Sour milk now tasting sweeter?

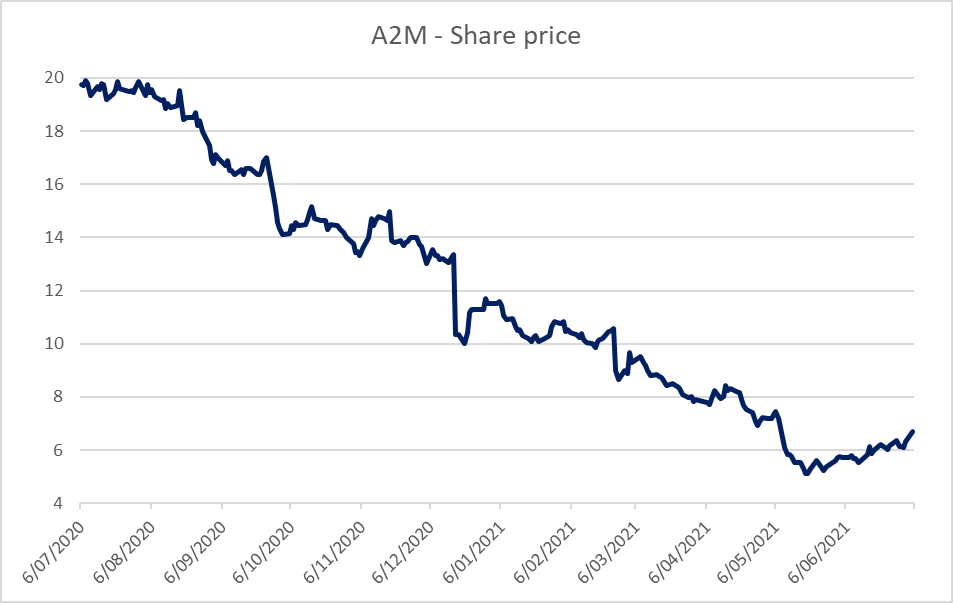

The A2 Milk share price has seen one-way traffic since its full-year result in August last year, down 75% before basing out in May.

Whenever we see a great brand cop a hiding like this, we get excited (as long as we don’t own it!). Successful brands are difficult and expensive to build, but most importantly tend to have enduring value. There can be many reasons for a brand’s near-term profit to fall, but the key is to determine whether these issues are permanent or transient.

In this wire we aim to

identify the reasons for A2M’s share price collapse and make some judgement on whether it's time to buy.

Ref: Bloomberg

Supply – a big part of the problem

A2M experienced volatile demand in 2020 because of COVID-19. Firstly, demand spiked as Chinese consumers panicked and filled their pantries. Later, as pandemic concerns eased, consumers started to work through their personal inventories and demand quickly eased.

This sort of volatility can be difficult to manage, but nonetheless we think A2M did a poor job of it. A2M management (now gone from the business), did not adjust supply to match slowing demand signals from its usual trusted wholesale customers. Instead, it pushed excess supply into new channels and customers that were not properly developed. The result was a market that was saturated with inventory, a large amount held by parties that A2M did not know and ultimately could not trust. These parties attempted to clear the inventory in discount channels, thereby reducing the profitability for A2M’s trusted partners. The ultimate effect of this ‘channel loading’ saw A2M’s FY20 revenue overstate true demand.

Coming down the other side of the mountain, FY21 revenue has been notably smaller, and the cause of the share price collapse. The incoming CEO has purposefully held back sales to allow excess inventory to clear and channel economics to recover. Our industry sources suggest that A2M elected not to participate in recent key selling events on Chinese e-commerce platforms. As such, FY21 revenue is likely a poor indicator of the true sales base and under-represents real demand for the brand.

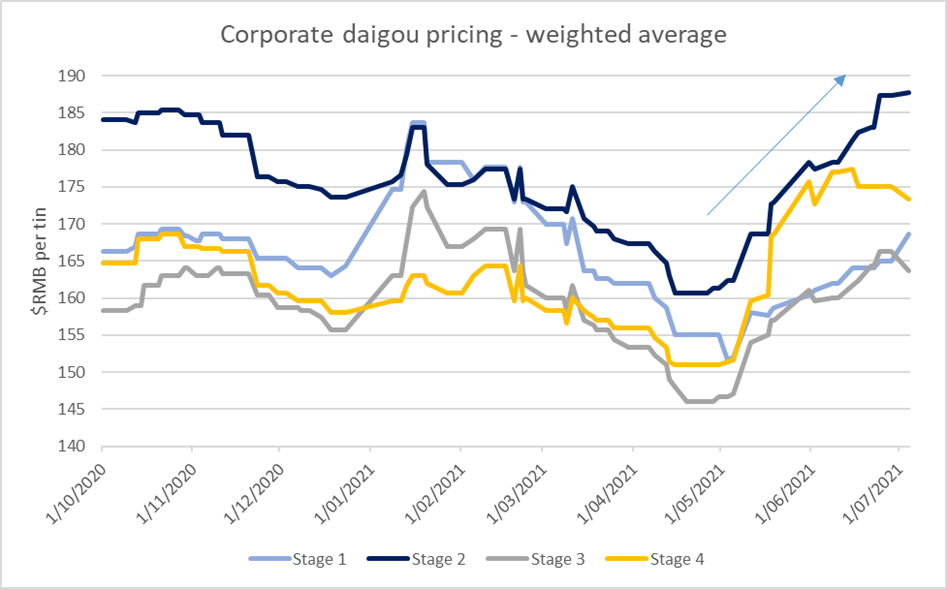

A key point of optimism, and an essential factor

for investment in A2M, is the following price chart for a2 Platinum infant

formula. This price recovery tells us that the oversupply may be nearing resolution. As such FY22 revenue is more likely to reflect true demand.

Ref: CLSA, 1688.com

Demand – appears to be holding up better than some might think

Underlying demand and brand health are important factors to assess for any consumer company experiencing distress. This can be difficult to determine when revenue is volatile, but ultimately comes down to what the end-customer (the mother) is buying. If the product is still in demand by mothers, supply issues can often be managed.

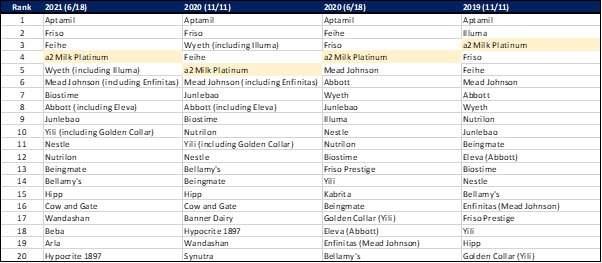

Below is a table showing the results of major

Chinese sales events over the last 24 months, the most recent in June 2021. As can be seen, the a2 Platinum brand has

maintained a strong position despite disruption in its supply chain. While this

data is indicative rather than conclusive evidence of brand health, it is a reassuring sign.

Ref: CLSA, Maternal Research Institute

While consumer preference is one factor influencing demand, the size of the potential market (or TAM) is also a factor. A decline in China’s birth rate in recent years has been a headwind impacting all infant formula producers. Because a2 Platinum has been gaining market share for several years, the impact of the birth rate has not been noticeable in reported revenue. However, as the brand matures it may become more important. While the Chinese Government is introducing policy for birth rate recovery, it is likely to remain a head-wind in our view.

Another headwind for a2 Platinum demand over the past 12-months has been the impact from restrictions to international travel. We estimate historically around 20% of A2M revenue came from ‘retail daigou’, who are Chinese students or travellers who send products back to family and friends. With COVID-19 restrictions, this part of A2M's customer base has all but disappeared. While this demand is unlikely to return to previous levels, a resumption of international travel could be incrementally positive. In the meantime, A2M management is employing strategies to see end-demand fulfilled via other channels.

China politics – Is this a risk for A2M?

The first point to remember here is that A2M is a New Zealand company reporting in NZD. 100% of its infant formula is manufactured in the South Island by Synlait Milk, which is also a New Zealand entity.

New Zealand is a ‘western country’, so it will not be helped by China’s Self-Sufficiency policy, a program to promote Chinese domestic enterprise. However, New Zealand PM Jacinda Ardern, has kept NZ out of Chinese related politics, so we see less risk of A2M or any other NZ company experiencing the intentionally disruptive treatment that some Australian companies have experienced.

We see little point in the Chinese government picking a fight with NZ farmers while they own significant milk processing capacity in NZ that needs milk feedstock to operate.

Also important in this discussion is the way A2M integrates with Chinese partners and industry. A2M’s sole infant formula producer, Synlait, is 32% owned by Bright Dairy, of which the Chinese government has a 52% holding. China State Farm, a Chinese State-owned enterprise, is the exclusive import agent for A2M’s infant formula products into China. China State Farm is also a 25% investor in A2M’s newly acquired Matuara Valley manufacturing facility. Given these Chinese Government investments in manufacturing capacity are intrinsically linked to the success of the a2 Platinum brand, we see it unlikely it will obstruct the licensing of those facilities.

Time to get long

We have recently made an investment in A2M based

on improving supply/demand data and our view that the a2 Platinum brand continues

to resonate strongly with Chinese mothers. While there are some risks around

market size (declining birth rate), and recovery timeline for Chinese travellers

(daigou), these are palatable risks when the stock is trading at such a

significant discount to prior valuations.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

1 stock mentioned

.jpg)

.jpg)