Taking the Top Off

The vibe is changing. It’s been a great rally but I can see (on the charts) and hear (in the headlines) the herd stopping to think about what’s next and it’s probably not great.

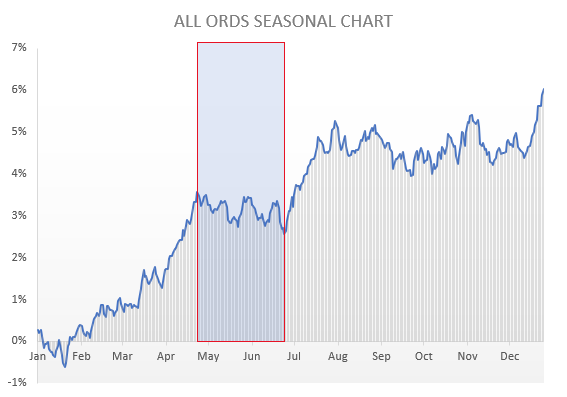

As my colleague Henry put it, we always come out of Easter fat and happy, then it all goes wrong. What is spooking Henry perhaps is his innate understanding of this chart which is the seasonal chart of the All Ords since 1988 not including this year. As you can see the market usually peaks at Easter and drifts until late June. Specifically, the chart peaks on April 26 – and bottoms on June 27.

Whilst I abhor the use of past statistics as a prediction for the future and I would never sell a thing on this sort of weak voodoo alone, it is mildly interesting - we are running into the gloomy zone of the stock market’s calendar year.

In the last few days we have been doing some cashing up - on the 16th April we cashed up to 15-20% and this morning (21/4/2020) we have cashed up to 35-40% again which includes some profit taking on recent highly profitable positions.

As a Member of Marcus today you can listen to our daily strategy podcast available in the newsletter - as an example, here is the latest from 21/4/2020 CLICK HERE

The logic for taking some profits:

- We want to run up cash so we outperform if the market tips over again and have some cash to deploy when it does.

- We are a fund manager judged on relative performance, so for us holding some cash means we outperform a falling market.

- The ‘pause’ we detect is not a significant pivot point as it was at the top and the bottom - this is a slowdown in a high velocity recovery rally.

Reasons to get a bit more cautious:

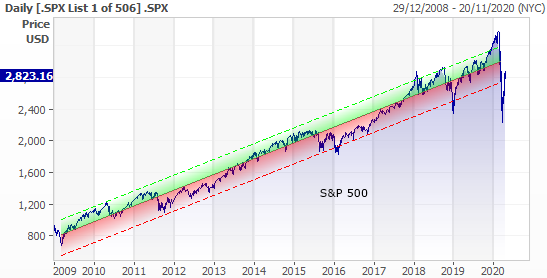

- The US market has already returned to the middle of the bull market trading range with $23.83 trillion worth of S&P 500 stocks trading on the fantasy world PE of 21x and that's despite significantly lower earnings expectations. The US market could have arguably lost 20% on sentiment alone even without coronavirus…but with coronavirus it is now above the bottom of the long-term bull market trading range.

- Amazon and Netflix hit record highs last week on PEs of 103.2x and 109.8x.

- The herd is sobering up. You can hear it in the headlines. The bulls are tiring.

- The rally has been a sentiment recovery – that only lasts so long.

- The one metric that turned the herd was those exponential curves flattening. This flattening is now ‘in the market’. Discounted.

- To follow through the rally needs to be supported by "value" as well. Value is currently unknown. Earnings are in flux. There is no reliable foundation to the market yet.

- The economic headlines are going to deteriorate significantly from here. Jobs numbers, consumer spending, retail sales, GDP, they are all crashing. We just haven’t heard the numbers yet. They are coming. In fact they are here...this is from our Overnight US Market commentary one morning last week:

US retail sales posted a record decline in March. March Industrial production fell the most since 1946. NY Fed manufacturing hit a record low in April, while homebuilder sentiment fell to the lowest level in seven years. The Fed's April Beige Book said economic activity contracted sharply and abruptly. Big provisions for credit losses were the takeaway from bank earnings.

- The next few weeks are going to be littered with company announcements as they (try to) quantify the damage for us. That’s likely to include a litany untimetabled, unpredictable, company announcements as they try to communicate expectations, and almost all of them will be downgrades. There is heightened individual, specific stock, announcement risk.

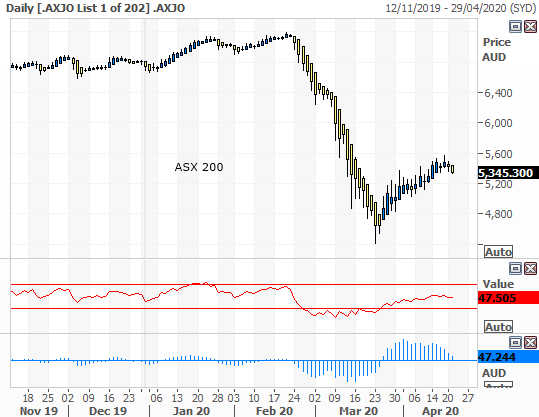

- Charts – Some market and stock charts are topping out for the first time since the bottom. This is a Heikin-Ashi chart of the ASX 200 showing the topping out:

- We were beginning to get back to normal, but some of the recent European and US market falls are not ‘normal’ - the herd is turning again.

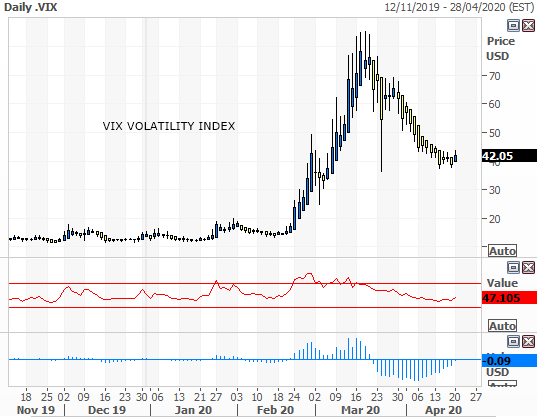

- VIX volatility index is on the rise again. First time in a while. Not significant yet, but watch it.

- We have some tremendous profits to take from the last few weeks on some of the stocks we bought on the lows.

- We retain neutral bank holdings going into results. The sector is down

45% still and is discounting a lot of bad news already including higher bad debt

provisions, narrower net interest margins and reduced or passed

dividends.

- We still believe that in this end this episode has been a (and may present an even better) long term buying opportunity.

- We are pretty sure we have already seen the bottom as of March 24th. But we make no grand predictions.

All of this is enough for us to just take the top off things short term.

For our daily Strategy advice you can join Marcus Today - click here for a free trial or here to subscribe - we have created a Promotional Code for Livewire readers only - use this when subscribing - LWXMT20

4 topics