Smaller companies going global

Clime Investment Management

It’s often said that Australians are a nation of travellers. One could stretch to almost any corner of the globe and stumble across an Aussie. Given the increasingly global context of business and economics, we would suggest that the intrepid nature present in individual Australian travellers is increasingly prevalent in some of our nation’s best emerging companies.

This creates significant opportunities for the more enterprising Australian investor seeking select exposure to offshore markets and associated growth thematics. Without necessarily investing via offshore exchanges such as the NYSE or the major European bourses, domestic investors can still access global growth opportunities that encompass varying geographic and sector specific exposures. While not only adding a degree of portfolio diversity, such a strategy also acts to provide access to significantly larger markets and therefore potentially substantial long-term growth runways.

With the above noted, offshore growth strategies are not without pitfalls. Australian corporate history is littered with stories of ambitious offshore growth plans that failed to gain traction and ultimately ended up in the destruction of shareholder capital. In today’s analyst piece, we highlight a handful of ASX listed smaller companies that we believe are well positioned to continue executing on their own global growth strategies.

Bravura Solutions (ASX: BVS)

BVS is a market leading global provider of enterprise software and software-as-a-service (SaaS) to the wealth management and funds administration industries. Established in 2004 and first listed on the ASX in 2006, BVS has grown to become a world class supplier of software and associated professional services to some of the world’s largest superannuation, pension, life insurance, investment, private wealth and funds administration entities.

Bravura has 12 offices throughout eight countries in Asia Pacific (APAC) and Europe, the Middle East and Africa (EMEA). Bravura operates development and support centres within eight of these offices in the United Kingdom, Poland, India, Australia, New Zealand and South Africa.

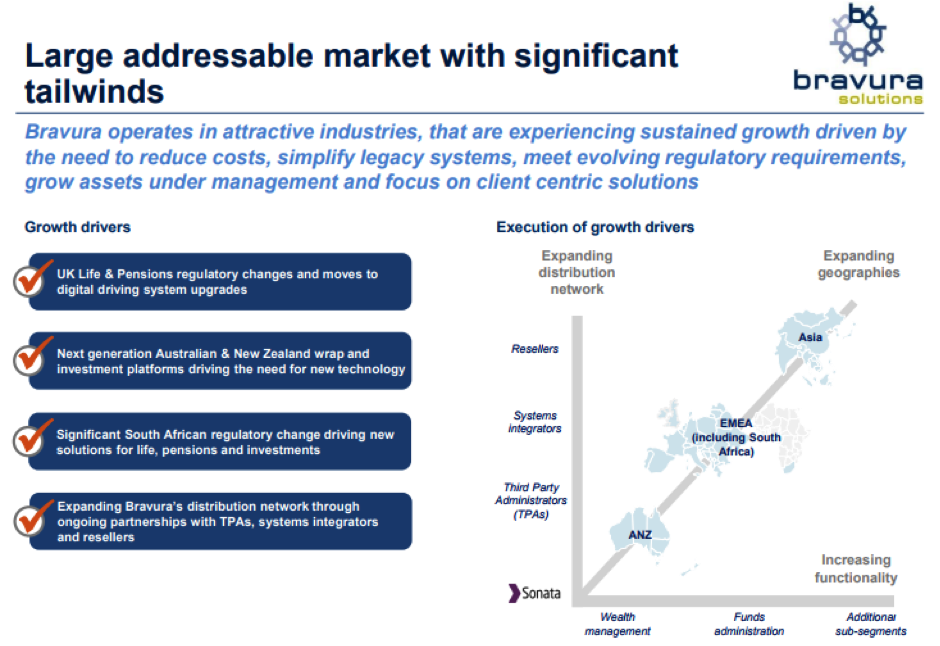

We believe the investment thesis for BVS stacks up well within our investment framework. Our analysis suggests that the company’s core software product, Sonata, is gaining market share in a growing market. Sonata is the result of in excess of $100m of product development and investment that now has it best positioned to capture a significant market opportunity. This sees BVS largely replacing ageing legacy systems that are no longer fit-for-purpose. This is becoming increasingly evident across its core geographical markets of the United Kingdom, Australia, New Zealand and South Africa.

Figure 1: BVS Market Overview

Source: FY2017 Results Presentation

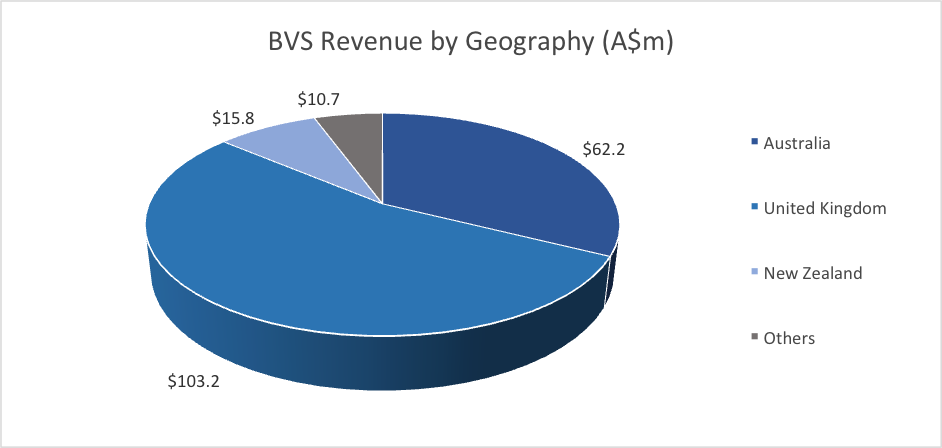

As it stands, BVS already generates about two thirds of its revenue in offshore jurisdictions, most notably the UK. We see this portion of revenue growing in future years, with most new contract wins in recent times coming from the UK and South African markets.

Figure 2: BVS Revenue by Geography

Source: BVS FY2017 Annual Report

Among many things, we are attracted to Bravura’s high degree of revenue visibility. This is due to the lengthy nature of its contracted client base, which typically spans 5 to 10 years. We also believe the business is well placed to drive significant margin expansion over time, particularly as the roll out and implementation of Sonata gathers pace.

To provide some further context around this, we believe it is useful to track the average revenue per Sonata client over time. As at FY2013, BVS had three Sonata clients producing an average annual revenue per client of $1.7m. In FY2017, Sonata clients numbered 20 while average revenue per client has nearly tripled to $4.6m.

We expect BVS to add between 3 to 5 new clients per annum for the foreseeable future, while revenue per client is expected to trend towards a range of $5m to $6m per annum. As (higher margin) annual license revenue becomes a greater share of the total group revenue, we also believe current EBITDA margins of ~17% will migrate towards a range of 20% to 25%, over the medium to long-term.

A common feature that BVS shares with many other Clime Smaller Company Fund constituents is that it has a net cash balance sheet, which when coupled with sound cash generation, affords management considerable scope to both reinvest in the business while concurrently paying out a good level of bi-annual dividend income. In line with this view, management have provided earnings guidance that equates to per share earnings growth of approximately 15% for FY2018, while the forecast dividend yield approximates 5.5% p.a.

While we are notably positive about the prospects of BVS, we are also cognisant of the risks associated with the investment. Given the geographical spread of the business operations, currency risk will be omnipresent. Therefore, an appreciating AUD would act to temper earnings growth (which was the case in FY2017) and vice-versa. The AUD-GBP exchange rate is currently the most significant currency exposure for BVS.

Given BVS operates in the software and services sector, risk of technological change may adversely impact the operations of BVS in coming years. The client base of BVS are also concentrated in the financial services sector, the operating conditions of which would obviously be impacted in the event of any material economic slowdown.

Collins Foods (ASX: CKF)

The core business of CKF relates to the operation, management and administration of KFC restaurants across Australia, Germany and the Netherlands. Though only listed on the ASX since 2011, Collins has been around since the 1960s, having obtained its first KFC franchise in 1968. In the decades since, CKF has steadily grown its footprint and is now one of the more prominent KFC focused franchise operators in the Australian market (at around 30% KFC network share).

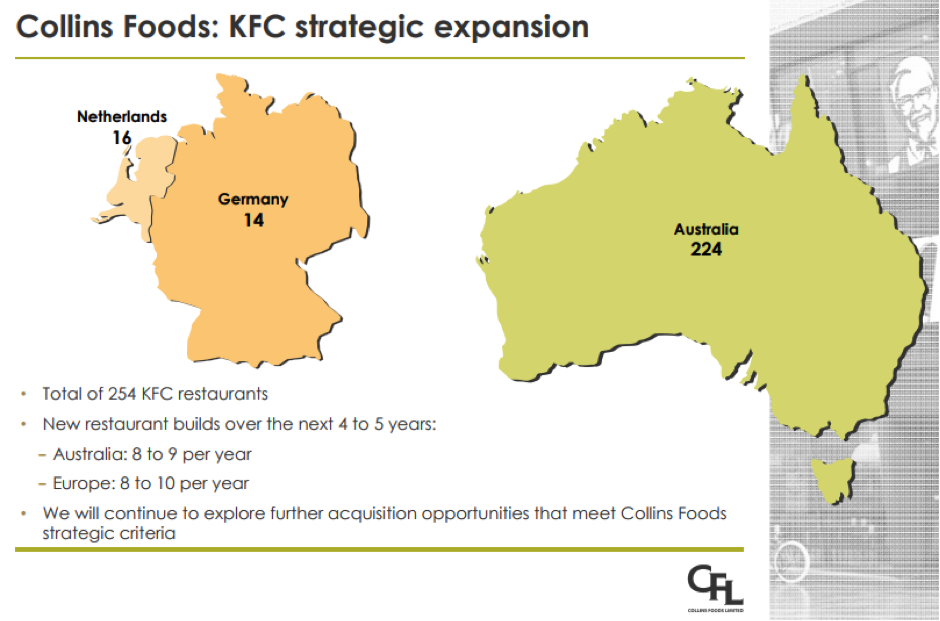

Today, CKF’s KFC store network totals 254, with 224 restaurants in the Australian market and 30 in the Western European markets of Germany and Holland. CKF’s Australian network, while still growing, is relatively more mature and forms the backbone of cash generation for the company.

Looking ahead, our thesis primarily relates to the opportunity for the business to reinvest its substantial cash flow into organically growing the store network in the underpenetrated Western European markets. To that end, management have indicated that they expect to roll out approximately 16 to 19 greenfield sites across all core geographies annually. This equates to organic footprint growth of about 7% per annum.

Figure 3: CKF’s KFC store network

Source: CKF Presentation

When coupled with moderate growth in same store sales and likely incremental scale benefits, we believe CKF can generate double-digit earnings growth over the medium-term. While much remains to be executed, given a sound track record, experienced management and a strong existing foundation, we believe CKF can become a much larger business in the years to come.

Navigator Global Investments (ASX: NGI) – formerly HFA Holdings (ASX: HFA)

NGI is a company that we have highlighted over the past 12 to 18 months given its value appeal and improving operational momentum. To recap, NGI is the parent company of Lighthouse Investment Partners, a US-based global absolute return hedge fund manager. Lighthouse manages US$10.0bn across commingled funds and customised accounts for endowments, foundations, institutions, pension funds and large individual investors.

NGI is somewhat unique in that all revenue is generated offshore in its core US market, with its ASX listing effectively a legacy borne out of corporate activity several years ago. In 2007, at the peak of the market, the then Australian focused HFA business bought Lighthouse for just shy of $750m in cash and scrip. Since that time, Lighthouse’s business has continued to steadily grow while the Australian operations have been wound down.

Along the way, following significant impairments, NGI has generated substantial carried forward tax losses in both the US and Australia, meaning the company won’t pay any (cash) tax for years to come. However, the Australian component of the tax losses remains landlocked until such time as the company has a domestic revenue generating presence.

After a long road to recovery, the company has emerged as a genuine growth story. With resurgent growth in assets under management, up 19% to US$10.0bn over the past 15 months, coupled with a strong cashed up balance sheet and consistency in cash flow, we believe the company is well placed to invest for future growth.

Given the clean slate and refreshed operational momentum, we believe the time is right for management to incrementally build out the scope of its operations. In line with this view, NGI recently renamed from HFA Holdings as part of the company’s gradual shift away from its historical exclusive core of fund of hedge funds operations. The business is still likely to retain its heritage in hedge funds; however, we expect that it will grow to become a broader asset management business in three to five years time.

Figure 4: NGI’s new name and branding

Source: HFA AGM Presentation

According to the company, ‘The change of name is sought now that the Company has completed a number of strategic milestones, including repayment of bank debt, rationalisation of the capital structure and balance sheet. It also signals the commencement of a broader business strategy which seeks to grow and diversify the Group’s key operations, in particular further leveraging the strengths of Lighthouse’s proprietary managed account platform.’

Now trading slightly beyond $3 per share (~$500m market capitalisation), and having paid a healthy dividend along the way, NGI has been a strong performer over the past 12 months. After a solid run, the question of course is whether it’s time to assess our portfolio weighting. In our view, although NGI is no longer extremely cheap, it is certainly not expensive. Given the company still trades on an attractive and growing free cash flow yield of around 8.0% (9.2% on a forecast ex-cash basis), which supports a 7%+ dividend yield, we remain positive on the company’s near-term outlook.

Perhaps more importantly, we also remain positive on the company’s longer-term prospects. Based on discussions with management, NGI looks to have a strong pipeline for more customised mandate wins in new distribution markets in the Middle East, Japan and Europe. NGI is a USD reporter and therefore enjoys a translational benefit as the AUD depreciates against the USD.

Hansen Technologies (ASX: HSN)

HSN is a company that has long had a presence in various offshore markets, a presence that is only likely to grow further over the coming decade. Established in 1971 by Ken Hansen, and later listed on the ASX in 2000, HSN is today a leader in mission critical billing software on a global basis. HSN’s billing software is crucial to the operations of its customers, primarily those operating in the energy, water, telecommunications and Pay TV sectors. As a result, customer churn is extremely low while the degree of recurring revenue is high.

HSN’s growing global footprint is impressive and encompasses a large, diversified client base of nearly 600, spread across 80+ countries and serviced by 20 offices in various geographical locations.

Figure 5: HSN’s Global Footprint

Source: HSN FY2017 Results Presentation

HSN recently acquired Enoro, the leading billing software provider in the Nordic region, in what was the company’s largest transaction to date. HSN has a sound track record of integrating acquisitions, extracting synergies and thereby building the margin of the acquired business. We expect HSN will again follow this template with the Enoro purchase, which will effectively become a core driver of growth for the company over the coming 12 to 24 months.

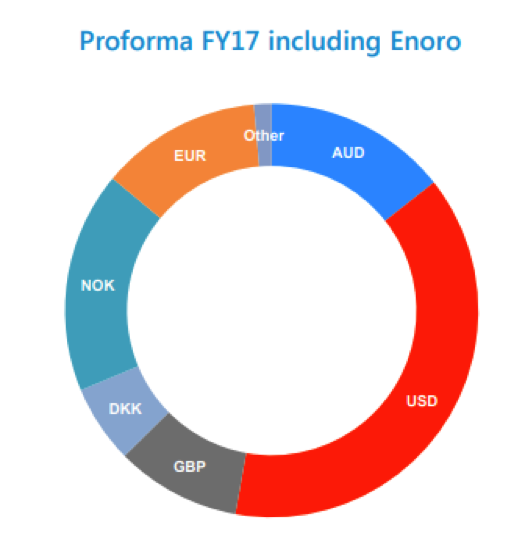

As illustrated below, HSN has a diversified exposure to various currencies. While the somewhat stronger AUD in FY17 was a mild headwind for the company in that financial year, should recent AUD weakness continue, this trend will likely benefit reported results for FY18.

Figure 6: HSN’s Currency Exposure

Source: HSN FY2017 Results Presentation

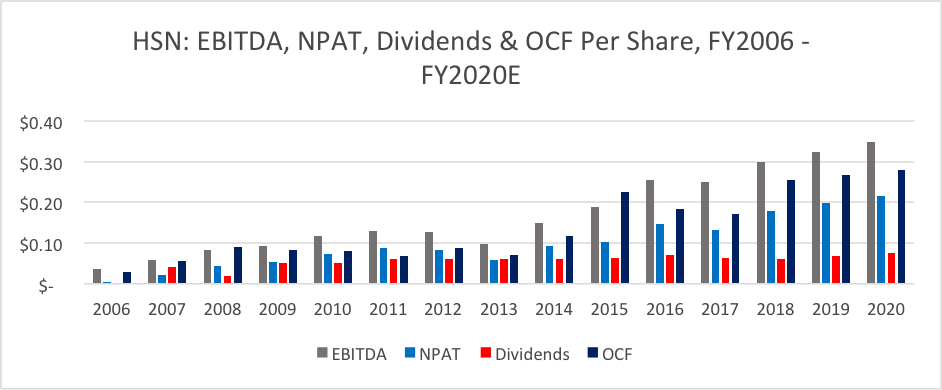

Looking ahead, we believe the company is well placed to deliver double-digit growth in per share earnings and cash flow over the next two to three years. If achieved, this will build on the strong track record of growth, largely self-funded, delivered over the past decade.

Figure 7: HSN’s Per Share Earnings, Dividends and Operating Cash Flow, FY2006 – FY2020E.

While there may well be some significant bumps along the way, offshore markets represent a potentially deep pool of opportunity for those Australian companies that are good at what they do. Although each of the companies highlighted today face their own specific set of risks, we believe all are well positioned to deliver on the longer-term growth opportunities apparent in a range of markets – both here and abroad.

Clime Asset Management owns shares in HSN, HFA, CKF and BVS on or behalf of various mandates for which it acts as investment manager.

9 topics

4 stocks mentioned

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.

Expertise

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.