The 2 big risks of income strategies, and how to fix them

As part of the Livewire income series, we’ve decided to put together our own three-part focus on income, its value right now, the challenges and trade-offs when chasing income in equity markets from traditional methods, and finally an alternate solution for investors.

Part 1: Find stability in shifting market conditions

Almost by definition, market convulsions come as surprises. Sudden government regulation and intervention in China is a fresh example.

Investors often get ambushed by the market if they tend to concentrate on guessing if something will happen, instead of figuring out how to respond if (or when) it does. In economic terms, they focus on forecasting rather than positioning (who owns how much of what).

History is littered with moments where even the most storied investors didn’t predict a dramatic shift in market conditions (GFC). So if those whose job it is to analyse all market scenarios cannot be relied on to forecast the future, then it is just common sense to suggest that, rather than gazing into crystal balls, investors would be better off considering how they might be placed if global market conditions were to change abruptly. Perhaps above all they should consider if they are sufficiently diversified.

Diversification is critical to lowering risk and increasing certainty of returns.

We believe investors need to diversify in a variety of ways, but this series will focus on income, as distinct from capital growth.

Total return comprises income and capital growth, and while it is true that investors should care about the level of total return and be indifferent to its composition, in the current climate of high (sometimes extreme) starting valuations, that indifference has become risky. In many ways, it has become a code for “I have made so much from capital growth over the last few years that I have no regard for income.”

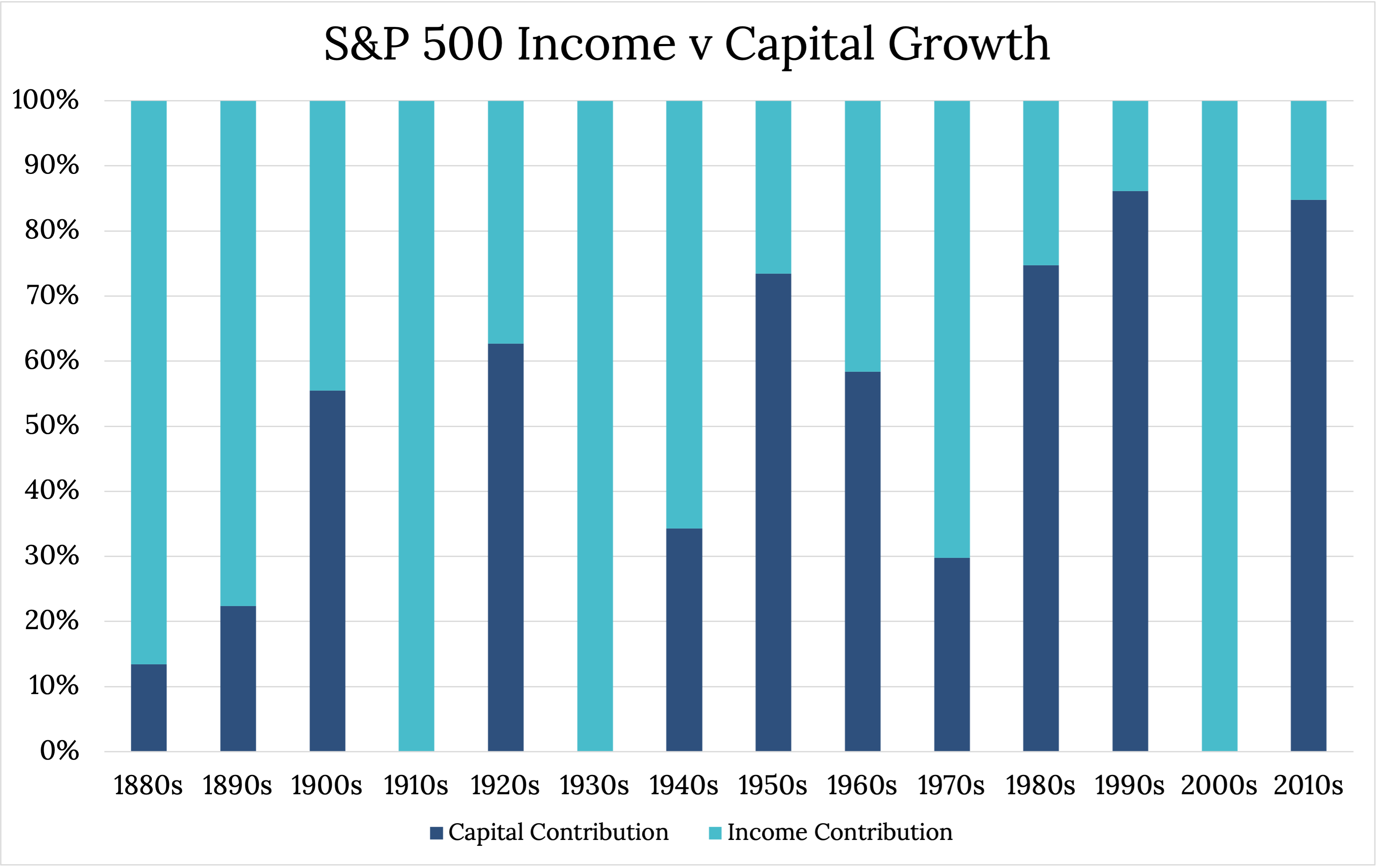

As the chart below shows, income has been a vital contributor to total returns for more than a century, and in some decades including the 2000s, was the sole contributor to total return.

So, if we agree income is important, now as much as any time in the last century:

- What are the best ways to find it, and

- What are the risks of chasing income for its own sake?

Most equity income strategies rely solely on dividends, which offer a number of attractions including sometimes capturing higher inflation through higher dividend growth. Another key point is dividend-yielding stocks are rarely longer duration (expensive growth stocks).

This means they're usually less sensitive to rising bond yields. It's also worth remembering a good equity income strategy can outperform fixed income, which risks capital losses if central banks counter inflation with higher rates (sound familiar?).

But as the economic impact of the pandemic has shown dividends can be unreliable. They are not guaranteed, fluctuate with earnings and can be halted by legislation in extreme circumstances, as we saw in relation to banks around the world last year.

A dividend-only strategy can be unreliable. It can also elevate risks as investors seek a shrinking opportunity set (reducing diversity). And it can also affect your portfolio's quality and ESG credentials... as we will discuss in part two and part three.

Why you can’t miss the Livewire Income Series

Livewire’s 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.

Click here to view the dedicated website, which includes:

- A list of income focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.

5 topics