Small caps are back: Global Health Ltd

It’s been a tough 18 months for anyone in the small cap space, with the underperformance vs large caps being well reported on. As a specialist small cap manager, we certainly felt it, with a couple of our holdings experiencing significant drawdowns, even in the face of continued strong fundamental performance.

But we’ve been through this many times before. The market always turns, and small caps can quickly go from being the place you don’t want to be to the place you need to be, and it usually starts when everyone is convinced small caps will never outperform again.

The bigger funds exited small caps a long time ago, sucking out all the liquidity and removing the marginal buyer. But there are signs that things are now turning in small cap land.

And I can assure you, there is some incredible value out there right now. It’s not a space where you can go hunting for bargains after the fact, by then many of them will have already run hard. And while I don’t know when the small cap market as a whole starts to turn, I am certain there are future multi-baggers waiting to be found right now.

At our small investment firm, we’ve had a ‘back to basics’ approach. Our targets are profitable, well-run businesses with typically founder-led management teams. For a long time, it was hard to find these businesses trading cheaply. That’s no longer the case.

With a bit of luck, we just exited our second

largest holding and are now very cashed up at a time when small cap value looks about as attractive as I can remember it.

We’re also going back to what we love to do, which is sharing our deep-dive analysis on companies. Given the emerging signs of the small cap market turning for the better, we think it is good timing to do so.

With that in mind, below is the first of our write-ups on our top holdings, this one on a small cap tech stock called Global Health (ASX: GLH).

GLH Overview & Business Model

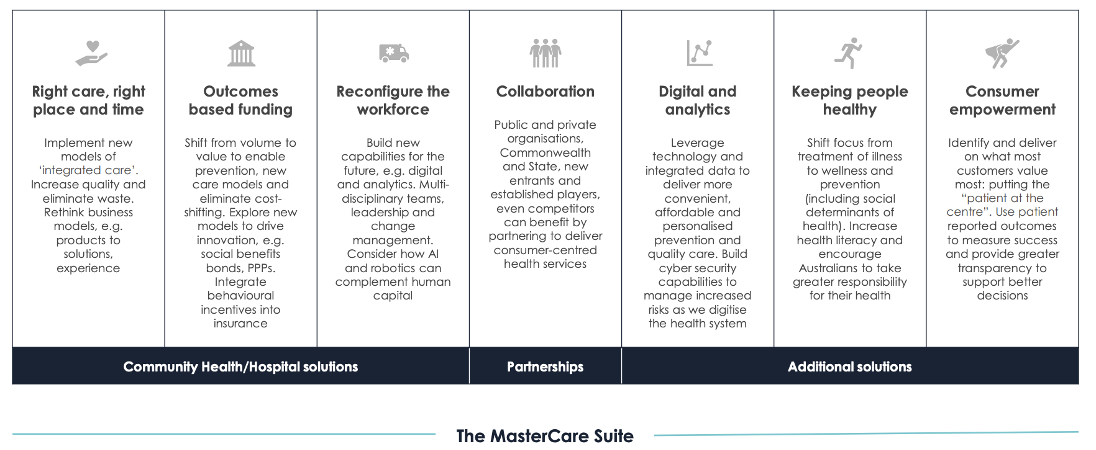

GLH provides software into community health (70 facilities) and mental health (50+ headspace community centres), private hospitals (30+ across Australia) and GP & allied health clinics (550+). The company has been operating in the healthcare markets of Australia for over two decades.

GLH’s flagship brand is MasterCare, and the cloud solution MasterCare+, which allows a facility to run its entire operations and generates >80% of GLH’s software revenue. These are complex solutions that need to be suitable for a highly regulated environment where privacy and cyber security is critical. This translates to long sales cycles and complex implementations & integrations, but typically very sticky clients.

Other products in the GLH suite include HotHealth (a telehealth and booking engine) and ReferralNet (secure messaging system). GLH generates revenue from software sales (both SaaS and licence fees), transaction fees from using their software (bookings, messages) and professional services (primarily for implementations).

Despite the stock being caught up in the small cap tech sell-off of FY23, there is a lot to like about the GLH business, particularly in today’s economic environment.

Healthcare is relatively insensitive to economic conditions and clients are high quality debtors. Typically, over 80% of total revenue is generated from software and all GLH contracts are indexed to inflation.

The cost base is primarily fixed and GLH is now hitting real scale, with this being hidden by the recent restructure of the cost base and shift from growth mode to profitability.

They’ve also built a strong brand in their niche, regularly beating out much larger competitors like Telstra Health, Track Care and All Scripts. While some in the market prefer big TAMs and lofty growth targets, we much prefer a business with a long track record in a relatively small but growing niche.

There are several attractive investment themes that GLH is exposed to, including:

- Increased focus on privacy, namely cyber

security, is beneficial to GLH’s ReferralNet product as it is one of only four

approved systems, at the same time that the Government is encouraging adoption

of secure messaging;

- Mental health is (unfortunately) an emerging crisis in Australia. Investment in the entire end-to-end infrastructure that supports patients will continue to be a long-term theme;

- Demographics will force an ever-increasing level of investment, both public and private, into hospital and community care facilities over the next few decades, including in the niche sectors and regions that GLH is highly active in;

- After the chaos of COVID smashed the healthcare system there has been an increase in the need to optimise and digitise. While decisions were delayed immediately post COVID due to uncertainty and staff shortages, several operators in this space are noting that customers are now making decisions, and there is likely to be a catch-up phase.

Shift from growth to profit

In 2021, GLH decided to raise capital and invest heavily in its sales capabilities, bringing on Michael Davies (ex-Macquarie Telecom) and substantially increasing the investment in growth (i.e. costs).

GLH has long had a good reputation as a product company but has lacked enterprise sales expertise. When Michael joined, the market backed him and his new team to accelerate top-line growth.

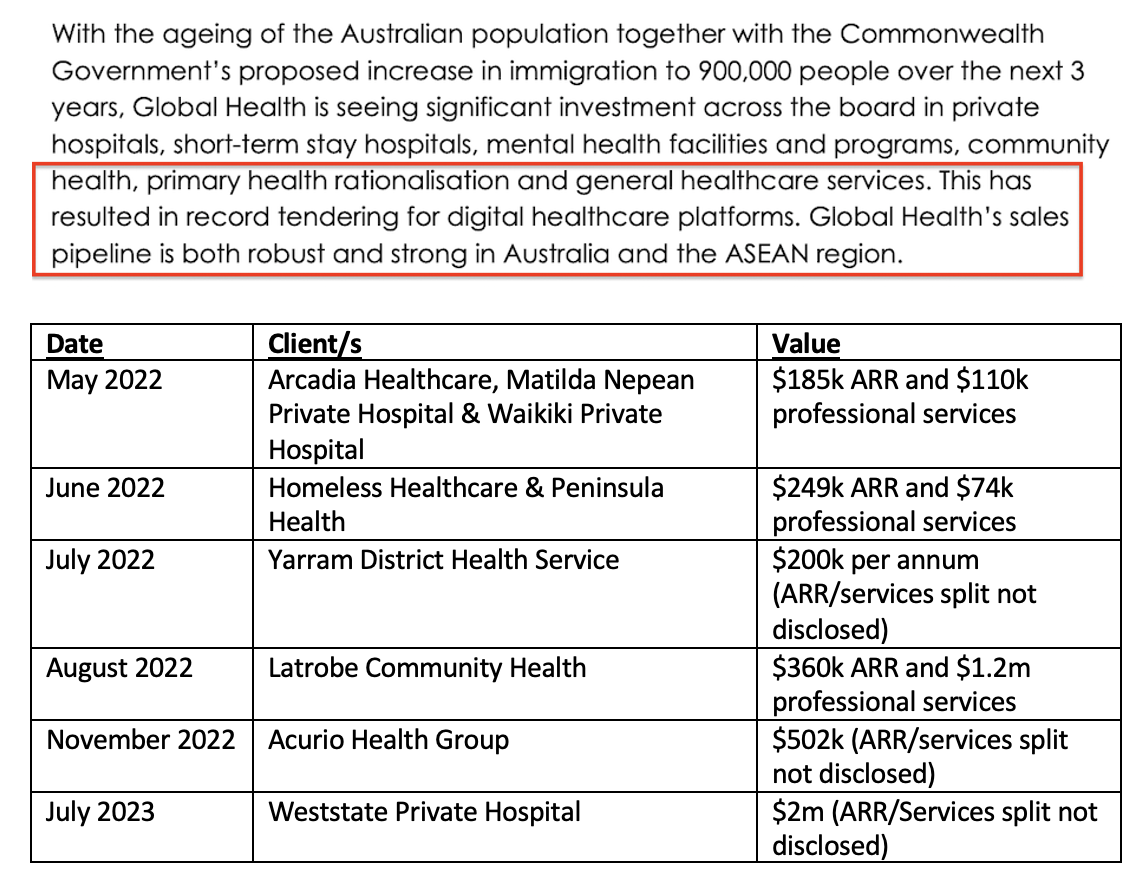

In our view he did an excellent job, with a flurry of contract wins already announced and others likely still in the pipeline, owing to the long sales cycle. The improvement in the sales and bidding process will benefit GLH for a long time to come.

The table above shows the progress the new team made, with momentum clearly building and contract size growing. We estimate that Contracted Annual Recurring Revenue (CARR) has grown by approximately $1.5m since April 2022, a big jump considering ARR in FY21 was just $4.7m.

Working against GLH through this period was the long delay in implementations (and therefore when revenue kicks in) due primarily to severe staff shortages at the client level. As one example, the Latrobe deal was announced in August 2022, but implementation did not begin until 2H23. Latrobe was not unique in this regard.

In late 2022, in response to the changing market conditions for small-cap tech stocks and delays in new contracts kicking in, GLH made the decision to move away from growth mode and back to profitability, with Michael leaving the firm and the cost base reduced by c.$1.5-$2m.

Given these cost reductions were only implemented in late 2022 and early 2023, with associated restructuring costs, the current numbers hide the now much lower cost base. It will be evident from the June 2023 quarter onwards.

Alongside the elevated investment in Australia in 2021/22, GLH made several hires in Asia with the intention to break into the markets of Thailand, Malaysia and Vietnam. But given the change in conditions, we expect them to pivot to a distributor-led model to reduce costs here too. We think there is ample room for growth and value creation in the Australian business and prefer the focus to be there.

While the market was no doubt disappointed when Michael left (the stock has more than halved since) and he was clearly creating long-term value, the fact is that with the prior cash burn, there were very high odds that GLH would need to raise more capital. Given the weak share price and poor conditions for microcap tech, it would have needed to be done at dilutive prices.

The board, no doubt led by founder and major shareholder Mathew Cherian, made the tough call. If you’re going to make a decision like this, make it early. Doing so means it appears GLH won’t need to raise any additional capital, at least for the time being.

Instead, based on market guidance, the group is about to move back into profitability, which the market has clearly not recognised given the company trades with just a $7m market cap. It’s important to note that this ‘EBITDA profitability’ is before capitalised R&D spend.

R&D is a massive cost for GLH today, running at $225k/month. The vast majority is due to the re-platforming process of moving what used to be an entirely on-premise solution to a full cloud offering (the current solution is hybrid). Clients still vary in terms of what they are after, but the long-term trend is to a fully cloud-hosted solution.

The intended timing of completion for this is early next year. At that point, R&D spending will reduce drastically, we think by at least half (~$1.35m). All of that then drops to the bottom line and, all else equal, would make GLH a cash-generative, profitable little business.

From around March 2024, assuming no delays to either implementations or R&D, we expect GLH to be run-rating at $1-$1.5m of PBT (with substantial tax losses to use).

If that’s proven correct, GLH is today trading on a one-year forward PE of 5-7x. If it can continue growing software revenue at the current 15% per annum it deserves at least double that range.

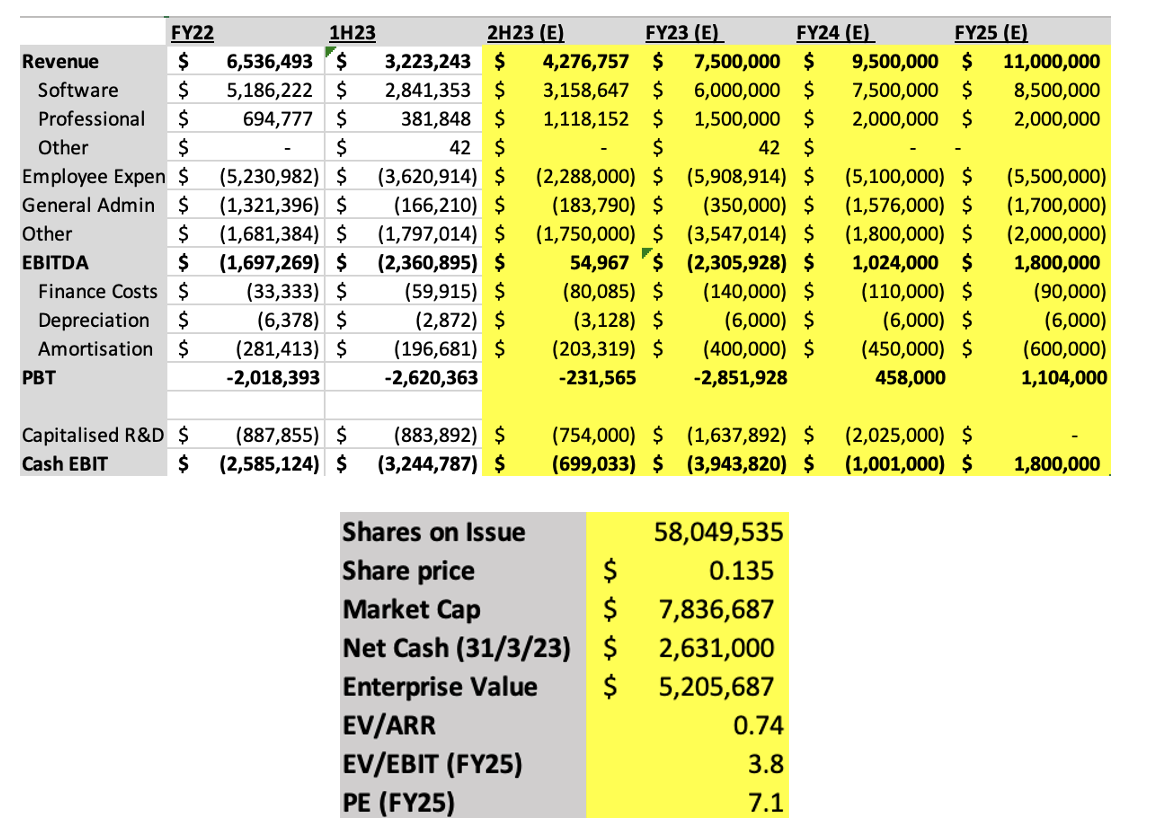

Note: The above figures are actual figures from FY22-1H23, with 2H23 and FY23 based on current revenue guidance from GLH and our estimate of costs. FY24 and FY25 are our estimates, but FY24 revenue can be reasonably estimated from announced contract wins (CARR) being implemented and expenses can be deduced from recent quarterlies as a starting run-rate.

Numbers tell the story

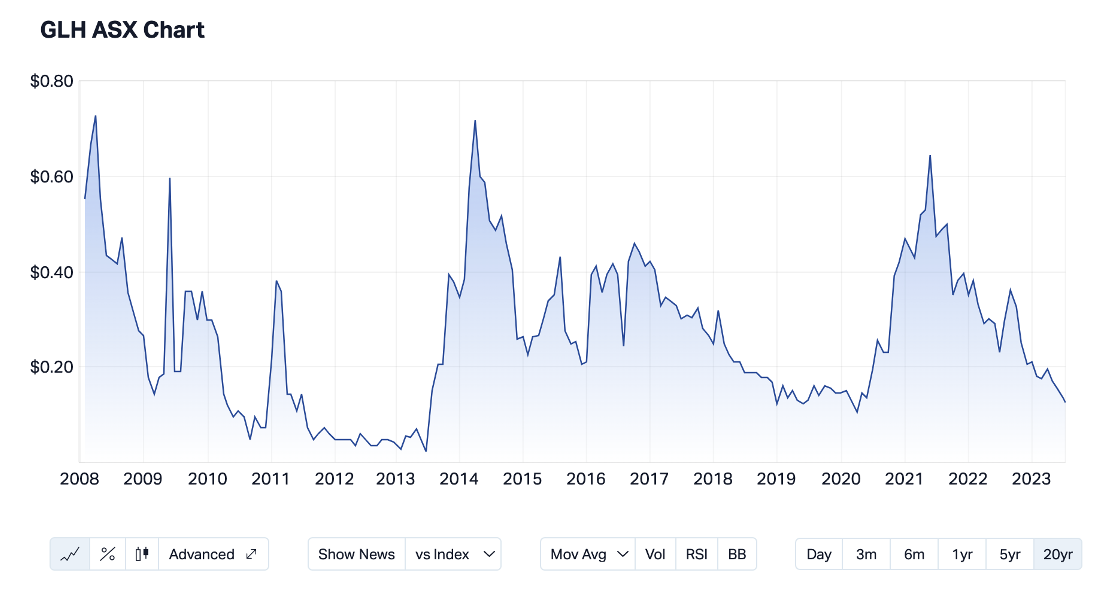

GLH’s share price has gone nowhere for over ten years now. There are two equally valid but opposing views on when this happens in microcaps.

The first is that any microcap that stays a microcap for more than a decade is probably destined to always remain a microcap and will never graduate to small or midcap status.

The second is that every microcap winner has their day, and timing is incredibly important in microcap investing. Sometimes it is company driven, sometimes it’s a material development in the industry and occasionally it’s just the market taking a liking to the thematic or narrative.

So, which is it? The numbers help tell the story.

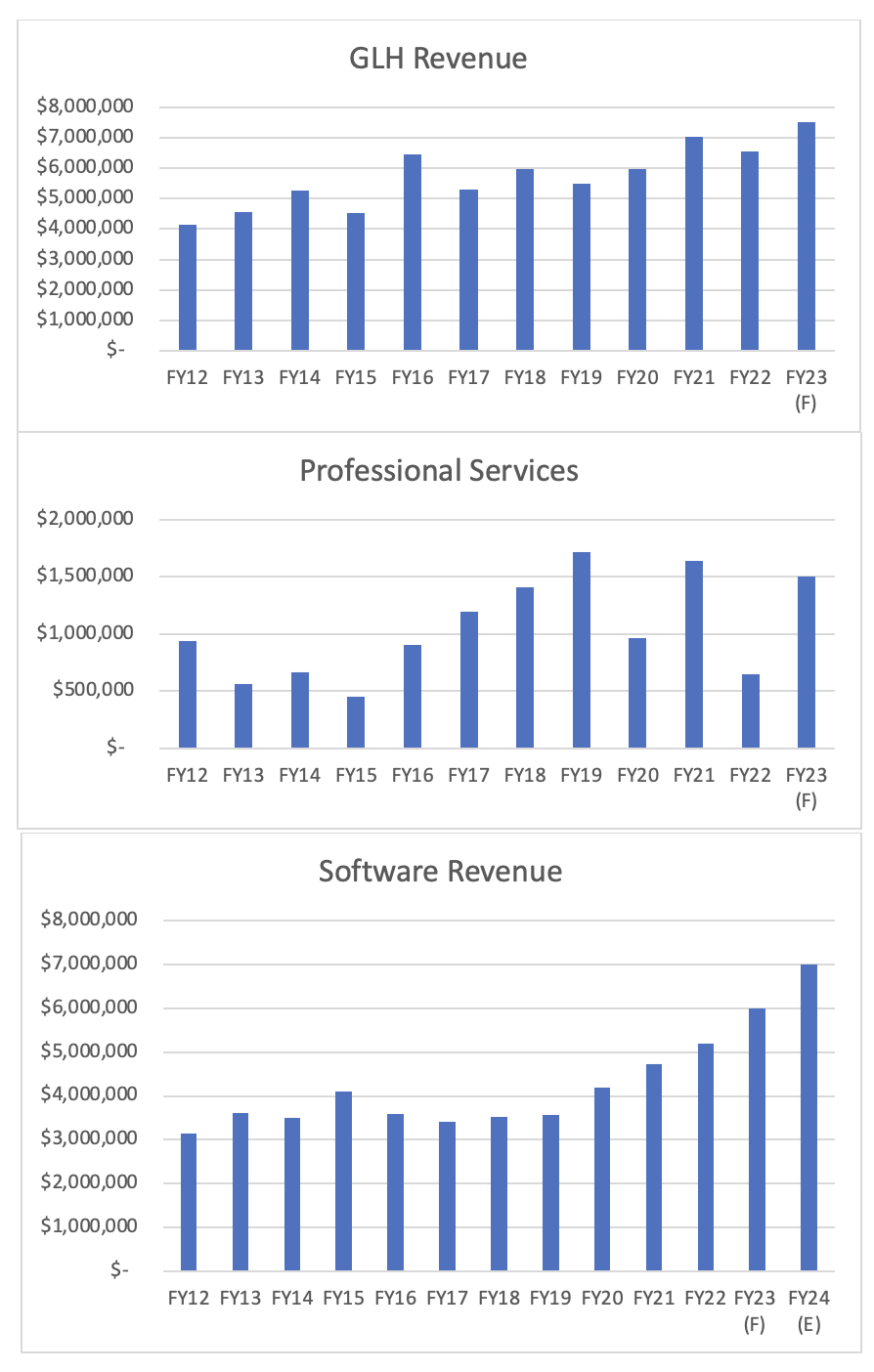

The below charts show total revenue, professional services revenue and software revenue over the last decade.

There are several important takeaways from the above charts:

- From FY12-FY19, there was zero growth in software revenue, so arguably there was no reason to own the stock over this period. It’s no surprise that the GLH share price tracked sideways for most of this time.

- Something clearly happened in FY19 that kick-started the growth in software revenue. We suspect it is a combination of GLH’s launch of MasterCare+, the shift in the healthcare market creating growing demand for a consumer-focused solution and an improvement in the sales process of GLH, boosted by new personnel.

- Total revenue consists of software + professional services. The latter is associated primarily with the implementation of new contracts, so it’s a good thing, but it’s very lumpy and was almost non-existent in FY22 and 1H23 when staff shortages and COVID disruption delayed implementations. You need to strip out professional services revenue and focus on the growth in annual software revenue, which is the key metric to track value.

- Software revenue has grown at 15% per annum since FY19 and will grow at least another 15% in FY24, based solely on already announced contract wins and new implementations (subject to no delays). Despite this, GLH trades at almost the same price it did in 2019. The market is yet to recognise this shift in trajectory and the creation of value.

Woolworths Healthy Life JV – A potential game changer

Out of nowhere, in March this year, GLH announced a partnership with Woolworth’s subsidiary Healthy Life, the supermarket giant’s new consumer health platform which sells supplements, personal care products, health foods, beauty products and, most relevant to GLH, provides a telehealth platform where consumers can book video or phone appointments with medical professionals.

Through Healthy Life, patients can speak to a medical professional and be prescribed an e-script, with the medication delivered to them via Healthy Life Pharmacy. GLH’s technology is providing the platform for all of it with bookings and online consults (HotHealth), Secure Messaging (ReferralNet) and client management and data reporting (MasterCare+).

For the time being the JV remains a paid trial ahead of a full launch. But the deal has the potential to be a complete game changer for GLH given the likely volumes that Healthy Life intends to handle, and the fact that all GLH’s core platforms are being utilised.

Even when priced at a wholesale rate, it’s hard to see how the revenues generated aren’t highly material to GLH, assuming Healthy Life hits its targets. Of course, until then, it’s near impossible to forecast.

Woolworths is not the only Aussie major pushing hard into consumer health, telehealth and e-scripts. Wesfarmers has been aggressive in the space, with the acquisition of API and more recently Instant Scripts for $135m. They have a publicly stated strategy of “accelerating transformation and investing in digital health”.

While this has received pushback from elements of the medical and pharmaceutical industries, it’s not an original strategy, with the two Australian companies simply following what’s occurred offshore.

As this AFR article explains well, Walmart now has a network of 50 primary and urgent clinics next to its grocery and merchandise stores. It established a health division in 2019 and a telehealth platform in 2021.

Amazon acquired its way into the pharmacy game in 2018 and bought a network of primary care clinics for $5.6b in 2022, giving the online giant 188 clinics across the US, alongside its telehealth platform.

The rationale is that big retailers like WOW, WES, Walmart and Amazon already have the logistics and distribution required for a successful push into healthcare and pharmaceuticals. Owning the front end (clinics and telehealth) allows them to push big volumes through their infrastructure.

It’s also very consumer friendly. I profess no medical expertise and don’t pretend to have a view on the clinical aspect but, as a consumer, it seems attractive to have a telehealth appointment rather than in-person for repeat scripts or standard, low-complexity doctor visits.

The Healthy Life JV remains a potentially very exciting, but uncertain, blue-sky story for GLH. It genuinely could be the venture that substantially accelerates GLH’s growth and drives a multi-bagger from here, or it could be nothing.

But if you’re going to partner with anyone when pushing into telehealth, you can’t get much better than WOW’s scale, reach, brand and distribution. That said, because it is uncertain, we’ve baked in zero contribution in our numbers.

Investors should closely track any further updates in regards to the Healthy Life JV. Given the current starting valuation of GLH and the fact the stock barely moved on the announcement there is essentially no downside if Healthy Life is not successful, but very substantial upside if it is.

Valuation

Valuing software companies can be hard for public market investors. “ARR” went from the holy grail of valuation metrics to a swear word and investors shifted from demanding growth at any cost to profitability, essentially overnight.

GLH has been caught up in this shift, with the share price falling c.40% in FY23. But the market is yet to realise that

- the company made a tough decision to pull back on growth and move to profit late last year, with the numbers yet to reflect this (but soon will),

- the move back to profit will coincide with a much higher recurring revenue line than the last time GLH was profitable, and

- R&D costs will drop materially from 2H24, significantly improving free cash flow.

For valuation, ARR is still a valid tool, so long as it’s real recurring revenue. It’s just that the fair value ARR multiple has compressed from say, 10x to 4-5x, the latter being where several listed small-cap technology stocks have recently received takeover bids.

In this context, GLH’s current valuation is not anywhere close to fair value. It currently trades at <1x EV/ARR. While 4-5x might be achievable in time and with continued growth, we think 3x is a reasonable target given GLH’s current growth in software revenue and recent transactions in the space.

Based on trailing ARR and recent contract wins, we use $7m ARR as the base. This would put GLH at 36c.

But we’re also value investors, and very aware the golden days of high-flying but cash-burning tech stocks is over. Cash flow multiples are the new, and eternal, reality.

In that light, GLH holds up pretty well too, with FY24 set to be an inflection point. Unlike many other listed microcap tech stocks, GLH has a history of being profitable, so it is reasonable to expect them to do it again, but this time with significantly higher revenue.

From March of next year, we expect R&D spending to drop materially as the re-platforming completes, while software revenue should exceed $7m+ based on the current contracted pipeline. We estimate that GLH will at that point (mid-2H24) be generating a run-rate of $1-$1.5m of cash PBT.

This would put the stock on a forward PE of 6-7x with a fair value of 32c, assuming a PE of 15x.

The major risks to the above are delays in implementing new contracts (and therefore when new revenue kicks in) or re-platforming falling behind schedule, given the company will remain cash-burning until early 2024. If you look at our numbers shared above, we estimate another c.$1m of cash burn before the company turns cashflow positive, though this is offset by the fact that GLH can slow down on R&D spend at any time, if required.

The upside could come from further contract wins or the Woolworths JV really kicking into gear. If the latter occurs, it could be a real game changer for the business, and therefore for our valuation of the stock.

1 topic

1 stock mentioned