T. Rowe Price has been underweight equities for a year. Here's what would spark a reversal

For more than a year, the team at T. Rowe Price have had been underweight global equities. It's a call they are still holding onto but as Asia-Pacific head of multi-asset Thomas Poullaouec told me, it's been an uncomfortable call.

Poullaouec and his global colleagues are currently debating the reversal of this call but he cautions that it does not mean investors can get all bullish, all of a sudden.

Far from it, as a matter of fact.

Poullaouec sat down with me recently for a conversation about the team's multi-asset calls, their thoughts on Australian assets specifically, and why no investor should be betting on a Federal Reserve pivot.

Why the team has been underweight equities for a year

The underweight position in equities has been a profitable one and its explanation has been equally simple, in Poullaouec's view. In short, the call was instituted because the market simply hasn't appreciated how far earnings still have to fall.

"Earnings need to be revised lower. This is really the key for us. We cannot see earnings estimates being met when and if a recession becomes our base case," he said.

Having said this, the team has been debating the removal of this underweight call for the last couple of months. In fact, Poullaouec revealed to me that the model portfolio was never designed for a lengthy underweight position in equities. But he also said the allocation will remain unchanged unless two things occur.

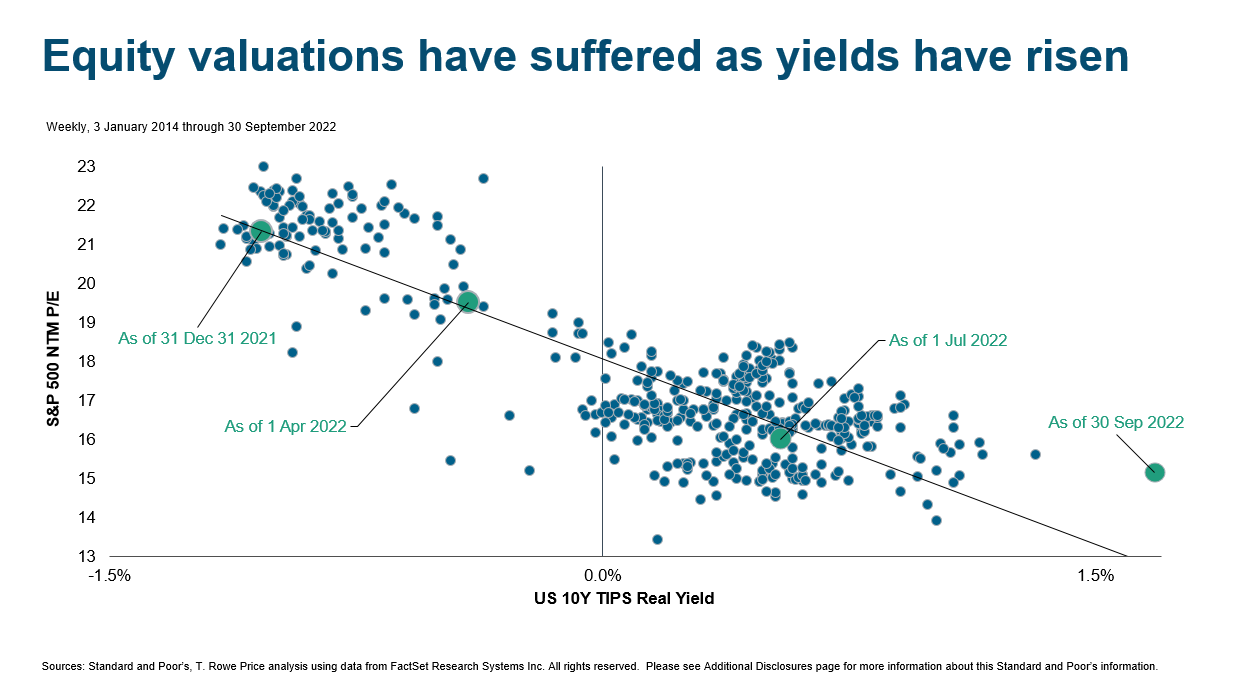

"What we look at is a relationship between valuation and real yields. And there is a very nice relationship between those two," Poullaouec noted. The relationship he is specifically referring to is between the NTM P/E ratio of the S&P 500 and US 10-year TIPS real yields - a correlation you can see below in this handy chart:

Follow the line

"Given where the real yield is right now, we should be at a 13 or 14 figure. We're now at 17," Poullaouec said.

"What we are missing is a reset of valuations and earnings forecasts that can give us more room to go back into equities," he added.

Poullaouec says that the process has started but in a recession driven by high inflation (i.e. the one we may be about to enter), global earnings growth estimates need to come down.

"Cautious does not mean bearish"

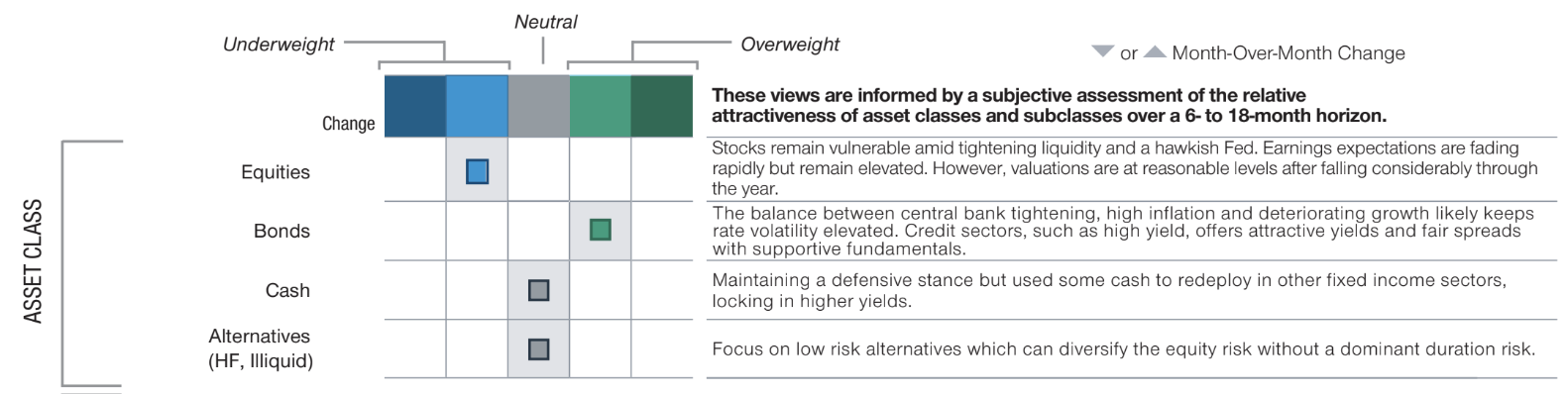

Poullaouec was very quick to point out that the team is not overly bearish, nor totally pessimistic about markets despite what their asset allocation would suggest.

"We are not completely bearish in our position," Poullaouec said. "We want to be conservative in our position but still see opportunities where valuations have already been reset."

Some of those opportunities include:

- Overweight high-yield fixed income

- Overweight energy markets

- Overweight global small caps

And notably, the team has its highest conviction overweight position in non-China emerging market assets.

But... Australia's different (in a good way)

On the macro front, Poullaouec has good news and bad news. The good news is he, like much of the growing consensus, believes the Reserve Bank is close to the end of its current rate hiking cycle.

"Australia has been lucky many times in its history, and it got lucky again in 2022 because of the commodities complex and strong fiscal support during COVID," Poullaouec quipped.

Indeed, even as China continues to pursue its zero-COVID policy, commodity exports have remained buoyant as our largest private players find other markets and customers.

But there is a key catch.

"The first half of 2023 will be key for Australia because that's when we will see a lot of mortgages being reset," he warned.

"There is a risk that Australia is not as lucky in the first half of next year, and that means the RBA could be on hold to watch for how bad this could turn out," he added.

Until then, equity multiples are looking attractive here at home. As a result, T. Rowe Price has a neutral rating on Australian equities. It also has a modest overweight position on Australian bonds, but that position is dependent on the Reserve Bank pausing its rate hike plans early next year as the consensus expects.

In the US, the game is much simpler...

With inflation still running at nearly four times the Federal Reserve's official target, they cannot afford a pivot no matter how much markets hope one is coming.

"What I don't get is that markets are so happy when there is a chance for hikes to step down from 75 basis points to 50. 50 is still hiking!" Poullaouec noted. "I don't see the Fed cutting rates in 2023. Inflation takes a long time to come down."

"I think the market is still too complacent on that right now," he added. He went on to add that he would place a "higher than 50%" chance of a global recession next year with a much narrower likelihood of a soft landing.

But 2023's best opportunities are hiding inconspicuously...

When I pressed him about giving me some good news for investors to hang onto in 2023, Poullaouec gave me an answer I had heard before from Moz Afzal at EFG Asset Management - emerging markets may provide more upside than you think, and that includes China.

"We believe there are opportunities in China for investors, especially those who want to be closer to mainland China than offshore opportunities," he said. China also provides a fertile ground for those small and mid-cap stocks that they are more bullish on.

Some of Poullaouec's key themes include:

- Electric vehicles

- Automation

- Areas of the property market which benefit from consolidation

Above all, "you cannot be too negative in a market which is priced at a single-digit P/E."

And because I know some of you will ask about the semiconductors question, Poullaouec had a response for that too.

"I think the risk and opportunity timelines don't align. The risk might be for right now but the opportunity maybe five or ten years away," Poullaouec added.

Note: If you'd like to read more about the other bullish emerging markets call of late, you can catch up on my interview with Moz Afzal of EFG Asset Management here:

.png)

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed-income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

2 topics