Soft landing or recession? These 3 economic indicators will tell you the answer

Global equity markets have rallied to begin 2024. A significant part of that rally has been driven by the US tech sector. And a good part of that rally appears to be driven by expectations around the productivity enhancements from artificial intelligence. At the same time, economic data are pointing to slowing growth but sticky inflation. And the Fed has pushed back against market pricing for aggressive rate cuts.

This somewhat conflicting environment can be interpreted through the use of scenario analysis. We find using scenarios allows us to gauge what future the market is pricing in, and that can be useful in deciding portfolio changes. In this wire, we consider three plausible scenarios and the portfolio positioning they support.

Three scenarios for the outlook

1) Soft landing: The prevailing market narrative has moved to one of a soft landing. In that scenario, inflation moves back towards the Fed’s target as growth slows to trend. The Fed can cut the Fed Funds rate gradually, keeping the real yield restrictive enough to slow inflation, but not so restrictive that a recession begins.

2) Recession: A recession remains a key downside risk. Rates have been very restrictive for some time. But the economy has been resilient. This resilience has been helped by excess savings in the household sector, and corporates that have not yet had to refinance into higher rates. We think excess savings are largely depleted, and corporates are having to start refinancing this year. Growth is already slowing (but not collapsing). That leaves recession a key risk.

3) Productivity boom: Artificial intelligence has become a key theme in equity markets. AI has the potential to improve productivity, allowing growth to surge without inflation reaccelerating. This re-acceleration of growth without inflation represents a positive outlook for the global economy above and beyond the soft-landing scenario.

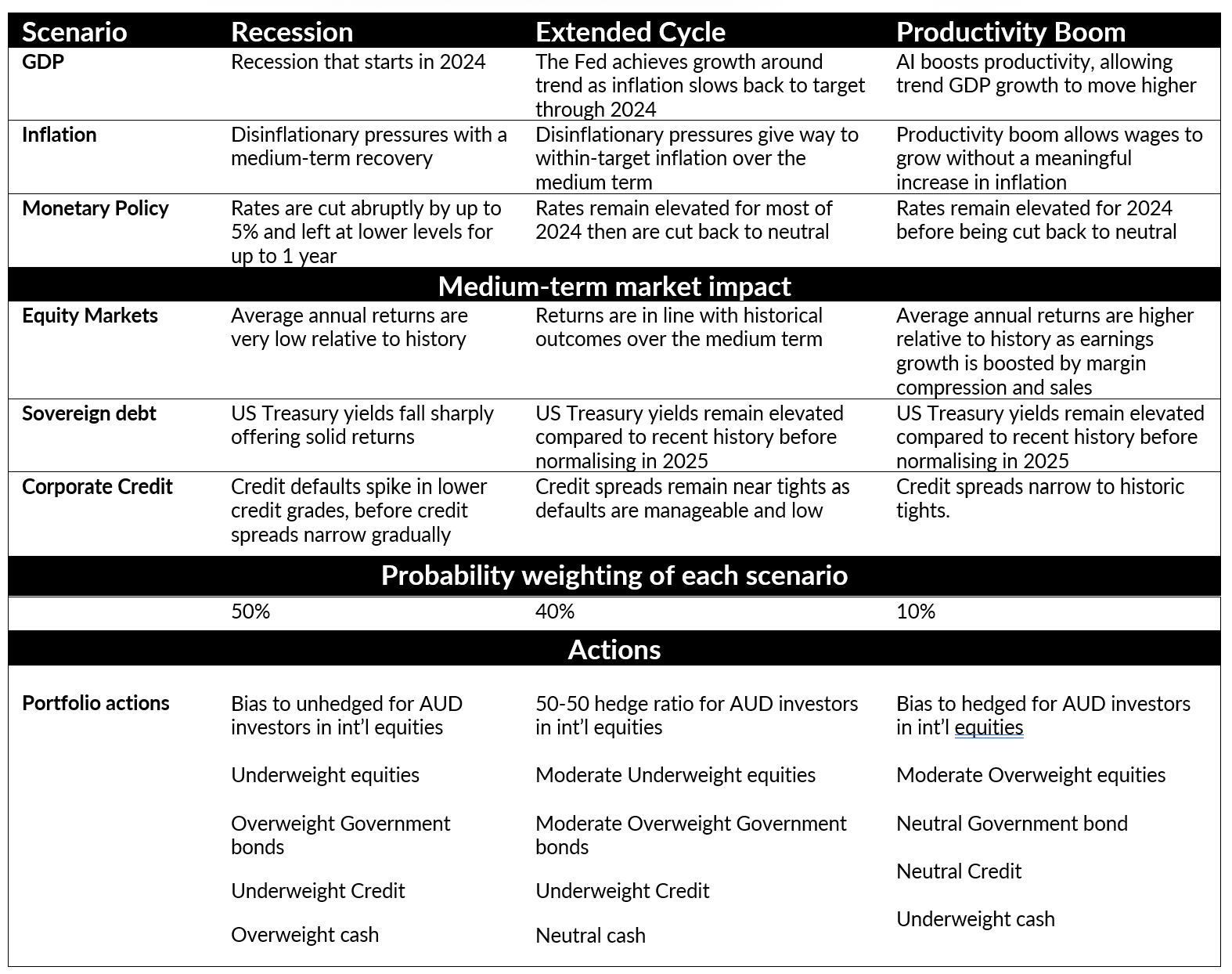

Table 1 below sets out our thinking of the economic pathway for each of the scenarios.

What does it mean for markets?

We use a range of quantitative models to gauge a fair value range for different asset classes under each of the scenarios. We compare a fair value under the scenarios to current market pricing to derive some potential portfolio actions. These are summarised in Table 1.

Table 1: Scenario analysis for 2024

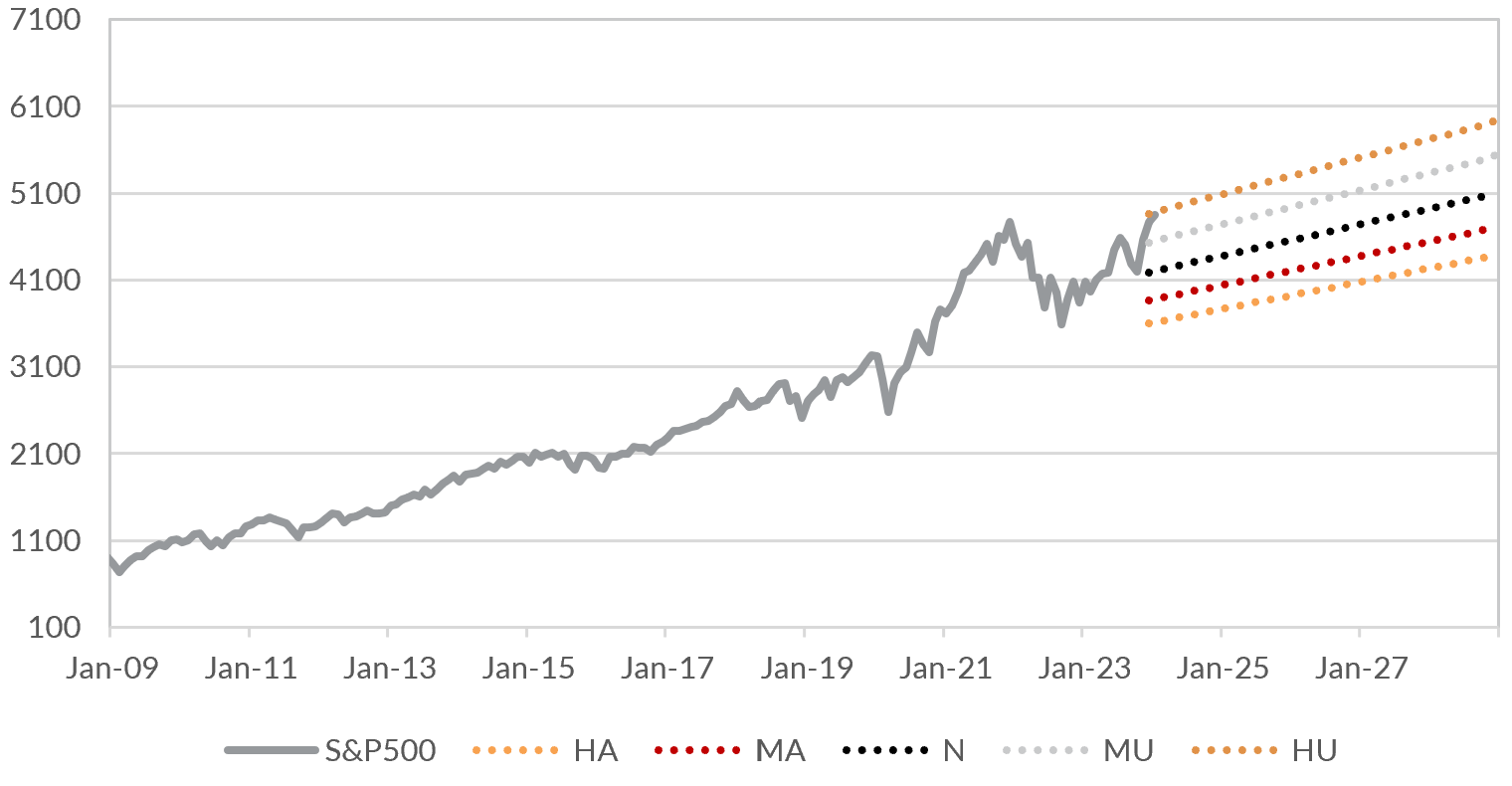

Equity markets are pricing a re-acceleration of growth.

Scenario analysis can be useful because it allows us to gauge what markets are pricing in. The prevailing narrative of soft landing or extended cycle has been used to justify equity market valuations.

However, equities are moderately unattractive in both the recession and extended cycle scenario. In a recession, stretched starting valuations reprice aggressively, delivering low expected returns.

In the extended cycle, moderating growth is not sufficient to deliver earnings growth at a fast enough pace to justify the starting valuations. Returns are still somewhat weaker than long-run averages. Equities are moderately unattractive (see Chart 1).

Chart 1: Expected Sharpe ratios are moderately unattractive for US equities even in an Extended Cycle scenario

For current valuations to be even moderately attractive, the future would need to look a lot more like the productivity boom scenario. That requires a sharp re-acceleration of growth. And the economic data do not support that. We think that leaves equities subject to asymmetric downside risk.

Credit spreads are not compensating for the risk

Credit spreads have narrowed in 2024 to levels that look historically tight. Yet absolute yields remain elevated, and growth is slowing. Defaults and downgrades are increasing. Refinancing activity is set to increase through 2024 and 2025. Credit looks moderately unattractive in the recession and extended cycle scenarios, and only neutral in the productivity boom given the tight starting spreads.

Yet demand for credit remains strong, particularly in the sub-investment grade universe, suggesting credit markets are also starting to price in the productivity boom scenario.

Government bonds remain attractive

In all three scenarios, high-quality government bonds remain attractive or neutral. High starting yields and the prospect for aggressive rate cuts in recession, and moderate rate cuts in extended cycles, deliver a high expected Sharpe ratio. In the productivity boom scenario, yields remain elevated for some time. That delivers decent income, although not the capital gains that accompany rate cuts in the other two scenarios.

How likely are the scenarios?

Assigning a probability to each scenario is more art than science. An equal weight probability is a useful starting point. But context matters. And right now, rates have been at multi-decade highs for some time. Growth is already slowing. Probabilities seem skewed towards an extended cycle or recession.

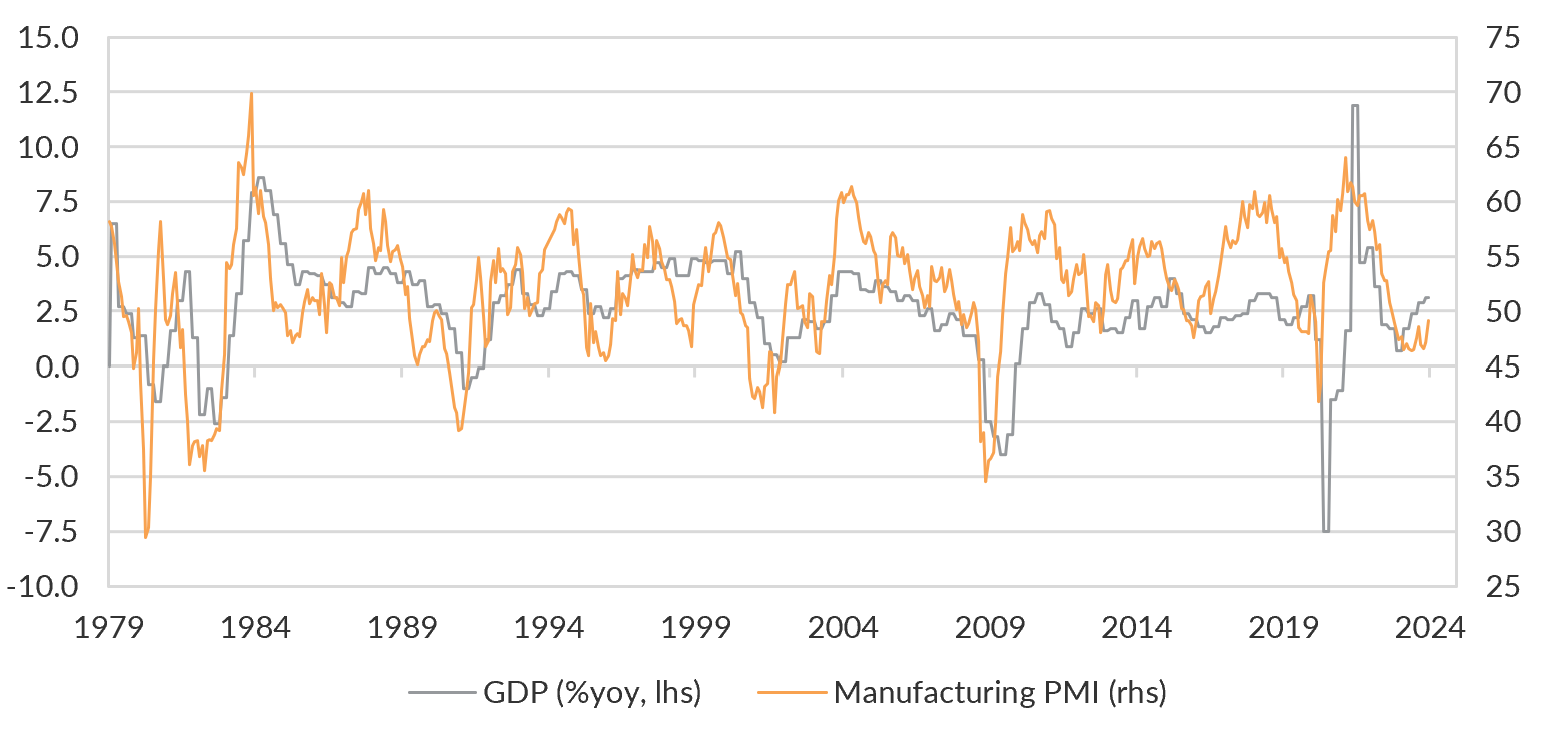

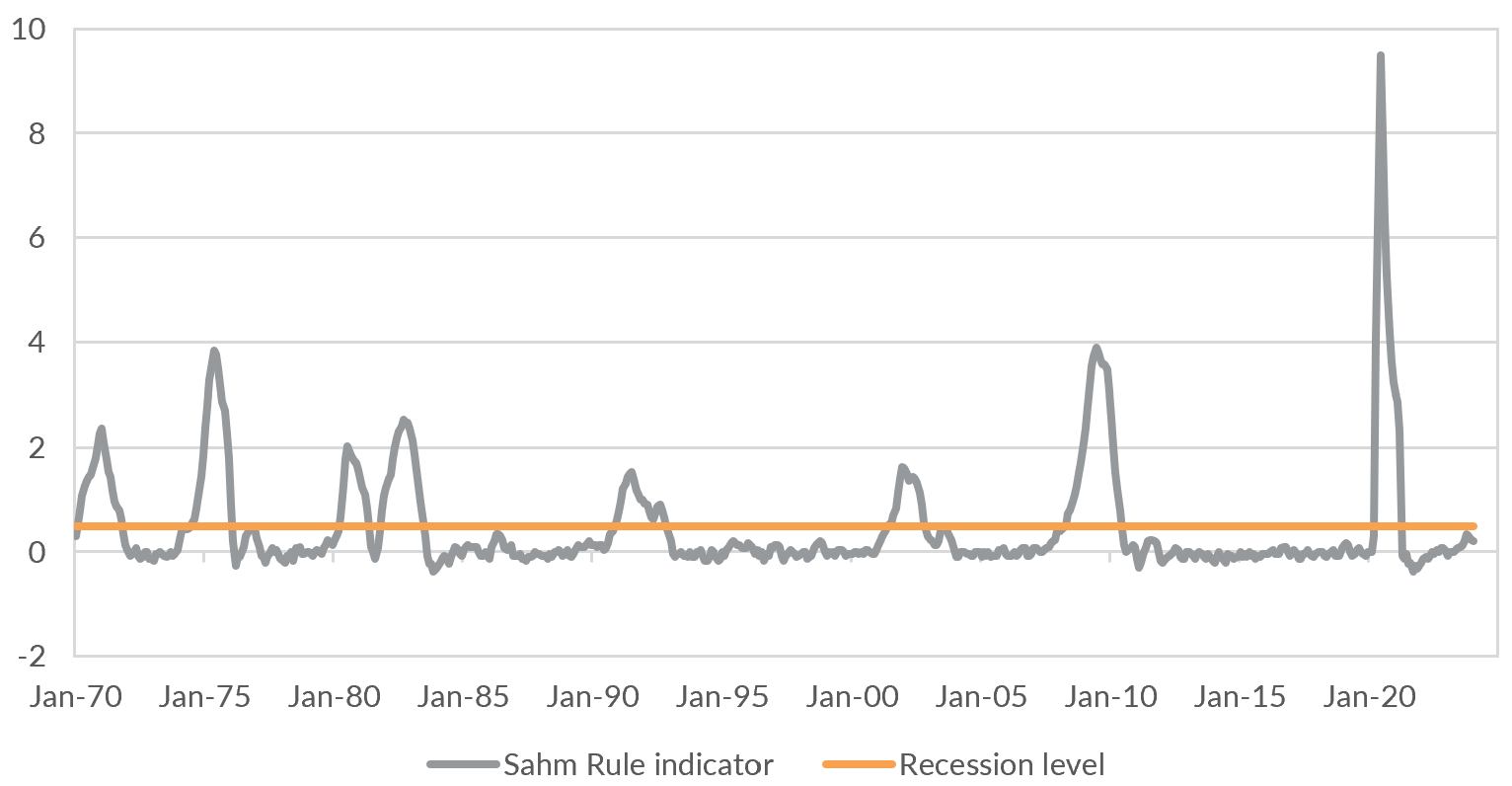

We have been using three indicators with fool-proof histories of picking recessionary periods to judge the relative probabilities. These indicators are the Sahm rule, the manufacturing PMI and the US Treasury yield curve. I wrote about them in a previous wire.

All three key indicators have moved further away from the level that indicates imminent recession. That suggests the economy could be getting closer to a soft landing.

But the evidence is not yet there to justify a re-acceleration of growth. We think that would be reflected by a break back towards 60 in the manufacturing PMI, stabilising unemployment, and a prolonged period of modestly inverted yield curve. For now, we think a recession remains modestly more likely than not.

Chart 2: The manufacturing PMI has rebounded away from the 45 that indicates recession

Chart 3: The Sahm rule has moved further away from the 0.5% that indicates recession

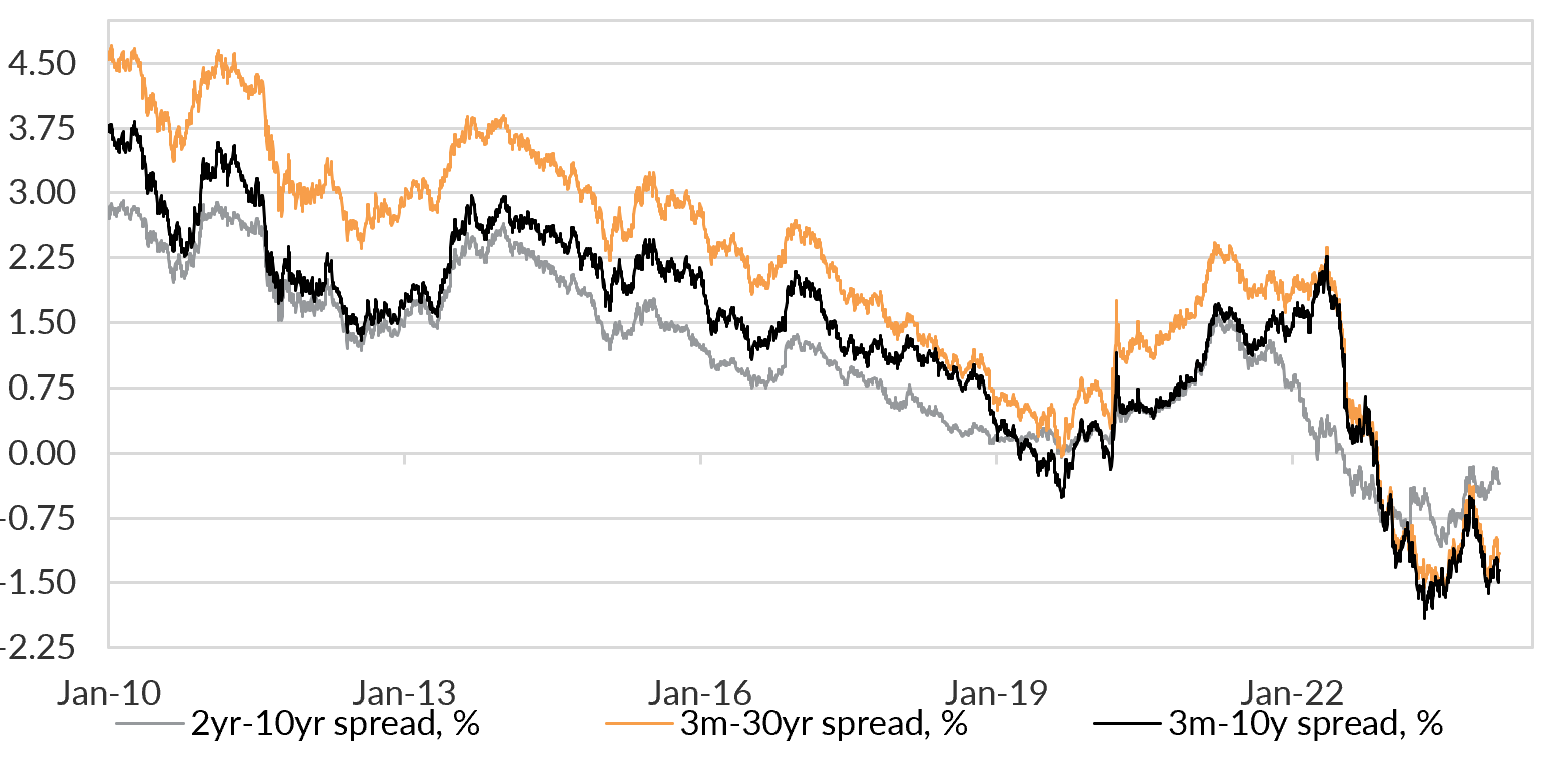

Chart 4: The yield curve has flattened (inverted further). Normalisation suggests imminent recession

Remain cautious as valuations look stretched

In summary, we think scenarios help guide portfolio decisions. Current market pricing has moved away from recessionary pricing and is discounting not just an extended cycle or soft landing, but a genuine re-acceleration of growth.

The three economic indicators discussed in this wire – the Sahm rule, the manufacturing PMI and the yield curve – provide a useful toolbox for gauging whether a recession or soft landing is likely. And there is some scope for a re-acceleration of growth to be driven by meaningful productivity gains as a result of AI developments.

But given stretched market pricing, the risk of disappointment remains high for investors if growth slows back to or below the trend. From a portfolio management perspective, we think that remaining cautious makes sense for portfolio positioning.

5 topics