Signal or Noise: Will the RBA pause rate hikes in early 2023?

In December 2021, the board of the Reserve Bank of Australia was still committed "to maintaining highly supportive monetary conditions". At the Federal Reserve, most of the board of governors thought the US interest rate would peak at just 0.75% in December 2021.

12 months and nearly 7,000 basis points in rate hikes later, everything has changed. All those predictions of inflation peaking early in the year have been swept aside and replaced with fears about a global recession. And the passive 60/40 portfolio, a benchmark for many a global investment model, has seen its worst year since the Global Financial Crisis.

So how did we get here? More importantly, what can we learn from this year as we look forward to 2023?

To answer some of those questions and kick off Livewire's Outlook Series, we're bringing you the last episode in the current series of Livewire's Signal or Noise. As has become tradition, I am once again joined by AMP senior economist Diana Mousina. They are also joined in this episode by two of Livewire's most prolific contributors and commentators:

- David Bassanese, chief economist at Betashares, and

-

Greg Canavan, editorial director at Fat Tail Investment Research.

This month, they cover three of the biggest topics in macro:

- The US November inflation print

- The RBA's language "pivot"

- China's possible exit from zero-COVID.

As usual, our guests will also bring along a couple of favourite charts. In addition, they both share a high-conviction call for financial markets next year. And each one is an absolute doozy!

Note: This episode was taped on Thursday 1 December 2022 and before the December Reserve Bank meeting.

THE DEBATE

The November inflation print in America

Diana - SIGNAL - Every headline inflation metric that the AMP team look at, bar commodities, has decreased significantly. She believes we will see a fall in services inflation shortly, leading to much lower inflation prints next year.

David - SIGNAL - History suggests inflation won't recede until the historically low unemployment rate starts to rise again. He is concerned services inflation will not fall as sharply as Diana says it might.

Greg - NOISE - Predicting inflation's peak, in his view, is noise investors can do without.

Michele Bullock's dovish language pivot

David - SIGNAL - David never thought the Reserve Bank would raise interest rates beyond 4%, but the quote provides the possibility for a pause early next year.

Greg - SIGNAL - The RBA wouldn't prepare the market this way if it didn't intend to pause its rate hikes.

Diana - SIGNAL - Was December's rate hike the last? Diana and the AMP team certainly believe so, adding she finds it difficult to see how the Australian economy could cope with a cash rate above 3.5%.

Will China end its zero-COVID policy?

Greg - NOISE - No one knows for sure when those lockdowns will ease. But given commodity prices have held up despite the US Dollar's outperformance and the Chinese property crisis, there is good reason to believe the commodity supercycle can go on in spite of the uncertainty around the reopening.

Diana - SIGNAL - The lockdowns will end but the timing comes down to vaccines. She is tipping an early 2023 reopening, and the signs of unrest may go a way toward realising that.

David - NOISE - Markets are simply too hopeful about this reopening coming to fruition. Even if the Chinese economy reopens, there is a long hard slog ahead of them after it which is not being priced in.

THE BIG CALL

DIANA - There could be pockets of deflation in early 2023, and that's great news for risk assets including equities.

Bigger than this big call, Diana questions whether we really are in a different market environment where the regime change will force central banks to change inflation targets or policy norms. She argues no, but she also admits it will be difficult for central banks to bring inflation back down to target next year.

David agrees with Diana's big call, but only in the context of Australia's economy. Greg thinks the question for markets will be the reaction function. If inflation does turn to deflation, do investors simply buy all-growth again, or did the 2022 experience change them?

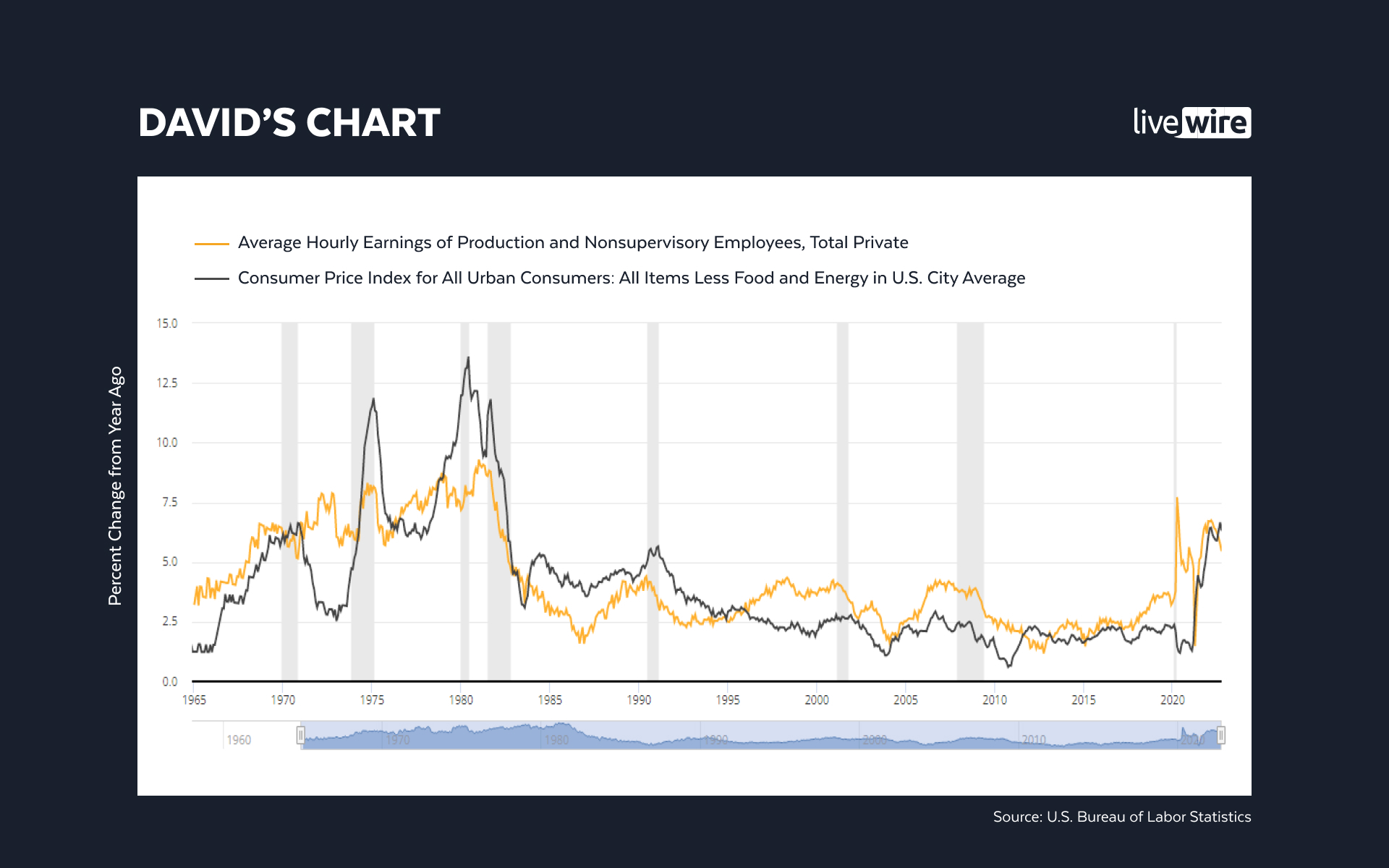

DAVID - The US is destined for a 2023 recession, which is in turn, fuelled by a wage-price spiral.

David's big call employs the help of ex-Federal Reserve economist Claudia Sahm, who observed that a recession is triggered whenever the US unemployment rate rises by 0.5% in any one cycle. And if wages continue to go up at 5 to 6%, that could be a big issue for the world's largest central bank. He also believes Australia will take a beating from a US recession, but at least the RBA is not likely to engineer one itself.

Diana thinks a US recession is a "50/50 call" and the result will be huge for share markets. Greg sides with David, arguing the US will enter into a recession early next year and the yield curve inversion isn't doing anyone any favours.

GREG - ASX gold stocks will have a big first half, possibly even outperforming the ASX 200 as a whole.

Greg's call is predicated on a peak in both real yields and the US dollar. It also helps that the ASX gold index is recovering from a brutal bear market that only bottomed out in September this year, and there's value to be found especially at the large end of town (i.e. Newcrest Mining (ASX: NCM), Evolution Mining (ASX: EVN), and Northern Star Resources (ASX: NST).

Diana concurs with Greg, arguing gold could be the energy trade of 2023. David can also see a case for the climbing gold price, but argues the next bull run for gold stocks will come during the next equity market bull run in general.

Do you agree with the big calls of our panellists? Let us know in the comments below.

THE CHARTS TO WATCH

Diana's Chart: The best trade in town for 2022

.jpg)

David's Chart: The correlation between US wages and inflation

.jpg)

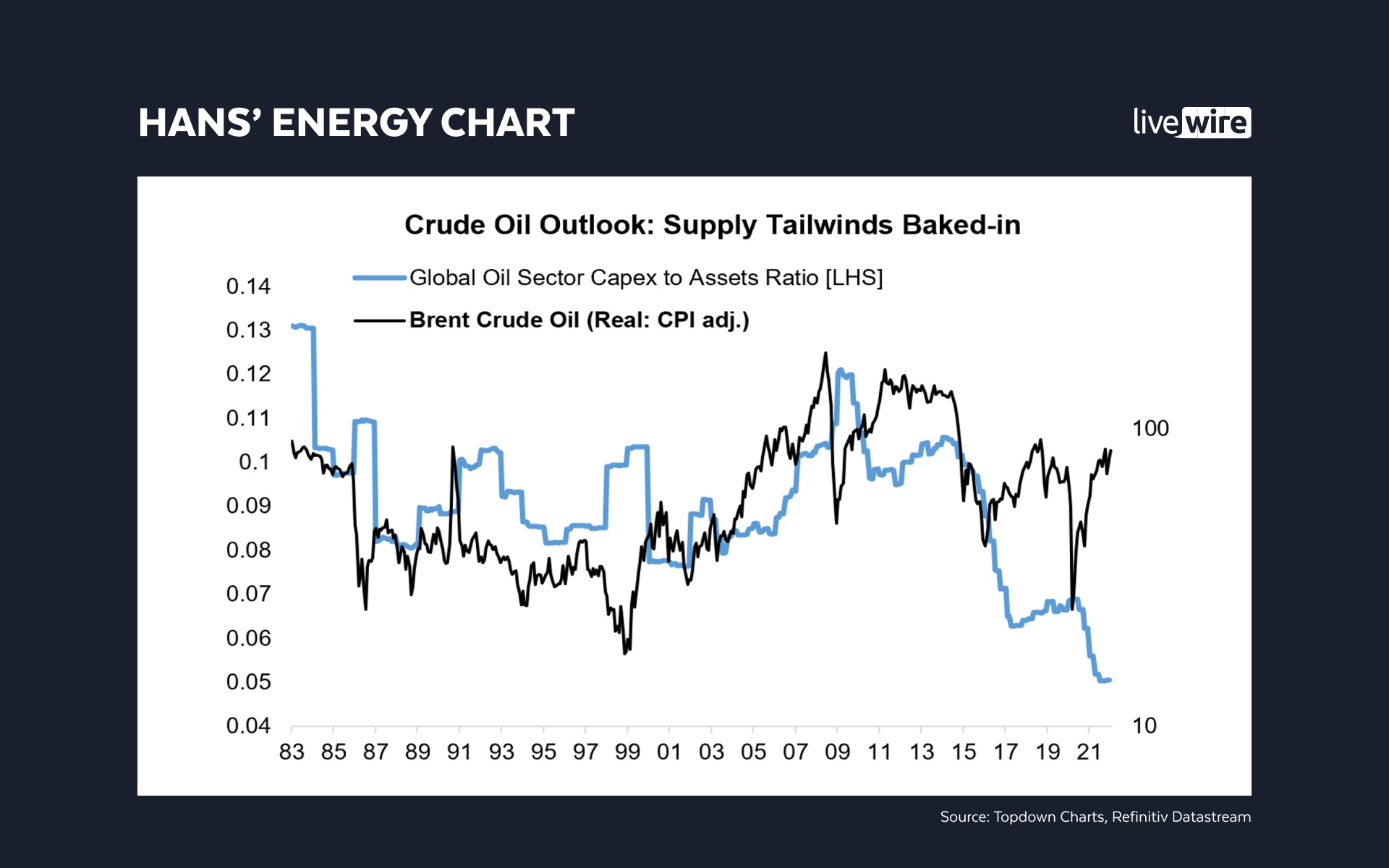

Greg's Chart: Why energy stocks are still cheap

.jpg)

Hans followed up Greg's chart with one he discovered recently on the correlation between energy underinvestment and the price of crude oil. As Callum Thomas of Top Down Charts pointed out, it was just a matter of time.

.jpg)

Enjoying Signal or Noise?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber, you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

This episode of Signal or Noise is part of Livewire's Outlook Series. Check out more of the great content coming through from the series - including interviews with Australia’s top fundies, a new series of Success and More Interesting Stuff, and an asset allocation roundtable featuring three of Australia's top money managers.

4 topics

3 stocks mentioned

4 contributors mentioned