Some great opportunities on the long and the short sides

January was a weak month for equity markets both in Australia and offshore. The ASX300 was down 6.5%, S&P500 down 5.3% and the Nasdaq was down 9%.

These index moves don’t tell the entire story, however, with some extremely volatile moves at a sector level.

The profitless tech and biotech names were particularly weak, compounding the moves we saw in the second half of December. Expectations of interest rate rises continued to strengthen during January due to strong CPI prints globally and a more hawkish tone from central banks.

This has been reflected in rising 10-year Treasury yields, with the US 10-year yield increasing from 1.51% at December end to 1.74% at the end of January. This has continued into February, with the 10-year yield now above 2% for the first time since 2019.

Strong inflation prints and rising bond yields are being priced into equity markets with long- duration stocks selling off materially and commodity / soft commodity-exposed stocks (perceived as inflation hedges) materially outperforming the market.

Long-duration assets cop it as expected

We have always said that when interest rate expectations start going higher, the first to cop it are the long-duration assets.

Non-earning tech companies are the very definition of long duration. They make no money today but hope to make a heap of money in ten years’ time.

Higher interest rates hit them in two ways. First of all, the discounting of cashflows well into the future are worth less today and secondly, these business models are reliant on capital markets, which becomes more difficult in an environment of less liquidity.

When interest rate expectations increase, high P/E companies tend to perform materially worse than low P/E companies all other things being equal.

Over the past couple of years, with interest rates close to zero, these long-duration “concept” company share prices have sky-rocketed and, in our view, completely detached from fundamentals.

However, with interest-rate expectations over the past couple of months changing, these long-duration stocks have fallen materially.

We have benefitted from this given our exposure in the short book to long-duration, profitless companies and in the long book our resources exposure has performed strongly in absolute and relative terms.

More importantly, our longs typically have valuation support and strong balance sheets, which has provided protection against duration sell-off and concerns around increases in funding costs.

What are we doing in this volatile environment?

Whilst it is pleasing to have generated strong performance over the last twelve months, we are not resting on our laurels.

If the past two years have taught us anything it is to keep an open mind and continue to reassess all views both at a macro and stock-specific level.

We continue to spend our time on bottom-up research, including getting monthly updates from supply-chain participants, unlisted companies and our investment companies, looking for lead indicators on inflation trends.

These calls and research gave us good insight into the inflationary pressures six months ago, before they showed up in the public data figures. We will respect the lead indicators which indicate any slow-down in growth or material deceleration in inflation.

The volatility in individual stock prices is also throwing up some opportunities. We have covered some of our shorts of higher quality but expensive companies as the share prices of these companies have overshot on the downside.

However, we still maintain our short exposure to the names that we consider low quality and where we see considerable further downside.

On the long side, we have been sharpening our pencils on some of the higher-quality names which are getting sold off as the market throws the baby out with the bathwater.

Valuing high-multiple stocks – is value emerging?

As mentioned above, we have been continuing to assess opportunities to lock in gains on some of our shorts and buy quality growth companies that have seen steep share price declines.

Seeing a quality company fall ~20%, the natural inclination is that the stock must be reflecting better value. This is true in a relative sense but whether the stock is in fact representing attractive value requires more work.

One thing we are seeing in the market at the moment is analysts and investors calling out stocks as being good buys merely due to the fact that the share price has fallen ~20-30%.

We are seeing lots of comments along the lines of stock x has fallen ~30% and thus it has priced a lot of the rising interest rate concerns in. We are also seeing stock multiples being compared to the average trading multiple of the last ~2 to 3 years.

In our view this is a risky way to assess whether a company reflects good value.

Anchoring share prices to where they have come from asserts that the share prices resembled fundamental valuations before the fall.

Similarly, comparing relative multiples to where stocks have traded on average over the past few years suggests that those multiples are an appropriate comparable moving forward. This reminds us of a variant of an old story:

A man comes home from the markets with a dog. He proudly tells his wife that he bought this dog for $30,000. Of course, his wife was stunned and asked him why he paid so much for the dog. He retorts proudly: “It’s a great deal, this dog was selling for $50,000 two weeks ago.”

The big issue we have had with this over the past few years is that interest rates have been at or very close to zero. In that context, we can fully understand why some of the “quality” growth names have seen trading multiples re-rate significantly.

Another reason why we think valuations got to such elevated levels is the increase of money flowing into passive. Take Afterpay (APT) for example.

It entered the ASX 20 in December 2020, which resulted in a wave of passive buying (this passive buying coming in after the share price had risen from $29.11 12 months earlier to $111 the day it entered the ASX 20 index).

Now, its adjusted price is $55 and there will be passive selling as it leaves the various indexes as the share price falls. Sounds counter-intuitive, but that is passive for you!

An example of investors buying the dip too early, in our opinion, is REA Group. If we look at the one year forward PE over time, you can see that the multiple has fallen over the past ~6 months from 65x to 45x – clearly a large de-rate.

This has in part been due to solid earnings growth but also a material share-price fall. If we take the chart back a bit further, however, the stock is still well above its average PE from 2013-2020. If interest rates and discount rates do continue to rise, will the REA PE continue to de-rate?

There are a number of times over the past ~10 years where the REA PE has been significantly lower than where it is today despite 10-year bond yields being lower than where they are today. (Source: Factset)

One other observation to make is that despite bond yields increasing, we have yet to see many sell-side analysts downgrade company valuations due to increasing discount rate assumptions.

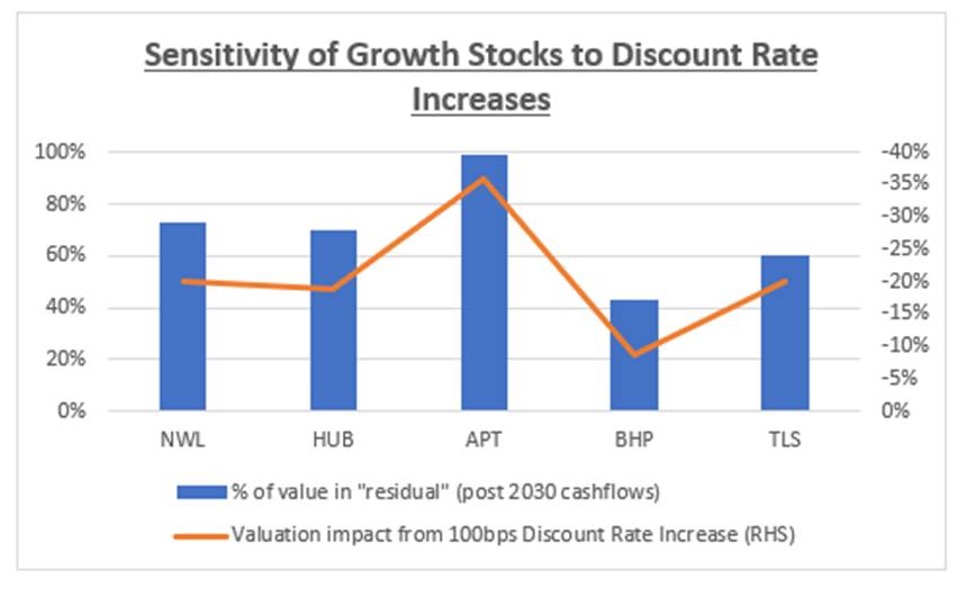

Below is a chart reflecting some work we did mid last year looking at the impact that higher discount rates had on a few select companies.

We were trying to work out two things.

Firstly, what the impact on a company’s DCF valuation would be if we increased the discount rate by 100bps. Secondly, we wanted to compare what percentage of analysts’ DCF valuation was in the residual value (ie. cashflows discounted from 2030 onwards).

The analysis on APT was pre the Square merger. Comparing APT to BHP for instance is interesting. A 100bps increase in a discount rate would negatively impact BHP’s valuation by 16% but hits the APT valuation by a whopping 36%.

This can be explained by the fact that almost 100% of the valuation for APT is from cashflows post 2030. We find this odd given how quickly things become obsolete in the technology sector. (Source: Perpetual analysis)

Whilst we continue to assess the opportunities in these high-quality growth companies, we are not yet seeing attractive valuations in many of them.

Conclusion

After a few months of volatile market moves dominated by macroeconomic concerns, we have found some great opportunities come out of reporting season. Operating conditions for a lot of companies remains challenging despite generally solid demand conditions.

Pressures around supply chains, managing inflationary pressures and weather will all be in focus. Our view in times like these is that strong business models, healthy balance sheets and good management teams excel.

As always, we will focus our attention on earnings quality and look for opportunities, both on the long and short side, where the market is overly focussed on short term earnings drivers.

We feel that this shift in narrative towards increasing inflation and interest rates should continue for most of the year.

This should prove to be a tough environment for both bonds and equities but, more specifically, long-duration equities like non-earnings-generating tech companies. However, we will keep an open mind.

What if negative real wage increases, combined with less fiscal stimulus and higher interest rates saps the confidence out of the consumer and we have a global recession in 2023 or 2024?

While this is not our base case, this scenario cannot completely be discounted. We could be back to where we started. Therefore, one needs to be careful about consensus macro views. We will need to keep on top of this from a portfolio risk management perspective. However, for the time being, we are seeing some great opportunities both on the long and the short sides.

2 topics

5 stocks mentioned

1 fund mentioned