Steady as she goes for Transurban, even with a new CEO on the way

Everyone needs a couple of stocks in their portfolio that they can set their watch to. Names that are metronomes of consistency. Names that, regardless of the broader market conditions, can be trusted to deliver.

In Australia, Transurban (ASX: TCL) is one of the names that fulfill that definition. We all need to drive, we all need to get places quickly and efficiently, and in many cases there simply aren't any substitutes.

Add to the mix the fact that toll road price increases are linked to inflation and you've got a pretty rock-solid formula for revenue and profits.

Not even a new CEO is cause for concern, according to Magellan's Ofer Karliner, who described TCLs results as follows:

The result was solid, and the outlook is good. The CEO's changing but, importantly, the successful strategy that Scott's [outgoing CEO] put in place is unchanged, so that's quite important going forward.

In the following wire, Karliner further unpacks the results and provides an outlook on the stock, sector, and market more broadly.

Note: this interview took place on Wednesday 16 August 2023.

Transurban (ASX: TCL) full-year key results

- Proportional EBITDA A$2.45B

- Toll Revenue A$3.31B

- Free cash flow A$1.73B

- Final distribution 31.5cps

- FY24 guidance:

- 62 cps

- FY24 distribution likely to include WestConnex cash previously held during construction. Expected to contribute ~3-4 cps

- Some further benefits of FY23 inflation will continue to flow through FY24 revenue and will compound over time

- FY23 record traffic and EBITDA provides solid base for continued growth in FY24

TCL ranks #7 overall and in the top 10 for effectiveness of CEO (10), leadership depth (10), earnings quality (7), value (7), clarity of strategy (3), growth prospects (7), quality of strategy (3), and sustainable competitive advantage (5) via MarketMeter research.

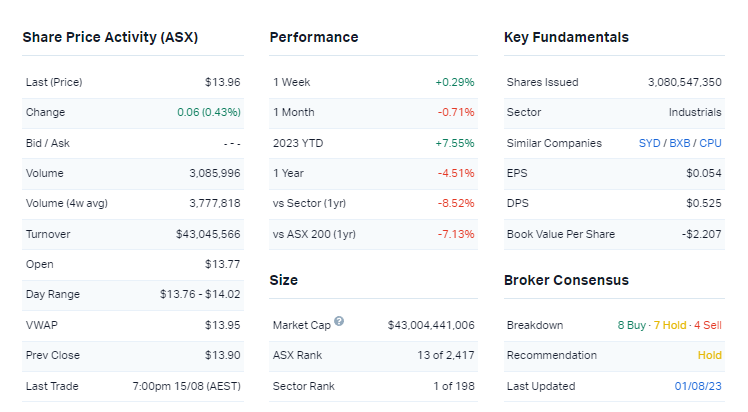

Key company data for TCL

In one sentence, what was the key takeaway from this result?

The result was solid, and the outlook is good. The CEO's changing but, importantly, the successful strategy that Scott's [outgoing CEO] put in place is unchanged, so that's quite important going forward.

TCL is down 0.8% on the day. In your view, was it an overreaction, an under-reaction, or appropriate?

Rating: Appropriate

I think it's probably about right, it's in line with the market as a whole. So, it was a solid result, basically in line with expectations. Trading in line with the market is probably fair.

Were there any major surprises in this result that you think investors should be aware of?

So, there's a CEO announcement, I wouldn't call it a surprise they were going to make the announcement at this result. Michelle was the leading candidate. The only surprise was the fact that we haven't had an internal candidate before.

I think that the board's been very good at grooming a bunch of internal candidates over the past four or five years, as Scott has kept pushing out his retirement.

So, they've had plenty of time to work on an internal candidate. It's good to see that happening.

From a traffic point of view, I think traffic is probably a bit weaker in Sydney than I would have expected and there are some roadworks impacting that and people moving back to public transport.

Overall, the numbers were broadly in line [with expectations] across the portfolio. In the US they shot lights out, Brisbane is strong.

Would you buy, hold or sell TCL on the back of these results?

Rating: HOLD

It's still one of our biggest positions and I think that nothing in this result is going to change that, it's still a very solid underlying business, very low risk, with traffic continuing to recover. There is also a lot of option value that is starting to materialise, through things such as the M7 widening [in Sydney].

What’s your outlook on TCL and its sector over the year ahead? Are there any risks that investors should be aware of?

For TCL, we're obviously very positive on it and it continues to see good inflation pass-through and good traffic recovery.

The inherent option value in things like the M7 is good but there are $10 billion dollars of potential projects in the next five years that they could bring to market. So, huge option value in there.

A lot of those are uncontested, in so far as no one else can widen a road that you own, so there are very low-risk type expansion projects there.

The key risk is probably around interest rates. I think we've probably peaked, or we're near peak, but to the extent you see interest rates jump, historically, we see what we call a "sticker shock effect," where long-duration stocks tend to get hit. This kind of ignores, a little bit, the fact that TCL actually benefits from short-term inflation spikes, which they talked about.

The cost of debt has barely moved, it's gone from 3.9% to 4.1% over the year, yet revenues have gone up, on average, around 7% off the back of toll increases linked to inflation, so you actually benefit from that. So, there are reflexive downgrades you get to see when you see interest rates increase, which probably isn't fair but that's a buying opportunity for us. But it does tend to create volatility risk in the stock.

As for the sector as a whole, there are three companies that we look at, or we consider to be infrastructure in Australia - APA Group (ASX: APA), Atlas Arteria (ASX: ALX), and Transurban. The sector as a whole looks cheap, as we see it.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

We're global investors and we cover three stocks in Australia, but the Australian sector would be rated 2.

More broadly, I have 130 stocks, given how we define infrastructure, and the sector as a whole is probably a 2. Again, there are quite a few very cheap stocks out there and a few things that are trading at fair value, and a couple of expensive stocks but, overall, probably cheap.

10 most recent director transactions

3 topics

3 stocks mentioned

1 contributor mentioned