Solving the income puzzle

In 1974 a Hungarian design teacher and puzzle enthusiast assembled his first cube-shaped puzzle and called it the Magic Cube. The puzzler was Erno Rubik, and shortly after his initial creation, Ideal Toy Corp licensed the cube and renamed it The Rubik's Cube. It is estimated that over 350 million Rubik's Cubes have been sold, making it the most popular toy in history.

There are 42 Quintillion possibilities but only one correct solution for this famous puzzle. It took Erno Rubik a month to figure it out, today there is a guide that teaches you the solution in 45 minutes, and the current Rubik’s Cube world record is just 4.22 seconds. That incredible record is only possible because the puzzle stays the same with no changes to the number, size, shape or colour of the twenty-seven small cubes.

Unfortunately, for many investors the solution to their income needs is getting more challenging over time rather than easier. It really is a puzzle.

We’ve looked in bewilderment at the negative rates experience in offshore markets, particularly in Europe. Why would you pay a bank to hold your money? It just doesn’t make sense.

In Australia, we still have positive interest rates, but that’s just on face value. When you account for inflation, running at 2.2% according to the RBA, you're losing money by holding cash. This is commonly referred to as the value of an asset in ‘real terms’.

.png)

Piles of cash on the sideline

With that backdrop, I was somewhat surprised at the results from a recent survey of Livewire readers and their investment intentions in the year ahead. What caught my eye was how much cash is sitting on the sidelines, assets effectively losing value. The results showed that roughly 35% of respondents were holding cash levels between 20% and 50%, an additional 14% of investors surveyed are sitting on cash levels above 50%.

I get that people may have raised cash in the sell-off, and I also appreciate that people like the optionality that comes with holding some cash. Individual circumstances vary, but it stood out as a large amount sitting on the sidelines.

The results also showed that one in four of investors surveyed currently use term deposits to execute their strategy. I did a quick around the grounds, and the absolute best rate I could find was 2.15% p.a. … but you have to lock your cash up for five years, leave it with an institution you’ve probably never heard of and even then you’re still going backwards in ‘real terms’. A term deposit at one of the big four will pay you about 0.85% on a 12-month term. Investing $100,000 for 12 months will leave you with $98,650, again in ‘real terms’.

That’s probably why only 6% said they were planning to use term deposits in the year ahead. It would be reasonable to conclude that at least some of the money currently sitting in term deposits will start looking for a new home.

At the other end of the spectrum are the ever-popular fully franked dividends spinning out of Australia’s listed companies. The tax incentive is a clear kicker, and there is no doubt that dividends are an essential part of the solution. Share price falls have been tolerated, but in recent times dividend cuts and deferrals have put the spotlight on the Achilles heel of strategies too heavily reliant on dividends.

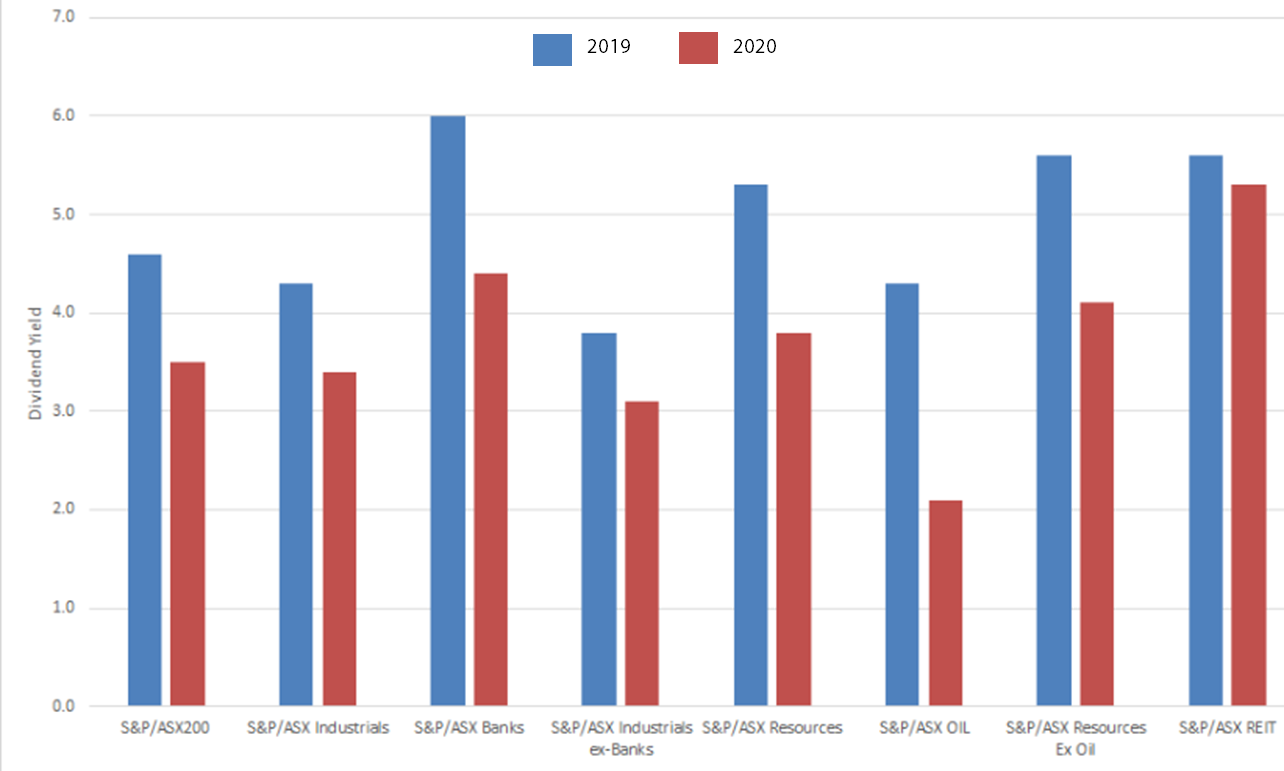

The chart below highlights the drop in expected dividends across several major sectors. An investor relying on the market for their income should be preparing for a ~22% hit compared to the prior year.

Chart: Market Expectations for dividend yield comparison: May 2019 – May 2020

Source: FactSet & Nikko Asset Management

More choice, not all good

The challenge I’ve outlined above is not new, and over the past few years, there has been an increasing number of investment products launched to address the income needs of investors. For example, there are nine listed investment trusts offering access to a variety of income-generating assets. ETF providers have come up with ‘dividend harvesters’, fixed income and hybrid offerings. Peer to peer lenders are advertising returns of ~7% p.a. and we’ve even seen some more exotic products hoping to flip a quick capital gain and pay it out as a ‘term deposit’.

As with anything new, there is the issue of establishing a track record and developing trust. A number of new products have delivered on their objective. However, some have fallen short. Investors are right to proceed with caution as these new products earn their place in a portfolio.

The 2020 Income Series

Starting on the 14th of July, Livewire will publish an educational series titled “Solving the income puzzle”. We want to help you understand the different approaches to solve your own income puzzle.

In late June Livewire ran a survey of six hundred investors to understand the challenges you face when investing for income. Here is a snapshot of the key insights from the survey.

- 44% told us that they rely entirely on investment returns to provide income.

- 75% said that they are willing to draw down on capital to support their needs.

- ~60% require a return of between 5% - 7% per annum, while 12% said they need a return of at least 10% per annum.

- 76% say they can live with a small amount of volatility, 16% care only about the income and 8% say capital protection is their #1 priority.

- 35% said they are willing to lock up capital for 36 months if it enables them to receive a better return. 31% said they’re happy to lock up capital for between 12 and 36 months for better returns and 15% said liquidity was a major priority.

- Hybrids, Bonds, Corporate Bonds, Alternative Assets and Private Debt are the less understood asset classes.

Nine income generating asset classes

We’ll be speaking with leading investment professionals to learn about their portfolio strategies for achieving income, and we will also feature a series of educational articles covering nine asset classes with a focus on the role that they play in a portfolio and the returns that they target.

*Click on the contributor names and hit ‘follow’ on their profile to be notified of their article.

- Private Debt – Omar Khan, Freehold Investment Management

- Global Equities - Alastair MacLeod, Wheelhouse Partners

- Alternative Assets - Mitchell Goldstein, Ares Management

- Corporate Bonds – Robert Mead, PIMCO

- Australian Equities – Dr Don Hamson, Plato Investment Management

- Bonds – Chris Rands, Nikko Asset Management

- REITs / Unlisted Real Estate – Jason Huljich, Centuria Capital

- Hybrids – Campbell Dawson, Elstree

- Listed Investment Trusts (LITs), Nick Yaxley, Bond Adviser

Investing for income webinar: Putting the pieces together

Once all nine of the educational articles have been published I'll be hosting a live webinar with two wealth managers to help put the pieces together. My guests will construct and share their own income portfolios using the asset classes covered in the series and explain why and how they use each asset class. I've also asked them to bring along a few of their own tips on where they think some of the best opportunities lie in the year ahead.

The webinar will take place at 11am on the 30th of July 2020, please send an email to team@livewiremarkets.com if you'd like to be put on the list.

Stay up to date with the Income Series

We have a dedicated Income Series 2020 section on the Livewire website where all the content will reside.

(Ed's note: This article was updated on the 12th of July to incorporate the survey results)

1 topic

4 contributors mentioned