The 3 stages of a market crash (and ways to navigate them)

Betashares

The financial press worked itself into a frenzy in May as the benchmark S&P 500 in the US briefly reached a 20% fall from its recent high in January1. The Australian market has been more benign, falling 8.3% from its more recent high. But this hides the pain being felt in some parts of the market2. The S&P/ASX All Technology Index, for example, is down more than 34% since November 20213.

When investors see red across their portfolios, the emotions this can trigger often lead to poor decisions. So, here’s a short guide to navigating stormy markets.

Part 1: Before the crash

The biggest gains from market dislocations are born before the crash even begins. But that doesn’t mean trying to predict recessions and sell in advance. At this stage, you should be putting together a plan for what you’ll do when (not if) there is a market crash.

For truly passive investors, this should be a straightforward affair. Setting up a regular deposit and purchase of specific assets is the easiest approach, and it completely removes any bias or emotion from the process.

In a broad sell-off, growth assets such as equities will generally decline by larger amounts. This can skew your asset allocation, resulting in an under-allocation to growth assets at the bottom of the market. It’s important to consider whether you’ll make additional deposits in line with your strategic asset allocation, or whether to put extra funds into higher-risk assets.

In many diversified investment options, assets are automatically rebalanced for you on a quarterly basis. But if you’ve created your own diversified portfolio, you may need to undertake this rebalancing yourself.

For the more active investors, it’s a good idea to keep a watch-list of assets you’d like to buy if prices correct. It’s important to have an idea of the level you’d like to own a particular asset at – this could be based on your views of the underlying fundamentals of the exposure.

Alternatively, if you’ve got a price target at which you’d like to purchase a security, most brokers will allow you to set an alert to notify you when that target is reached. If you think the price might be hit within the next month, you could even place an at-limit order, which will allow the trade to execute automatically if the limit price has been reached.

Whatever your approach, the key is to have a plan, write it down, and then stick to it.

Part 2: When markets head south

When markets do begin to crash, emotions will quickly become elevated. The first thing to do is stay calm.

The next thing to do is to review that plan you put together (you wrote it down, right?). Now comes the hard part – following through and sticking to the plan.

As Mike Tyson famously said, “everyone has a plan until they get punched in the mouth.”

For investors, a market crash is a bit like getting punched in the mouth. What seemed like a good idea in the calm of a bull market, might suddenly seem folly when markets are in freefall. But that’s why we plan and write things down, because making decisions like these in the heat of the moment is a recipe for failure.

For those taking a more active approach to managing their portfolio, now is the time to pull out those watch lists. Have a good look at everything on your list and prioritise after considering any recent developments in that thematic, geography, or asset class.

Part 3: The slow recovery

If you’ve done well so far, you might want to try to ‘pick the bottom’. As tempting as it may seem, it’s almost impossible to do successfully. The good news is that it’s not necessary.

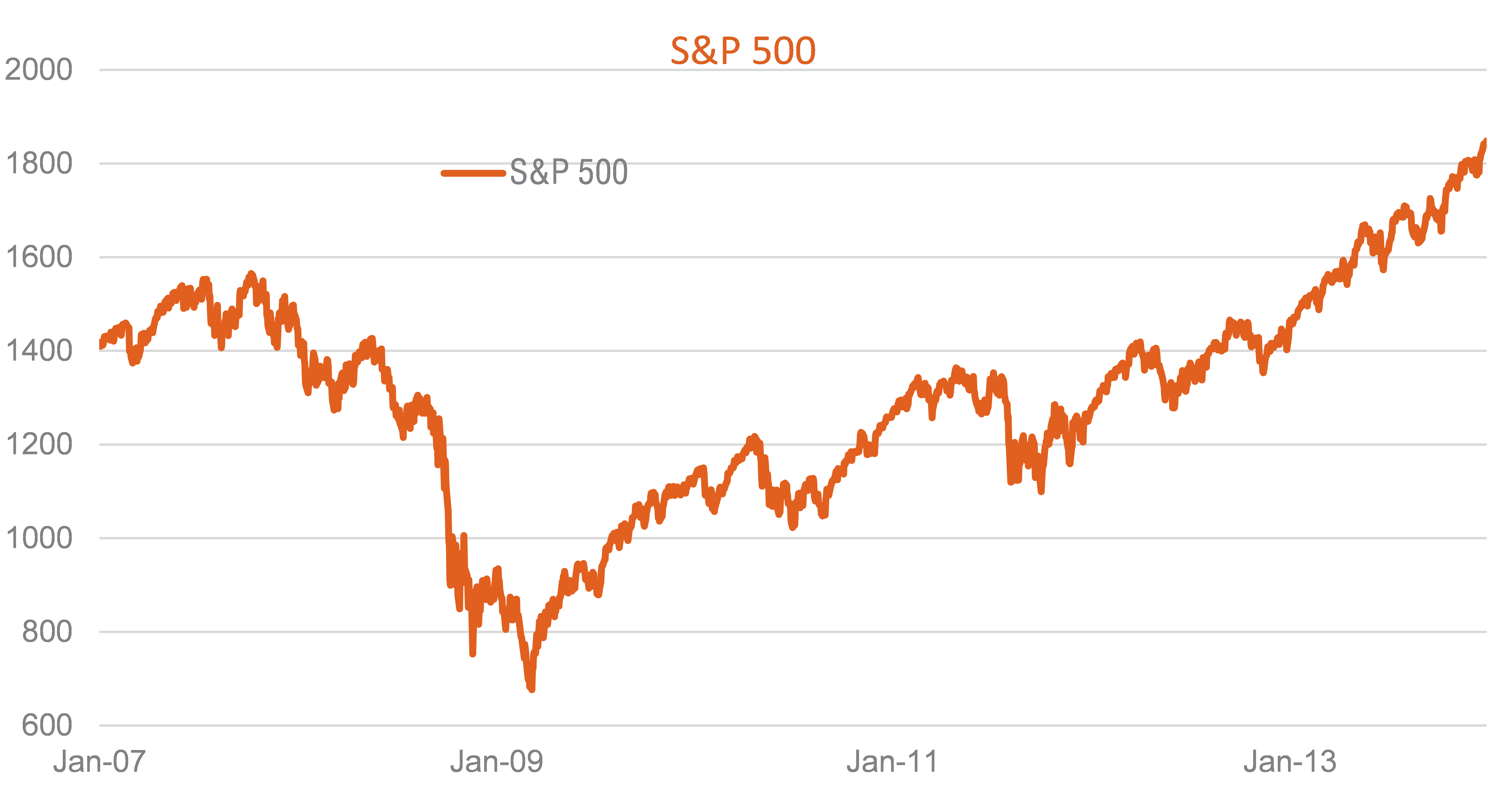

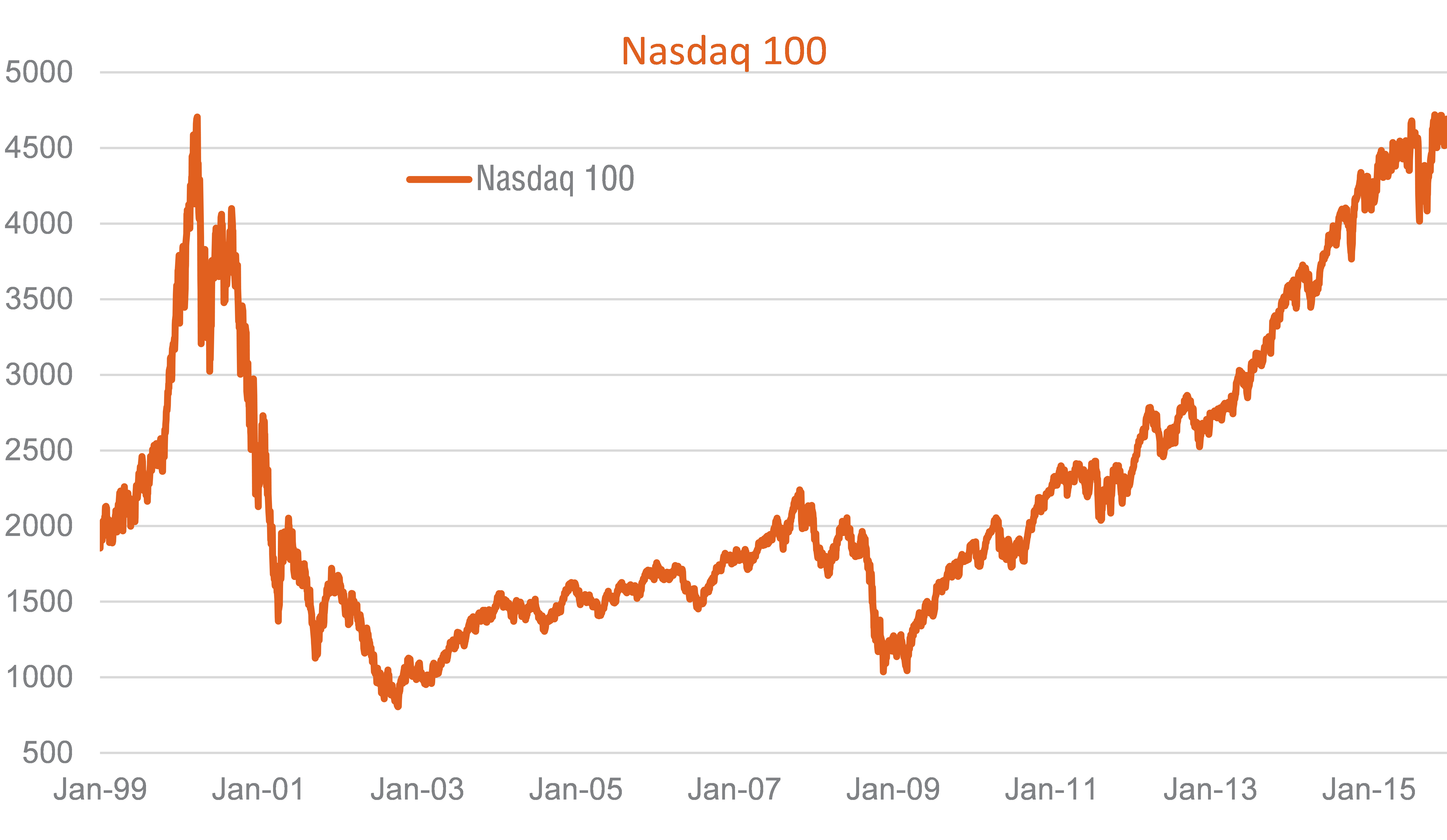

Markets generally can fall very quickly, before recovering slowly. Or as it’s more commonly described among investors: markets go down the elevator and up the escalator.

In the charts above, you can see this effect in full force. These aren’t cherry-picked examples either. If you look at any major market dislocation, you’ll more than likely see a similar pattern.

There are three possible approaches to dealing with this situation:

- Buy in early. This allows you to catch the initial rally, which can be sudden and violent. However, this means accepting that there’s a very good chance your investments may first fall further.

- Wait for markets to start recovering. Though this means missing out on that initial rally, it can be less stomach-churning than option 1.

- Take the passive approach and never stop buying. Even the world’s best investors struggle to pick tops and bottoms, so why try? By accepting that you can’t time markets and continuing to add to your investments, you can ensure you buy some on the way down, some near the bottom, and some more again on the way back up.

The aftermath

Congratulations! You made it through the crash. If you stuck to your plan, you likely did better than most. Hopefully you didn’t lose too much sleep along the way.

Don’t lose that plan though. You’ll need it again someday.

Follow for more insights

If you enjoyed this wire, don't forget to give it a 'like' or leave a comment. To be the first to read my insights, hit the follow button below.

Trusted by hundreds of thousands of Australian investors, BetaShares offers cost-effective, simple, and liquid access to the broadest range of ETF investment solutions available on the ASX, covering almost every asset class and investment strategy.

Footnotes:

1. The S&P 500’s high was on 3 January 2022, while the low was on 20 May 2022.

2. The S&P/ASX 200’s high was on 21 April 2022, while the low was on 12 May 2022.

3. The S&P/ASX All Technology Index’s high was on 18 November 2021, while the low was on 12 May 2022.

Patrick is the Editorial Director at Betashares and a member of the Investment Strategy and Research Team. He has over 15 years of finance and financial media experience with past roles at Livewire, netwealth, Link Group, and others.