Spotlight on the highest-yielding LICs and LITs

LICs and LITs can offer investors an attractive income stream through exposure to a range of investment classes.

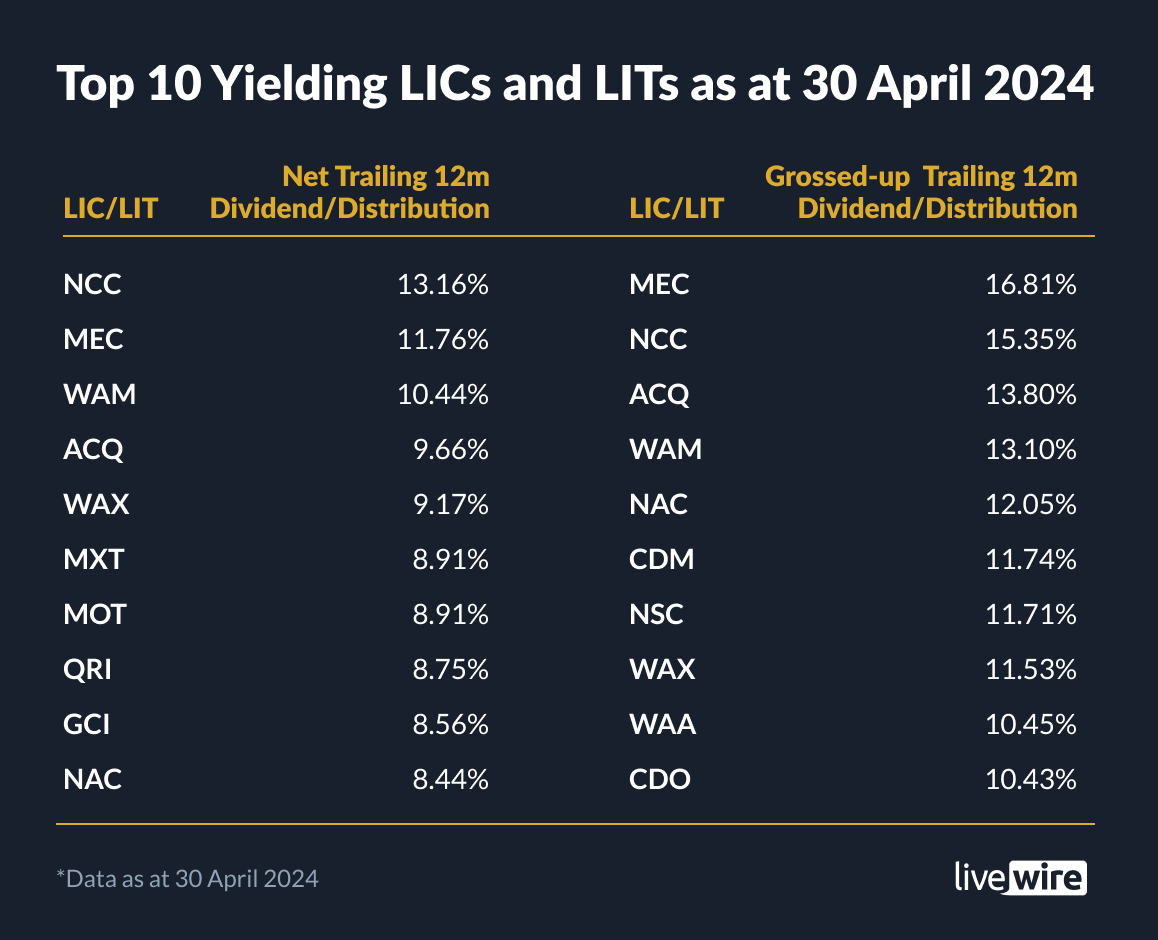

Below we take a look at the top 10 yielding LICs and LITs based on the trailing 12-month dividend/distribution yields as at 30 April 2024. We look at the highest-yielding LICs and LITs on both a net and grossed-up basis, as we know that franking credits are important to some investors.

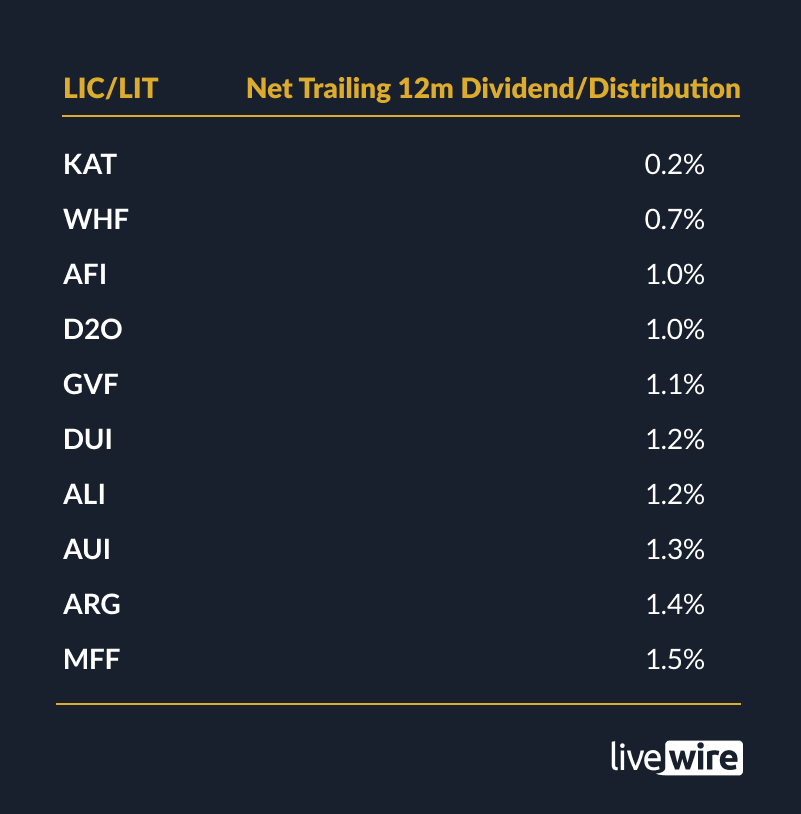

It’s not all about the size of the yield, however. Consistency is also an important factor for investors. As such, we also take a look at the 10 LICs and LITs with the lowest levels of volatility in dividend/distribution yields over the three years to 30 April 2024.

Top 10 Yielding LICs and LITs

The top 10 yielding LICs and LITs include companies and trusts that provide exposure to a range of asset classes and investment strategies. The highest yielding LIC/LIT on a net basis was Naos Emerging Opportunities Company Limited (ASX: NCC), which provides exposure to a concentrated portfolio of listed and unlisted microcap companies. Over the two years to 30 April 2024, NCC’s share price has declined 44.7% on the back of the substantial decline in the NTA. During this time, the company has maintained the semi-annual dividend of 3.75 cents per share, resulting in an elevated yield. While the company has maintained the dividend, the franking account has been exhausted which has seen the last four semi-annual dividends being partially franked. This is why the company does not have the highest grossed-up dividend/distribution yield.

One of the differences between a LIC and LIT structure is a LIC can retain income and realised capital gains to payout at a future time determined by the company. This means the company has the ability to smooth the dividend stream. This compares to LITs which are required to payout the income and realised capital gains for any given year. This can result in increased volatility in annual distributions.

When considering a LIC it is important to consider the level of dividend coverage in the retained earnings and reserves as well as the franking account if fully franked dividends are of importance. If these are exhausted this will result in an increased risk to dividends. A number of LICs/LITs in the top 10 table below have elevated risks regarding dividends/distributions.

There is elevated risk associated with WAM Capital Limited's (ASX: WAM) dividends, with the company having a low level of dividend coverage. The franking account has been exhausted, which has resulted in the most recent semi-annual dividend being partially franked.

While Morphic Ethical Equities Fund Limited (ASX: MEC) had one of the higher yields as at 30 April 2024, the company has exhausted its franking account which resulted in a significant reduction in the quarterly dividend that went ex in May. This is expected to impact the amount of dividends paid in coming quarters, therefore the yield below does not reflect the expected future yield.

It’s also important to understand the dividend policy as this may impact the dividend yield. For example, Acorn Capital Investment Fund Limited’s (ASX: ACQ) dividend policy is to pay out at least 5% of the closing post-tax NTA for each financial year. The decline in the post-tax NTA resulted in a 35.3% decline in the semi-annual dividend that went ex in May and therefore the dividend yield in the table below may not reflect the dividend yield moving forward.

Four of the top 10 yielding LICs and LITs on a net basis as at 30 April 2024 were fixed income LITs. Three of the four fixed income LITs, Metrics Master Income Trust (ASX: MXT), Metrics Income Opportunities Trust (ASX: MOT) and Qualitas Real Estate Income Fund (ASX: QRI) provide exposure to private credit, while Gryphon Capital Income Trust (ASX: GCI) provides exposure to a portfolio RMBS and ABS.

The fixed income LITs have benefited from the increased interest rate environment with all four fixed income LITs having a floating rate target yield. With the LITs exposed to predominantly floating rate securities, the distribution yield will be influenced by the RBA Cash Rate.

LICs and LITs With Lowest Yield Volatility

The below table shows the 10 LICs and LITs that have had the lowest volatility in the trailing 12-month distribution/dividend yield on a rolling monthly basis over the three years from 30 April 2021 to 30 April 2024.

Katana Capital Limited (ASX: KAT) had the lowest volatility in the dividend/distribution yield over the period with the Company paying a quarterly dividend of 0.5 cents per share for the three-year period. While KAT had the lowest dividend yield volatility, it also had the lowest dividend yield of the LIC/LIT universe as at 30 April 2024.

Despite the volatility in the share price, the consistency of the dividends paid by Whitefield Limited (ASX: WHF) and Australian Foundation Investment Company Limited (ASX: AFI) has seen these two LICS also having a low level of yield volatility.

In summary, it’s important to lift the lid with regards to yields, as the yield itself does not present the full story. Investors should make sure they first understand the structure as company and trust structures provide different outcomes for investors and can impact the level of volatility of dividends/distributions.

For LICs, investors should take into consideration the level of both dividend and franking coverage to determine the potential risk to future dividends. Investors should also make themselves aware of a LIC's dividend policy. For example, some LICs seek to pay a dividend that represents a percentage of the NTA while others seek to only pay fully franked dividends and as such even though they may have the capacity to maintain the dividend will cut dividends if the franking account is exhausted. Finally, while it's important to look at volatility and potential volatility in dividends/distributions, it is important to make sure the yield is going to be sufficient to cover an investor’s needs.