Sneak peek: An emerging food crisis and how to play it

Today I reveal an investment opportunity that I shared with Diggers and Drillers readers in our latest monthly report.

While the specific stock recommendation will be withheld for Diggers and Drillers subscribers only, I think the idea behind it is prudent to share with you today.

If you’d like to get access to the full report, join Diggers and Drillers now by clicking here.

With that, enjoy this peek behind the curtain!

Broken supply chains, geopolitical tensions, war, inflation, rising energy costs, food crisis, droughts, famine, depleting mines…welcome to the 2020s!

The age of abundance is dead.

The patterns defining this decade suggest more volatility is on the way…especially in the things that matter most — food, energy, and shelter.

It’s why you must own commodities.

But so far, we’ve been focusing on critical minerals…

Stocks developing graphite, rare earth, lithium, nickel, and copper mines…the companies set to benefit as the global economy attempts to end its reliance on fossil fuels.

Critical minerals are a major theme, yet they represent just a tiny segment of the overall commodities market.

That means there are other avenues to tap as we head into the pointy end of this emerging commodity cycle.

A perfect storm of tight supply that spans minerals, oil, gas, food, and water is approaching.

The modern world has been spoiled with years of cheap and plentiful supply.

But that’s set to change.

Decades of underinvestment in the old economy means we are embarking on a new era of shortages.

Mines are being depleted without replacement reserves in sight…

Oil, gas, and groundwater deposits are turning into giant underground voids…

Global crop production is declining alongside severe droughts and war in the Northern Hemisphere.

All this while the planet adds around 1 billion people every decade!

And all this while humanity embarks on its most ambitious project yet…ending its 100-year reliance on fossil fuels.

Demand for commodities is not going to stay still in the years ahead — it will surge!

And the timing couldn’t be worse.

We’re on a collision course for global shortages just as the world demands more.

The lifeblood that sustains civilisations is now running on empty…meaning there’s no safety net built into the system to absorb global shocks.

You might remember the consequences from last year…everything from barley to nickel recorded triple-digit price gains after the war broke out in Ukraine.

The same thing happened a few months earlier as the West opened from its COVID hibernation.

An assumption that supply was limitless meant we’ve underinvested in the commodity sector…

The consequences are now boiling to the surface.

So, how did we get to this point?

Years of falling commodity prices and stable supply drove global capital out of the commodities and into the new economy…tech.

To give you one example, let’s take the US tech giant, NVIDIA. The company currently trades on a price-to-earnings (P/E) ratio of 245.

Now compare that to the world’s largest diversified mining company BHP Group (ASX: BHP). Right now, it trades on a P/E of less than nine!

There’s a deep chasm of value separating those industries producing luxury, ‘nice to have’ items…

Social media, entertainment, streaming service, video gaming, and smartphones versus those that are critical for human survival…

FOOD, SHELTER, WATER, and ENERGY.

But you can’t build tech devices without mining. In fact, you can’t build, eat, or drink anything without investment in the commodity sector.

This is why a gross misalignment in capital distribution from the old economy into the new is steering us on a dangerous path.

One that promises a critical decline in living standards as we sink into the EVERYTHING shortage.

As an investor bracing for this fallout, the solution is simple…accumulate commodity stocks.

In this report, we’ll be shifting our focus away from critical minerals into perhaps an even more important theme…food.

Other than water, food represents the most basic but critical resource for human survival.

And just like its commodity cousins, the ‘softs’ — as some would describe them — have witnessed massive volatility in the early parts of this decade.

Wheat futures recorded their lowest price in 60 years on 13 April 2019. That followed years of declining prices.

It set the stage for complacency…

But COVID and the war in Ukraine laid bare the consequences of underinvestment in a crucial sector.

It’s why last year in April 2022, wheat futures exploded 150% from their lows — the spike on the far right of the chart below.

But wheat wasn’t the only commodity igniting. The 146-year-old London Metal Exchange (LME) broke down as traders put a squeeze on the nickel market.

On 7 March 2022, Reuters reported nickel had soared 30.7% in a single trading session — the biggest daily percentage gain on record.

The LME suspended trading and abandoned contracts.

Without the capacity to deal with extreme volatility, the world’s oldest and most important commodity exchange now faces a torrent of litigation from traders as they line up for their turn in the London courts seeking compensation.

But last year’s dramatic surge offers a glimpse into the future. Volatility is here to stay.

Tight supply in the global market has not been addressed. Meanwhile, demand continues to rise.

It guarantees many more price shocks in the years ahead.

We’re seeing the consequences of underinvestment play out in the real world, too…

The supermarket, fuel station, building costs, power bills, hardware store, etc. You name it, we’re all feeling the pinch.

The ‘Age of Scarcity’ is upon us!

SOFT COMMODITIES SET TO DELIVER HARD TRUTHS

Now, let’s turn our attention back to food commodities and the strategy behind this month’s recommendation.

What could drive prices of things like grain, rice, and oats higher in the years ahead?

Well, on the demand side, we have a burgeoning global middle class that’s ravenous for meat.

As populations in the East climb the wealth ladder — moving from poverty to middle class — so too do their eating habits…from a vegetable-based diet to one that’s dominated by meat.

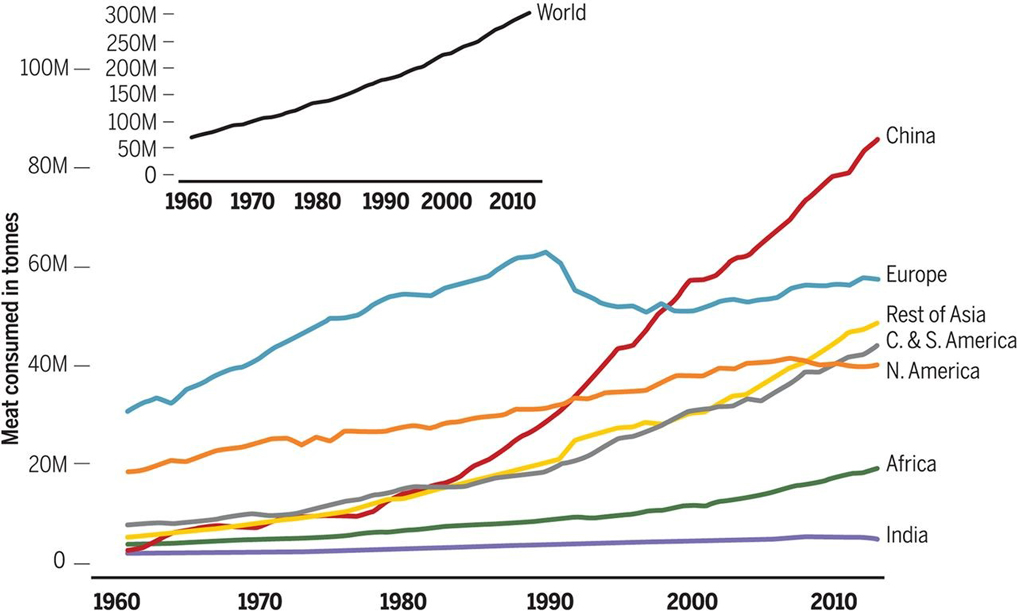

As the graph to the top left shows you, global meat consumption has increased sixfold since 1960, from 50 million tonnes to a staggering 300 million tonnes.

Meanwhile, the lower graph shows an exponential increase in meat consumption in China (red line).

So why does that add pressure to food supplies?

Well, meat is an inefficient source of protein and requires high volumes of agricultural inputs, including the very thing set to meet shortages in the months ahead…grains.

Only a tiny fraction of the grain used to feed livestock passes onto the consumer in the form of meat — most of an animal’s energy or protein is lost through daily metabolism.

Simply put, as Asia continues to bring more citizens into the middle class, pressure on grain prices, fuel, and arable farmland will rise.

Yet, the grain supply is already under strain.

Unlike the supply of metals, which are extracted from the ground, grain production primarily depends on global weather patterns.

For many important grain-growing regions in the Northern Hemisphere, the outlook looks bleak.

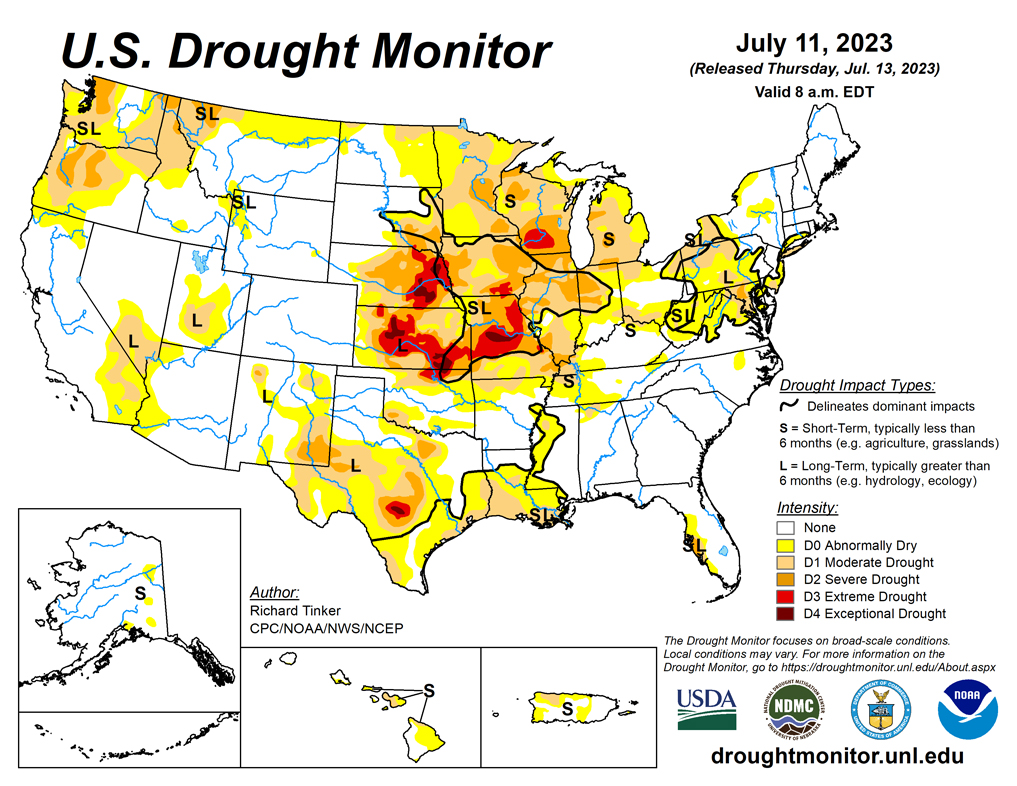

The latest monitoring survey from the US shows much of the country under drought.

Severity ranges from abnormally dry across the south, northeast and northwest (yellow) to extreme or exceptional drought conditions in the bread bowl states of Nebraska, Iowa, and Kansas (red/purple).

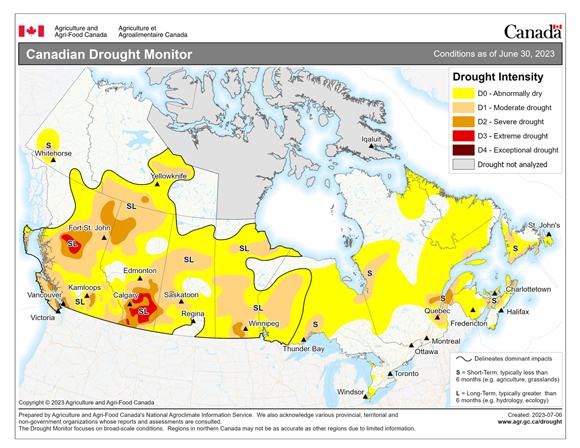

It’s a similar situation to the north of Canada.

Farmers in this major grain hub are feeling the pinch with 60% of the country classified as abnormally dry or in moderate to extreme drought.

That’s according to the latest research from Canada’s Department of Agriculture, which you can also see on the heat map below...

Climate alarmists put this down to global warming, oceanographers claim its El Niño and El Niña events, while geologists suggest sunspot cycles.

The fact is that no one really knows the cause.

It’s likely to be a combination of all these factors.

Yet scientists are unanimous. Drought and flood events are occurring with higher frequency and severity…right across the planet.

Global grain production is on a collision course with major changes in the earth’s weather patterns.

But this is not the only concern…

War and geopolitics will also play their role in constricting supply in the months ahead.

The latest example is Putin’s decision to pull out of the Black Sea Grain Initiative last week.

The agreement, which was brokered between Ukraine and Russia by the UN and Turkey nearly 12 months ago, was critical for maintaining global supply chains of grain.

It allowed more than 32 million tonnes of Ukrainian grain to be exported to 45 different countries while the war raged on.

Yet, the deal is as good as dead. Grain cargo leaving Ukrainian ports is no longer protected under the agreement.

With the prospect of being destroyed by a Russian naval vessel, shipments have ceased.

Like a return to the biblical epochs of the past, the 2020s have witnessed a rebirth of war, pandemic, trade hostilities, drought, food shortages, and famine.

Are all these events colliding in unison thanks to some major cyclical change? Perhaps.

One thing’s for sure…a rapid deployment of global investment is needed to help stabilise commodity supplies.

As an investor, this is a trend you need to follow.

We’ve been doing that by adding select resource stocks set to benefit from higher critical metal prices.

But what’s the best strategy to play the looming food crisis?

Fertiliser stocks.

As the world braces for a decade of climate volatility, drought, war, and broken supply chains…fertiliser stocks offer a glimpse of hope in this coming age of scarcity.

And right now, I think we have a closing window of opportunity to jump in while prices remain depressed…

To access the rest of this report and find out the specific fertiliser stock I’m talking about, you can sign up for my Diggers and Drillers publication.

You can also follow my Twitter feed @JCooperGeo

5 topics

1 stock mentioned