The 21st Century started this year

In 2020 the use of hydrogen in transportation reached critical levels, much to the benefit of Plug Power (6x), whose fuel cells now transport ~30% of US retail food and groceries.

It was also a good year for space, with Virgin Galactic (NYSE: SPCE) (which we own) and SpaceX (which sadly we can't) both laying down serious milestones in what will be one of the future's largest industries.

Biology has always had data at its core, but in 2020 this data science reached new heights. Chinese scientists posted the genetic code of the coronavirus online, and within days the Moderna (NASDAQ: MRNA) developed the first of what will likely be many mRNA vaccines without any access to the virus itself. Truly science fiction stuff.

Fortunes were invested in biological research this year, and it has never been cooler to be a biological scientist. Talent and capital is a thrilling combination. The next decade should be a good one for the life sciences.

Risk

We'll always position our fund at the forefront of technological shifts. It's often uncomfortable on the front lines. Balance sheets and income statements are messy, and the extraordinarily talented people that build new businesses are often odd.

But it's far riskier, in our opinion, to be on the other side of these shifts. Simply look at the performance of Tesla (NASDAQ: TSLA) and Carvana (NYSE: CVNA) versus the auto industry, Afterpay (ASX: APT) and Square (NYSE: SQ) versus global banks, and Shopify (NYSE: SHOP), MercadoLibre (NASDAQ: MELI) and Sea (NYSE: SE) versus traditional retailers.

Our mid and large cap companies are growing at over 75% pa. In a world of flat to weak GDP growth, this revenue must be coming from somewhere else.

And that somewhere else is where the vast majority of capital is invested - and quite likely most of your own.

This was a year where those taking extraordinary risks to advance the human race were richly rewarded, and for that we can all be thankful.

Rotations and double winners

Readers will know we laid the groundwork for November by reducing our exposure to richly valued software companies (for example) and investing in companies well placed for a recovery.

The best companies right now are double winners with these two characteristics:

- They're already growing exceptionally fast, and;

- Will also accelerate in a recovery.

This is a tough ask for any one company, but there are indeed some.

Disney (NYSE: DIS) is an example we have given before, with an explosively fast-growing consumer business (Disney+) combined with broadly loved theme parks, which used to contribute almost half of Disney's profit, and will soon do so once more.

Another example is Square (NYSE: SQ), which is already amongst the fastest growers among companies with market capitalisation over $100 billion, while also standing to benefit from a return of foot traffic to retail malls.

Square is interesting for another reason.

The holy grail in payments is creating a closed loop, where transactions between customers and merchants all happen within a single ecosystem, effectively on a company database rather than through the archaic payments network.

This would bypass traditional banks, the likes of Mastercard (NYSE: MA) & Visa (NYSE: V), and all the other payment layers that plague us (we seem to discover new ones all the time).

A closed loop payment system would allow instant, highly efficient transactions, which is precisely how financial data should flow in the 21st century.

We think Square could be the first to achieve this.

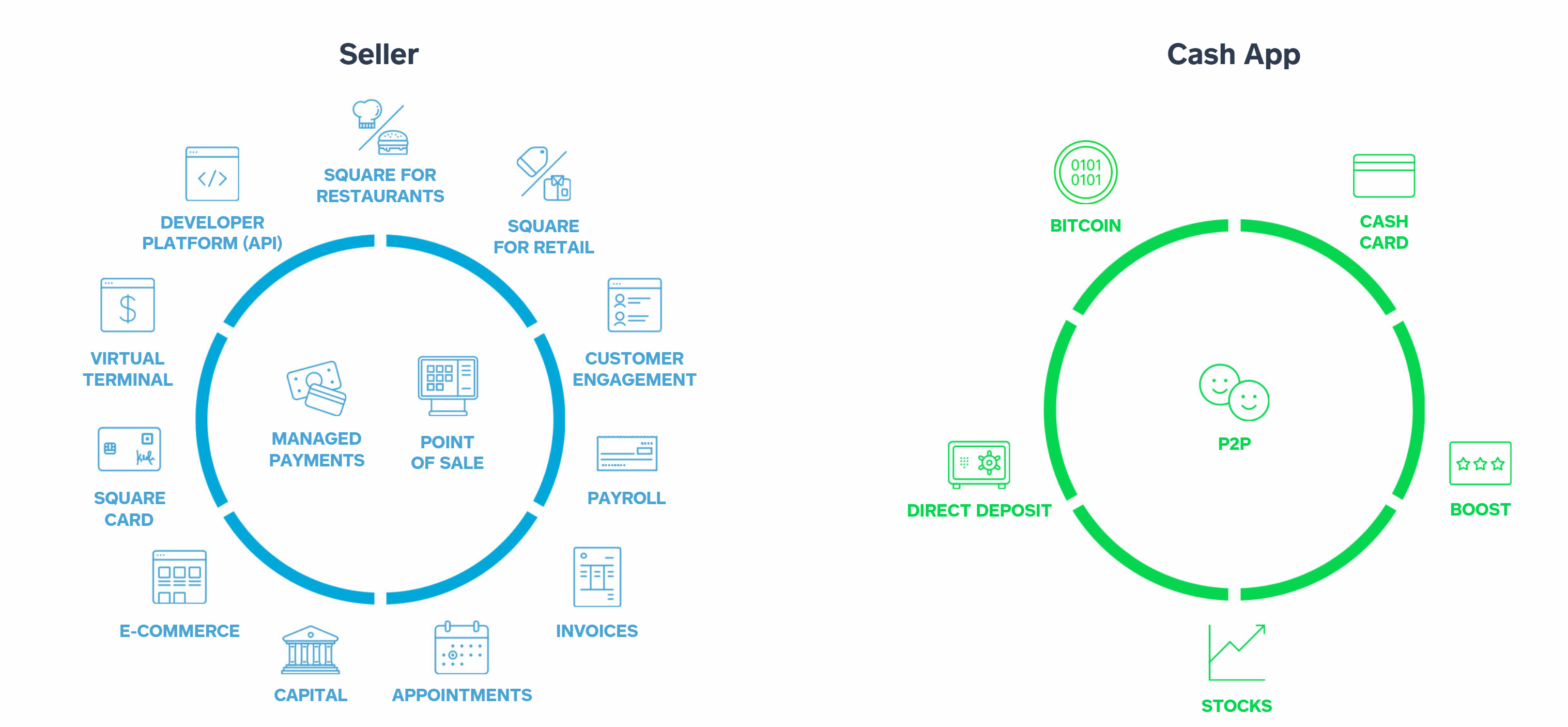

Square began with those familiar smartphone card readers for merchants. But Square also has a rapidly growing cash app in the United States. This now has over 30 million users, up from 15 million last year, and as you know we love growth rates >100%! These users are transacting about 15x per month on average.

So they have two sides of the prized closed loop:

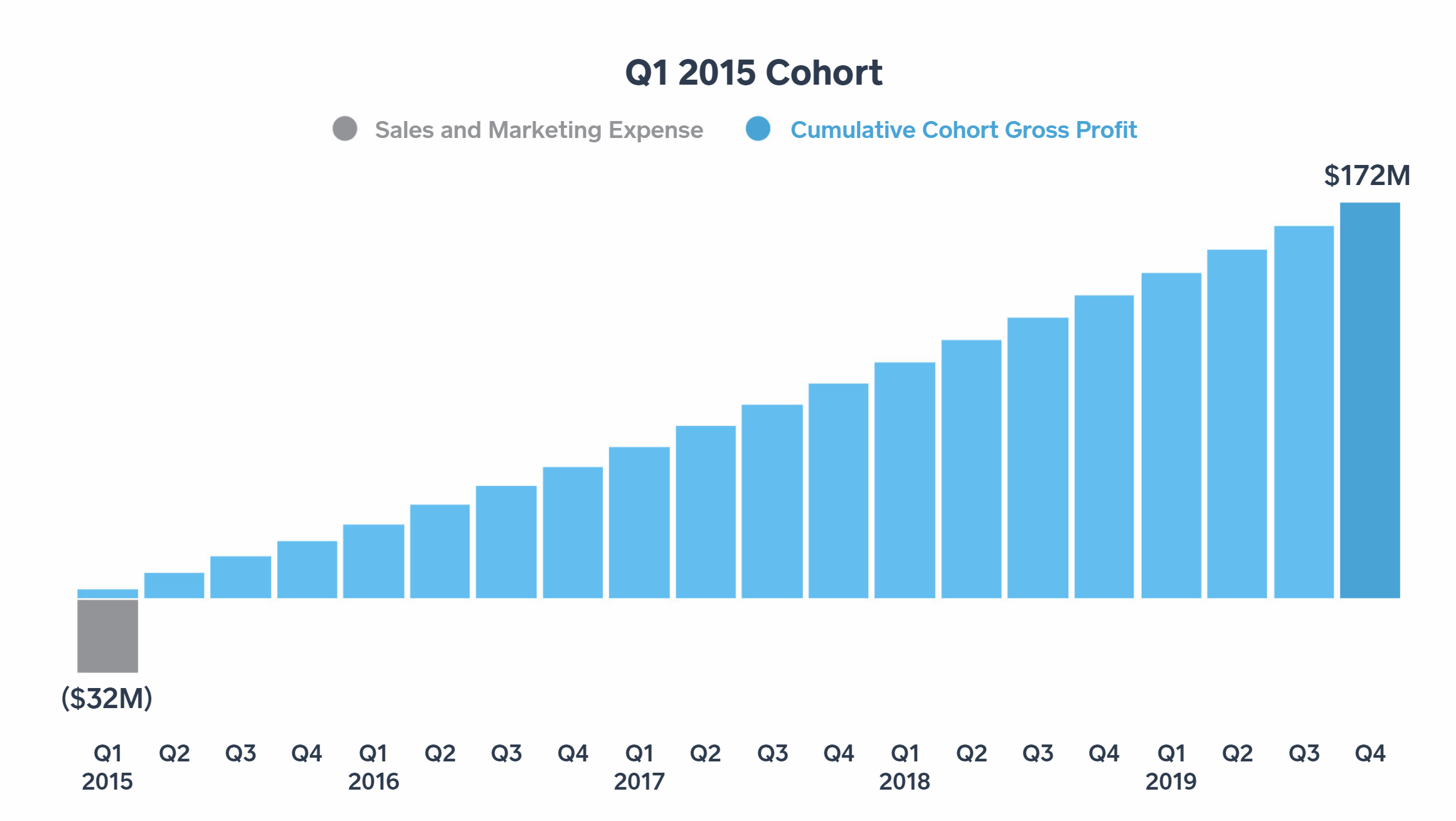

We think the graphic below is interesting not only for what it says about Square, but also how it illustrates what's going on in financial markets today.

A $32 million investment in Sales and Marketing in Q1 2015 is now generating $172 million of gross profit a quarter.

Imagine a value investor looking at the financial statements in Q1 2015... they will just see that expense as a cash flow drag, a cost with no corresponding balance sheet item. Yet this kind of return is one and perhaps two orders of magnitude greater than what's achievable from traditional capital expenditures in factories, equipment and the like.

The optimal strategy here is to spend all those subsequent gross profit dollars on even more sales and marketing.

Winners Only

The best guide to 2020 was to focus entirely on companies that were thriving in the prevailing market. E-commerce, digital health, payments, the right life sciences companies - these served us extraordinarily well.

We plan to use the same process to guide us over the next 12 months: we will only invest in companies thriving in the current market conditions. The good news is the kinds of companies that we invest in can thrive for decades, and perhaps generations, like the evolution of hydrogen energy, solar, electric vehicles, advances in genomic sequencing and space.

Stay diverse, stay nimble

It's fashionable in some tech investing circles to run highly concentrated portfolios. We've been sympathetic to that approach in the past, but think a broader portfolio is better, as it ensures we capture the explosive organic growth of our companies without overexposure to any one name.

We know that for many of our investors, we are their only exposure to these companies, and there's something inherently unpredictable about which of our companies will perform best at any one time.

Perhaps the best risk/reward in finance is found in a 3-4% position in a fast-growing company. The downside is 1-2%, but a high performer can easily add >25% across an entire portfolio.

With 2%-4% positions it's also straightforward to add to companies that have temporarily sold off, and to sell a company that no longer displays the explosive growth and customer love we find so useful as a guide.

Given the rapid explosion in technological adoption this year, we don't think we're going to run out of opportunities any time soon.

Outlook

It's good to know that even in a year including an astonishingly brutal bear market (which hit us quite hard) we can still net over 90%. The juice has been worth the squeeze.

It wasn't easy in March... there were more than a few McDonalds-eating Buffett-quoting managers who turned out to be sellers, rather than buyers. And to be fair, a nastier virus could have lead to a more prolonged shock - though this may have led to a stronger policy response, a sharper rally after, and perhaps even greater returns to our holdings in ecommerce, digital health etc.

Finally, a comment on timing.

I had multiple discussions around June/July about timing. Many thought things had run hot, and they had. But as we approach the new year, quite a number of our portfolio companies are already 30-40% larger. And June wasn't so long ago.

There are people reading this who invested on 1 October 2018, right before the trade war and Jerome Powell's shortlived attempt to raise rates. There are others reading this whose funds were invested on 1 March 2020, moments before one of the sharpest sell-offs in market history.

Both sell-offs hit us hard, and friends of mine will attest I wasn't exactly the best of company during those months. But when markets really started moving, we proved one of the steadier hands, and were able to take advantage of the opportunities on offer.

The smart play now is to stay invested in the fastest growing highest quality companies we can find. That was our approach in March, and remains our approach today.

It's a sad fact that at some point in the future a new turn of events will shake markets to their core. And when that happens, you can rely on us to act in exactly the same way.

Learn more

Stay up to date with all our latest Livewire insights by clicking the follow button below, or visit our website for more information.

1 stock mentioned