Straw that breaks the RBA’s back? Does CPI “shocker” guarantee an August rate hike?

By now you would have read or seen various media reports about yesterday’s consumer price index (CPI) ‘shocker’. Mainstream media tend to report on market matters sparingly, so when they do, they might as well get some bang for their buck with respect to alarmist headlines.

Hey, I love clickbait as much as the next word slinger, but let’s dial down the fear mongering and look at what the market and the big brokers are saying about which direction official Australian rates are headed.

Unfortunately, in the cold light of the day after, it does appear both market pricing and broker views are converging on another Reserve Bank of Australia (RBA) hike, but neither indicate it’s a lock.

Market pricing: Cut still more likely than hike

This headline might be the real shocker in this article – and it's certainly not something that has been bandied about in the mainstream media over the past 24-hours (it would be too reassuring for mortgage holders plus downright boring!). But, when we look at market pricing of the probabilities around the next move in the RBA’s cash rate, this is exactly what we find.

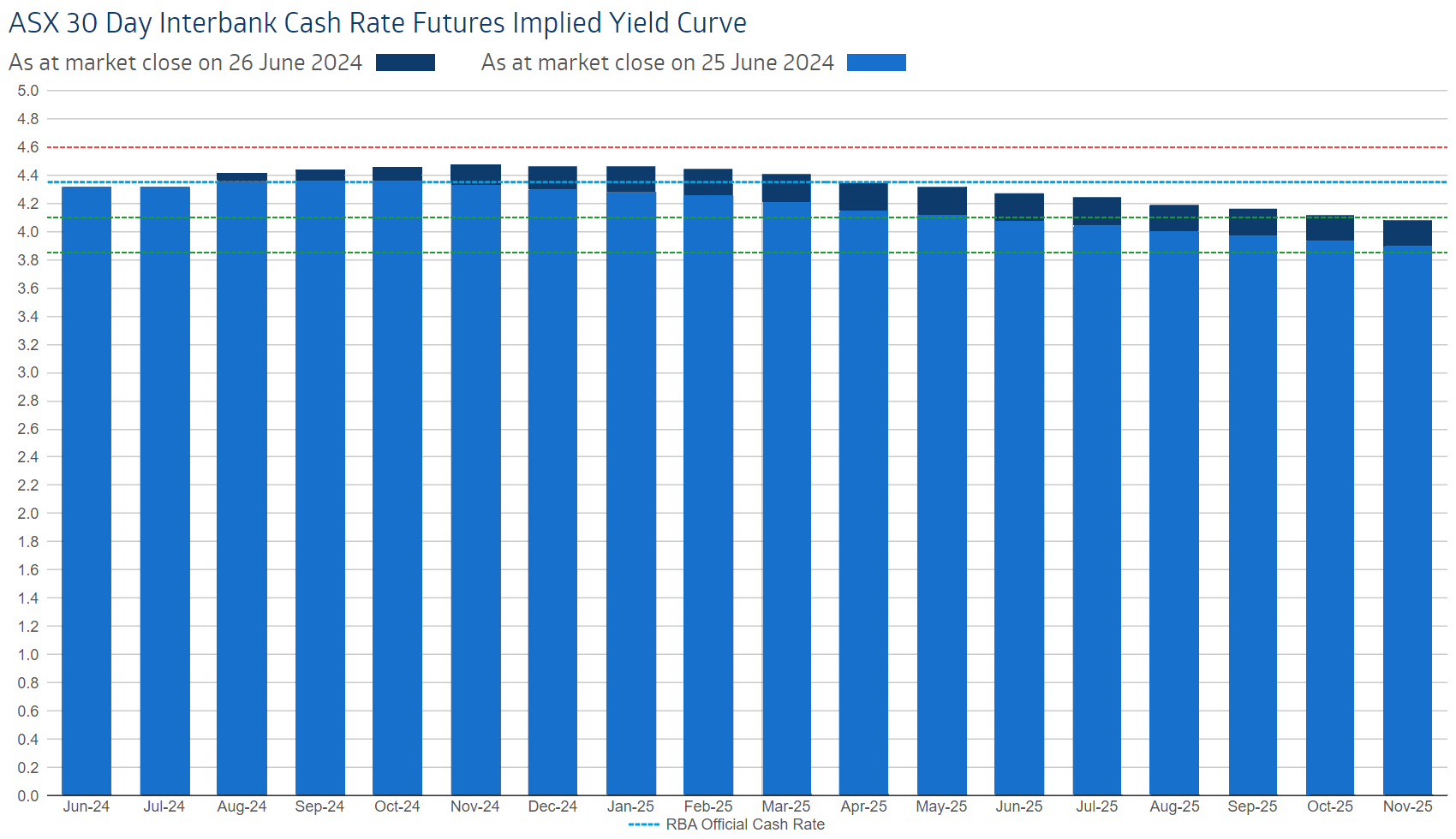

To understand these factors, I like to use the 30-day cash rate futures implied yield curve. It is derived from the prices of short-dated Australian interest rate futures contracts and represents a theoretical schedule of where the RBA cash rate is going to be over the next 18 months.

It’s important to remember that the futures contracts which influence the shape of the yield curve are traded by major fund managers and professional investors. I put to you that these investors do not put their trading capital at risk without very serious consideration of all of the available information – economic, political, or otherwise.

The future is unknown of course, and anything can happen, but when it does, that ‘anything’ will also be instantly factored into the price. For me, market prices contain everything I need to know.

The above graphic shows how the implied yield curve has changed between yesterday and today to incorporate the news contained in the latest CPI data. Clearly, yes, the curve has shifted up, and therefore it indicates a higher probability of interest rate hikes.

Here are the key probabilities/changes to consider:

Rate hike probability (i.e., to 4.60%): from 4% chance by September to 48% chance by November

First cut probability (i.e., to 4.10%): from 100% chance by June 2025 to 100% chance by November 2025

Second cut probability (i.e., to 3.85%): from 80% chance by November 2025 to no longer in look-forward period

It is clear from the above probabilities the market continues to view the next move in the RBA’s official cash rate is more likely to be down – not up. The probability of a rate hike has clearly risen as a result of yesterday’s CPI data, though, by some 44% with November showing peak probability for a hike. The timing of the first cut has shifted 5 months into the future, and a second cut now isn’t likely within the look-forward period.

Broker views: Risks to the upside are growing

Market pricing for an early 2025 rate cut appears to be converging with several major broker forecasts.

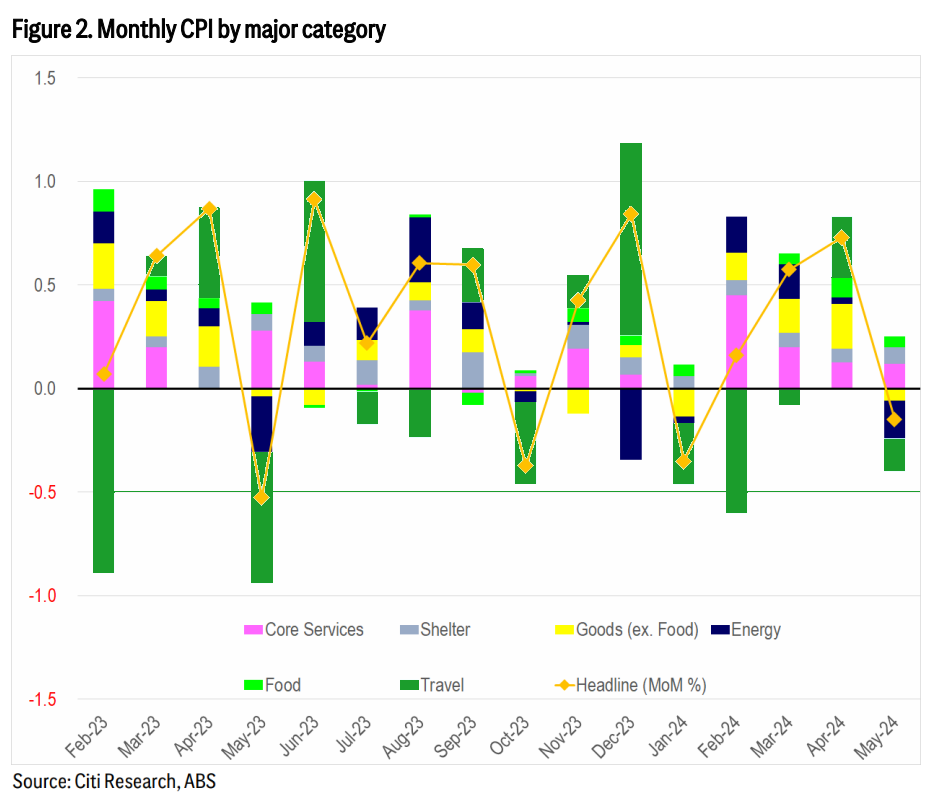

Citi

“This [May CPI] squarely puts upside risks to RBA and Citi’s trimmed-mean inflation forecast of 0.8% for Q2. The market is currently pricing in over 50% chance of a hike in the next two meetings. We see this as fair, and will reassess our Q2 inflation forecast and our RBA view of no changes to the cash rate this year.”

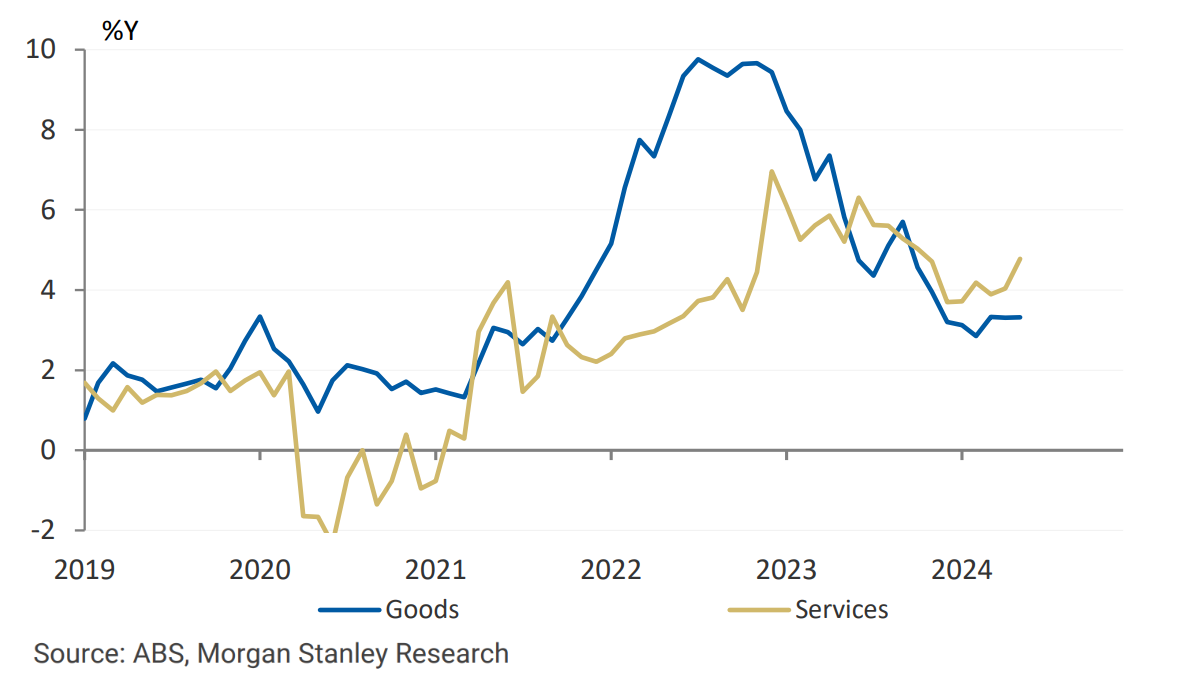

Morgan Stanley

“There has been no disinflationary progress all year, across all measures, and the RBA's Q2 core forecast looks very likely to be beat. Combined with policy settings that are only modestly restrictive, we think this likely sets up an August hike.”

UBS

“Our new CPI forecasts make a rate hike in August a 'close call', and we could be early (i.e. wrong) to change our view, if Q2 CPI is below our forecast. However, we see enough evidence to change our base case view. Hence, we now expect the RBA to hike the cash rate 25 bps in Aug-24, to 4.60%.”

Key dates to circle on your investing calendar

Timing is everything in the markets, and when it comes to RBA rate hikes, some meetings tend to be more ‘live’ than others (when the market thinks a move in rates is likely, the meeting is said to be ‘live’).

The RBA doesn’t do anything without painstakingly careful consideration of the data. Obviously, inflation is a bit of a big deal for them, so it makes sense they would prefer to act after seeing key inflation data like the CPI.

There are two series of CPI data compiled by the Australian Bureau of Statistics (ABS) – monthly and quarterly. The quarterly series is substantially more comprehensive than the monthly series – and therefore the RBA is less likely to act after one or two bad monthly prints, and more likely to wait for confirmation from the quarterly data.

The next RBA meeting is on Tuesday 6 August. This does encompass the June quarter CPI data due for release on Wednesday 31 July, and therefore it does make August a live meeting. It’s the main reason why everyone’s talking about it.

The September meeting comes before the release of September quarter CPI due on Wednesday 25 September, so I’d rule that out. The next meeting that has the benefit of the September quarter CPI is the 5 November meeting.

For me, and in consideration of market pricing via the implied yield curve – November is the most likely meeting we’ll get an interest rate hike (assuming the July CPI isn’t another ‘shocker’ and the RBA hasn’t already pulled the trigger in August).

There’s also an old market wives’ tale that the RBA is more inclined to hike in November when it’s on a hike path as the November meeting generally coincides with Melbourne Cup Day. The theory here is the media will be otherwise distracted, meaning less bad press!

I’m not so sure about the reliability of the above theory, but I do place importance on the fact that if the RBA wants to hike, then November is generally their last chance to do so for a while. There’s usually a December meeting, sure, but no RBA Governor wants to hike rates a couple of weeks before Christmas! The first meeting of the new year is typically three months away in February.

One thing is for sure, the situation is dynamic, and investors should follow the data and not attention grabbing headlines in the media.

This article first appeared on Market Index on Thursday 27 June 2024.

5 topics