Solid fundamentals are set to deliver a boost for biotech this year

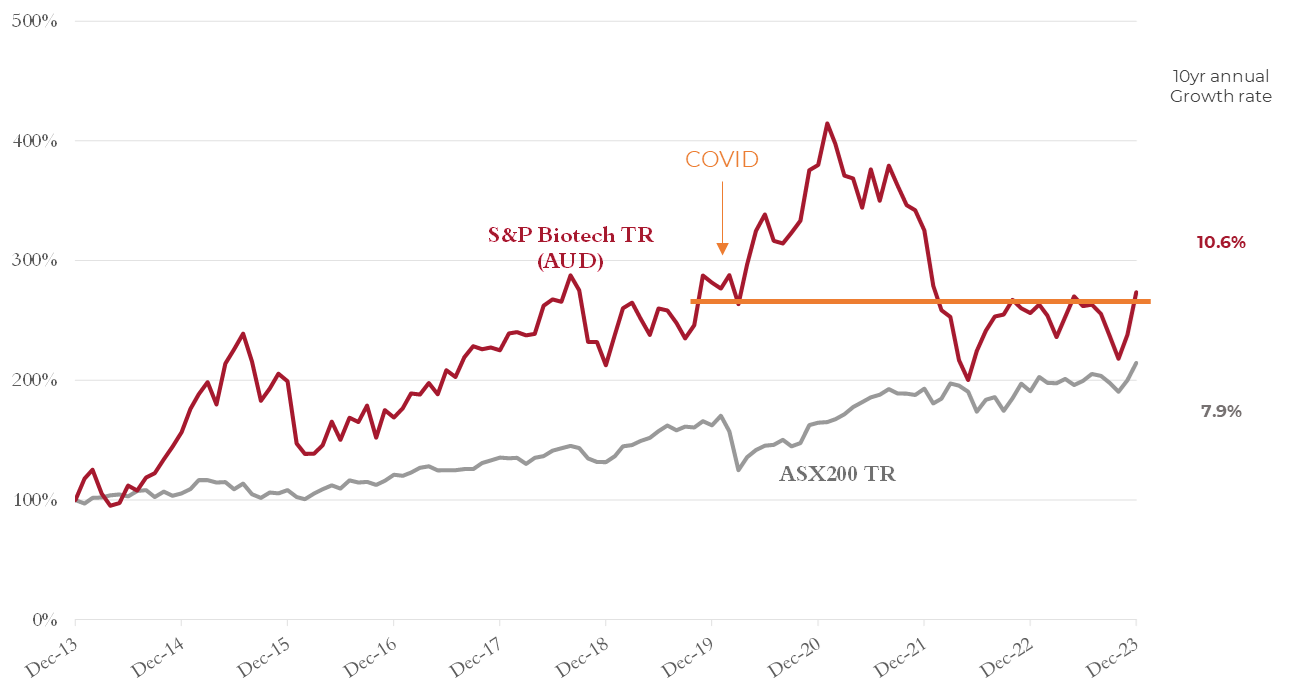

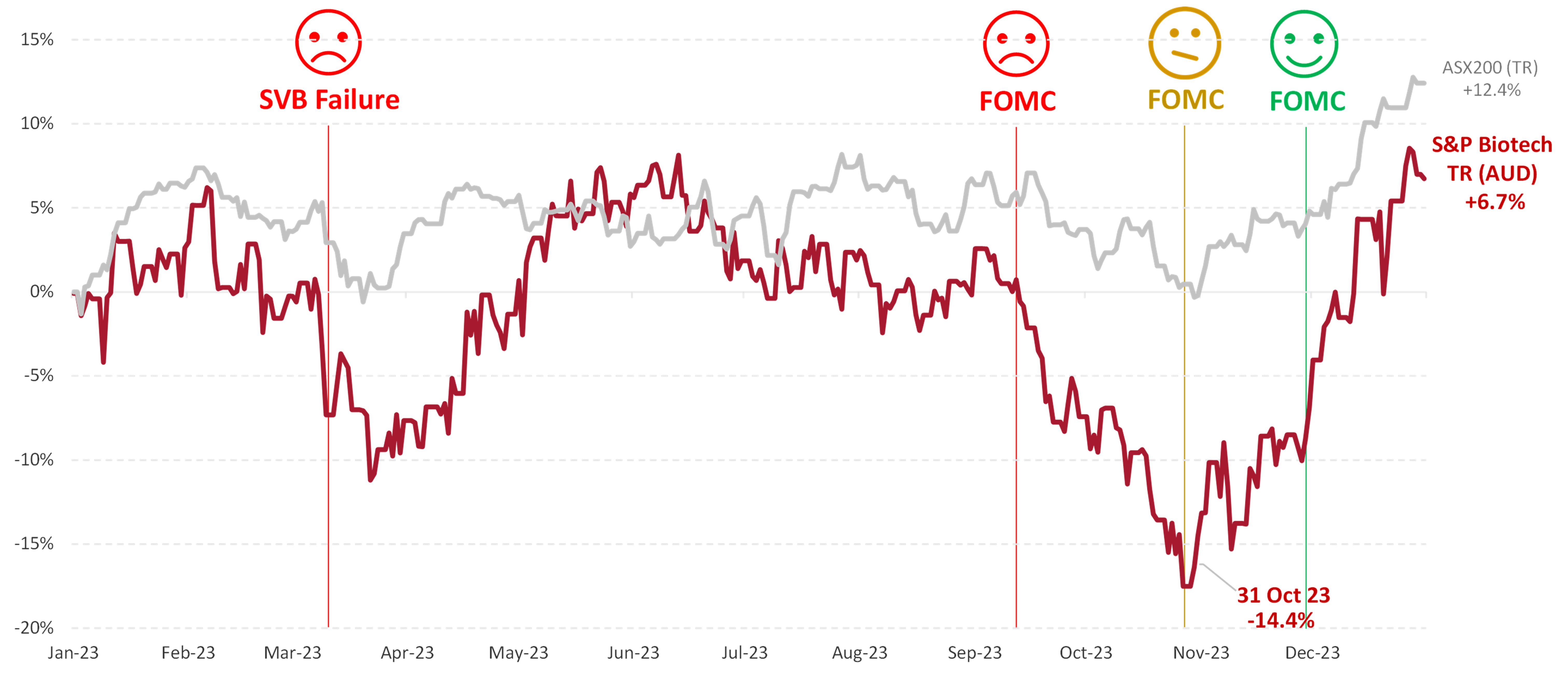

What a difference two months can make. Had the year ended on 31 October, the global biotech market, as measured by the S&P Biotechnology Industry Index (“Biotech Index”), would have been on track to return -14% at 31 Oct 2023, measured in AUD. Instead, the biotech market put in a herculean effort during November and December, coming home with a wet sail to return 6.7% for the calendar year and avoiding what would have been the first time the index had posted 3 consecutive calendar years of negative returns. Despite this rally in late 2023, we believe the biotech market remains inexpensive, still below pre-covid levels.

Coming home with a wet sail - or just getting warmed up?

Throughout both 2022 and 2023 the biotech market had been driven by macro factors, as we have written about previously. During this period, it has been extremely difficult for investors to focus on any biotechnology fundamentals as markets gyrate on macroeconomic data. Furthermore, an innocent bystander would be forgiven for thinking that the only news coming out of biotech since Covid was the rise of GLP-1s and their impact on obesity and its downstream effects – this is not the case with progress on many fronts throughout the year. Far from simply coming home with a wet sail in 2023, there are many reasons to suggest that the biotech market is only just beginning to warm up for 2024.

Macro had its hand on the tiller throughout 2023.

The movements in the chart below of the Biotech Index can be directly tied back to macroeconomic data and key Federal Open Market Committee (FOMC) meetings. The low in March 2023 was driven by the failure of Silicon Valley Bank while the severe downturn from September to October, which had the Biotech market testing 5-year lows, was a result of the US Federal Reserve (‘the Fed’) signalling that it will hold interest rates higher for longer and, more importantly, significantly reducing the likelihood of highly anticipated interest rate cuts throughout 2024.

This resulted in generalist investors indiscriminately selling unprofitable companies with cashflows only expected sometime in the future (i.e. Biotech stocks) in a flight to perceived safety. However, the gyrations did not stop there – more benign economic data in November had the Fed returning to a more dovish tone and suddenly ‘risk’ assets were back in vogue, propelling the biotech market higher by over 20% in just two months. You could be forgiven for imagining that it was Jerome Powell under the Santa Suit this year, personally delivering the ‘Santa Rally’.

Taking a closer look at biotech in 2023, it was not just about macroeconomics. 2023 was far more exciting for fundamental reasons. Despite the macro jitters, Biotech M&A activity posted its second highest year on record with ~US$150 billion of acquisitions. It also saw important progress in fields of science including Alzheimer’s Disease and Gene Editing, among others

M&A

Far from hiding under the covers as markets reacted to the highest inflation in decades, large pharmaceutical companies, flush with cash and many facing Loss of Exclusivity on blockbuster drugs, stepped into the market and collectively acquired over US$150b of smaller (as well as some quite large) biotech companies. With prices still depressed in biotech, we expect M&A to continue into 2024.

2023 was the second highest M&A year on record with ~US$150 billion of acquisitions during the calendar year

Acquisition themes for the year included Antibody-Drug Conjugates (ADCs), Immunology, Neurology and Radiopharmaceuticals. Given the unique supply chain challenges involved with radiopharmaceuticals in particular, large pharma has historically opted to acquire companies with late stage assets to establish a presence in this therapeutic modality, as opposed to develop them internally. Locally, both Telix (ASX: TLX) and Clarity Pharmaceuticals (ASX: CU6) fit that description and could easily be garnering attention from potential partners.

With so much M&A activity in Biotech, it is not surprising that if you were to strip out all ‘premium based’ returns, in other words the collective M&A premium paid by various acquirers over the calendar year, the S&P Biotech Index would have posted a modest loss for 2023. This is not a bad summary of 2023 for Biotech: Very mixed fortunes unless your portfolio companies were the subject of M&A. While HB Biotechnology had one portfolio company acquired during the calendar year, we believe there are numerous others in our portfolio that could easily be the subject of M&A in the not-too-distant future.

More than just GLP-1s

Arguably GLP-1s, the anti-obesity medicines from large pharmaceutical companies Novo Nordisk (NYSE: NVO: Ozempic / Wegovy) and Eli Lilly (NYSE: LLY: Mounjaro) were THE healthcare story of 2023, with the share prices of the aforementioned companies climbing 53% and 59% in 2023, driven higher by data demonstrating that they can reduce the incidence of cardiovascular events by up to 20%. Under this backdrop, very few other healthcare / biotech stories were getting much attention from generalist investors.

2024 should see a move away from the ‘magical thinking’ about GLP-1s as a slew of datasets read out.

Despite the jubilation by investors around this drug class, 2024 should see a move away from the ‘magical thinking’ about GLP-1s as a slew of datasets read out and we can begin to better define the populations that will (and will not) benefit from this drug class. In 2024 Novo Nordisk is expected to release results for its GLP-1 in MASH (formerly NASH) and Chronic Kidney Disease, while Eli Lilly is expected to release results for Mounjaro in Sleep Apnoea – a dataset Resmed (ASX: RMD) investors will want to keep a keen eye on.

While investment and acquisitions in oncology remained the highest throughout 2023, It is clear there is growing interest in neurology, spurred on by the first FDA approval for (an effective) Alzheimer’s drug: Eisai and Biogen's (NASDAQ: BIIB) Leqembi. In the past we have typically avoided investment Alzheimer’s Disease as it has been condition that has seen billions of R&D dollars directed towards it with almost zero return in over 20 years.

However, we are now starting to see neurology drug developers take on a more ‘precision medicine’ approach: Targeting defined sub-populations (e.g. genetically defined, as opposed to an ‘all-comer’ approach), with good mechanistic rationale – akin to what has occurred in oncology over the past decade or so. Accordingly, we expect a greater emphasis and interest in neurology drug development moving forward and expect our portfolios to accumulate names in this area during 2024.

Once market darlings, gene editing stocks that had eye watering valuations during 2020 and 2021 have come crashing back to earth over the past couple of years. However the field saw an important regulatory precedent in 2023 with the first FDA approval for a CRISPR/cas9-based therapeutic: Vertex (NASDAQ: VRTX) and CRISPR therapeutics’ (NASDAQ: CRSP) Casgevy for treating Sickle Cell Disease. Quite apart from the fact that it is possible to deliberately and accurately modify functional DNA in a living organism for therapeutic benefit – a truly remarkable feat in itself – what is particularly remarkable about this approval is the speed from which CRIPSR (an enzyme adapted from bacteria to make precise gene edits) was discovered in 2012, to its use in a first drug approval in 2023. Despite this approval and the pullback in prices since 2021, we remain on the sidelines with respect to investment in this area, but continue to keep a keen eye on this sector, poised to step in where we see compelling risk / reward profiles.

Just getting warmed up for 2024

As we look forward into 2024, if there’s anything we’ve learned from the past couple of years, it’s that we should be careful not to prematurely declare victory on inflation or assume that materially looser monetary policy is just around the corner. While we wouldn’t be surprised for another curve ball thrown at us in this arena, we are cautiously optimistic that the work central banks have done to tame inflation is having the desired effect. For us investing in biotech, this means we should be able to focus more on fundamentals (clinical trial readout-outs / regulatory approvals / commercial launches) and less time seeking guidance from FOMC meetings.

As we have opined before, the prospects for the clinical success of a drug have absolutely nothing to do with inflation or macroeconomic conditions. Provided biotech companies have sufficient access to capital to deliver on their pipeline (something we focus on heavily when selecting portfolio companies) investors with a medium to long term investment horizon should continue to expect superior, uncorrelated risk-adjusted returns from investing in a well selected portfolio of biotech companies.

As a result, we are cautiously optimistic for future returns in biotech and, far from simply coming home with a wet sail in 2023, we believe we are just getting warmed up for 2024.

2 topics

8 stocks mentioned