The 2025-26 Budget – pretty uninspiring, with deficits for years

- Many measures were pre-announced, but key new measures include tax cuts from 2026-27 & more cost of living support.

- While the revenue windfall is expected to continue, its mostly being spent on new measures resulting a return to deficit of $27.6bn this financial year and $42.1bn next year.

- The Budget continues to lock in structurally higher spending and budget deficits for the medium term.

- The ongoing high level of public spending risks higher than otherwise underlying inflation and weaker productivity.

- Overall, it’s a pretty uninspiring Budget.

The Budget is aimed at three things: getting the government re-elected; providing more cost-of-living support; and talking and shoring Australia up ahead of Trump’s tariffs & trade wars impacting. It further cements bigger government and structural budget deficits for the medium term.

Key budget measures

- $17.1bn in tax cuts over the next four years, cutting the 16% tax rate to 14% – but they’ll buy less than “a sandwich & milkshake” amounting to $5.15/week from July next year and $10.3/week from July 2027.

- $7.9bn on Medicare to boost bulk billing, $1.8bn for public hospitals, $644m for new urgent care clinics & $793m for women’s health.

- More money for infrastructure including $7.2bn for the Bruce Highway, along with various other road and rail projects.

- More cost of living relief including extending electricity rebates for another six months at $150 per household and small business (costing $1.8bn) and $689bn to lower PBS drug prices from $31.6 to $25.

- $800m to raise the income and price caps for the Help to Buy shared equity scheme (although it remains capped at 40,000 places over four years) and $54m for pre-fabricated and modular homes.

- $1.2bn extra for disaster relieve and rebuilding after Cyclone Alfred.

- Another freeze to deeming rates & a two-year freeze to beer indexation.

- Subsidies to help industries affected by Trump’s tariffs, support for the Whyalla steel works and $20m for a “Buy Australian” campaign.

- Spending of $1.5bn over 5 years in “decisions made but not yet announced” allowing for more election promises.

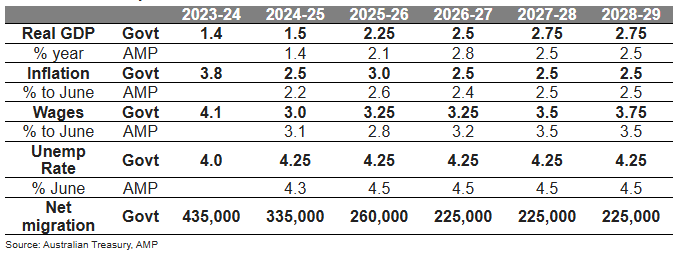

Economic assumptions

Despite increased global uncertainty associated with Trump’s tariffs – where the indirect impact on Australia from trade wars is seen as a far bigger risk than the direct impact of tariffs, the Government continues to expect a modest pick up in growth over the next few years. However, its sees inflation remaining in the 2-3% target range (helped this year by the latest cost of living measures will knock around 0.5% off inflation this year. Abstracting from the energy rebates it sees inflation around target from the middle of the year.

It also revised down slightly its unemployment forecasts to 4.25%. The Government now sees net immigration of 335,000 this financial year (MYEFO was 340,000), falling to 225,000 in 2026-27, taking population growth down to around 1.2% from 2.4% in 2022-23. The Government kept its medium-term iron ore price assumption at $US60/tonne but pushed it out to March 2026. With iron ore well above that (~$US100 as of March 2025), it’s still a source of revenue upside.

Back to Budget deficits

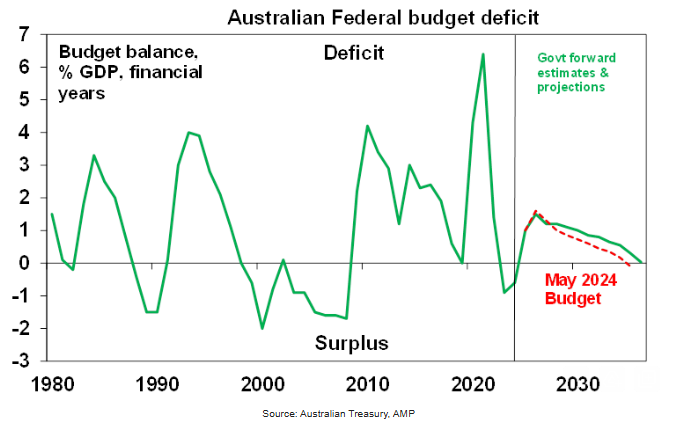

While it’s not forecast for this year, the Government is again benefitting from extra revenue flows coming from higher personal tax due to stronger jobs growth and higher commodity prices (and hence mining profits) than assumed. This is not smart management but good luck flowing from conservative forecasts. This is what gave us the surpluses in 2022-23 and 2023-24 of $22bn and $16bn. But the windfall is diminishing and in the face of another round of extra spending is seeing a return to deficits.

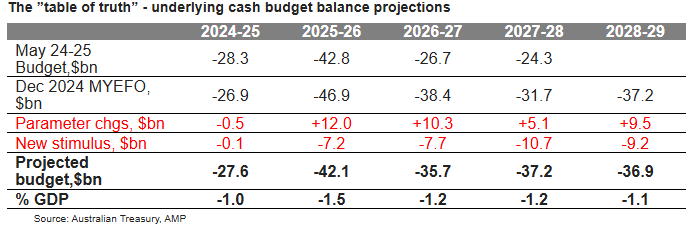

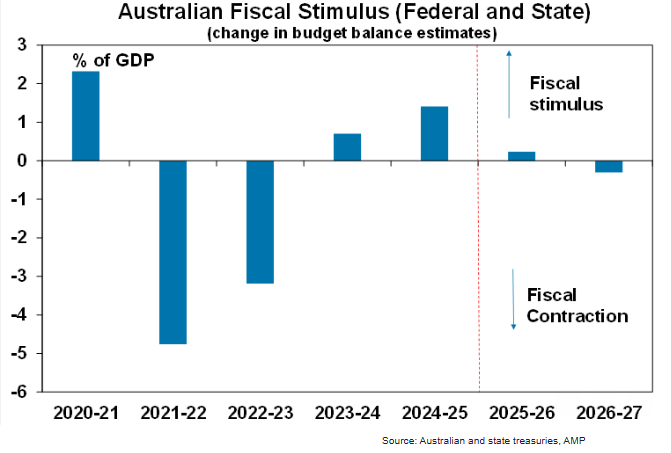

The windfall can be seen in the next table (called “parameter changes”) and is estimated to reduce the deficit over the five years to 2028-29 by $36.4bn. But this table – nicknamed the “table of truth” – also shows how much of the windfall has been spent (see the “new stimulus” line) and in this Budget it totals $34.9bn over five years. So 96% of the windfall is being spent leaving in place the forecast return to budget deficits.

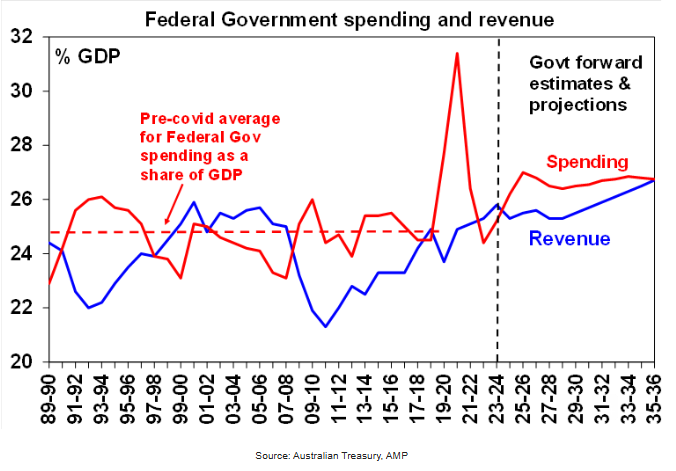

Due to new spending & structural pressures from interest costs, the NDIS, defence, health and aged care, spending as a share of GDP is expected to average 26.7% over the longer term, well above the pre-Covid average of 24.8%. Despite another blip down with mini tax cuts, revenue starts trending up from 2028-29 reaching a record 26.7% of GDP in a decade as bracket creep kicks in again. So bracket creep, not spending restraint is still assumed to do the work in getting us back to balance.

After two surpluses we are now back into deficits for the next decade.

Gross public debt of $940bn or 34% of GDP is projected to rise above $1trn in 2025-26 and reach 37% of GDP by 2028-29 before trending down.

Winners and losers

Losers include: tax evaders, scammers & consultants with more measures to curtail them.

Assessment

However, the Budget has several significant weaknesses in relation to:

- Inflation and the RBA. The cost-of-living measures will help lower measured inflation. But the new stimulus, the shift from surplus to deficit and average 5.5%yoy projected growth in Federal spending to 2028-29 will boost demand in the economy. All of which makes the RBA’s job harder. We don’t think it precludes more rate cuts, but it means rates will be higher than would otherwise have been the case.

- Structural deficits. The Budget continues to lock in structural budget deficits. This sees no money put aside for a rainy day over the forecast period. The ratcheting up of spending on temporary revenue windfalls (amounting to over $300bn for the current Government) leaves the budget vulnerable to a reversal of the windfalls.

- Reliance on bracket creep to boost revenue beyond 2028-29 and return to surplus. The rising burden on Millennials & Gen Z is unfair and unrealistic. Politicians will eventually want to give some back as “tax cuts”. So how will we get back to surplus then?

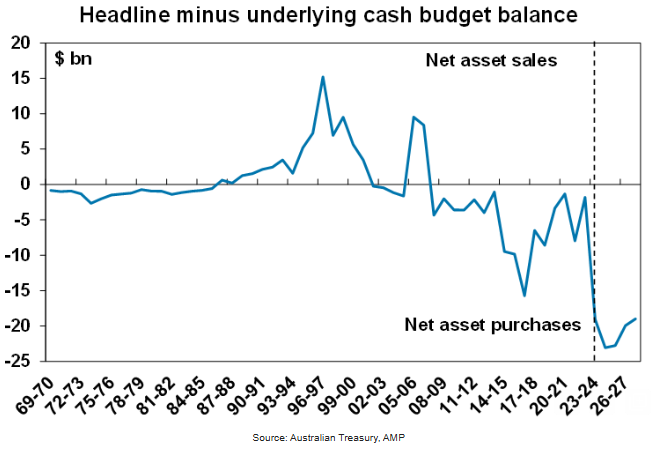

- Off budget spending. This is becoming a big issue as governments have been allocating increasing spending as “off-Budget” on the grounds that it’s an “investment”. This is resulting in a widening gap between the underlying cash balance (referred to above) and the headline balance (which includes “investments”). However, much of the spending are not wise investments but they add to public debt.

- Bigger government. Spending as a share of GDP is settling well above that seen pre pandemic, locking in big government which risks slowing productivity growth. And the problem will escalate if Australia is forced to rapidly push defence spending up to 3% of GDP costing $30bn pa.

- More protectionism. While “made in Australia” is popular, its reliance on protectionism and government picking winners has been tried and failed in the past with a long-term cost to productivity & living standards. We have no advantage in batteries & solar panels.

- Productivity. Despite the rhetoric there is not really much to improve Australia’s poor productivity performance. This needs urgent reform in terms of tax, competition, the non-market services sector, industrial relations and energy generation. This is where the focus needs to be if we want to strengthen the economy ahead of Trump’s disruption not on “made in Australia” subsidies and “Buy Australian” campaigns.

- Housing. The measures to boost pre-fabricated housing are good, but unlikely to be enough to hit the 1.2 million new homes over 5 years target. Help to Buy will only help the lucky few who get in early.

Implications for the RBA

While the cost-of-living measures will keep headline inflation down, the RBA will focus on underlying inflation and here the ongoing rise in government spending is making its job harder. But it’s probably not enough to change our forecasts for more rate cuts this year.

Implications for Australian assets

- Cash and term deposits – cash and deposit returns have likely peaked with RBA cutting rates – the Budget may keep them higher than otherwise.

- Bonds – medium term deficits put pressure on bond yields, but they are roughly as expected so there is not much in it.

- Shares – the Budget is positive for spending and hence retail shares, but this may be offset by higher than otherwise rates. Some manufacturers may benefit from subsidies. Overall, it looks neutral for shares.

- Property – the housing measures are unlikely to alter the home price outlook. We see modest home price growth this year.

- The $A – the Budget is unlikely to change the direction for the $A.

1 topic