Stocks with further to go

I had an email from a Marcus Today Member this week saying “I know you have said many times that the market is sentiment-driven, but at the moment the US market has broken through its February 2020 highs and the Australian market is only about 7% off the pre-pandemic February top. With businesses collapsing, unemployment rising, global economies suffering, does this make any sense at all that the markets are basically at the same levels as prior to COVID-19?”

The answer is two-fold.

- There is now a lot more money around from stimulus and interest rates are lower, factors which arguably render the February valuation out of date. Plus some of those Big Techs in the US and some of our own pandemic beneficiaries are materially more profitable than they were in February, thanks to the pandemic. So some of it is real.

- I think we all crave certainty and need everything explained, but in the end, the big secret is that the stock market is not predictable and constantly defies logic and science. It is an animal, with ever-changing moods, and the only way we have found to handle it is with constant vigilance, an open-mind, and perpetual flexibility. What you can’t afford to do is defy it, know better, and put your trust in some grand unmakeable prediction. The job is not to be fundamentally right, the job is to make money out of any rally, be it deluded or a scientifically justified.

For the moment the mood could not be better. We are in the grips of a recovery rally which has been sharp and fast. It started with the US election result, it was turbo-charged by vaccine developments. This is an Heikin-Ashi chart of the ASX 200. We have decisively broken out of the sideways trading range we were stuck in from June to early November.

And here are some of the headlines driving the market at the moment:

- The newswires have started to talk about the “Pandemic Peak”.

- The first vaccine jabs are expected to be administered before the end of the year.

- Cases have flatlined in Australia.

- Cases are plateauing in the US.

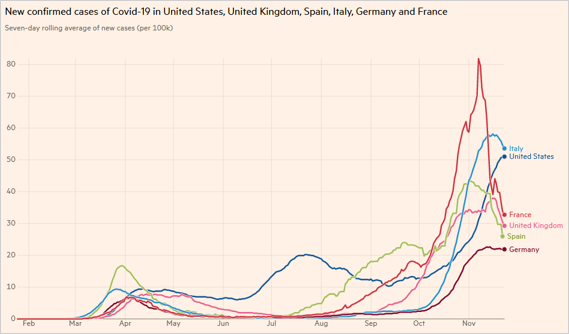

- Cases are plummeting in Europe. This is the Financial Times chart of case numbers in various countries.

- The Dow Jones has gone through 30,000 for the first time.

- The Presidential transition has finally begun, eliminating a lingering risk.

- Oil demand is rising and the oil price and energy stocks are flying.

- A US relief package compromise looks possible if not likely.

- Janet Yellen’s appointment as the US Treasury Secretary has been well received. She is the master of inactivity, which the markets will enjoy.

- The Victorian budget offered positive spending plans with an unavoidable debt hangover.

- NSW opened its borders to Victoria.

- Queensland opened its borders to Victoria.

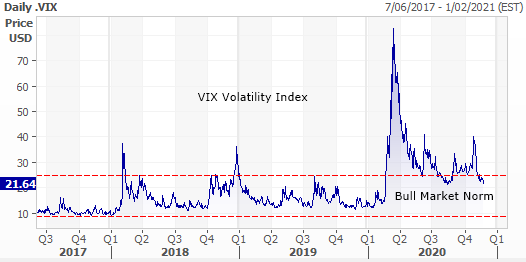

- The VIX volatility index has returned to bull market norms.

I know this rally is going to sober up at some point but for now, it’s exactly what the world hoped for. A recovery rally and the game now is not to deny it, but go with it. To stay fully invested, running with the bulls, until they change direction. There is simply no point in predicting when the market will stop running until it does. Investment is a reaction business, not a prediction business. For now, let's enjoy it. Tomorrow is another day. All you need do is keep waking up and making decisions based on what’s happening, not what you think should happen. It is the best that you can do.

Earlier this week we highlighted some recovery sectors:

- REITs

- Energy

- Insurance

- Travel

- Banks

- Gambling

- Aged Care

- Interest rate-sensitive stocks (benefit from rates rising)

And a couple of sectors doing their own thing:

- Coal stocks

- China exposed stocks

And for the moment the stock market’s pandemic beneficiaries should take the back seat:

- BNPL

- Iron ore

- Resources

- Defensive

- Stay at home

- Consumer Staples

- Healthcare

Now let's drill a bit deeper into the stocks beneath the sectors.

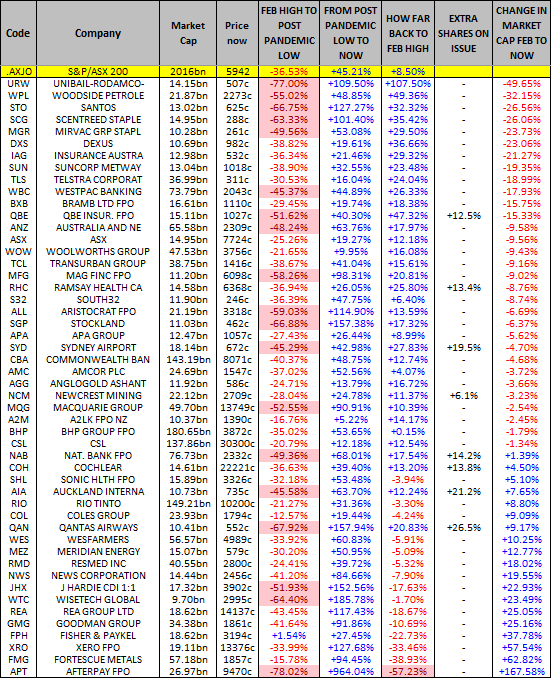

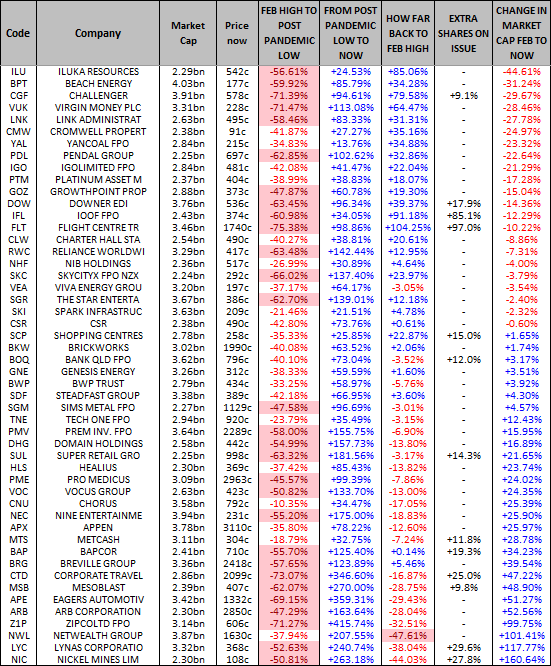

Some of you might remember these tables. We were using them after the initial pandemic inspired sell-off in February to identify the stocks to buy for the bounce in March, April and May. They can now be used to identify the stocks have suffered the most in the pandemic and have the most recovery potential.

The stocks are broken up into sections including the TOP 50, NEXT 50 and the NEXT 100, and within those sections, the stocks are listed in order of how far their market capitalisations (including capital raisings) have fallen since the February high.

As the experienced investors amongst you will know, using a reference point such as the market capitalisation in February, is a pretty poor way to judge future performance, it’s called Anchoring. But it is the best broad brush reference point we have and the stocks with the most recovery potential become obvious.

TOP 50 - the biggest fifty stocks first

This table shows the top 50 stocks by market capitalisation listed in order of how far the market capitalisation (including capital raisings) has fallen since February's pre-pandemic high. So URW, for instance, has seen its market cap fall 49.65% since February which means it has arguably got the furthest to recover and with French and European cases plummeting the recovery is real.

Other obvious recovery stocks are in the energy sector - WPL, STO - the REITs - SCG, MGR, DXS - Insurance - IAG, SUN, QBE - Banks - WBC, ANZ.

You will also see in the right-hand columns whether a stock has issued a significant number of new shares since February 1 and how much their shares on issue have changed. Qantas, for instance, has 26.5% more shares on issue now than it had pre-pandemic. This of course limits the recovery potential and makes the February share price (which has to be re-based for the capital raising) that much harder to achieve. So bear that in mind when reading these blunt numbers.

Updated on 28th November 2020

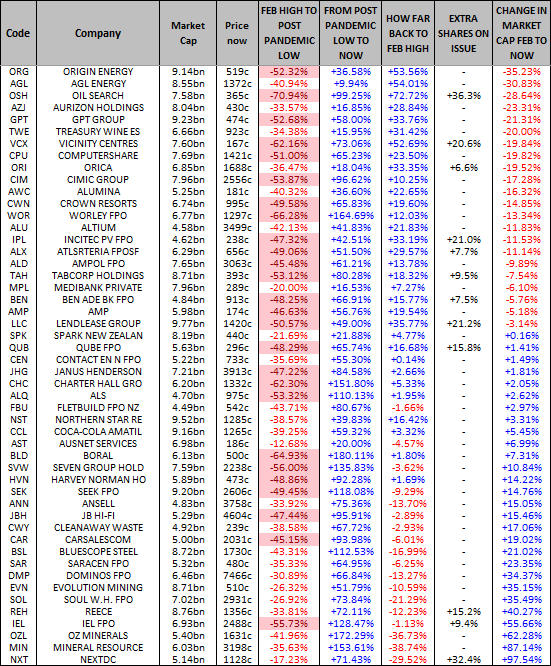

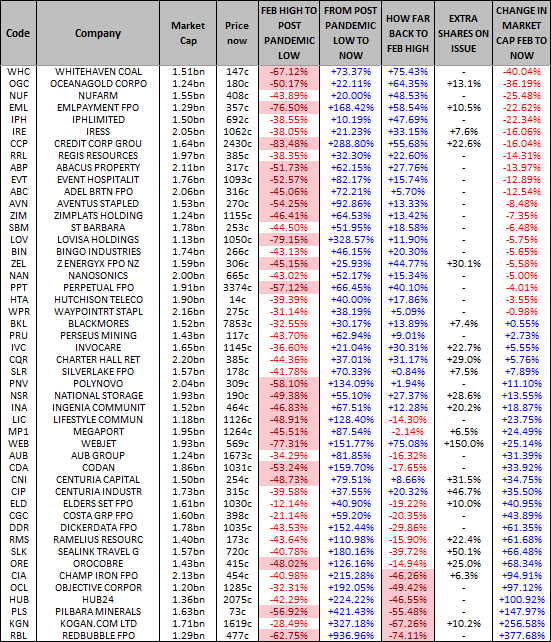

NEXT 50

This is the bottom half of the ASX 100. It suggests OSH and ORG have the most recovery potential with REITs VCX and GPT close behind.

NEXT 50

This is the top half of the bottom 100 in the ASX 200:

NEXT 50 - The bottom quarter of the ASX 200

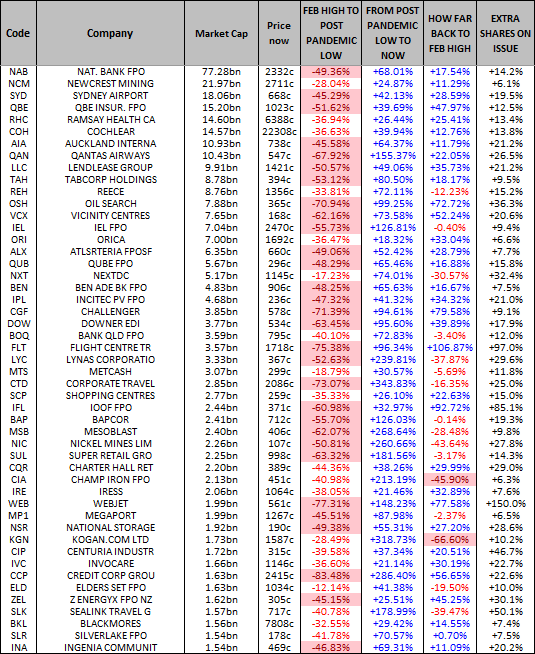

Capital Raisings

Whilst we're talking about capital raisings - 104 companies have had capital raisings since February 1 - here are the top fifty by market cap showing the number of new shares raised:

Access to our exclusive newsletters

We write daily for Marcus Today members, keeping them up to date on our current strategy and stock ideas. To get our next update, sign up for a 14-day free trial to the Marcus Today newsletter – CLICK HERE to get started.

9 stocks mentioned