Stocks, bonds, gold: this is what to expect after US presidential elections

It’s finally here: Trump versus Harris. The 2024 US presidential election. If all goes well (wow is this a big assumption under the present circumstances!), sometime within the next 48-72 hours we should have a pretty good idea of who is the winner in one of the closest run presidential races in recent memory.

For investors, the outcome of the US presidential election is less about red or blue, and more about how the outcome will impact markets. Stocks, bonds, gold – this article aims to help answer this exact question. Thanks to the latest research from major broker Citi, we now have a potential roadmap of what to expect from these asset classes over the next 12-months.

How does gold perform after US presidential elections?

Let’s kick off with Gold. Gold is the age-old hedge against uncertainty, and therefore it potentially has the most to gain or lose following the resolution of such a major global risk event. This potentially explains gold’s tendency of dipping in the short-term periods immediately following U.S. presidential election results.

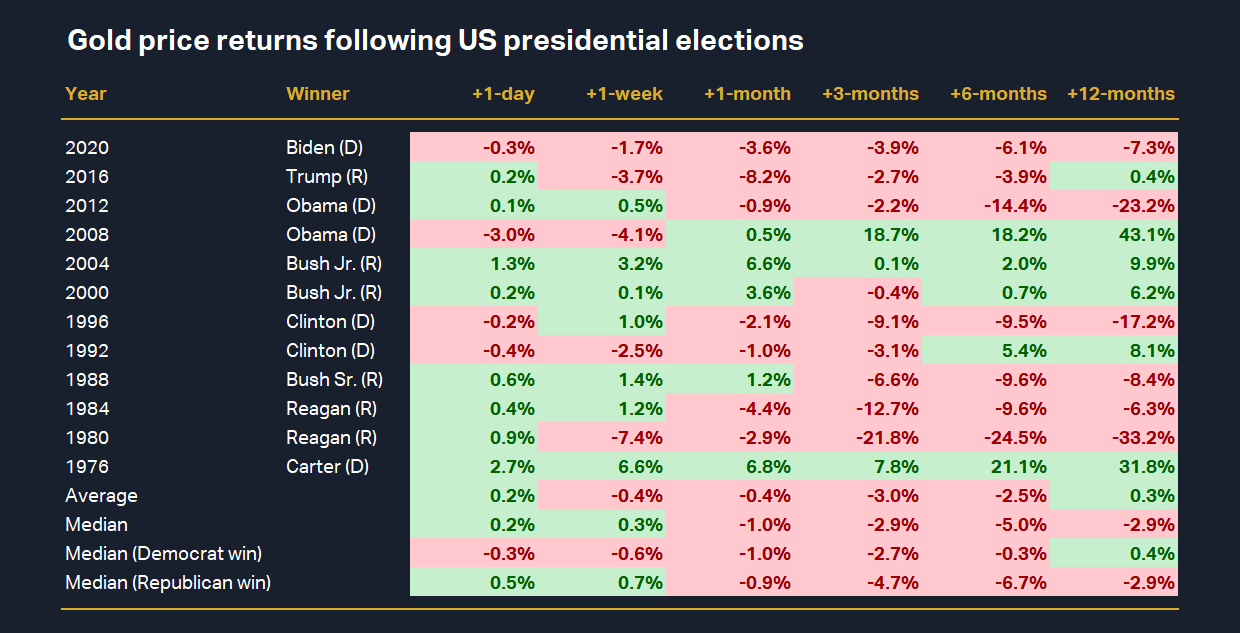

Citi points out data in the post-Nixon era (approximately the last 50 years) that demonstrates in the immediate days and weeks post-election gold tends to fall. Gold’s 1-week return post elections since 1976 was -0.4%, and it was also down by around this much after 1-month. Within one day of the election it was up 0.2%, however.

If we consider more recent elections only, that is over the last four election cycles since 2008, 1-day returns turn negative at -0.8% and 1-week and 1-month window returns grow to -2.2% and -3.1% respectively. If similar returns were to occur this time around, suggests Citi, it could present investors with “dip-buying opportunities”.

We’ll discuss Citi’s medium-term gold target and overall stance in a moment, but for now it's worth noting their views on the widely held assumption that gold is one of many “Trump Trades”. This is not necessarily the case, opines Citi, noting that gold has been moving to the beat of its own drum as the lead/deficit of Trump over Harris in the polls has swung wildly this year.

The broker agrees that a Trump win, followed by the implementation of his proposed tariffs would likely be “bearish for US growth and like in 2019 will see increased gold asset allocation and higher gold prices”. However, Citi also sees a potential scenario where President Trump undertakes greater fiscal austerity, therefore helping the US dollar and by extension hurting gold.

Taking all of the relevant factors into account, Citi concludes the “knock-on impact” of this US election “looks negative on gold”. Investors should be tuned to buy into any gold price weakness the US presidential election result presents, however, suggests Citi. The broker cites non-election related factors such as the continued deterioration in the US labour market and rising ETF demand as key reasons for maintaining its overall bullish stance on gold.

Citi’s 6-month target for gold, which has been in place for several months now, is US$3,000/oz, approximately 10% higher than the current price of US$2736/oz. Longer term, Citi points out structural drivers that will likely continue to support the gold price, including the ballooning global debt burden, a rising preference for alternative fiat options as nations reconsider their reliance on the U.S. dollar, as well as other "de-dollarization trends".

Momentum appears to be on gold’s side, suggests Citi. History shows that when gold experiences a calendar year gain of more than 20% – as it has in 2024 (up 33% year-to-date) – it often carries over into the following year with an average return of 15.4%. The sole exception in recent history was during the pandemic period, where gold’s robust 25.1% rally during the uncertainty of 2020 was followed by a modest decline of 3.6% in 2021.

How do stocks perform after US presidential elections?

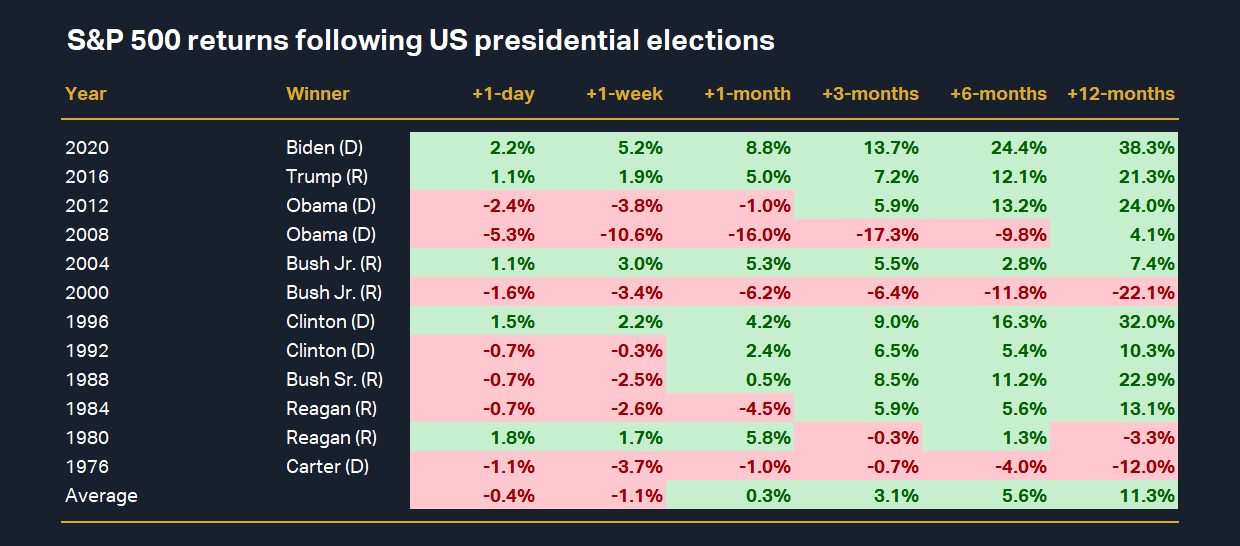

Gold’s typical underperformance following the resolution of a US presidential election appears to be the stock market’s gain. Literally. Unlike gold, stocks hate uncertainty – so as the market’s appetite for risk improves in the wake of an election – equities tend to rally.

This rotation from risk-averse to risk-loving assets likely reflects an anticipation of economic stability or fiscal growth policies that tend to make owning stocks more attractive. For example, in the context of a Trump victory or more specifically a "red wave" which markets widely view as favourable for business, growth, and therefore corporate earnings.

The data from Citi’s research points to strong gains for stocks as represented by the S&P 500 in the weeks and months following US presidential elections, with only 1-day and 1-week period following the election showing negative returns. Since 1976, the S&P 500 has on average risen a very attractive 11.3% following a US presidential election result.

How do bonds perform after US presidential elections?

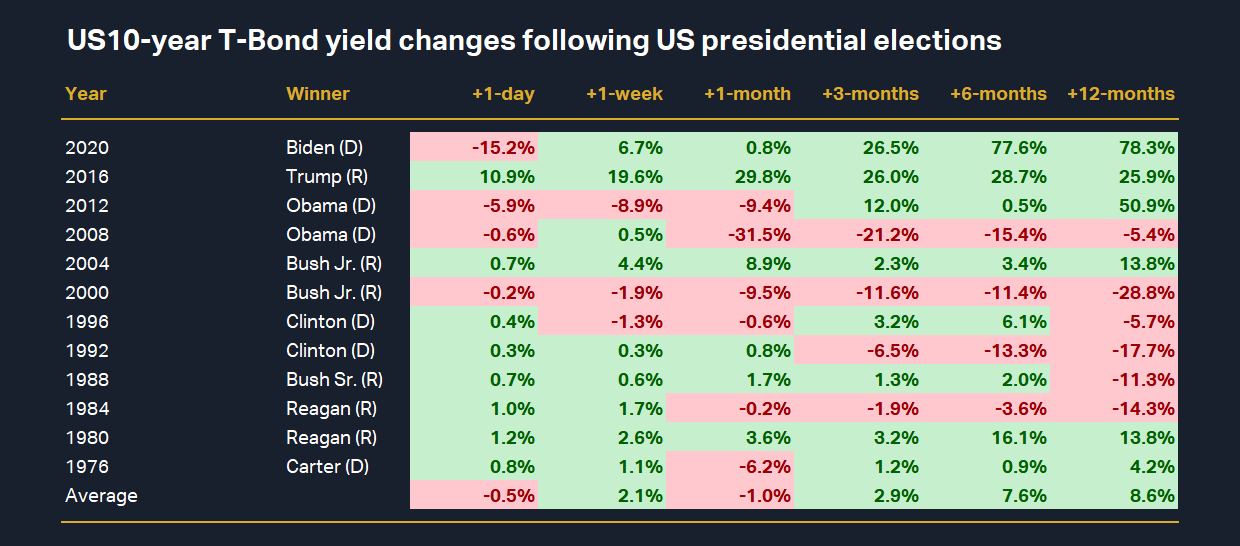

Bonds are typically seen as more of a defensive asset class than stocks, but generally less so than gold. With respect to US bonds, bond prices tend to rise when the outlook is for a weaker US economy and therefore generally lower interest rates. Conversely, the prospect of a strong US economy and accompanying higher interest rates tends to result in weaker bond prices.

Given that bond prices are therefore more closely tied to interest rates, which is the monetary policy domain of the independent US Federal Reserve – and not fiscally or US government-dependent – the relationship between US presidential elections and bond performance is less clear than it is for gold or stocks.

Citi's data shows that the yield on benchmark US 10-year Treasury Bonds (“T-Bonds”) tend to be volatile in the shorter term periods following a US presidential election, but tend to rise between 3- and 12-months afterwards. This trend appears to reaffirm the link between election results and economic growth related policies.

Conclusions

Citi’s research is based on the performance of each asset class after US presidential elections over the last 50 years. As with all research based on historical data, there is no guarantee that a pattern – no matter how seemingly well entrenched – will occur again even under the same circumstances.

Still, it is always better to be forewarned on the types of trends we have discussed here, as this allows us as investors to plan our strategies for the range of potential outcomes.

The data presented here suggests that gold has usually underperformed in periods up to 1-year following US presidential elections. Note however, Citi believes this year will be different as the gold price will continue to be supported by several economic and structural factors.

The data also implies that stocks could be set for another robust performance over the next 12-months, while the performance of bonds is likely to be mixed in the short term, but for bond yields, ultimately positive over the same period.

This article first appeared on Market Index on Tuesday 5 November 2024.

5 topics

12 stocks mentioned