Stocks that "beat and miss": How they perform today and after the report

Let's start with how the "beats and misses" fared during the August 2023 reporting season.

How they went last time - August 2023 - beats/misses/inline results

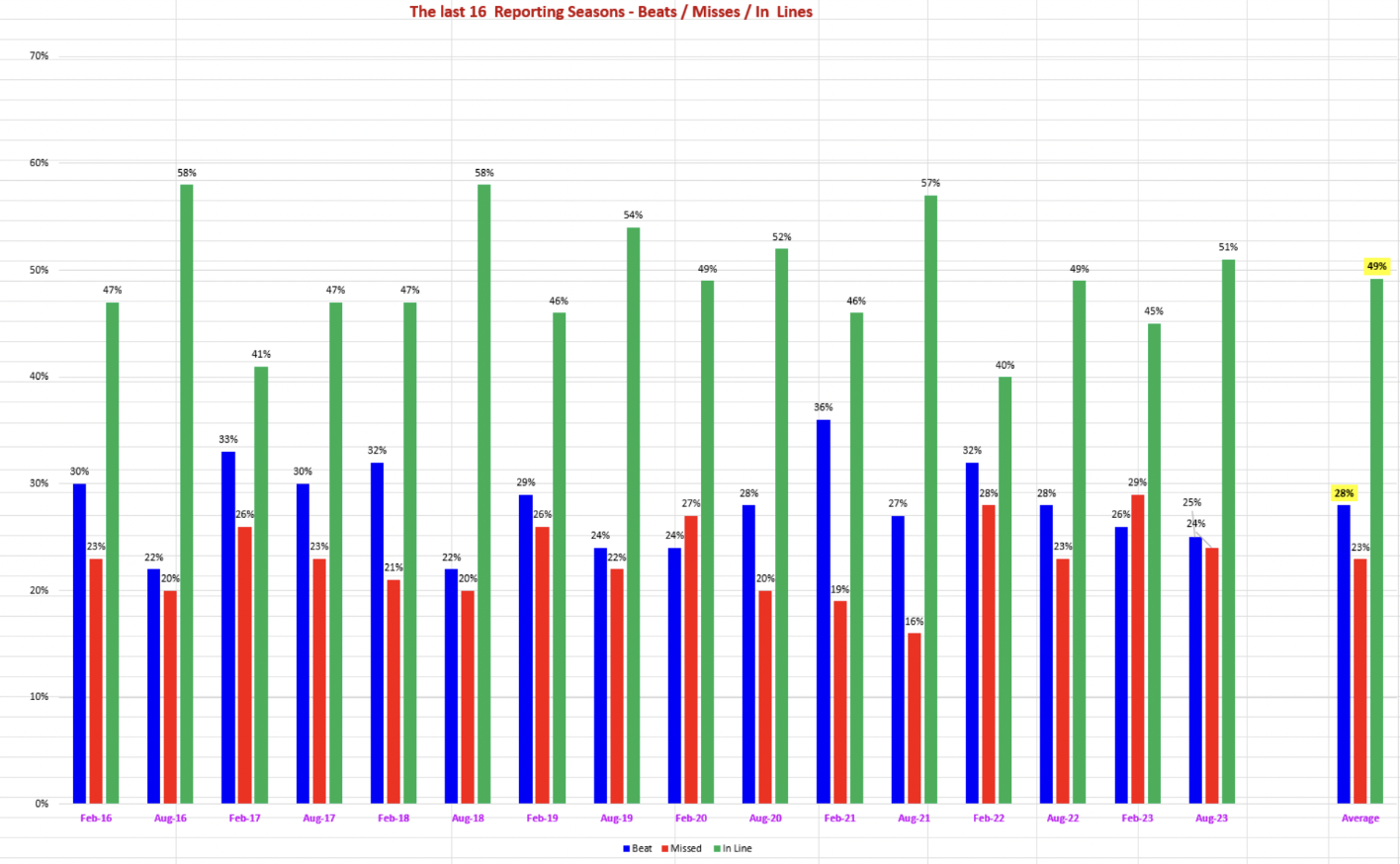

Beats were a bit lower versus the average of the last 16 reporting seasons at 28% vs the 8-year average in August 2023 at 25%. The misses were 24% vs the 8-year average of 23%.

In the last 8 years, we have not seen three consecutive falls in ASX 200 in the reporting season. So maybe it will go up in February 2024?!

Interestingly of the last 16 reporting seasons, the market has been down 8 times (or 50% of the time).

During the last 16 reporting seasons, earnings beats have occurred approximately 28% of the time, misses happened around 23% of the time, while in-line results occurred half of the time.

How stocks moved on the day they reported – August 2023 reporting season

Did they follow the same pattern as the previous 15 reporting seasons?

- Beats: +6.8% (performed well)

- Misses: -7.3% (performed poorly)

The average moves in the last 16 reporting seasons

Also of interest, in the last reporting season (August 2023), the "Beats" (as they do almost every time) had a “lower short interest” at 1.6% vs the Misses which are only slightly higher at 1.7% this time.

What happens over the next four months?

As a group, the Beats have outperformed the ASX 200 four months later 87% of the time (that is, during 14 out of the last 16 reporting seasons).

Companies with earnings Beats, four months later

In the last 16 reporting seasons (blue bar) and then the purple bar shows where the ASX 200 was as a comparison.

The Misses

During the last reporting season (August 2023), the MISSES were down by an average of 7.3% on the day - and four months later, were down another -0.9%. In total, four months later, companies with earnings misses generally fall a total of -8.2% since reporting (versus the ASX 200, which was up +1.7% four months later).

Chart showing the last 16 reporting seasons - Day one move and then where they were four months later

Chart showing the earnings misses, 4 months later

In the last 16 reporting seasons, misses (yellow bar) and then the ASX 200 (iron red bar). The Misses were on average down -7.9% four months later. That is significantly underperforming the ASX 200, which was up +0.5% at the same time.

So you buy the stocks that are up on day one (or more importantly, don’t sell them after a big move to the upside (shorts will need to cover over the next few weeks). A "beat or "miss" may look like a good guide but more importantly, you sell the stocks that go down on day one - ASAP.

Get more insights from the insto desk in the Coppo report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, Director - Institutional Sales and Trading, Bell Potter. You can find out more here.

You can also stay up to date with the latest news by hitting the ‘follow’ button and you’ll be notified every time I post a wire.

2 topics

1 contributor mentioned