And this month's episode actually has quite the global flavour as investors deal with more inflation, more rate hikes, more iron ore royalties, but unfortunately a whole lot less gas in the pipeline in Europe.

So with that stage set, let's bring in the team. Matthew Sherwood is head of multi-asset investment strategy at Perpetual Asset Management. Stephen Miller is an advisor at GSFM, but he's definitely done his time in the Australian bond market. And of course, Diana Mousina, senior economist at AMP, and she's our series regular. Thank you all for being here.

Jerome Powell's Non-Pivot

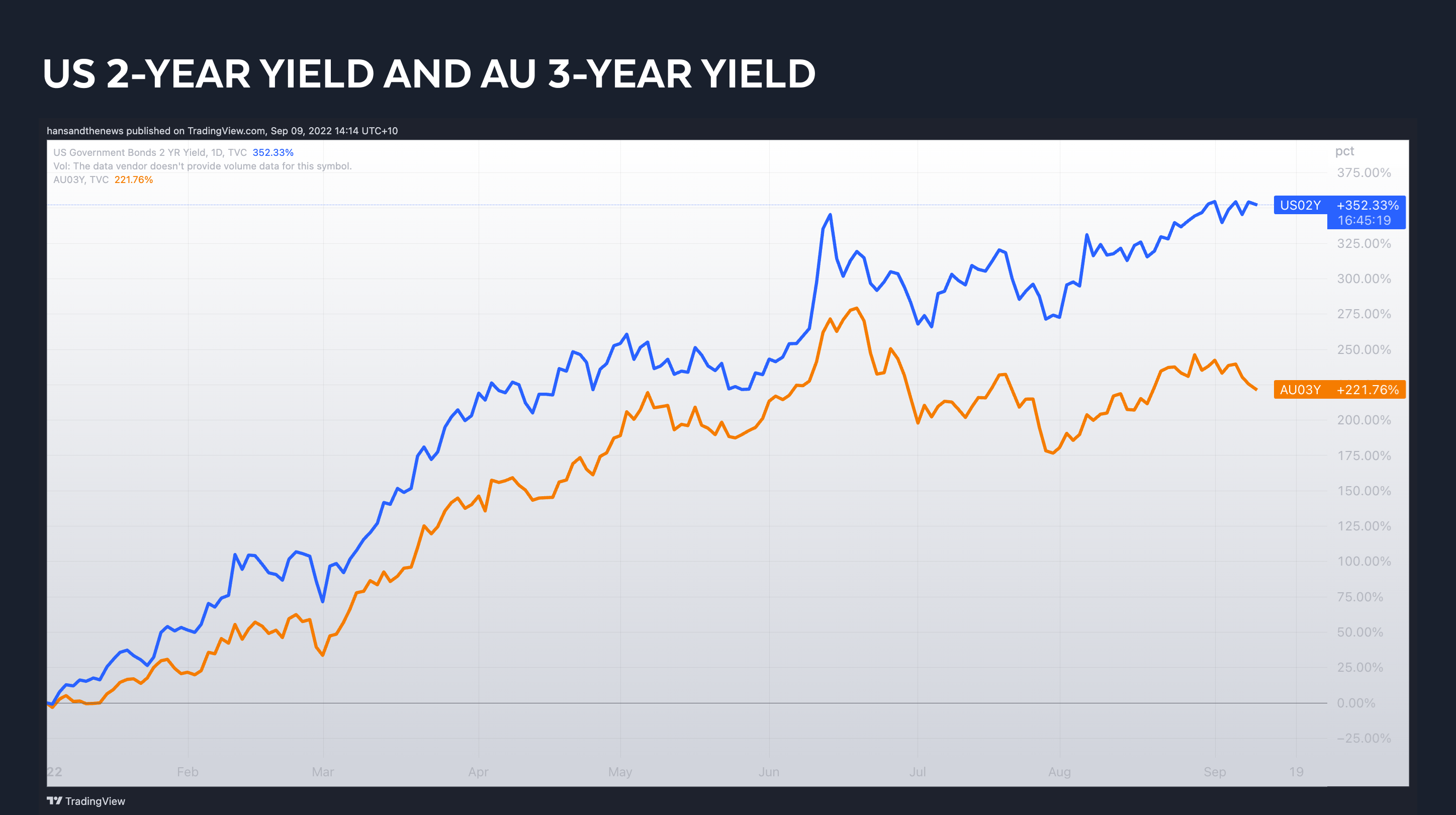

Our first topic this month is Jerome Powell. At the recent Jackson Hole Economic Symposium, the Federal Reserve chairman spoke for just eight minutes and, in that process, managed to send equity markets plummeting south. But it wasn't just equities. The two-year yield also surged in the United States. And as we put up this chart, we'll show you what we're talking about here.

The two-year yield is the most sensitive in terms of all the treasury instruments to monetary policy decisions and that has absolutely surged in the past year. You can also see the Australian three-year yield there moving in tandem. Again, just the magnitude has been remarkable. Diana, I'll come to you first now. Powell's non-pivot, signal or noise?

Diana Mousina: Signal because we know that, in the short term, the Fed will have to take rates a lot higher. What we've been seeing is market pricing for the Fed continues to rise for the next three to six months. Powell is clearly telling us, "Do not expect us to slow down until we get inflation under control." With inflation over 8% on a headline basis, they clearly don't have it under control, so we are expecting more rate hikes.

Hans Lee: Steve, same question to you. Signal or noise?

Stephen Miller: Clearly, a signal. And if you wanted a full stop on that, look at that August CPI. They're not just the headline number, which certainly shocked the number, or the core number, which certainly shocked the market, but also if you look at these underlying measures, the Cleveland Fed measures, and that was Powell's message that inflation may be intractable, that we are focused on inflation, we need to get interest rates higher, we need to get bond yield higher. Once we've got them higher, we want them to stay there for a bit longer. Markets were, I think, complacent about that, and that's what he was addressing.

Hans Lee: The complacency has been so interesting, I think, in the lead-up to this, and just the savage sell-off afterwards. Matt, same question to you. Signal or noise?

Matthew Sherwood: Undoubtedly, it's signal. The reason is that US policy rates are just still too low for the inflation problem that they have. The market tried to get bullish despite the Fed tightening. The Fed chair has come out and said, "We're not only going to tighten more, we're going to keep it there," there won't be a pivot, and I can't see one unless there is a recession. We expect rates will go into the 4% at the Fed funds rate; bond yields two-year, 10 years, probably around the same level. The US bonds are the basis of every asset's price, so Powell's got to tighten financial conditions, and this is how he's going to do it.

Hans Lee: You all mentioned August CPI in there, which I think is very important. I was watching an interview with Nomura's Charlie McElligott, actually, and he basically said that the soft landing dream is now dead essentially because of this CPI print. I wonder, do you all, on the panel, share that video?

Diana Mousina: I don't think that that's necessarily true. We've actually seen the economic data hold up okay for now. There are still a lot of positive offsets that are supporting the economy, US consumers and Australian ones too still have a very high amount of savings that will help to offset rate rises and also high inflation.

I mean, the probability of a soft landing continues to go down the higher that rates go and the more that inflation stays elevated.

But I do think that in the next few months we will see inflation drop quite significantly. We have a pipeline inflation indicator that we've put together looking at some of these supply chain issues and including things like high commodity prices. We've seen that commodity prices have fallen quite drastically from the earlier highs. If we see that very fast lowing in inflation, then we could see the Fed start to ease off on a very aggressive rate hike. So, it's a small probability of a soft landing, but it's still there.

Stephen Miller: I'm probably seeing less, Diana. I think inflation's a little bit more than the increases in selected commodity prices or supply chain blockages. What you got from last night, you got quite significant inflation in the services sector, quite significant inflation, inflation in the core good sector.

And I worry because of the lags that most central banks had in recognising the inflation problems through 2021, they are now engaged in a high wire act between charting a course to lower inflation without tipping the economy into recession.

It's a high-wire act for the Fed. It's a high-wire act for the RBA, the Bank of Canada, and the Reserve Bank of New Zealand. For the Bank of England and the ECB, it's almost death defying.

So, I'm less sanguine than Diana on inflation. I think the Fed is going to have to keep rates higher for longer. I think we get 75 next week. We probably get at least a 50 following that, and maybe a 50 following that. I agree with Matt that the policy rate has to have a four in front of it. So, I don't think it rules out a soft landing, but I think where I do agree with Diana is that it makes it more difficult to achieve.

Hans Lee: I can hear you agreeing there, Matt.

Matthew Sherwood: In the end, the risks of policy mistake increases when policy is late. The hikes are significant, and they're one after the other. All of those boxes are ticked by the Fed. But I think the important thing with the Fed is they're actually now in the process of swinging their concerns on inflation away from commodity markets to tight labour markets. That, to me, is going to be the Achilles heel because they're going to have to keep lifting rates where inflation is pretty much until something breaks.

Soaring natural gas prices in Europe

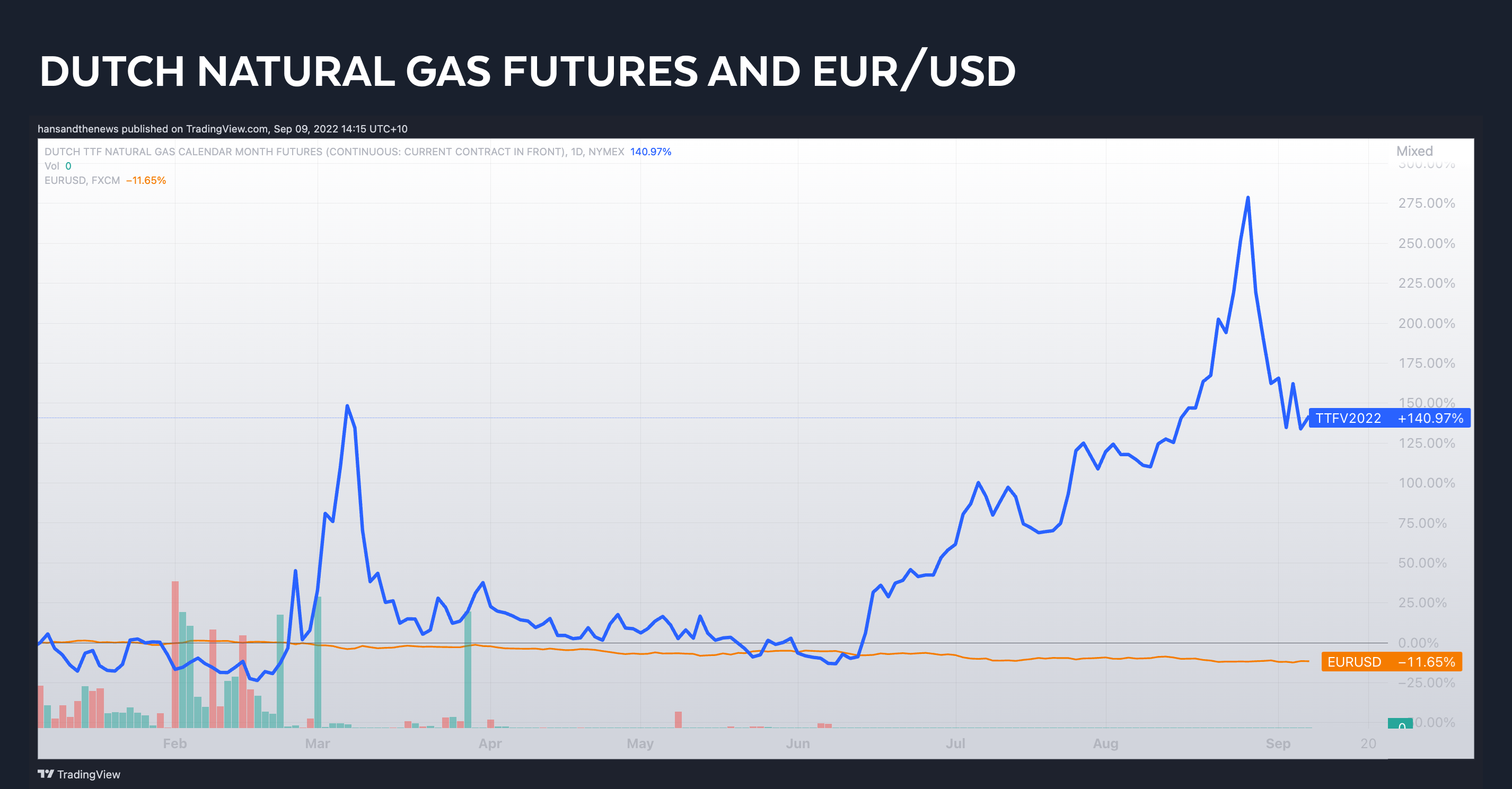

Hans Lee: You were all talking about commodities just then. So let's move straight on to topic number two. If you thought US inflation was hot, if you thought the price that you pay at the petrol pump is hot, well spare a thought for natural gas. Here's a fun fact for you: Dutch natural gas futures are up nearly 400% over the last year, and that's just according to Reuters data. Some of that can be seen in this chart which we're going to put up now.

Of course, the energy crisis is the main force behind inflation moving to double digits in the Eurozone. In fact, nine of the 19 member nations of the Eurozone now have headline prices of 10% or more, and that is giving the ECB, the European Central Bank, one giant headache.

Hans Lee: Stephen, I'm going to go to you first on this one. Soaring gas prices in Europe for longer, signal or noise?

Stephen Miller: I think, it's probably a signal. Higher energy prices will be with us for some time. If the Europeans have learned a lesson... Australia didn't have to learn that lesson because of our commodity sort of blessing but if the Europeans have learned a lesson, they don't want to source the bulk of their energy supply from Russia.

Hans Lee: And Matt, what do you think?

Matthew Sherwood: It's absolutely a signal. Energy inflation is going to be one of the key themes this decade because one of the views I've had for the last couple of years is just the world is sleepwalking into decarbonization. There is very little spare capacity in global energy markets, there's no investment, and that means energy markets are really, really tight. What we've seen in the UK last week is the government has virtually said, "I'm going to provide some support to household incomes 6% of GDP," which is an absolute whack.

This could almost become an annual event because energy markets are so tight. We have the seasons warm and cold. To me, energy price inflation is going to be something that's going to be around for a very long period of time.

Hans Lee: Diana, same question to you.

Diana Mousina: I'm gonna say noise just to be a bit different. The reason that I say that is because I think we've probably reached the peak of the story around extremely high energy prices. I'm not saying that you're going to get a huge slowing. But to see continued inflation, you need to see energy prices continue rising.

I think that prices will probably slow from here because the Europeans will move away from Russian gas to other sources. Australia's potentially a source. We have LNG here; other sources globally as well. With that meeting last week that they had, they clearly want to do something about the very high price. I think that they will do something about it.

To me, the story has kind of passed. That's not to say that energy profits won't remain high because I do think prices will remain high for the next few years overall, but not as high as what we saw during their peaks this year.

Stephen Miller: I think Europe knows what the problem is. The problem that Europe has had in the past is its makeup. The makeup of the EU in the making of the ECB visits upon its decision-making process is institutional inertia. It can meet with the best of intentions and say, "We're going to do something about energy," but it's like herding cats to get all those member countries to agree to a consensus. What often happens is you get the lowest common denominator outcome, which goes nowhere to solving a problem.

I mentioned the ECB because I think that attaches to the ECB as well, but it attaches to the EU as well. Again, I'm just not as sanguine as you as to thinking that I think everyone knows the source of the problem, I just don't trust the European Union's ability to be able to get to a solution.

Diana Mousina: Well, actually, I've been surprised that energy prices have been going down over the last week even though, last week, we saw the announcement that Nord Stream was completely going to be shut off after the maintenance, and there's no schedule for when it's going to come back online because Russia has said, "We aren't going to open it until you take the sanctions off." The prices have still gone lower.

Matthew Sherwood: I think the reason why they've gone down is the fact that they've said, "We're going to have 90% energy capacity by November," so they don't have to keep buying all of the supply at extremely high prices. They may come off in the near term. They're currently sitting around 200, could go a bit further south.

But this is almost going to be an annual event because there's no way Europe is going to get 90% capacity next year from Russia. There's going to have to be a complete redesign of its energy policy that is going to take five years plus. In the meantime, the energy market just remained really, really tight. I think this is a theme over the very long term because no one's figured out how to supply bulk energy through renewables.

The resilience of the Australian Dollar

Hans Lee: That was a very robust discussion. Thank you very much, everybody. Let's move on to our third topic. I'll tell you what, if August is earnings season in Australia, then September must surely be called money counting season, especially if you own one of the big three iron ore miners. In fact, the iron ore miners' performance over the last year has actually been so strong, and it's been a big part of why Australia recorded a 13th consecutive current account surplus recently.

Now, that's all a long way just of saying that GDP has been holding up and it's also holding up the Australian dollar. You can see that if we look at this chart, which the Australian dollar is down 6% or so over the year to date, but it's nothing on the Chinese yuan. It's nothing on the euro, and it's nothing on the Japanese yen for that matter. Matt, I might start with you for this one. A resilient Australian dollar, signal or noise?

Matthew Sherwood: Look, I think it's definitely a signal. The currencies are very important, diversify within portfolios, and it's also very important for the Aussie dollar value of our export income. Yes, we haven't had the depreciation like Europe or China. But there are economies that are in a lot more pain than Australia is. The Australian economy is still very, very strong at the moment. The good thing, as growth is slowing rates are rising, and the currencies going down, that kind of at least adds to growth through net exports. That's exactly what Paul Keating wanted the Australian dollar to perform during periods of stress and periods of shock. Overall, I think it's a signal.

Hans Lee: Diana, same question to you. Signal or noise?

Diana Mousina: Signal. I agree, if we didn't have the strength in commodity prices, the Aussie dollar would be in the 50s probably. Like Matt was saying those other economies are also experiencing what China and Japan are experiencing, much lower inflation, and they're still cutting rates. It's all doing quantitative easing, so it's a little bit different. We think, on a six to 12-month view, the Aussie dollar will be back in the mid to high 70s because we see the strength in commodity prices continuing.

Stephen Miller: I'm a little agnostic on this one, to be honest. I think energy, commodity prices, and iron, in particular, probably held the Aussie dollar up as Diana sort of mentioned. They may stay elevated, as we've discussed, but I'm sort of finding it a little bit hard to sort of see there to be further increases, which we've discussed in the past. The other thing is, I get a little bit fearful without knowing much about it that the challenges currently facing China might take on a more structural hue. I sort of wonder if that will mean that the resilience of the Aussie dollar will be tested. But just because I'm a cantankerous, old and difficult character, I'll say it's noise.

Hans Lee: Let's move now to our final rapid-fire round, Our Charts to Watch segment. In case you're new to this show, this is the part where we ask our experts to bring in one shot, the one shot that best informs their view of markets right now, whether it's something they're curious about or something they're interested in or something that helps inform their core investment view.

Diana, I'm going to start with you, as I usually do. You brought along something that's actually quite interesting. It's the approval rating of US President Joe Biden. Why this chart?

Diana Mousina: Well, because it's changed. You can see that in the last few weeks, there's been a clear shift up in the approval rating before it was down at levels that were associated with the worst of the Trump presidency. Those approval ratings demonstrated that the Democrats would have a pretty large loss in the midterm elections.

The expectation had been that the Democrats would lose the House, which would mean a split Congress. But the big increase in the approval rating recently, gas prices have come down in the US, and also the decision to overturn Roe vs Wade has actually given Democrats this new sense of, "Well, we need to support Biden in the midterms."

The current levels of the approval rating for Biden would suggest that, actually, the Democrats have a decent chance of keeping the House, which would mean a Democrat Congress. And I think that that would actually be a negative for markets because the Democrats still want to pursue a high tax agenda.

If they have control of both the House and the Senate, then they can do those policies and increase taxes through the reconciliation process, which means you just need a simple majority in Congress to pass these bills. I think markets would take a Democrat win at the midterms as a negative because it would mean higher taxes for the next two years.

Hans Lee: Steve, you've done something quite interesting. It's the US equity-bond return correlation. Why did you specifically pick this chart?

Stephen Miller: I think I've got an obsession with this chart but throughout this century, there's been a bedrock assumption in investment markets that bond returns and equity returns are negatively correlated. If you look back to the last century, that wasn't the case, and there were different regimes. From the mid-'60s to the early '80s, bond and equity returns were positively correlated in what I call an adverse way. They were both quite modest; on occasions, are both quite negative. In the '90s and into 2000, the turn of the century, they were positively correlated in a benign way because they both gave you solid returns.

Then we got the negative correlation for most of this century because central banks could ride to the rescue, enact the central bank put whenever there was turmoil in equity markets because inflation was dormant.

Now that we've got inflation back, I wonder whether we're going back to a more positively correlated regime. Because deep down I'm a bond guy and I like to be negative - I wonder if it's going be that adverse scenario where both bond and equity returns, as they have done for, say, the last year, year-and-a-half, both delivered us negative returns.

What I'm saying to investors is just be wary of that bond equity correlation and learn the first lesson of investing: diversify, diversify away from bond beta, diversify away from equity beta into things that are uncorrelated with both those things.

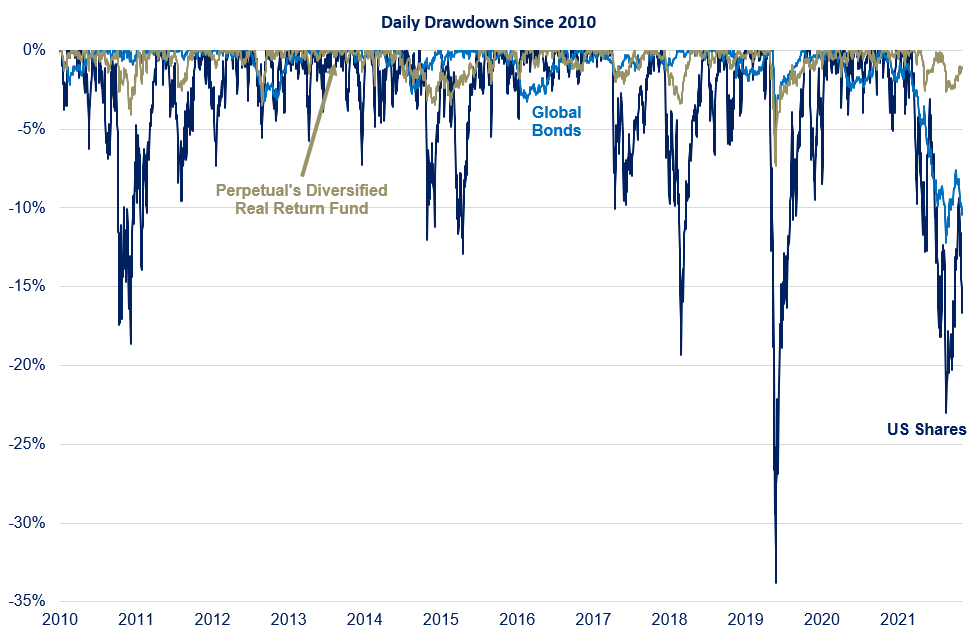

Hans Lee: Matt, you've used US shares as well and global bonds, but you've decided to look at it from a draw-downs perspective. Why specifically drawdown?

Matthew Sherwood: Well, it really captures one of the themes of what Steven was just talking about. And that is, when we looked at the first half of this year, the US share market fell about 23%, even though earnings were actually pretty good. It wasn't a bad six months for earnings. The reason for that, of course, was that real interest rates were rising, and valuations were coming off.

Now, people may think, "Oh, okay, we're through the valuation adjustment," but it really kind of depends on whether we can get a soft landing or a recession. And if it's a recession, if it's a long recession because, at the moment at about 17 times earnings, in a deep, prolonged recession, PEs get down to about 10 or 11 times. That's a massive leg down for where we are currently.

The other part of that chart, of course, is the bond market. Now the global bonds aggregate index recorded its largest first-half loss since 1900, and that's as far back as records actually go. As Steve was saying, bonds have got record losses. Equities in the US and globally have had one of their worst starts the year ever.

Bonds and equities are the traditional building blocks of portfolios. I think the key message to investors in this environment is you may need to do something different. Think of what other diversifiers they have in a portfolio. Gold hasn't worked this year, the yen hasn't worked, and bonds haven't worked. What has worked is the US dollar.

Hans Lee: This has been an outstanding conversation. I wish we could do a full hour show, but we can't. Can we just say a massive, massive thank you to Diana Mousina of AMP, as always, to Stephen Miller of GSFM, and to Matthew Sherwood at Perpetual ... Let's get this panel back on at some point! It's been a very robust discussion. We appreciate both of you being here, and Diana, of course, we'll see you in a month's time. And we will see you in a month's time because that's it. That's our show for another month.

If you do like it and you have enjoyed it, please feel free to leave us a like and a subscription to our YouTube channel, and of course to the website livewiremarkets.com. On behalf of all of us, thanks for watching. We'll see you next time.

Enjoying Signal or Noise?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber, you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

3 topics

2 contributors mentioned