Tech without the extreme price tag

If you're like me, you may not have the stomach for holding too many stocks trading on prices equal to more than 60 times analysts' consensus forecast earnings per share for the 2020 financial year.

Logistics software group Wisetech Global (WTC) is one of those high-flyers. We have used it as an example not because of a specific negative view (a recent analyst report we've read with a "Sell" rating said "Good result and outlook but expensive") but simply because of its high ranking based on earnings multiples. Analysts' consensus forecasts have WTC priced on a multiple of 61 times the earnings per share projected for the 2020 financial year.

WTC's share price shot up 52% in just two days in August but has since slid back around 25%. That kind of volatility is to be expected when huge long-term growth expectations are built in.

Analysts are assuming WTC grows EPS 36% in FY20. "Back-of-the-envelope" calculations suggest a stock priced similarly to WTC would have to sustain earnings growth at that annual rate all the way through to 2027 to deliver a return of 10% a year to investors. That assumes its price will eventually revert to a more normal 17x earnings.

A company that can achieve that kind of sustained growth is a very rare company.

Many are called but few are chosen

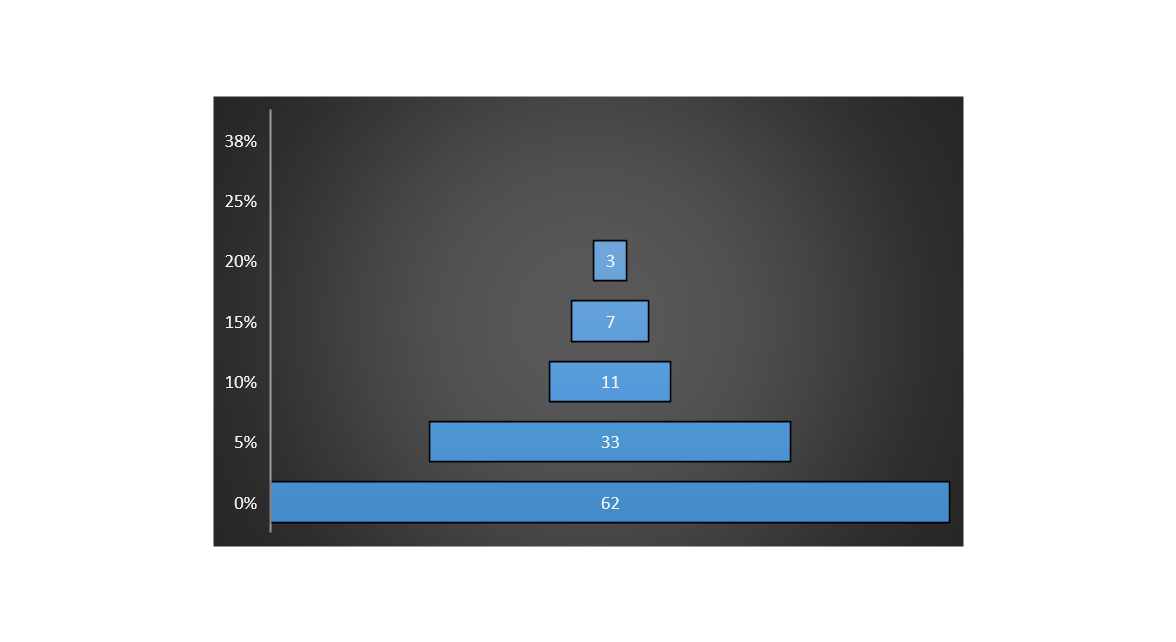

Historical data tells us how tough it is to sustain growth at that rate:

- In fiscal 2014, 138 ASX-listed companies achieved 36% EPS growth

- Only 32 of those businesses repeated the effort in 2015

- By the time we got to 2017 earnings, only one company had sustained the pace

- When we review results for fiscal 2018, even that last company has dropped away.

- But if we dropped the EPS hurdle to 10% each year, 11 companies would have made the full distance.

Below is a chart showing for a range of minimum EPS growth rates, the number of stocks that achieved at least that minimum rate in each of the last five years.

Figure 1: No. of ASX-listed companies sustaining EPS growth above a minimum level (vertical axis) in each of the past five years

Source: Sentieo, Equitable Investors

This data set isn't perfect as we are reliant on any adjustments to reported EPS that Thomson Reuters has made - and there are companies that may well have been on course to achieve the required growth rate but were acquired mid-way through the period.

Still, given the statistics are drawn from 625 stocks that were identified as having positive earnings six years ago, the results are meaningful and warn that investors should think very carefully about what will be required of a business for the investor to achieve a reasonable return.

Higher expectations, lower results

There are academic studies that show investors are typically too optimistic about the growth rates of companies that have historically achieved high earnings growth - and too pessimistic about companies that have not achieved great things in past years.

Two ways to look for tech without the lofty expectations and extreme price tag are to: (1) hunt for companies priced on lower earnings multiples; (2) seek out companies with small market capitalisations but meaningful revenue relative to their size that can be expected to grow.

A bird in the hand

There's an argument that cash generative stocks priced on lower valuation metrics may benefit from a global scenario where interest rates are gradually rising. Cash returns either paid out to shareholders (dividends and share buy backs) or reinvested for compounding returns in the near term may become relatively more valuable than they have been compared to far-off projected earnings for businesses that may be very promising but are many years away from generating returns on the capital they've employed.

We count 53 ASX-listed companies classified as technology stocks with price-to-earnings ratio of less than 20, based on analysts' forecasts for the current year. That potential field of cheaper technology stocks can be expanded to include stocks that aren't classified as such but do have a strong technology element; and smaller stocks that analysts don't cover.

How Equitable Investors is positioned

The Equitable Investors Dragonfly Fund currently holds three stocks on that list of 53 tech stocks trading at less than 20 times earnings. It also holds three technology stocks out of a group of 48 that have market caps of less than $100m and have already recorded $5m anual revenue or more.

None of this means that one should simply avoid all technology stocks on extremely high multiples without further thought.

The Equitable Investors Dragonfly Fund has owned stocks like Afterpay (APT), Next DC (NXT) and Updater (UPD) at times where we felt prospects for their businesses were attractive relative to the price. That is based on our assessment of each company's potential future earnings after taking into account both the time value of money and risks of falling short of our target.

Working through this process of potential returns relative to risk is, however, generally going to favour stocks that aren't as widely known. With these lesser-lights, we may not always be able to dream quite as big but there's often less downside risk as well.

2 topics