Signal or Noise: 3 commodities (and 5 stocks) navigating the geopolitical risks of 2023

The global commodities market is at a vital point in its current cycle. Years of underinvestment have caused massive supply problems in the energy market. Climate change has drastically changed the food production supply chain. And central bank rate hikes are adding to real yields - creating a headwind for gold investors at a time when gold should be thriving.

It's also been just over a year since Russian forces invaded Ukraine, causing already high prices to soar even more. At the outbreak of the war, some energy prices increased by more than 100% in a matter of days. According to McKinsey, more than 1,000 companies have withdrawn their operations in Russia, the world's 11th biggest economy, since the first days of the invasion.

While we recognise the tragedy and injustice of war, we also cannot avoid its impact on financial markets.

As the conflict enters its second year, Livewire's economics series Signal or Noise is taking a closer look at how the war has changed investing and the wider economic landscape. We'll also take a close look at the commodities market - the asset class which saw the biggest single movements as a consequence of the war.

I am joined this month by the following panel members:

- Diana Mousina, senior economist at AMP and series regular

- Todd Warren, portfolio manager at Tribeca Investment Partners

- Benjamin Goodwin, portfolio manager at Merlon Capital Partners

EDITED SUMMARY

Topic one: Will energy prices continue to remain elevated?

Diana: SIGNAL - Higher for longer energy prices go long beyond the war in Ukraine. Diana adds that oil investment stateside peaked long before the conflict. The push towards ESG-friendly assets also isn't helping matters.

Todd: SIGNAL - "100% a signal". There was a lot of noise at the war's outbreak but this problem was sown well before the war started, especially in the natural gas market. While there are long-term decarbonisation desires, there is a "stiff" energy security headwind.

Ben: SIGNAL - Especially a signal in the case of natural gas and coal. There is also a lot of demand destruction at play, due to high prices and rationing. This, in turn, also gives a strong signal to invest from a CAPEX perspective.

Todd's energy pick: Santos (ASX: STO) - Tailwinds are too good to ignore, not to mention the valuation disparity between it and its most significant competitor (Woodside Energy).

Ben's energy pick: Origin Energy (ASX: ORG) - The increased run-rate of its energy markets business as well as increased margins at its APLNG project are keeping Ben bullish.

Topic two: What will happen to global food prices?

Todd: SIGNAL - Plenty of short term noise here as well, just like in the energy market. But the other factor for why agri-commodity prices may surge again is climactic. Tribeca believes different markets may respond in different ways should raw commodity prices climb again.

Ben: SIGNAL - Ben looks at the agri-commodity price spike in a slightly different way. Coming back to his views on natural gas, fertiliser prices may also rise if gas prices remain high. That's bad news for consumers which will end up being hostage to it.

Diana: Short term SIGNAL - Food prices may remain elevated in the short term but in the longer term, there could be good reason for a pullback - which is great news for the RBA, consumers, and emerging markets which are far more exposed to food prices.

Todd's food pick: Nufarm (ASX: NUF) - Some of the Australian producers have had a multi-year earnings tailwind for some time now. But Nufarm is not one of those companies where its earnings may have peaked, thanks to its offshore operations primarily.

Ben's food pick: Incitec Pivot (ASX: IPL) - When you're making margins that are two to three times that of a 'normal' market period, it's a high-conviction position worth holding. And if they can monetise any excess gas supply, that'll be even better.

Topic three: Is gold no longer the safe haven it used to be?

Ben: NOISE - The spot price did not do a whole lot given all the tailwinds it should have had last year.

Diana: Short term NOISE, long term SIGNAL - The US Dollar and real yields may climb higher given the Federal Reserve recently became more hawkish. But in the long run, that huge surge in King Dollar will probably taper off.

Todd: NOISE - It is the commodity most influenced by noise in the short- and long-term, and frankly, Todd's given up trying to work out whether the bulls or the bears will win out!

Todd's gold pick: Northern Star (ASX: NST) - Despite his views on the gold price, he does hold Northern Star for its attractive valuations (which are back at 2013-2015 levels). As he puts it,"it's a stock with a fundamental growth in its earnings profile."

Ben's view: The Merlon Capital team do not currently hold any gold stocks on behalf of clients, and that's predicated on a view that real yields will continue to drive investors to the US Dollar and bonds over gold.

The Charts to Watch

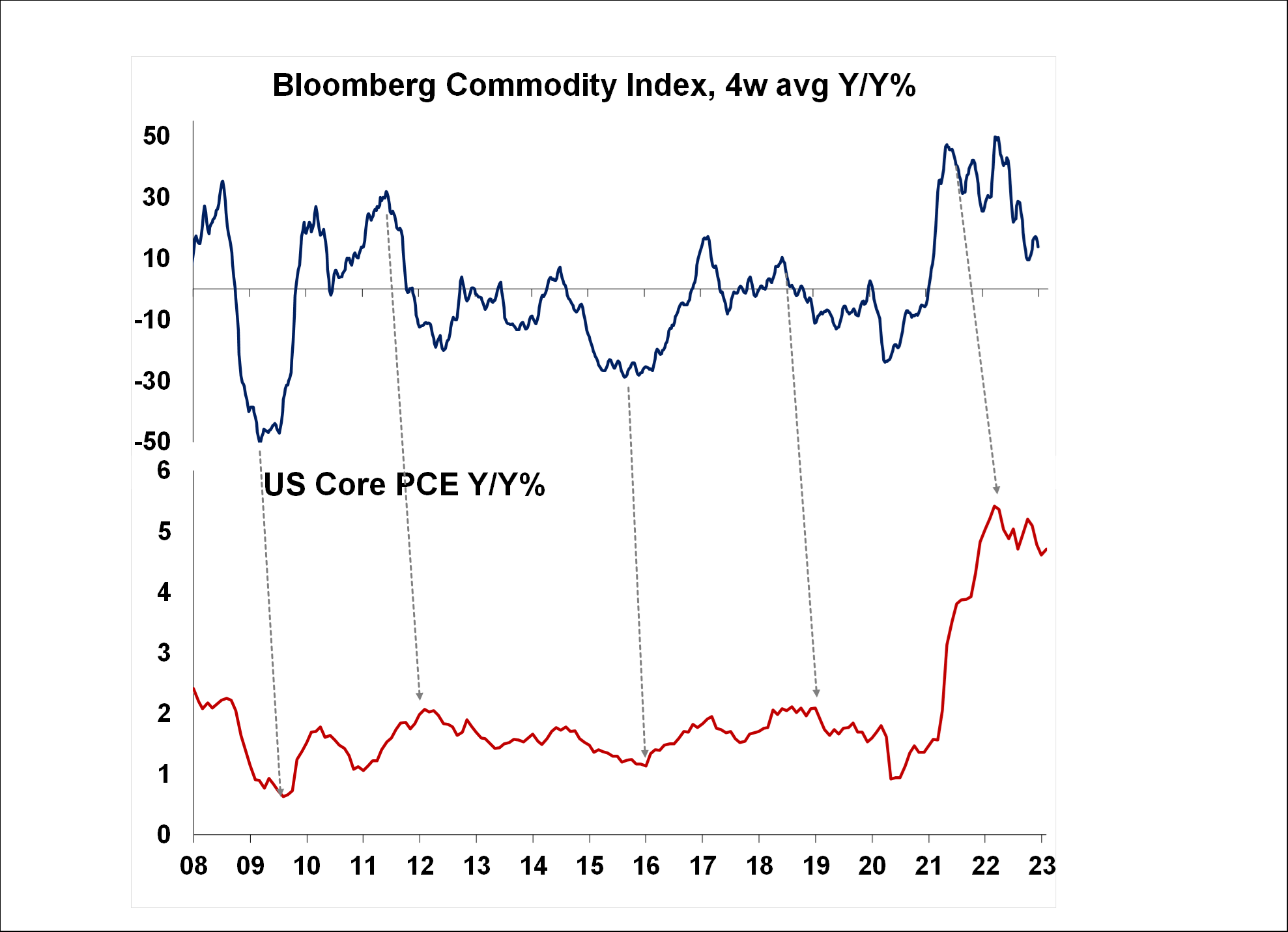

Diana: Bloomberg Commodity Index vs US Core PCE Inflation

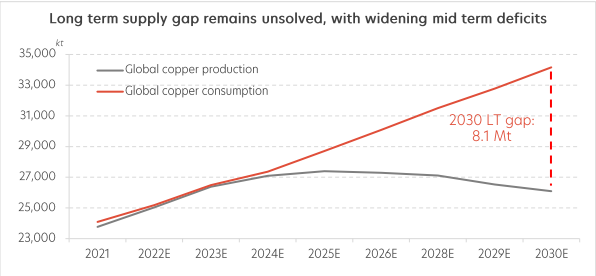

Todd: Copper production versus consumption

.png)

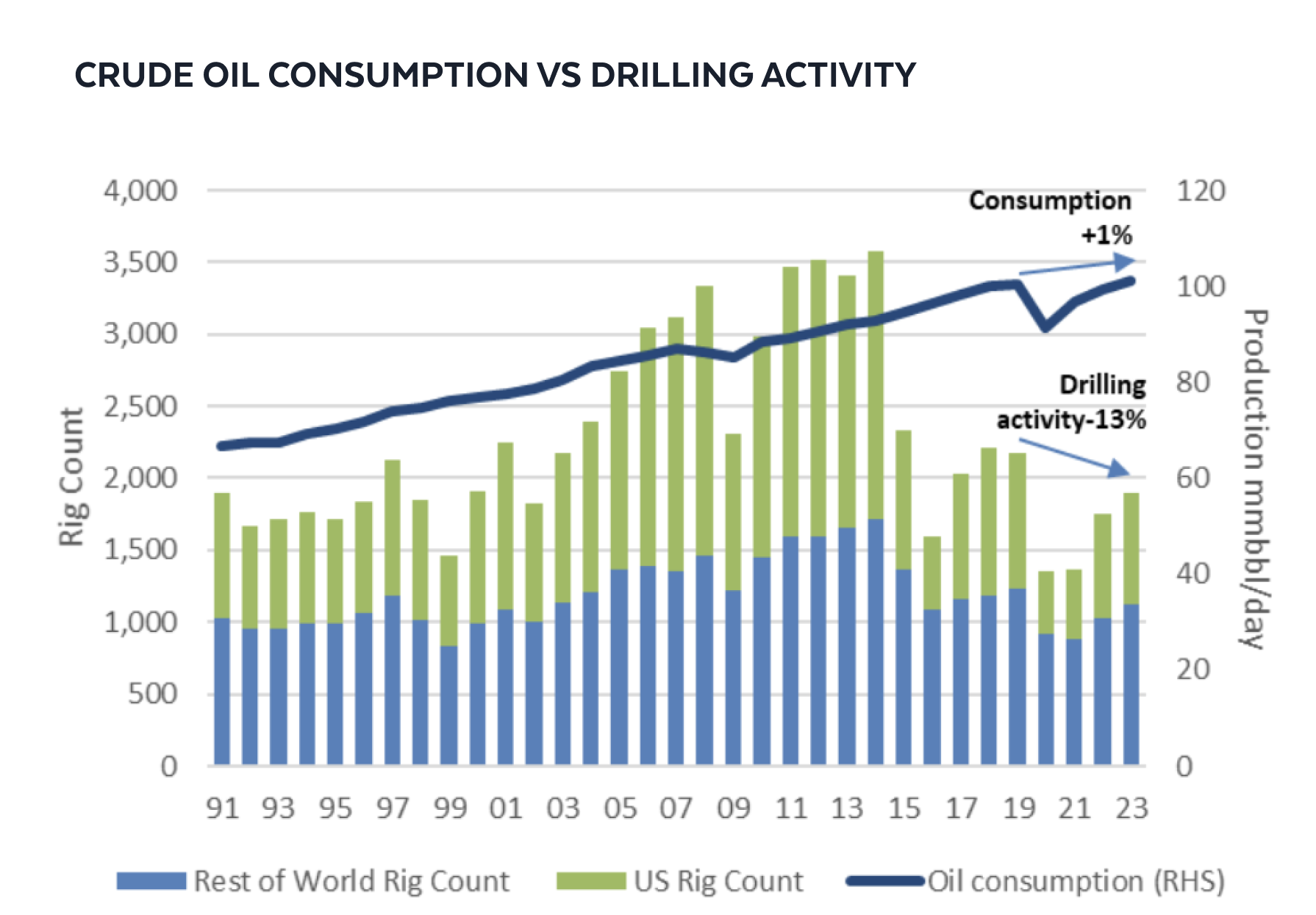

Ben: Oil rig count vs crude consumption

.png)

We hope you enjoyed this episode of Signal or Noise. Let us know what you think of our portfolio managers' top commodity stock picks and their views on the price movements of those commodities going forward.

2 topics

5 stocks mentioned

3 contributors mentioned